A devaluation means there is a fall in the value of a currency. The main effects are:

- Exports are cheaper to foreign customers

- Imports more expensive.

- In the short-term, a devaluation tends to cause inflation, higher growth and increased demand for exports.

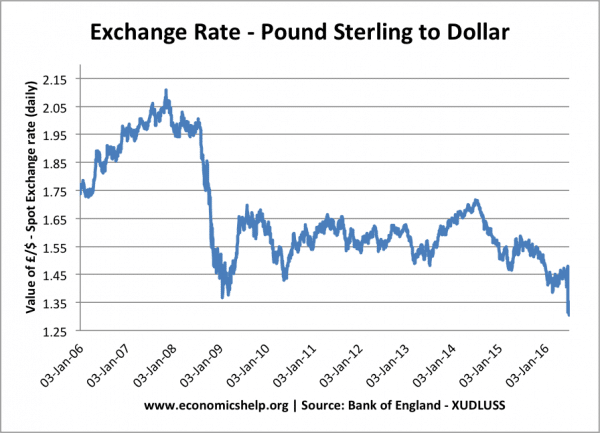

A devaluation in the Pound means £1 is worth less compared to other foreign currencies. For example

- Jan 2016. £1= $1.50

- July 2016 – £1=$1.28 )

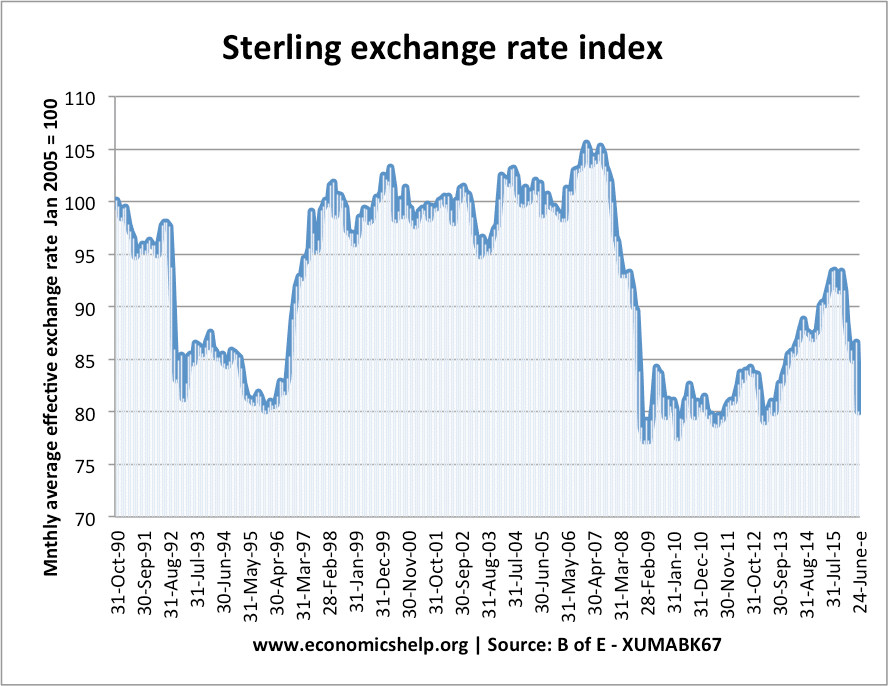

Sterling exchange rate index, which shows the value of Sterling against a basket of currencies.

This shows the devaluations in the value of the Pound in 1992, 2009 and 2016.

