Greece is a very good example of the damage of austerity can do to both economies and the social fabric of a country. Firstly Greek austerity is almost unprecedented in its scope and intensity.

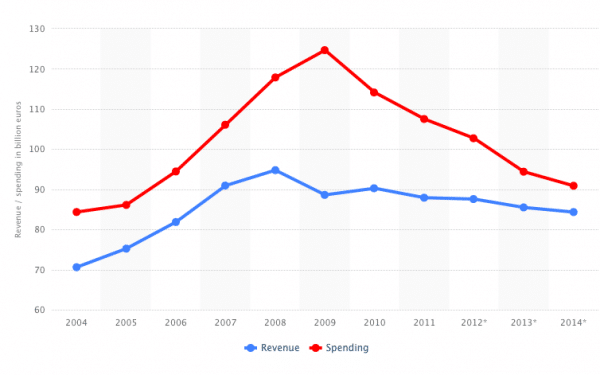

Greece government spending and revenue

Greek government spending was cut from €120 bn in 2008 to €90 bn in 2014.

To put that into context – the UK years of ‘austerity’ have seen government spending rise from to £522bn in 2007/08 to £722 bn in 2013/14 (UK government spending)

To cut government spending by 25% in nominal terms is quite rare. In addition, the Greek economy was also saddled with other difficulties which have contributed to lower economic growth.

- Due to higher inflation rates, Greece experienced a decline in competitiveness . Because it was in the Euro it couldn’t devalue and this led to a large current account deficit – lower exports and reduced domestic demand.

- No control over monetary policy. The ECB increased interest rates in 2011, and have, until very recently, rejected any form of quantitative easing to help boost domestic demand in southern Europe.

Cost of Austerity

The cost of this austerity has been enormous in terms of economics, social and political upheaval.

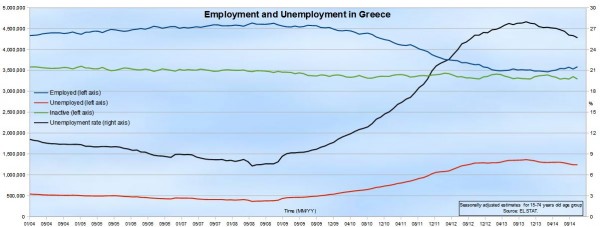

Source: wikipedia

In particular, unemployment has increased to one of the highest in the world – 27%, creating a real economic crisis and decline of ordinary economic activity.

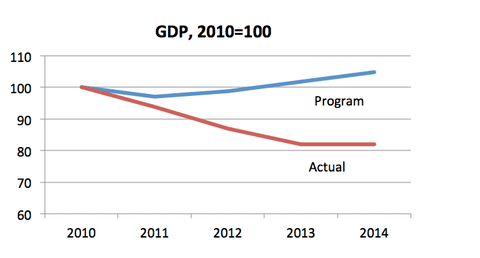

The Greek depression.

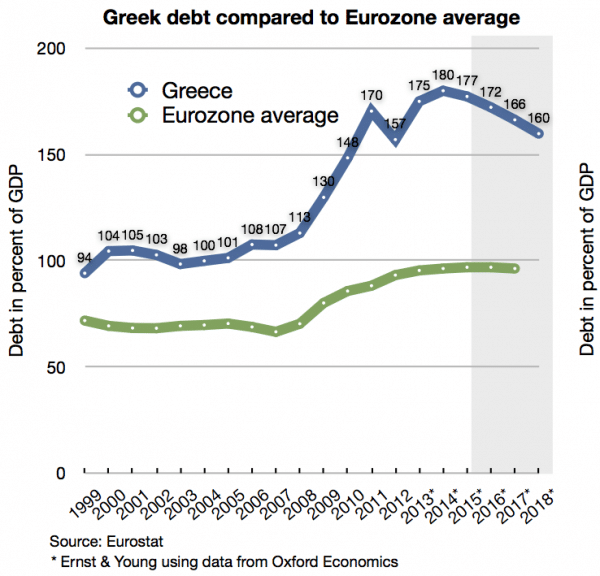

Greek public sector debt as a % of GDP

For all the austerity measures, the decline in Greece national debt as a % of GDP has been very slow to materialise. This is because the fall in GDP has made it very difficult to reduce the debt to GDP ratio. This is a cost of austerity – if it leads to lower GDP, it can become self-defeating

Greece and the Euro

Back in 2011, I wrote a piece about whether Greece should exit the Euro?

There are tremendous costs of leaving the Euro. In particular, there is a danger of capital flight as people seek to protect their savings by moving money abroad into Euro bank account.

However, if you have lived for eight years under austerity, it is understandable if people think it is too much. Yes, there would be short-term costs of leaving, but the Euro doesn’t work for Greece. It has been incredibly damaging. Also, it is better to feel in control over your economy – even if leads to short-term difficulties.

Even if Greece overcame this crisis, there is no guarantee they won’t experience a similar problem in the future.

In 2009, EU officials said the ‘sensible thing’ to do was to pursue austerity. But, this was not a sensible thing. The decline in GDP was much greater than they anticipated (though to many economists it was quite obvious what would happen to a depressed economy, if you cut spending so severely).

It is just a shame that Greece didn’t reject austerity five years ago. No one benefits from damaging an economy like Greece has been.

Related

Here is an alternative diagnosis :

http://unofficialdimioannou.wordpress.com/2013/09/07/greece-victim-of-excessive-austerity-or-of-credit%E2%80%91induced-turbo%E2%80%91charged-dutch-disease/

And a more readable one :

http://unofficialdimioannou.wordpress.com/2013/04/18/stories-about-defaults/

I believe they raise issues that the original post has missed.

It appears to me that the author doesn’t understand his own charts. Greek GDP flattened BEFORE austerity began. The earlier trajectory pre-austerity (especially 2004-2008) was clearly unsustainable, because government spending was growing faster than GDP, putting HUGE drag on the productive classes until it (and the resulting national debt, with its interest payments) started choking them, which choking was reflected in the decline in GDP. In fact, government spending is declining at a more rapid rate than the GDP is declining, which is a GOOD thing. If the current trajectories are maintained, GDP will be higher than government spending in the next couple of years, at which point Greece should see an improvement in the unemployment rate (and in the GDP).

Does any drug addict expect to become sober again without going through withdrawal pains? Those pains are very real, but they cannot be avoided except by staying under the influence of the drug…which is the ultimate in self-destruction. If Greece does the right thing and cuts government spending until GDP is higher than government spending, THAT is when the pain will start to subside.