Some economists, such as Arthur Laffer, argue that there are circumstances when cutting tax leads to either increased tax revenue or tax revenues stay the same.

The logic is related to the incentive effects of tax cuts on productivity and growth. If income tax rates are too high, then workers may be discouraged to work. Alternatively in the mobile world, they move to other countries with lower tax rates.

Therefore, if income tax rates are cut, it leads to an increase in labour supply; workers are more willing to do overtime and people may be more inclined to work in that country. Therefore, despite tax cuts, tax revenues continue to rise.

It is a similar argument with corporation tax. If corporate tax rates are cut, it is more likely that multinational companies will locate in those countries with the lowest tax rate. Therefore, despite the low company tax rate, the actual amount of revenue increases.

In 2017, the US Treasury secretary, Steven Mnuchin claimed that the upcoming tax bill would a large boost to economic growth. He revived the idea tax cuts will pay for themselves.

“The tax plan will pay for itself with economic growth,” (NY Times)

Trickle-down effect. The logic of tax cuts is related to the trickle-down effect. The idea that if taxes are cut (even if primarily for high-income earners) it will spur innovation, investment and higher growth. This higher growth will cause an increase in spending and growth and lead to higher tax revenues which benefit everyone in the economy.

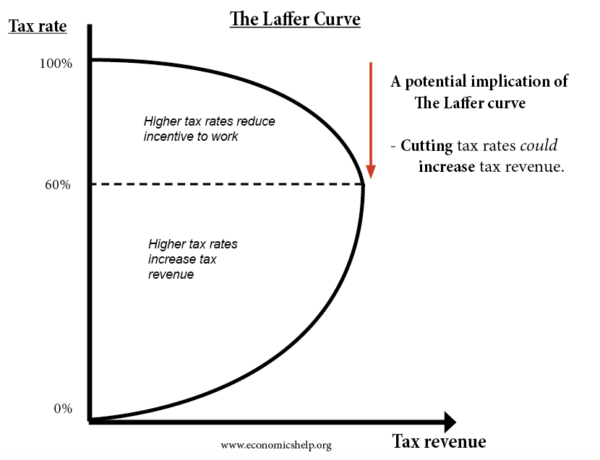

When looking at whether tax cuts can increase revenue, the Laffer Curve is sometimes invoked. This was imagined by Arthur Laffer. The basic principle is that

- If tax rates are 0%, the government will get no tax revenue

- If tax rates are 100%, the government will get no tax revenue because there is no point in working.

Therefore, there must be an optimal tax rate which maximises revenue.

Evaluation

Optimal tax rate. The most important factor is what is the tax rate which maximises revenue. Some estimates place the tax rate around 60 – 70%. Therefore, if income tax rates are cut from 38% to 35% then there will be no rise in income tax revenue.

Complex world. Most economists argue the idea tax cuts pay for themselves is simplistic. Economist Greg Mankiw claims

“A reasonable rule of thumb, in my judgment, is that about one-third of the cost of tax cuts is recouped via faster economic growth,” (NYT)

Paul Krugman is more forthright claiming the idea tax cuts pay for themselves is a ‘zombie’ idea.

“The ultimate zombie, the one that you see most often, is that tax cuts pay for themselves,” Krugman (Marketplace)

Isolating the impact of tax cut. Suppose there is strong economic growth, and rising company profit, then ceteris paribus, the government can expect a growth in company tax. If there is a tax cut, the tax cut, may lead to lower revenue – but this is outweighed by the rise in economic growth and profitability

- 2010 – company tax revenue = £120bn

- 2020 – company tax revenue after 10 years of profit growth £180bn

- 2020 – company tax revenue after 10 years of profit growth and corporation tax cut by 2% £160bn.

At first glance, it appears that cutting corporation tax by 2$ has led to higher revenues of an extra £60bn. But this does not mean that the higher revenue was due to the tax cut.

Without the tax cut, the government would have gained £80bn. So effectively the tax cut has lost £20bn.

Of course, a difficulty is knowing to what extent cutting the corporation tax rate leads to higher growth and higher profitability.

