Since the financial crisis of 2009, the UK economy has experienced a real decline in economic fortunes.

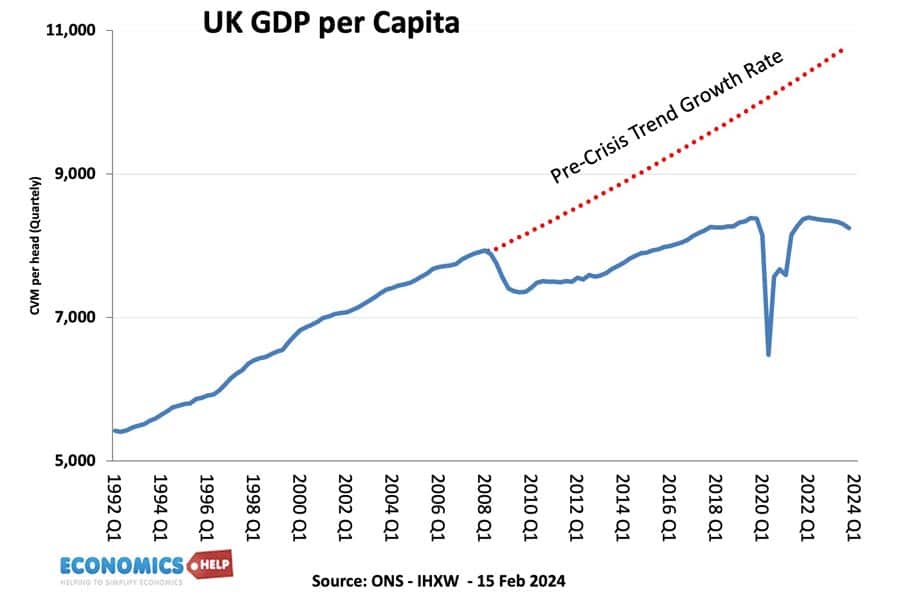

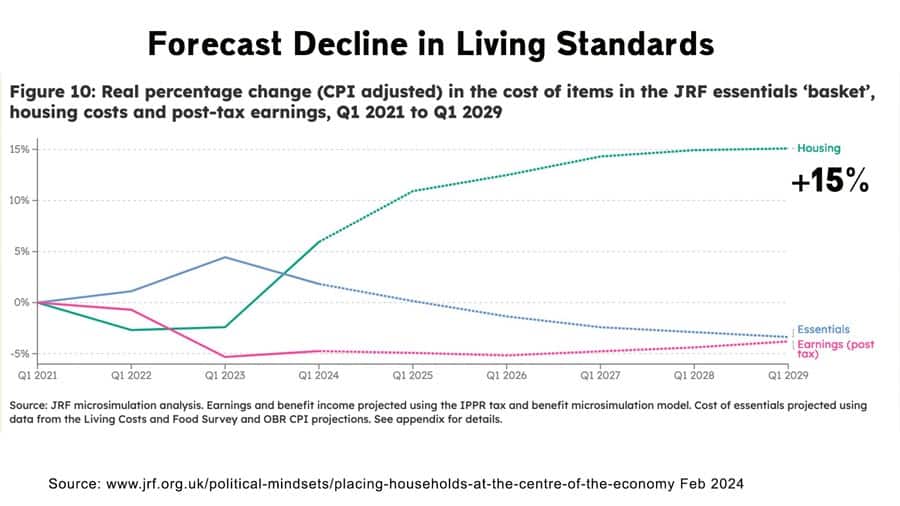

Last month, we entered a recession, but real GDP per capita has been stagnating for a decade. This poor economic performance is creating its own spiral of problems- rising debt, low investment and creaking public services. Recent budgets which sort to boost short-term growth, have fallen flat. The UK has become racked with short-termism, flip-flopping on policy and poor decision-making. The JRF report that on current trends the average household is at risk of being nearly £1,300 worse off by 2029. Where did it all go wrong and why, without a radical change of direction, it is destined to get worse?

In 2010, in the aftermath of the financial crisis, the outgoing Chief Secretary to the Treasury left a note saying “I’m afraid there is no money.”

Austerity

It was supposed to be a humorous joke, a dark sense of humor, but it was capitalised on by the incoming government who repeatedly used it as a justification for austerity.

However, cuts in government spending and investment undermined the economic recovery, and throughout the 2010s, the UK struggled. The economy was propped up by ultra-low interest rates and quantitative easing, but this did more to inflate the housing market than encourage business investment.

