Is the Argentina Economy Doomed to Fail?

In the past 65 years, Argentina has defaulted on debt five times.

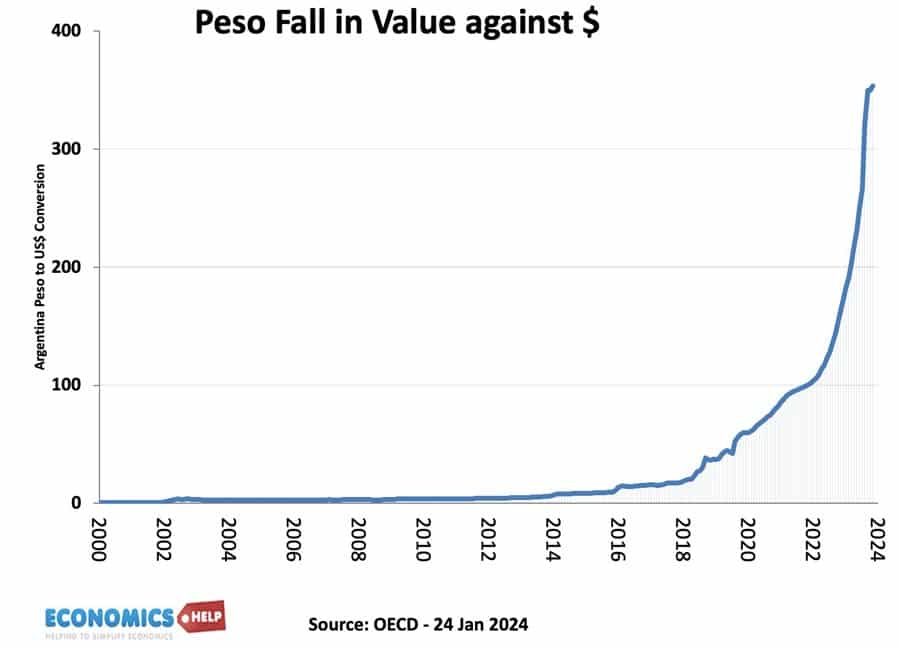

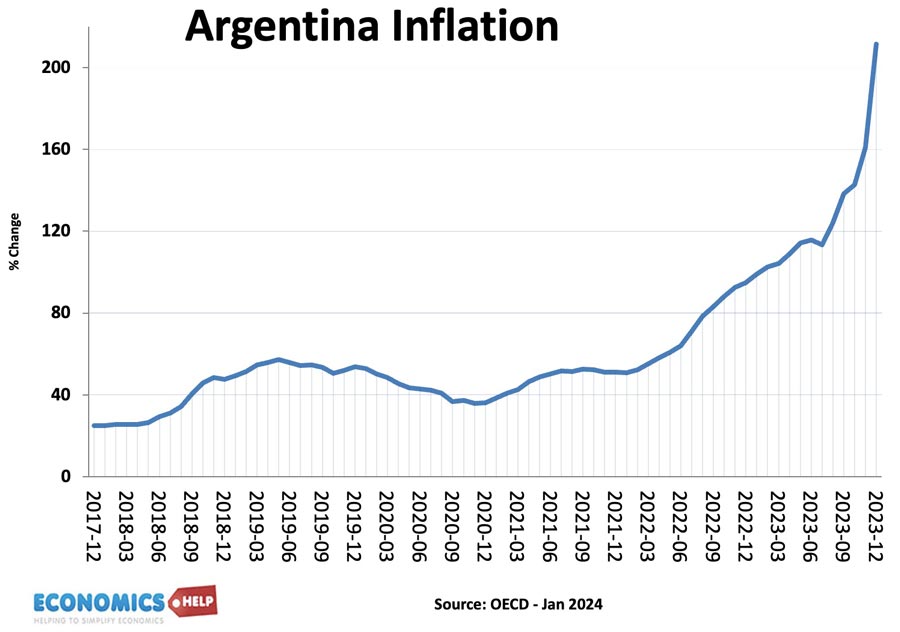

It has the highest rate of inflation in the world, and the devaluation in the Peso makes it one of the worst-performing currencies.