Income and substitution effect. It is often assumed that if income tax rates are cut, people will supply more labour – they will be more willing to do overtime. However, this is only one possibility.

The substitution effect looks at how tax cuts (and higher wages) make work more attractive than labour. But

The income effect looks at how tax cuts (and higher wages) mean workers can gain target income through working fewer hours.

In other words, it is not straightforward that higher wages make people work more. Some may work less. Also, in practice, workers may not be able to even work longer hours – hours may be fixed.

Examples of tax cuts

Kansas tax cut. In 2012, the Kansas governor, Sam Brownback passed the Kansas Senate Bill Substitute HB 2117, which was a radical program of income tax cuts and business tax cuts – in particular, it abolished pass-through income – income paid by business owners. The top rate of local income tax was cut from 6.45% and 6.25% to 4.9%.

The hope was that the bill of tax cuts would create an additional 23,000 jobs, boost the Kansas state’s rate of growth and the initial lower tax revenues – offset by future higher economic growth. Supporters stated that the Kansas Policy Institute, predicted the budget would create $323 million in new local revenues by 2018.

However, after the first year of the budget, the tax cuts led to a $688 million loss of revenue. (New Yorker). It led to record budget deficit and spending cuts had to be enacted.

Also the job creation was lower than hoped. Kansas saw just a 1.1 per cent increase in jobs – below neighbouring states Missouri’s 1.5% and Colorado’s 3.3%.

According to the Kansas centre for economic growth – After the tax cuts (2013-15) Personal income growth slowed. Kansas was 12th nationally in personal income growth before the tax cuts (2010-12) but slipped to 41st