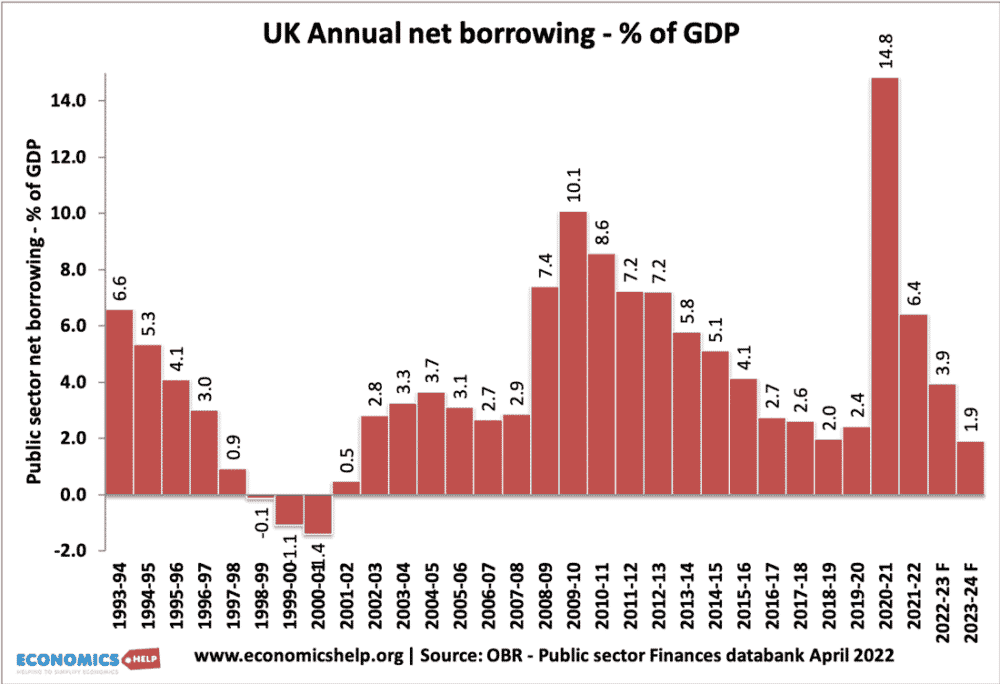

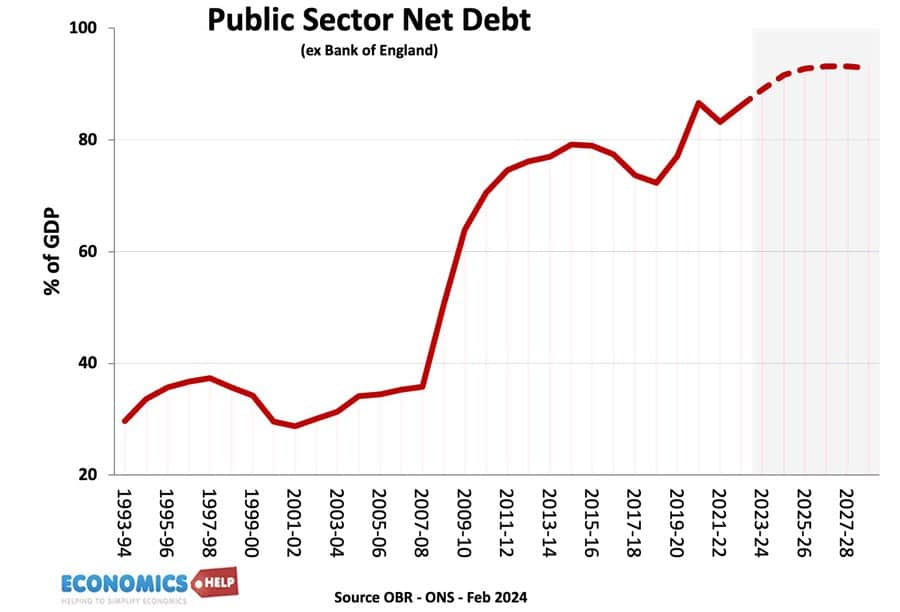

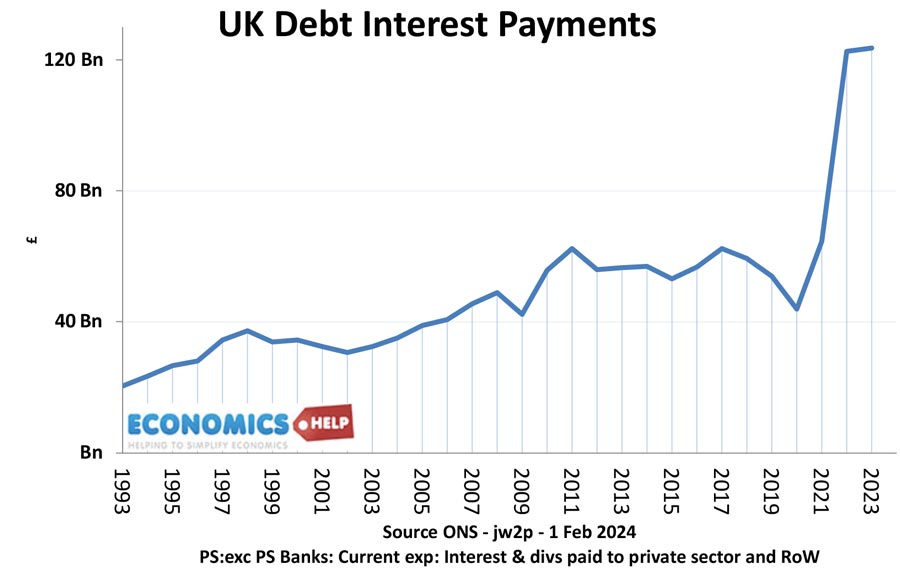

The irony of that note was that in 2010, public sector debt was 55% of GDP, in 2023, today it is closer to 100%. Despite cuts to public services, the years of austerity and lower growth saw government debt continue to rise. In the 2010s, the Bank created money to buy government debt, making it easy and cheap. But, now they are doing the opposite – selling off their bonds, meaning the private sector is having to buy even more debt, risking higher interest rates.

