Readers Question: Does Germany Benefit from the Euro or does it lose out from the Euro because of the cost of bailing out weaker southern European countries?

It is a difficult question to answer, but Germany has gained many advantages from membership of the Euro. There are also many costs involved.

Firstly, you could look at the traditional benefits of the Euro (lower transaction costs, greater certainty over exchange rates). But, these seem relatively minor compared to bigger issues which have emerged.

Benefits to Germany of Euro

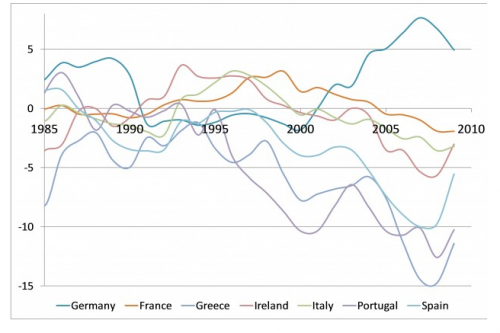

Very Competitive Exports. A key issue of Euro membership is that German exports are more competitive than if Germany had its own currency. Germany has seen the strongest productivity growth in the Eurozone area. Germany has been successful at increasing output and keeping wage costs low. If Germany still had the D-Mark, this increased productivity and low inflation would cause an appreciation in the D-Mark. But, with Euro membership, Germany hasn’t seen this appreciation against other European economies. Also, to non-EU countries the Euro is weaker than the D-Mark would be. The consequence is that the German export sector has done well because of improved competitiveness. This competitiveness is reflected in a large current account surplus.

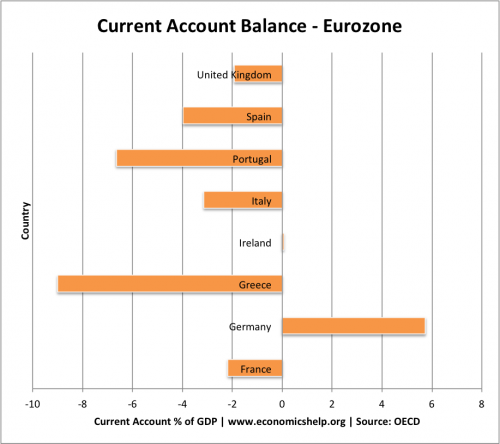

Germany has a large current account surplus nearly 6% of GDP – matched by a corresponding current account deficit in southern Europe.

Germany has seen a current account surplus since 2001

Without membership of the Euro, Germany would have more expensive exports, higher unemployment and lower economic growth. This is the nature of a single currency – some will be ‘winners’ some will be ‘losers’.

From one economic perspective, the Euro may be better off without the strength of the German economy. (why Germany should leave the Euro) It is something of a paradox that German economic success (improved productivity, lower wage costs) can create problems. But, within the structure of the Eurozone, one country’s current account surplus, is another current account deficit.

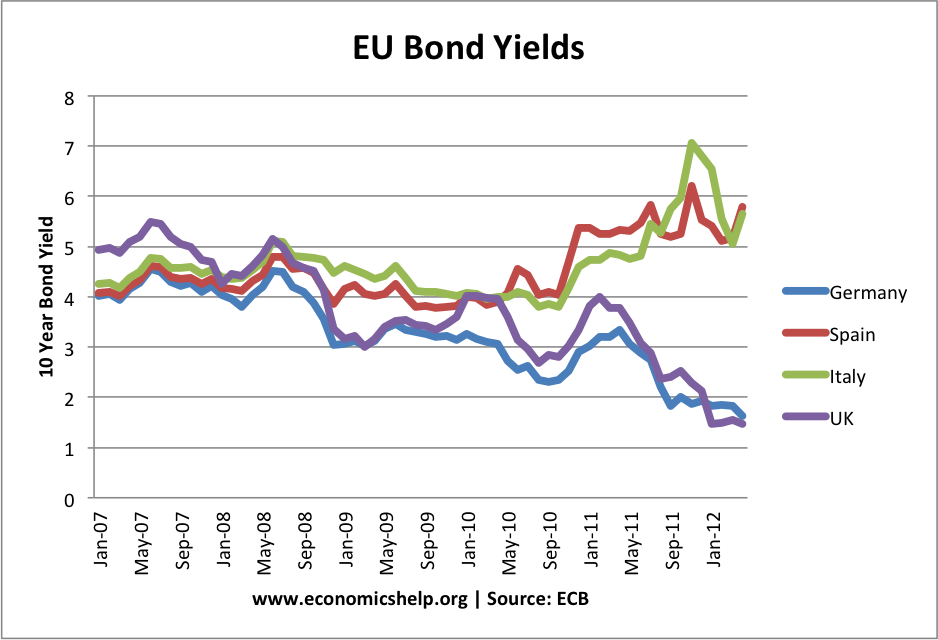

Bond Yields

Uncertainty over government debt in southern Europe has led to rising bond yields in countries like Spain and Italy. By contrast, German has seen record low bond yields, making it very cheap for German to finance its public sector debt.

Economic Growth

The German economy is closely linked to the fortunes of the rest of Europe. But, the Eurozone has seen strong deflationary tendencies. This is partly due to inflation targeting of the ECB, overvalued exchange rates, and the pursuit of austerity. If Europe gets dragged into recession, the German economy – which is strongly export-based, will struggle as a consequence.

Despite German’s relative success in the Eurozone, prospects for growth in 2012 are weak, and economic growth rates since the introduction of the Euro are hardly impressive.

Costs of Bailouts

Germany sees the benefits of keeping the Euro and avoiding a Euro breakup. This places them in a difficult position because they are one of few countries to have the necessary resources to provide substantial bailout funds to the economies in a real crisis. Germany has committed substantial funds to the EU bailout funds.

Credit Suisse suggests if all German bailout contributions are used, it will cost an estimated bill of 671 billion euros ($838 billion) or 25 per cent of German GDP. (link, Yahoo Finance)

However, the temporary loans and commitments have so far failed to solve the underlying problems in the Eurozone, therefore there are persistent calls for more bailout funds – and different kinds of bailouts (i.e. IMF called for direct recapitalisation rather than just temporary loans) Germany has committed substantial sums, but it hasn’t even worked. Some economists fear that without a commitment to fiscal union and structural change, the ‘half-hearted’ bailout funds may fail anyway – leaving a cost, but no benefit.

Political Influence

Another difficult for Germany is that there plan for saving the Euro resolves around very strict rules for fiscal policy and budget deficits in other Eurozone countries. In return for bailout funds, Germany is insisting on ‘fiscal responsibility’ the EU fiscal compact. This could increasingly draw Germany into a difficult situation – where it is perceived as directing domestic policy in other countries.

Cost of Eurozone Breakup for Germany

The Euro has many costs for Germany and political support is falling. With 39% of Germans in favour of leaving the Euro. But what would the break up of the Euro cost Germany?

The German ministry of finance has done just such an analysis, according to Der Spiegel, and found that the costs of such a break-up and the re-introduction of the D-Mark would lead to an up to 10 per cent fall in GDP in the first year. Unemployment would surge to its record high of over 5m. (FT)

Related

Has euro membership been of benefit to its participants?