The Bank of England has the task of setting base interest rates to try and meet the government’s inflation target of 2%.

The base rate is the rate at which the commercial banks have to borrow from the Bank of England. The Bank manages the money supply so that commercial banks usually end up having to borrow from the bank of England at the end of the day. This means that this repo rate is very influential in determining general interest rates throughout the economy.

An increase in the base rate usually, but not always, leads to an increase in the lending and saving rates of commercial banks.

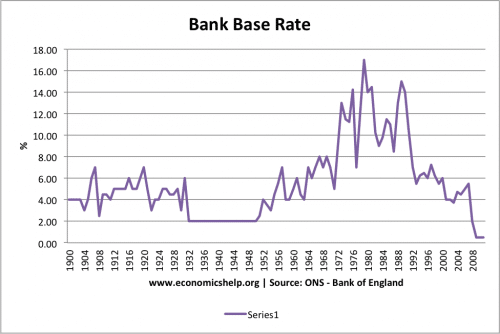

Bank of England Interest Rates since 1900

What is the Current Bank of England interest Rate?

The Bank meet every month to set rates. To find the latest base rate you can go to the home page of the Bank of England The Bank of England change interest rates to try an maintain the inflation rate close to the government’s target of CPI inflation = 2%

Bank of England Inflation Forecasts

The Bank of England prepare inflation forecasts to try and predict future inflation trends in the economy. Future inflation prospects are important because base rate changes take time to have an effect on influencing spending. If the Bank think inflation will rise over the next 12 months, they will raise interest rates now. (this is called pre emptive inflation policy)

To predict inflation, the Bank of England look at a variety of economic statistics including:

- Factory gate inflation

- Raw material prices

- % of firms operating new full capacity

- Exchange Rates

Related