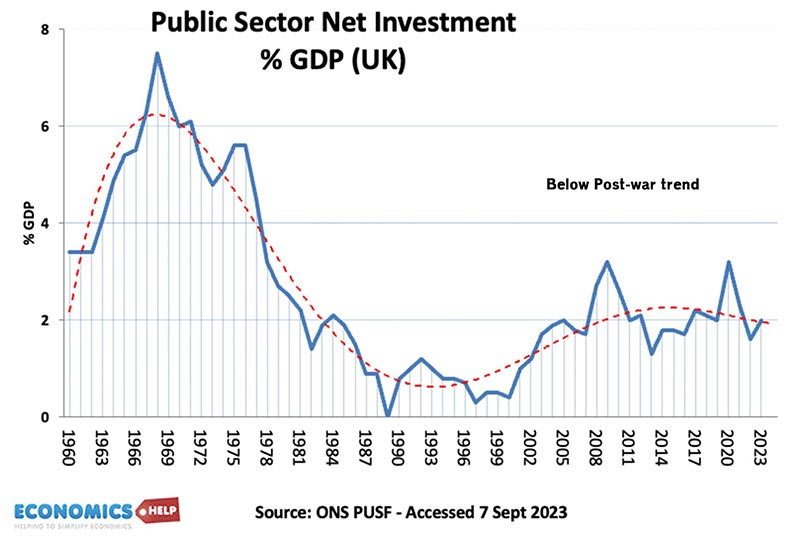

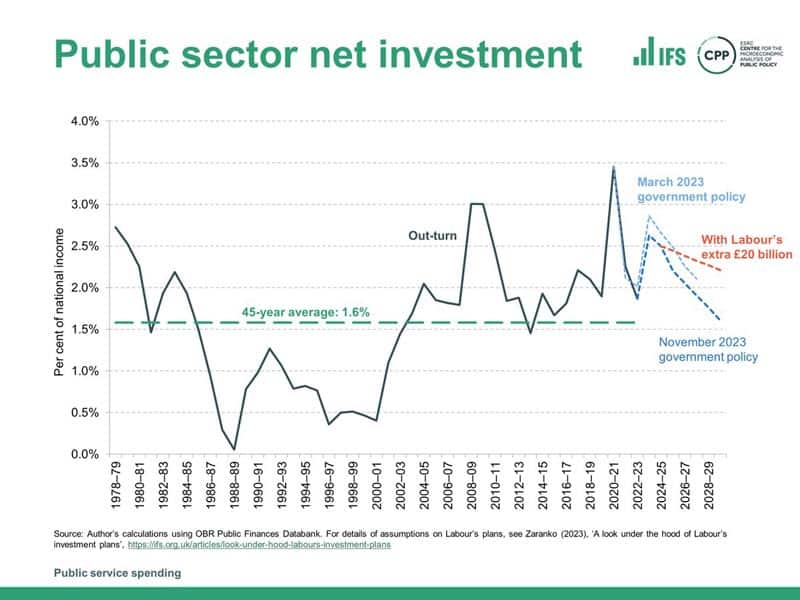

The decline in public sector investment is particularly worrying because we are becoming reliant on things built in the 60s and 70s. The education budget is one area badly affected by austerity, and this was manifested in the collapsing school roofs earlier in the year. But, whilst it fades from the news, many other services face backlogs and underinvestment. The problem is this decade-long cycle of underinvestment is set to get worse.

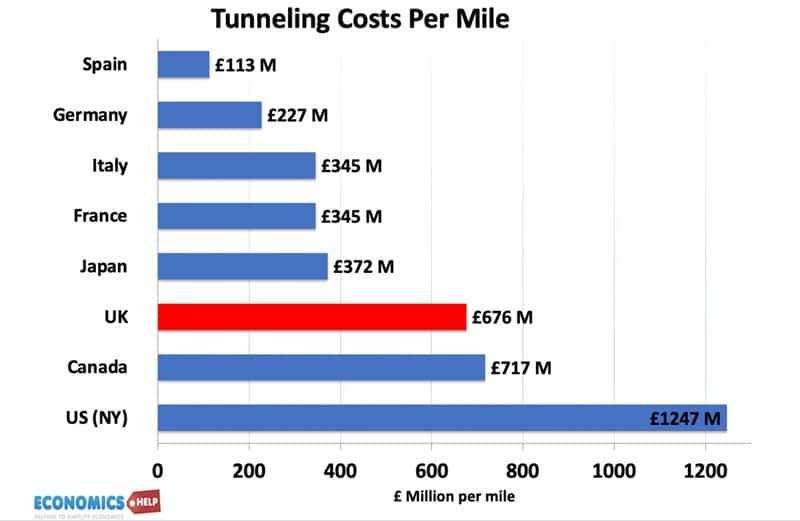

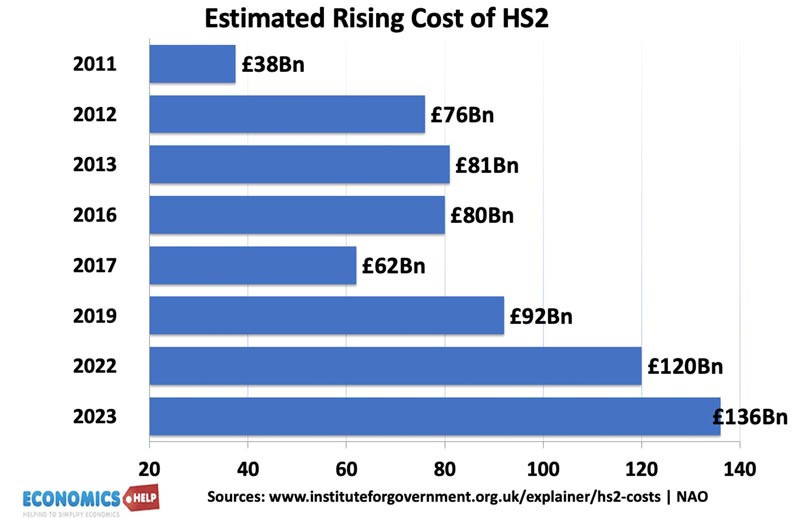

Both parties are committed to reducing public sector investment as a share of GDP. But, the UK has many areas needing more investment. It is also not just about spending more, but also trying to tackle the UK’s inability to build things. The HS2 fiasco highlighted the serious problems the UK has with investment.

It’s just expensive to build in the UK – bad management, expensive planning regulations and political meddling all caused HS2 to run over budget and then be partially cancelled leaving the least attractive part of a £50bn railway no one really wants.

And when HS2 was cancelled, experts warned it would make it harder for companies to trust big infrastructure projects in the UK again.