Now its beleaguered citizens are facing higher prices and recession as Javier Milei’s shock therapy is upending the economy. But, it wasn’t always like this. In 1914, Argentina was one of the wealthiest countries in the world, with a higher GDP per capita than Canada, Germany or France. Its large fertile agricultural land was a magnet for investors and European immigrants who moved to Argentina seeking a better life. At the time, Argentina was a pioneer in refrigerated meat – a cutting-edge technology which enabled Argentinian beef to be served around the world. When Harrods opened its first overseas branch, the natural location was not Paris or New York, but Buenos Aires. So how did such a rich country become a victim to perpetual crisis, instability and a stagnant economy.

Problems of Economy

Inequality

The great land rush of the early twentieth century was not distributed evenly. The government favoured a wealthy class of landowners and this lack of democratic ownership created a deeply unequal society. When the Great Depression struck in 1930, Argentina, which relied heavily on exports, was particularly hard hit. Global trade dried up and Argentina’s economy suffered. In response to the crisis, a military coup only worsened matters, causing foreign investment to flee and investment to fall. It is a cautionary tale that gaining wealth from commodities is not enough. Economic riches also need strong institutions which can avoid extreme economic and political division.

Welfare State

In reaction to the past coup and high inequality. The 1946 election of the populist Juan Peron and his glamorous wife Evita saw a very different economic model. Wages were increased and a welfare state created. But, the government frequently promised more than the economy could produce. It led to cycles of rising budget deficits, foreign borrowing and in desperation to pay bills, the Central Bank was pressured to print money and inflate away debts.

The problem is that to reduce inflation requires unpalatable policies like controlling money supply, and higher interest rates, But given a weakness of living standards, it is something governments are reluctant to do. Rather than tackle the causes, there has been a preference for quick fixes. For example, when inflation was a problem in 2014, the government simply fired the official statistician and published its own data which massaged the figure. It was even illegal to publish inflation data. But, no one was fooled, only serving to reduce faith and confidence.

2001 Crisis

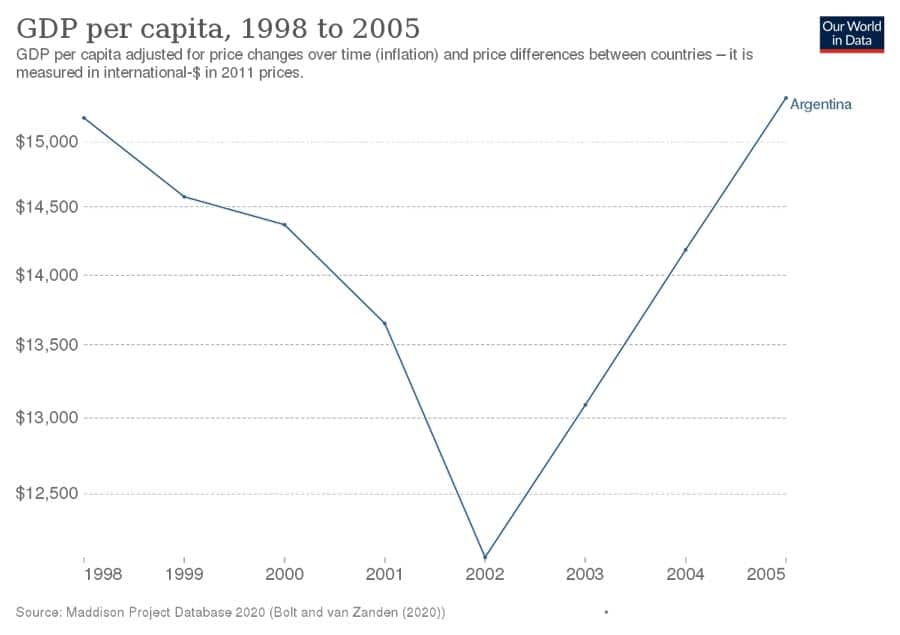

In 1991, in response to a latest bout of inflation, the IMF became heavily involved in Argentina as the country sought to introduce free-market reforms, privatisation and pegging the currency to dollar. However, in 2001, a build up of debt and collapse in confidence caused another full-blown crisis, the Peso devalued, the country defaulted and there was a run on the banks. By the end of 2002, the country had contracted 20% with tremendous economic and social costs. It wasn’t supposed to be like this why did Liberal free market reforms fail so badly in Argentina? Some blamed the IMF and its insistence on free-markets, others blamed the government for misusing IMF funds. In truth, it was a bit of both.