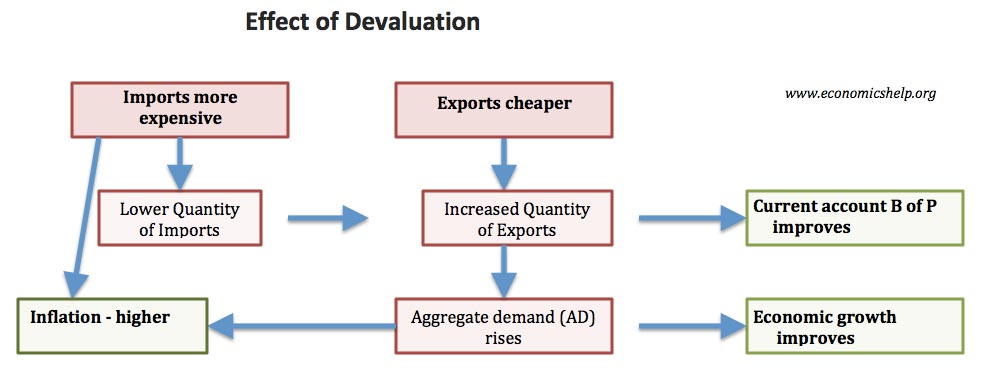

Effects of a devaluation

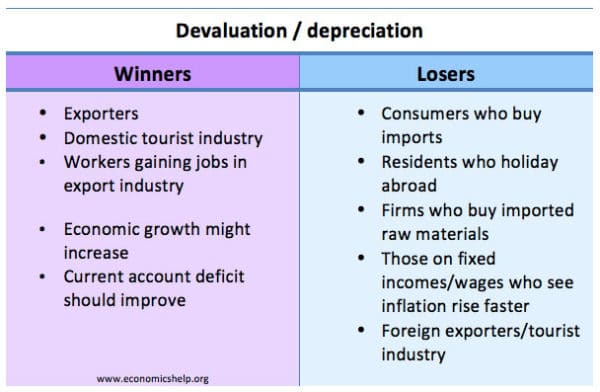

1. Exports cheaper. A devaluation of the exchange rate will make exports more competitive and appear cheaper to foreigners. This will increase demand for exports. Also, after a devaluation, UK assets become more attractive; for example, a devaluation in the Pound can make UK property appear cheaper to foreigners.

2. Imports more expensive. A devaluation means imports, such as petrol, food and raw materials will become more expensive. This will reduce the demand for imports. It may also encourage British tourists to take a holiday in the UK, rather than the US – which now appears more expensive.

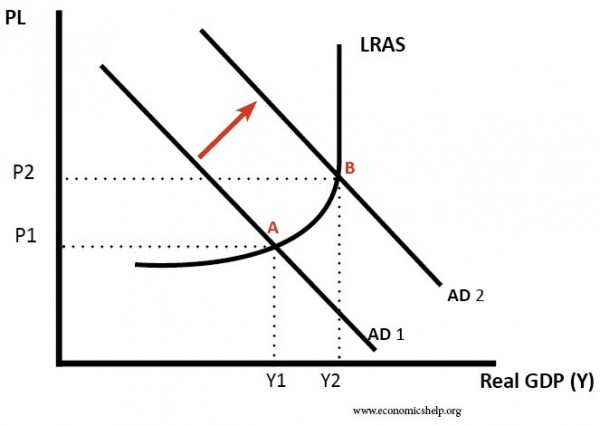

3. Increased aggregate demand (AD). A devaluation could cause higher economic growth. Part of AD is (X-M) therefore higher exports and lower imports should increase AD (assuming demand is relatively elastic). In normal circumstances, higher AD is likely to cause higher real GDP and inflation.

4. Inflation is likely to occur following a devaluation because:

- Imports are more expensive – causing cost push inflation.

- AD is increasing causing demand pull inflation

- With exports becoming cheaper, manufacturers may have less incentive to cut costs and become more efficient. Therefore over time, costs may increase.