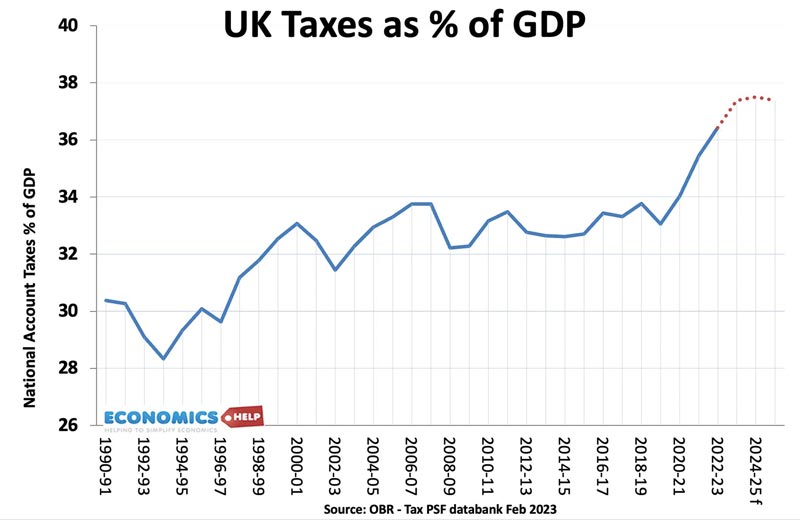

Flip-flopping of policy is another feature of recent years. The large scale of tax cuts under Truss crashed the bond market. This was followed by one the largest scale of tax rises on record. Corporation tax has been changed four times since 2019.

After large rax rises last year, Taxes will be cut slightly this year. But, as a consequence, they are very likely to rise next year. A kind of tax cut sandwich. The unwelcome truth is that the UK is facing a series of unpalatable choices.

If we really want to force tax cuts through, we will have to deal with another round of austerity on depleted departments. Wherever you look, be it courts, education or health care, there is a fraying at the edges and backlogs of court cases or waiting lists in health.

Despite efforts to offer selected tax cuts, the UK tax share is rising to record post-war levels. NI cuts are clearly outweighed by the freezing of tax allowances.

Another unwelcome development is that the cost of servicing UK debt has substantially increased. In the 2010s, ultra-low rates made it very cheap to borrow. But, since 2022, interest rates have soared and this means the UK is paying more on debt interest payments. It’s an unpopular truth that we are paying more tax just to pay debt interest payments. The big problem is that debt to GDP is forecast to continue rising – primarily because economic growth is expected to be so low. And this is the vicious cycle – low growth rising debt, higher interest payments, feeding into lower investment. The 2010s saw very cheap government borrowing but an opportunity to invest in renewable energy was limited, making the UK particularly susceptible to the energy price shock of 2022. £100bn on importing energy in one year.

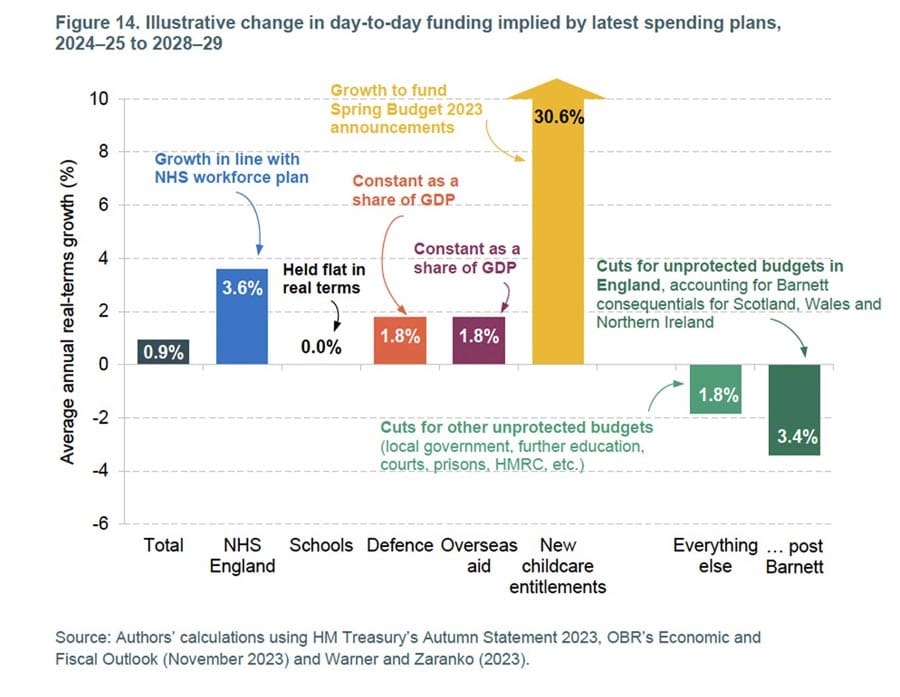

However, even these forecasts for future debt are highly debatable. The OBR is legally obliged to model forecasts based on government spending plans. The government has stated spending by departments will rise to £477.6 billion by 2028. However, they made no specifications for how this would be achieved. It led the head of the OBR to comment, the fiscal plans were worse than fiction. The problem is that high inflation has eroded the real value of spending, but the government is not adjusting upwards. Therefore, there is a squeeze on real spending. The IFS warned that unprotected departments could see a real cut of 3.4% a year for four years.

But another element is that the population is rising rapidly, primarily because of high immigration. Therefore, spending per capita is even more squeezed. High immigration does boost GDP and tax revenues, but unless there is a corresponding rise in public services, per capita spending will be worse off. Adjusted for population, the cut in departments will be 4% per person.