With continuing inflation resulting governments have sought to reduce prices through a complex array of price controls and regulations, all aimed at artificially reducing prices, but without fixing underlying structural weaknesses. Energy is massively subsidised in Argentina, monthly electric bills are only $15 a month, compared to $115 in the US. But, when energy prices soared in 2022, the government had to borrow more.

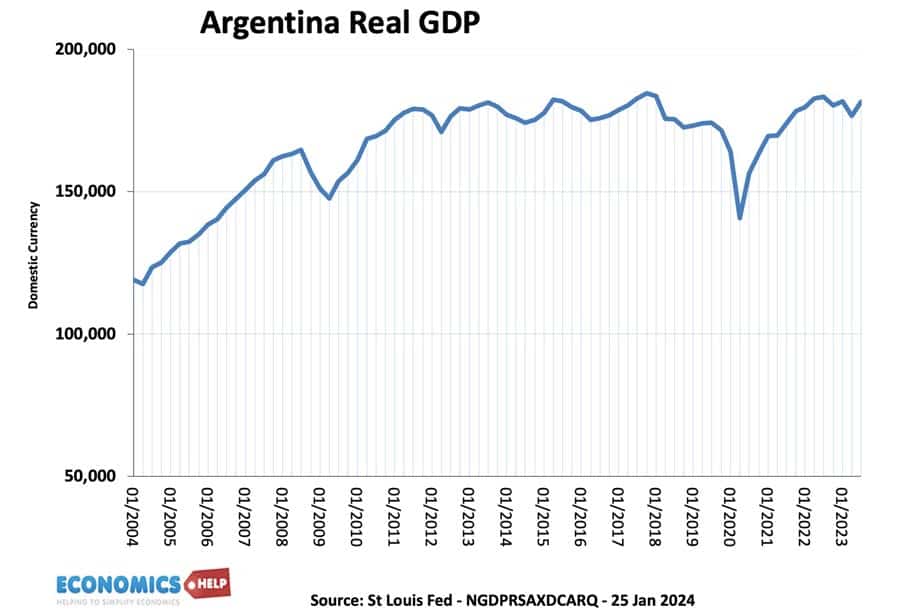

Natural resources

Like many struggling economies, Argentina is paradoxically rich in natural resources. It owns 21% of the world’s lithium and a powerful agriculture sector. But, Argentina has been hit by the resource curse. When the economy does boom, there is a failure to use proceeds for long-term investment, a preference for short-term spending and over-confidence. Throughout the past 100 years, the economy has flitted from boom to bust, without any stable, less spectacular expansion.

In the post-war period, Peronism promoted import substitution. A policy which involves trying to be self-sufficient and not rely on imports. Tariffs were increased and Argentinian trade as a share of GDP fell from its heady heights of its golden period. Even recently global trade has been shrinking. Argentina has many natural resources, but it struggles to make use of the opportunity and its reserves diminish

In fact, Argentina has been an outlier of economic performance with a steady relative decline. The Nobel Prize winning economist Simon Kuznets is said to have claimed throughout history that there are four kinds of countries: developed countries, underdeveloped countries, Japan, and Argentina.

Shock Therapy?

But, can this unfortunate story be overturned? Javier Milei says Argentina needs shock therapy medicine, devaluation, free markets, cuts in government spending and ultimately dollarisation of the economy. But, will it work can the economy survive the short-term pain of shock therapy and why does he invoke Thatcher as an economic model, find out on my new channel and this video on Shock Therapy.