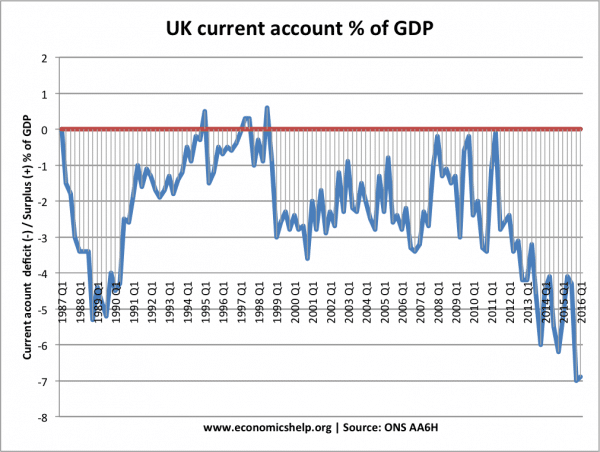

5. Improvement in the current account. With exports more competitive and imports more expensive, we should see higher exports and lower imports, which will reduce the current account deficit. In 2016, the UK had a near record current account deficit, so a devaluation is necessary to reduce the size of the deficit.

6. Wages. A devaluation in the Pound makes the UK less attractive for foreign workers. For example, with fall in the value of the Pound, migrant workers from Eastern Europe may prefer to work in Germany than the UK. In the UK food manufacturing industry, more than 30% of workers are from the EU. UK firms may have to push up wages to keep foreign labour. Similarly, it becomes more attractive for British workers to get a job in the US because a dollar wage will go further. (FT – migrants become more picky about UK jobs)

7. Falling real wages. In a period of stagnant wage growth, devaluation can cause a fall in real wages. This is because devaluation causes inflation, but if the inflation rate is higher than wage increases, then real wages will fall.

Evaluation of a devaluation

The effect of a devaluation depends on:

1. Elasticity of demand for exports and imports. If demand is price inelastic, then a fall in the price of exports will lead to only a small rise in quantity. Therefore, the value of exports may actually fall. An improvement in the current account on the balance of payments depends upon the Marshall Lerner condition and the elasticity of demand for exports and imports

- If PEDx + PEDm > 1 then a devaluation will improve the current account

- The impact of a devaluation may take time to influence the economy. In the short term, demand may be inelastic, but over time demand may become more price elastic and have a bigger effect.

2. State of the global economy. If the global economy is in recession, then a devaluation may be insufficient to boost export demand. If growth is strong, then there will be a greater increase in demand. However, in a boom, a devaluation is likely to exacerbate inflation.

3. Inflation. The effect on inflation will depend on other factors such as:

- Spare capacity in the economy. E.g. in a recession, a devaluation is unlikely to cause inflation.

- Do firms pass increased import costs onto consumers? Firms may reduce their profit margins, at least in the short run.

- Import prices are not the only determinant of inflation. Other factors affecting inflation such as wage increases may be important.

4. It depends on why the currency is being devalued. If it is due to a loss of competitiveness, then a devaluation can help to restore competitiveness and economic growth. If the devaluation is aiming to meet a certain exchange rate target, it may be inappropriate for the economy.

Winners and losers from Devaluation

Examples of devaluation

- Leaving the ERM in 1992

- UK devaluation of 1967

- Devaluation of Indian Rupee

- Why is Chinese currency undervalued? – the impact of weaker Chinese currency

Effect of devaluation of Pound – 2016 post Brexit

The Pound fell against major currencies, especially the Dollar due to Brexit. The effects will be:

- Higher prices of imported goods.

- Inflation. However, UK inflation was low to start off with, and the global economy is facing a period of deflationary pressures. So in this scenario, the inflationary effects of a devaluation are less damaging than usual.

- Inflation combined with low wage growth (e.g. public sector pay freeze of 1%) – has seen a fall in real incomes causing lower consumer spending.

- Exports should see a rise in demand because of the falling value of Sterling. However, the rise in exports may be muted by weak growth in the Eurozone and global economy. If global growth is low, we may see less growth in exports than we might usually expect. Demand may prove inelastic.

- The Pound is falling which boosts exports, but the low wage growth means the strongest effect is the decline in real wages which damages economic prospects.

Related