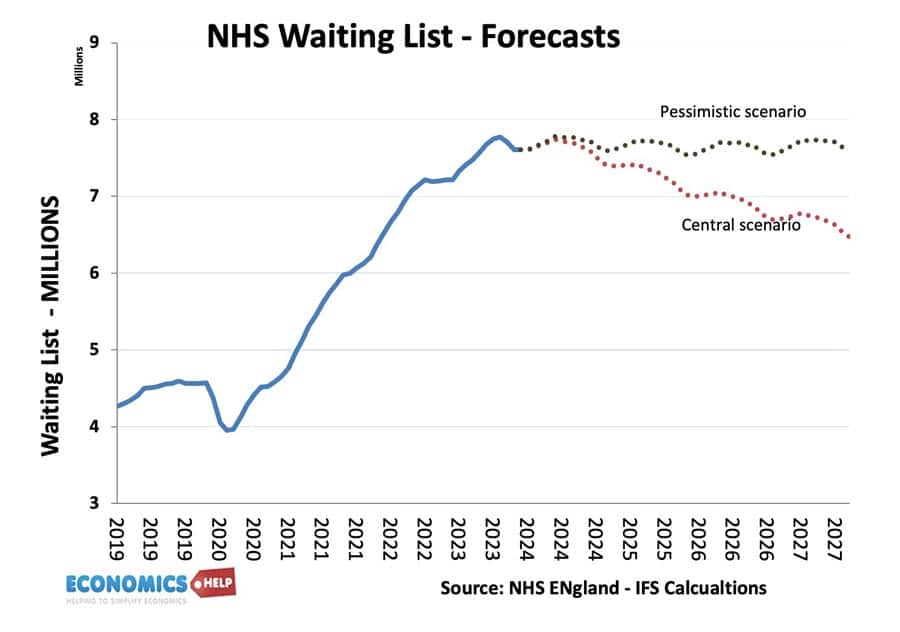

The public are concerned about the state of public services. Concerns over the NHS are the biggest fear of the public, and there is good reason. NHS waiting lists have soared to record levels. However, there is little hope for a quick fall.

IFS forecast only a small decline from the Covid peaks, leading to a long-term structural waiting lists as an ageing population places more demographic pressures on government finances.

Poor health is increasingly an economic as well as social concern. The UK has seen a rise in long-term sickness causing a decline in labour market participation and shortages, even as the economy is in recession. This is adversely affecting labour productivity and is causing a rise in government spending. Benefit spending on disability allowances has almost doubled in the past decade.

Regional Divide

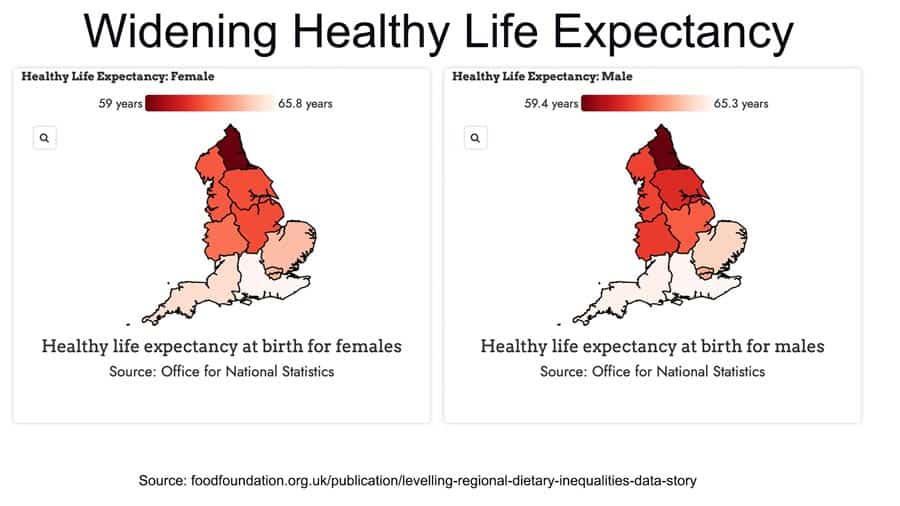

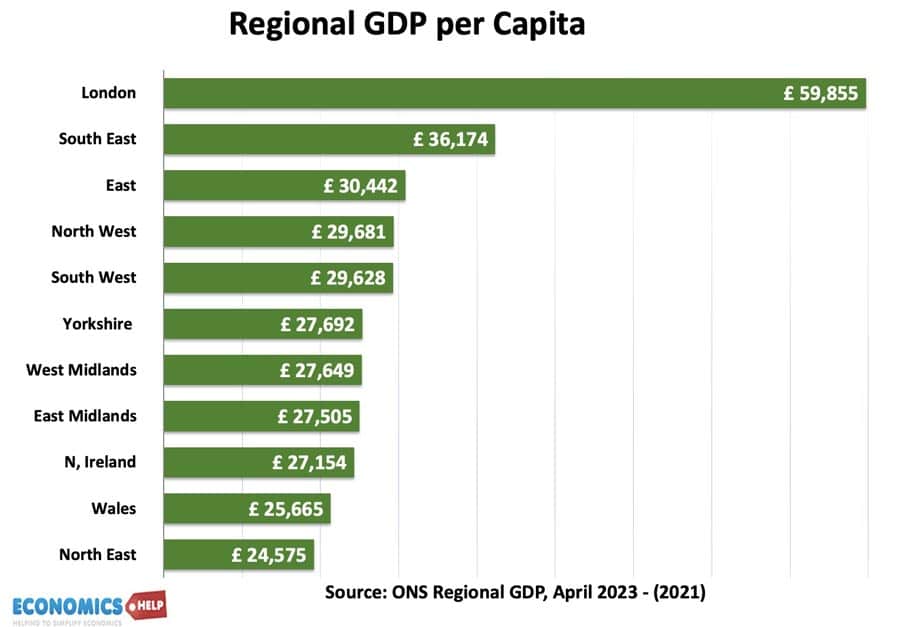

One of the UK’s fundamental problems is a regional divide, with real GDP per capita almost double in London compared to elsewhere. Take out London, and the UK record looks more dismal. London is attracting jobs and investment, but other regions are struggling. Despite promises of levelling up, the IPPR think tank expects regional inequality to worsen in the coming years.

