A current account deficit occurs when the value of imports (of goods/services/inv. incomes) is greater than the value of exports. Policies to reduce a current account deficit involve:

- Devaluation of exchange rate (make exports cheaper – imports more expensive)

- Reduce domestic consumption and spending on imports (e.g. tight fiscal policy/higher taxes)

- Supply side policies to improve the competitiveness of domestic industry and exports.

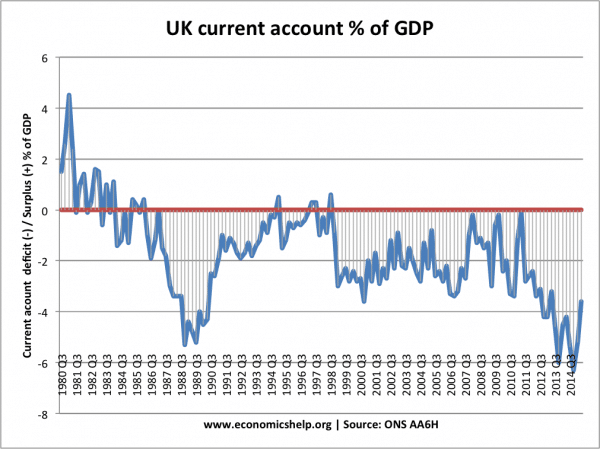

The UK has had a persistent current account deficit since the mid-1980s.

Policies to reduce a current account deficit

1. Devaluation

This involves reducing the value of the currency against others. (e.g. selling pounds would cause the value of the Pound to fall)

- If there is a devaluation of the currency, the price of imported goods increases and therefore the quantity demanded of imports falls.

- Exports will become cheaper, and there will be an increase in the quantity of exports.

- Therefore, assuming demand is relatively price elastic, we would expect a devaluation to lead to an improvement in (X-M) and therefore the current account on the balance of payments.

- However, it does depend upon the elasticity of demand for exports and imports.

The Marshall Learner Condition

This states that a devaluation will improve the balance on the current account, on the condition that the combined elasticity’s of demand for imports and exports is greater than one.

- If (PED x + PED m > 1) then a devaluation will improve the current account.

- If (PED x + PED m > 1) then an appreciation will worsen the current account.

This is because the effect on the current account depends on the total value and not just the quantity of exports.

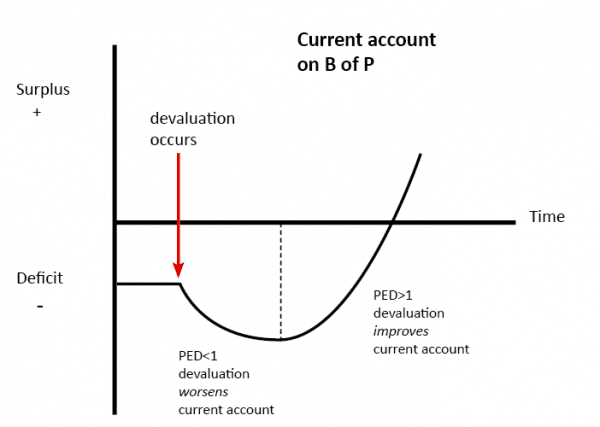

The J Curve effect

- In the short term, demand for imports and exports tends to be inelastic. Therefore, after a devaluation, the current account tends to get worse before it gets better. However, over time, demand becomes more price elastic and the current account improves.

- Another problem with devaluation is that it can lead to imported inflation. Basically, imports will be more expensive. Higher inflation can reduce the countries competitiveness. Therefore the improvement in the current account might only be temporary.

- More on the J-Curve effect

See more on effects of devaluation

Deflationary policies

These are policies aiming at reducing the growth of aggregate demand and reducing inflation. They can include a tightening of fiscal policy or monetary policy; this will reduce aggregate demand.

2. Monetary policy

Tight monetary policy involves increasing interest rates.

- Higher interest rates will increase the cost of debt and mortgage repayments and leave people with less money to spend. Therefore, this will reduce their consumption of imports, improving the current account.

- Also, higher interest rates will cause a fall in AD and therefore reduce economic growth. This will reduce inflation and help to make UK exports more competitive.

- Deflationary policies will also put pressure on manufacturers to reduce costs, and this will lead to more competitive exports, and so exports may increase in the long run because of this effect.

Evaluation of monetary policy for reducing current account

- The main issue with using monetary policy to reduce a current account deficit is that an increase in interest rates will tend to cause hot money flows and therefore an appreciation in the exchange rate. This appreciation makes exports less competitive, and imports more attractive. Assuming demand is relatively elastic, this appreciation will worsen the current account.

Therefore, monetary policy has two conflicting effects.

- Higher interest rates reduce spending on imports – improving the current account.

- But, on the other hand, higher interest rates cause an appreciation in the exchange rate – worsening the current account.

- The overall effect is uncertain – it depends on which effect is bigger.

- However, since the UK has a high marginal propensity to import, higher interest rates will tend to cause a reduction in AD and improve the current account significantly.

- It depends on many other factors, for example, if the economy is growing strongly, a rise in interest rates may not actually reduce consumer spending – because income growth is high and confidence high.

Deflationary fiscal policy

- An alternative to using monetary policy is to use fiscal policy. For example, the government could increase income tax. This would reduce consumer discretionary income and reduce spending on imports.

- The advantage of fiscal policy is that it would not have an adverse effect on the exchange rate. Higher income tax would also improve government finances.

- However this policy will conflict with other macroeconomic objectives – with lower aggregate demand (AD), growth is likely to fall causing higher unemployment. A government is unlikely to want to risk higher unemployment just to reduce a current account deficit.

3. Supply side policies

- Supply side policies can improve the competitiveness of the economy and help make exports more attractive. This can improve the current account position, but it may take considerable time to have an effect.

- For example, if the government pursued a policy of privatisation and deregulation it may help to increase the efficiency of the economy because of the profit motive in the private sector. This increased efficiency would translate into lower costs of production and more exports

See: supply side policies

4. Lower wages

A policy used by many Eurozone economies facing a large current account deficit (but unable to devalue within single currency) is to reduce wages. Lower wages will reduce costs of production and improve competitiveness.

- However, lower wages will also lead to lower aggregate demand and could lead to deflation and low growth.

- If the government cut public sector wages, it may have limited impact on improving the competitiveness of exports.

- Reducing wages is also known as internal devaluation.

5. Protectionism

The government could increased tariffs on imports or even impose quotas. Both these measures would have the impact of reducing imports and therefore improve the current account.

However:

- Protectionism may lead to retaliation – with other countries placing tariffs on our exports – so exports could decrease.

- Protected by tariffs – domestic industries may become uncompetitive because there is less incentive to cut costs.

Policies to reduce a current account could also be classified into two types:

1. Expenditure switching policies

- This involves changing the goods that people buy. For example

- Devaluation makes domestic goods relatively cheaper, and imports more expensive. Therefore consumers will switch from buying imports to domestic goods

- Supply side policies make British goods relatively more attractive

2. Expenditure reducing policies

- Policies to reduce overall spending on imports.

- This can involve tight fiscal or tight monetary policy.

Further reading