US tax cuts 2017

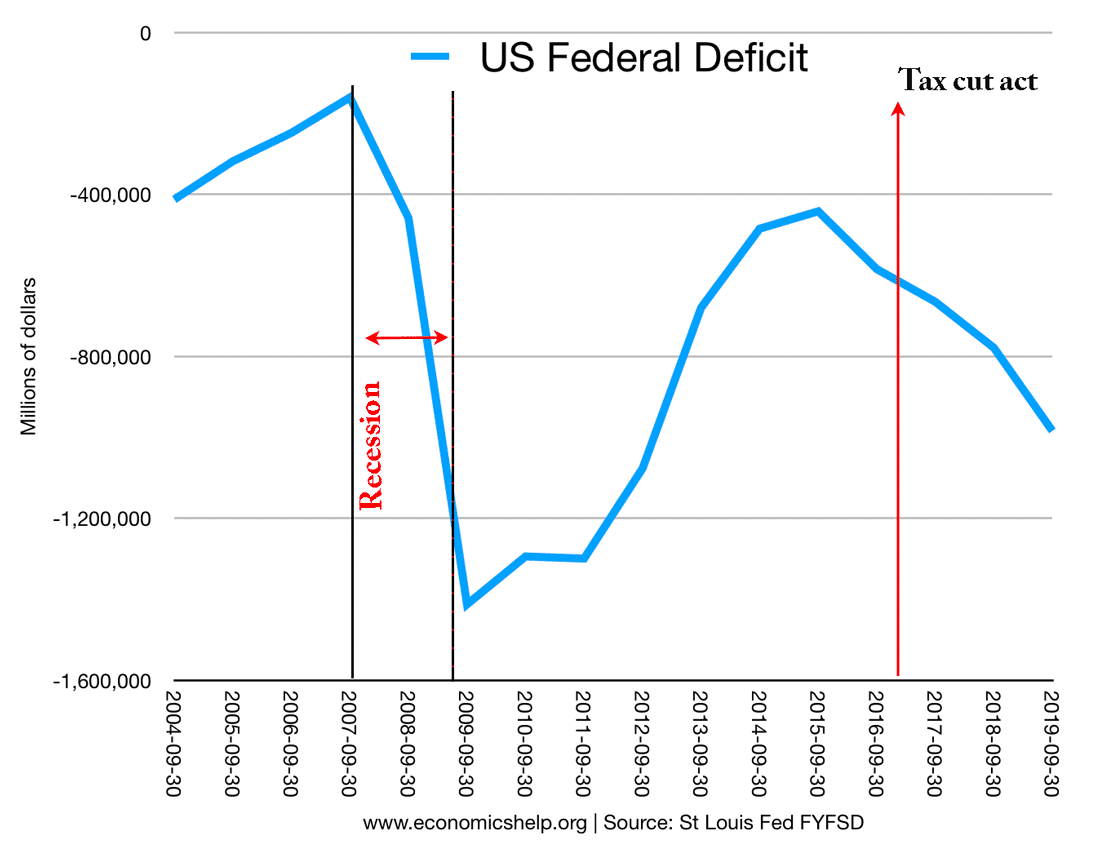

In 2017, Tax Cuts and Jobs Act (TCJA) passed a series of tax cuts. The Committee for a Responsible Federal Budget’, estimates it will include $5.8 trillion of total tax cuts over the decade at a net cost of $2.2 trillion through 2027

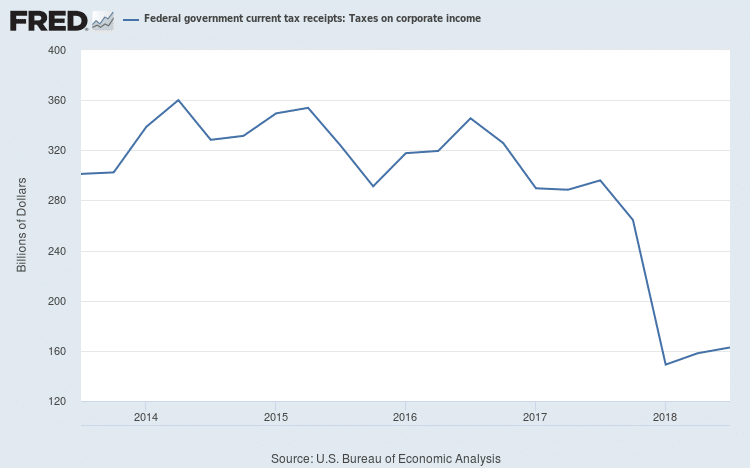

A particular feature of the US tax cuts was a big cut in corporation tax, but after the tax cut, corporation tax revenues fell sharply.

US tax cuts

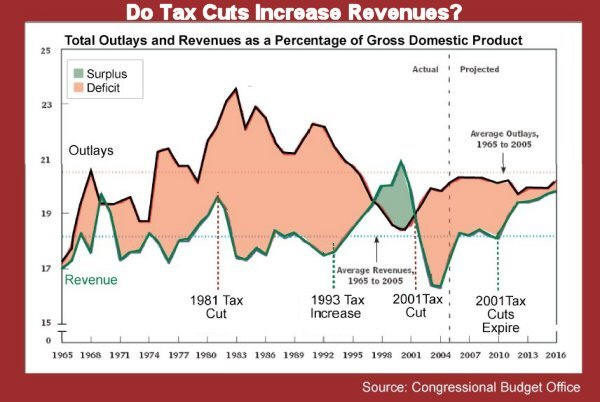

Tax cuts historically lead to a large deficit.

French income tax rate of 75%

For a brief period, France enacted a 75% income tax surcharge on incomes over €1 million (announced in 2012 and enacted in 2013 & 2014). However, the high tax rate provided a disincentive to work and high profile actors and business people took out foreign residency to avoid paying. The tax revenue generated from the tax cut was disappointing and less than the government prediction. The tax raised:

€260m in 2013 and €160m in 2014 (Guardian). Over the same period, the French budget deficit soared to €84.7bn.

The abolition of the tax in 2014 is an example of a tax rate that can be cut without affecting tax revenues. The tax revenue gained was so small. Interestingly, cutting the tax in 2015 only had a small effect on encouraging tax exiles to return to France, suggesting there is a long term disincentive of very high tax rates.

Conclusion

There is a significant difference between cutting tax rates in the US, where marginal tax rates are generally lower than 40% and cutting tax rates at 60 or 70%. At marginal tax rates of 40%, there is strong evidence that cutting tax rates (ceteris paribus) does lead to a fall in tax revenue.

Related

well explain on the laffer curve ,before i could not understand it