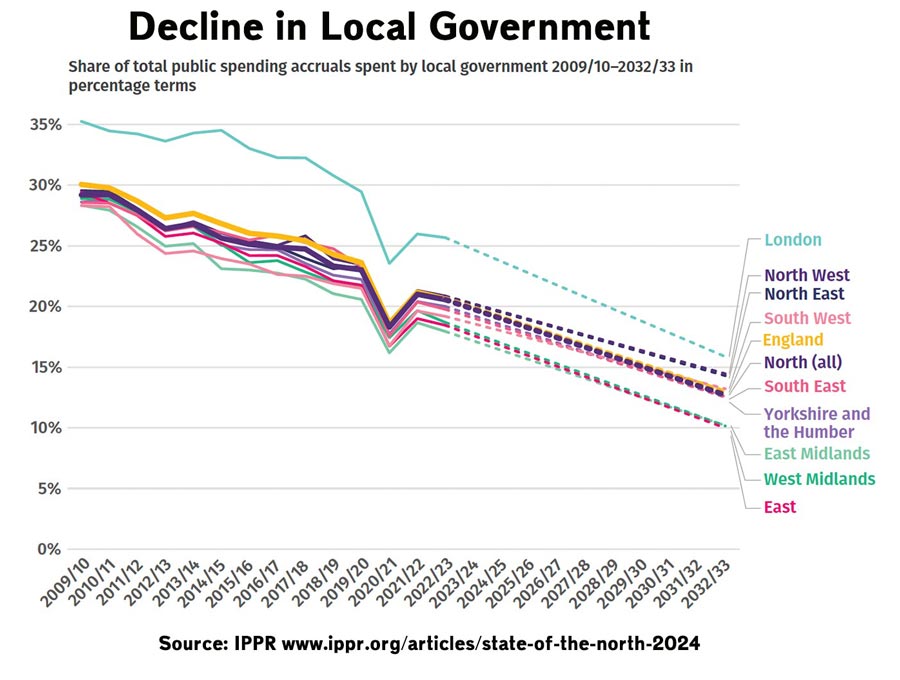

Funds for levelling up have been dwarfed by a decline in local government spending, and with many councils facing bankruptcy, local councils are facing more austerity than ever. One way to revitalise the left-behind regions is to devolve more power and decision making to local communities, but the reality is that local councils have been starved of funds and this is likely to continue in the next 10 years.

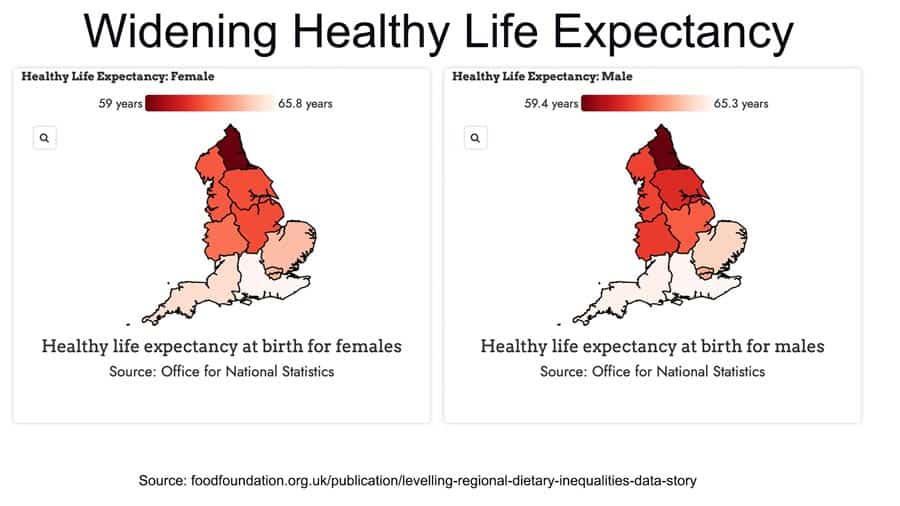

Regional inequality is not just about economics, it is also reflected in life expectancy and healthy life expectancy. And this is still expected to worsen in the coming years.

Productivity Decline

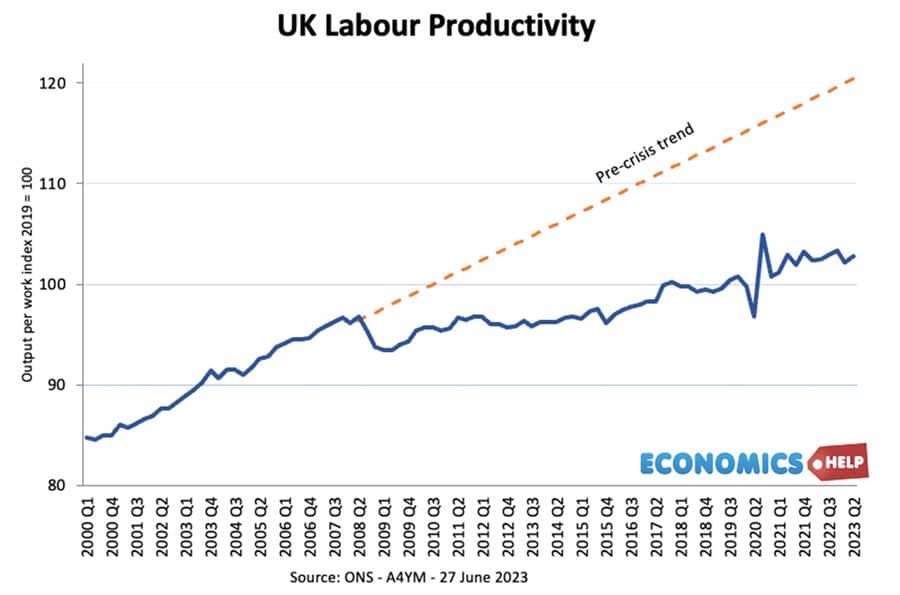

At the root of the UK’s problems is a fall in productivity, with around a 25% gap to pre-trend growth. This is not just a UK issue. Many advanced countries have seen lower economic growth and lower productivity growth. But, the UK has one of the worst performances in productivity, not helped by some self-imposed handicaps.

