An economic shock is a negative event affecting the economy it can involve

- Demand-side shock

- Supply-side shock

- Global shock

- Loss of confidence in the currency and banking system.

Policies to deal with economic shocks include

- Monetary policy – to reduce inflation or boost economic growth

- Fiscal policy – higher government borrowing to finance higher government spending.

- Devaluation – reduce the value of the currency to boost exports

- Supply-side policies

- External help – e.g. Accept bailout from IMF, EU (often requiring conditions such as structural adjustment)

Dealing with Demand Side Shocks

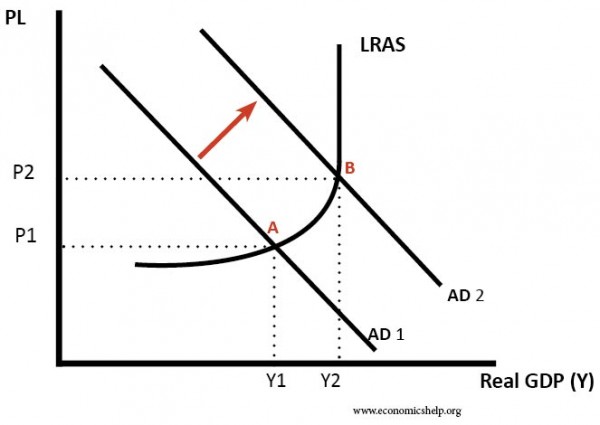

A demand-side shock could be an event which causes fall in aggregate demand such as global recession, fall in bank lending or fall in wages of workers.

1. Monetary Policy

Changing interest rates can affect AD. For example, in a recession, the government can cut interest rates to boost demand and increase growth. The lower borrowing costs will encourage firms to invest and increase the disposable income of those households with mortgages. When the economy is stuck in recession, monetary policy may be able to boost spending.

However, there are many limitations to this policy

- Monetary policy is usually operated by an independent Central Bank. Their target is low inflation, not economic growth. This might make them reluctant to cut interest rates if inflation is still a problem.

- Cuts in interest rates don’t necessarily increase spending. If confidence is very low, lower interest rates may not stimulate demand because firms still don’t want to invest – even if it is cheaper.

- If there is a banking crisis, lower interest rates will not encourage banks to lend. So there might be a shortage of funds – even if people would like to borrow at these low-interest rates banks don’t have the liquidity to lend.

More detail here: What determines the effectiveness of Monetary policy?

Unconventional monetary policy

In times of a severe recession, cutting interest rates may be insufficient to restore economic growth. In this case, it may be necessary to pursue unconventional monetary policies such as quantitative easing. This involves electronically creating money and using it to buy government bonds. This can be necessary for a balance sheet recession where spending falls considerably.

2. Expansionary fiscal policy

Expansionary fiscal policy involves increasing AD, through increasing government spending and cutting taxes. It will lead to a budget deficit. In times of a recession, it can help the economy come out of a recession. It can help create a multiplier effect and get unused resources being used economically efficient.

However, expansionary fiscal policy has many criticisms.

- Basically, it is argued fiscal policy may lead to crowding out. – This means the increase in government spending leads to less private-sector spending. Also, when expansionary fiscal policy is really needed, government borrowing may become too high, leading to higher interest rates on government bonds and a fiscal crisis.

- Also, expansionary fiscal policy involves higher levels of government borrowing and this may be politically difficult.

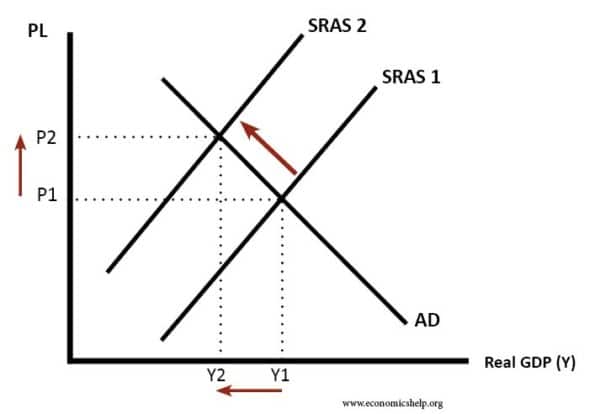

Dealing with a supply-side shock

A supply-side shock could involve higher oil prices. This causes SRAS to shift to the left. This leads to both higher inflation and lower growth. This is difficult to deal with because you can either

- Raise interest rates to reduce inflationary pressure

- Cut interest rates to boost economic growth.

But, whatever policy adopted, it will make the other problem worse.

IMF bailout

Another option for a real economic crisis is to borrow funds from the IMF. For example, if a country experiences a shock and there is capital flight – causing depreciation in currency and fall in economic output, then the country may approach an external body such as the IMF. The IMF can give temporary aid – the injection of capital can restore confidence in the economy. The IMF may insist on certain reforms which increase the efficiency of the economy – for example, improved tax collection, privatisation, deregulation.

See more at the role of the IMF

Supply-side policies

- Supply-side policies – These are policies aiming to increase productivity and efficiency in the economy. They take a long time, but, may increase productivity and deal with some issues such as cost-push pressures.

Devaluation/leave the Euro

Some countries in a fixed exchange rate system may be able to devalue as a solution to an economic shock. For example, the UK left the ERM in 1992. This policy enabled the country to boost spending and economic growth.

- If a country is a member of a single currency like the EURO, a country has even less capacity to change economic management. – Interest rates are set by ECB. One nuclear option Greece considered for a while was leaving the Euro.

Related policies

1 thought on “Policies for Dealing with Economic Shocks”

Comments are closed.