Brexit

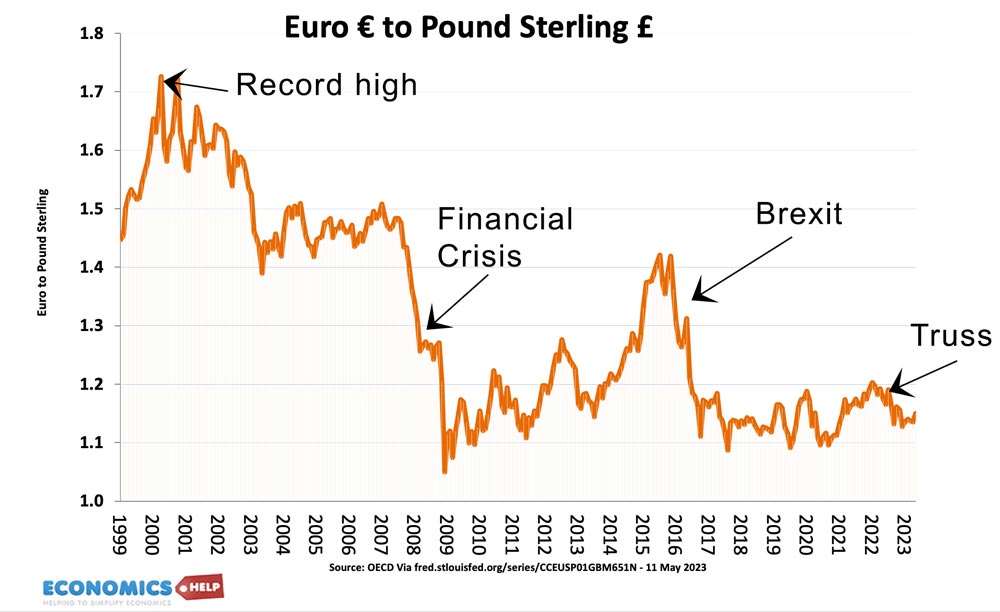

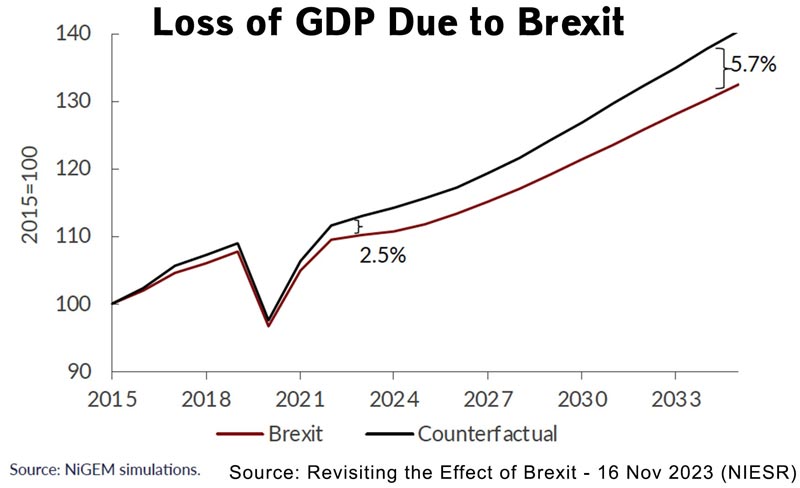

The Brexit vote of 2016 led to a sharp fall in the Pound, though admittedly, the Pound has been sliding for decades, but markets were more pessimistic with the UK outside the EU. The performance of UK-based firms on the FTSE-100 has fallen behind those who are more global. The Brexit deal finally negoriated was much harder than many predicted and has seen new barriers to trade with the EU and so far, very little in the sign of new trade deals. The disruption to trade has seen exports to Europe fall since 2016, and in particular since the UK left the single market in 2021. New barriers and regulations are still coming into force this year, making life difficult – especially for small and medium-sized firms. But, Brexit was more than trade barriers, the uncertainty and frequent changes hit business investment, at a time when UK investment was already one of lowest in the OECD. Brexit also damaged the UK’s reputation as a place to do business, making it harder to attract Foreign Direct investment.

The costs of Brexits can be exagerated, but various models suggest a loss of income between 4-5% of GDP over a decade. That’s £2,000 per person. On the positive side, Brexit is one area where a more pragmatic attitude could see future benefits to trade and investment.

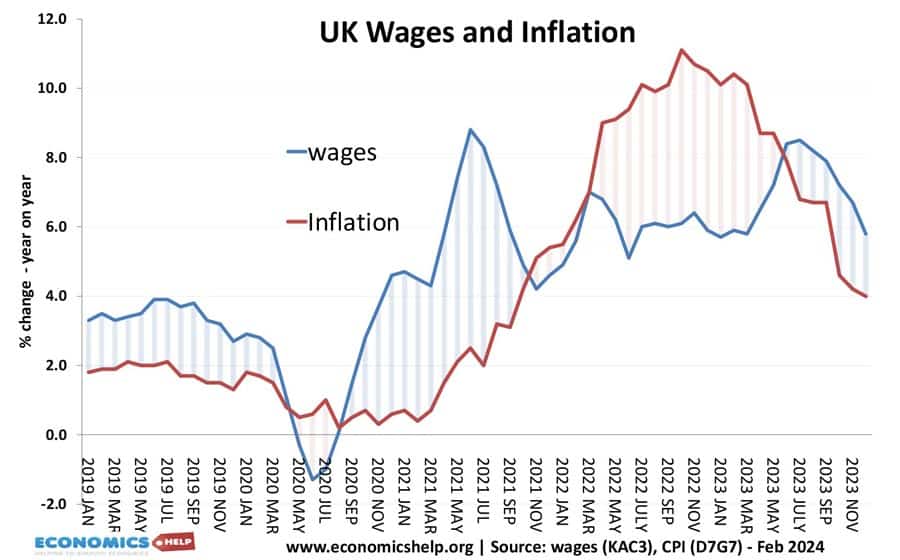

One of the biggest causes of declining living standards in recent years has been the high inflation combined with low wage growth. This stemmed primarily from global factors, such as rising gas prices. However, the UK has experienced a relatively higher inflation rate than other countries. Higher food prices are at least partly attributable to Brexit effects. This continued inflation is an issue with the Bank refusing to cut interest rates despite pushing the economy into recession.

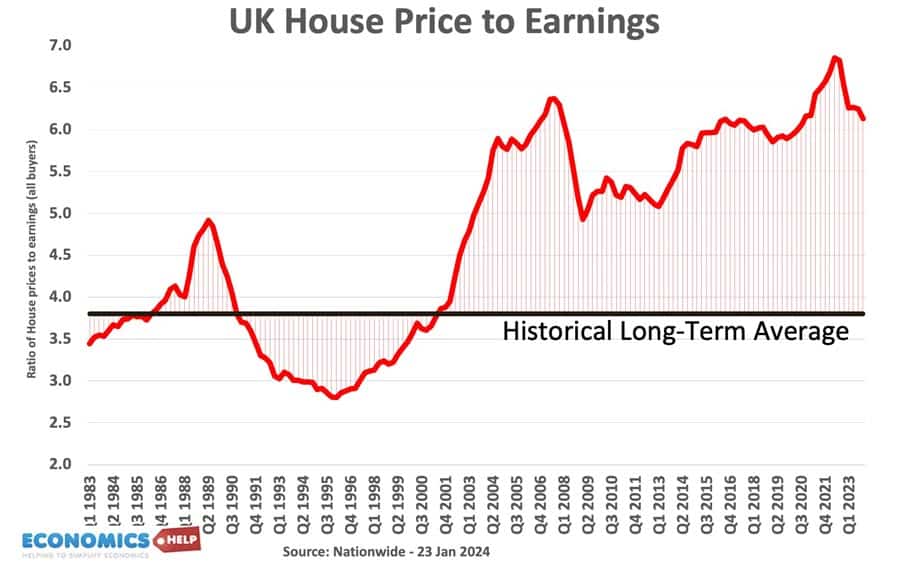

Housing is another particular weight on UK living standards. Prices and rents rose faster than incomes in the 2010s and due to a chronic shortage, according to the Joseph Rowntree Foundation housing costs are expected to continue rising faster than inflation in the coming several years.

The problem is the UK has proved very ineffective at meeting even modest house-building targets. Since the government stepped back from building social housing, the private sector has shown little willingness or ability to build the quantities needed by a growing population. The result has been a rise in homeless with more living in temporary accommodation, and a fall in homeownership rates, especially for the young. The distorted housing market has also increased wealth inequality. Housing opportunities are increasingly determined by parental wealth.

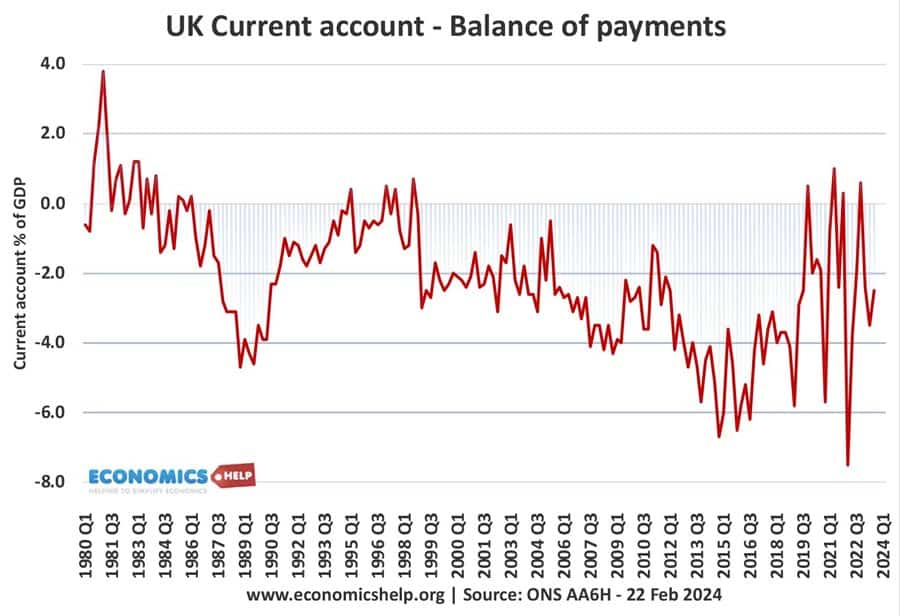

Current Account Deficit

Another reason to be pessimistic is that the UK has another form of deficit – a trade deficit. Since the decline of the manufacturing export sector, the UK has run a persistent current account deficit, becoming a net importer from Asian countries like China. This kind of deficit puts more pressure on the government to run fiscal deficits in order to support the struggling economy. This is not unique to the UK, other Western economies like the US are running this twin deficit. The problem is that readjusting the exporting sector is quite difficult, especially with disruption to EU trade.

It all paints a fairly grim picture, and there has been relatively little effort to convey the difficult trade-offs the country face. Two budgets a year don’t help, when there is a tendency to seek a short-term sticking plaster to long-term solutions. The outlook is for either higher taxes and or lower quality of public services. In this video, I only briefly touched on the housing market, but this video goes into more detail about why the housing market has become more unaffordable and unequal and what if anything can be done about it.