A current account deficit occurs when the value of imports (of goods, services and investment income) is greater than the value of exports.

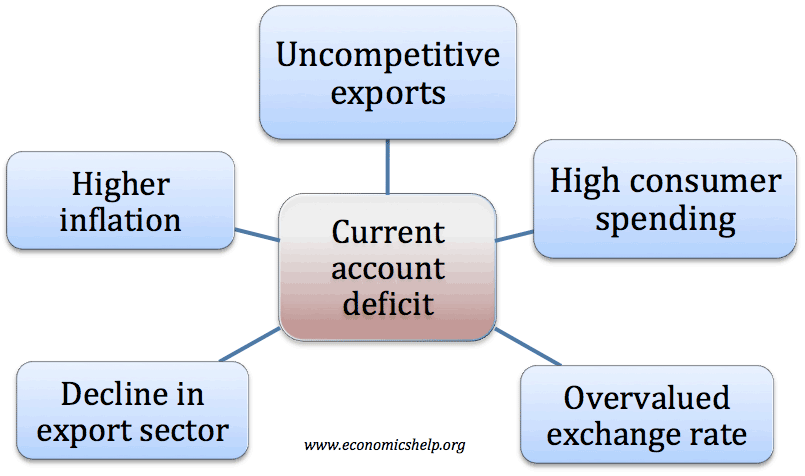

There are various factors which could cause a current account deficit:

1. Overvalued exchange rate

If the currency is overvalued, imports will be cheaper, and therefore there will be a higher quantity of imports. Exports will become uncompetitive, and therefore there will be a fall in the quantity of exports. Countries in the Eurozone (e.g. Greece, Portugal and Spain) experienced an overvalued exchange rate (and they couldn’t devalue). In 2007, these three countries had a current account deficit equal to 10% of GDP.

2. Economic growth

If there is an increase in national income, people will tend to have more disposable income to consume goods. If domestic producers cannot meet the domestic demand, consumers will have to import goods from abroad. In the UK we have a high marginal propensity to imports (mpm) because we do not have a comparative advantage in the production of manufactured goods. Therefore if there is fast economic growth there tends to be a significant increase in the quantity of imports and a deterioration in the current account.

3. Decline in competitiveness/export sector

In the UK, there has been a decline in the exporting manufacturing sector because it has struggled to compete with developing countries in the far east. This has led to a persistent deficit in the balance of trade.

4. Higher inflation

If UK inflation rises faster than our main competitors then it will make UK exports less competitive and imports more competitive. This will lead to deterioration in the current account. However, inflation may also lead to a depreciation in the currency to offset this decline in competitiveness.

5. Recession in other countries

If the UK’s main trading partners experience negative economic growth, then they will buy less of our exports, worsening the UK current account.

6. Borrowing money

If countries are borrowing money to invest e.g. third world countries, then this will lead to deterioration in current account position.

7. Financial flows to finance current account deficit.

If a country can attract more financial flows (either short-term portfolio investment or long-term direct investment), then these flows on the financial account will enable the country to run a larger current account deficit. For example, the UK has run a persistent current account deficit since the 1980s; this reflects the fact the UK has attracted capital flows to finance this current account deficit. Without financial flows, the currency would depreciate until equilibrium is restored.

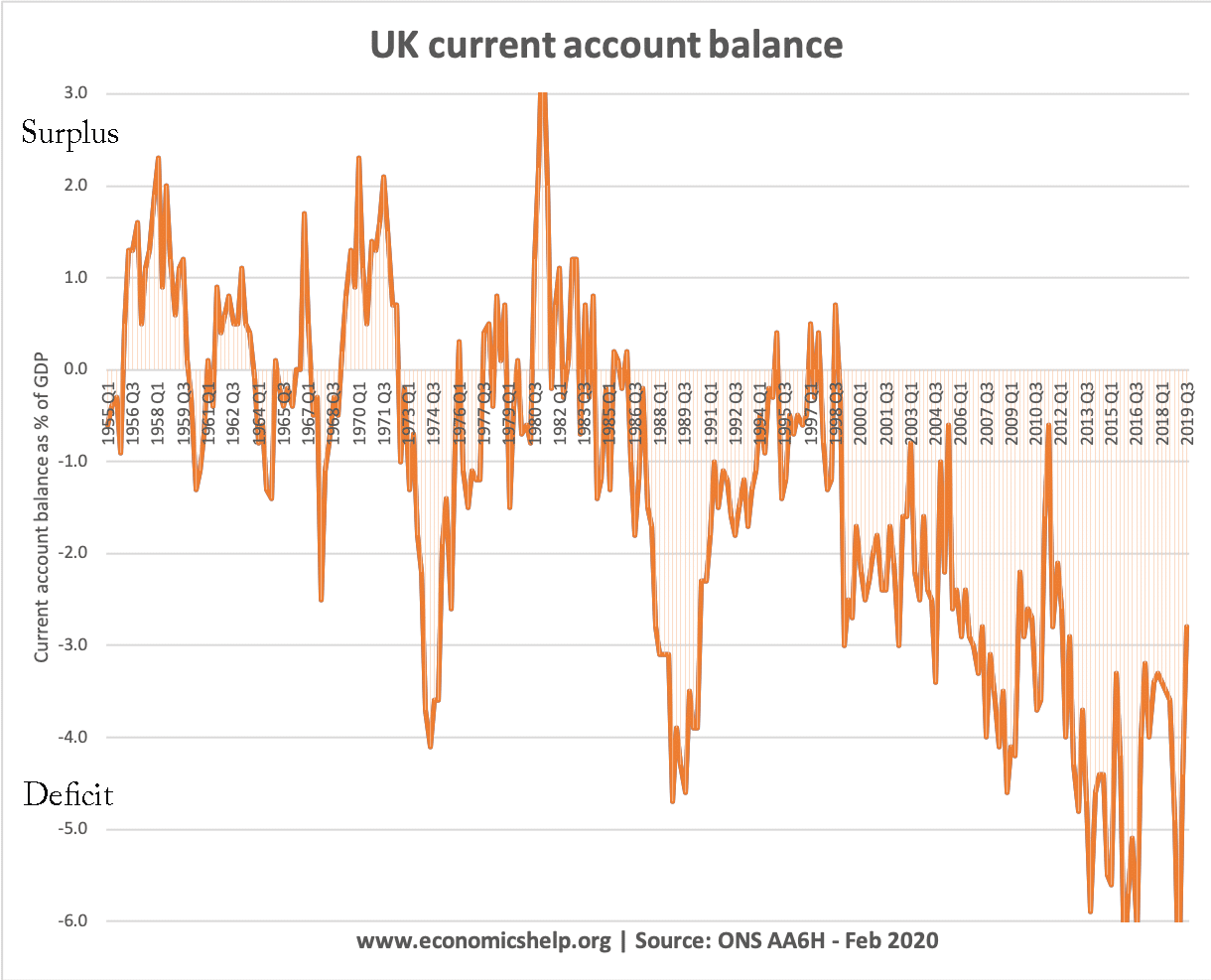

UK current account in post-war period

This shows a deterioration in the UK current account from the early 1980s. This corresponded with a period of de-industrialisation and decline in traditional manufacturing export industries.

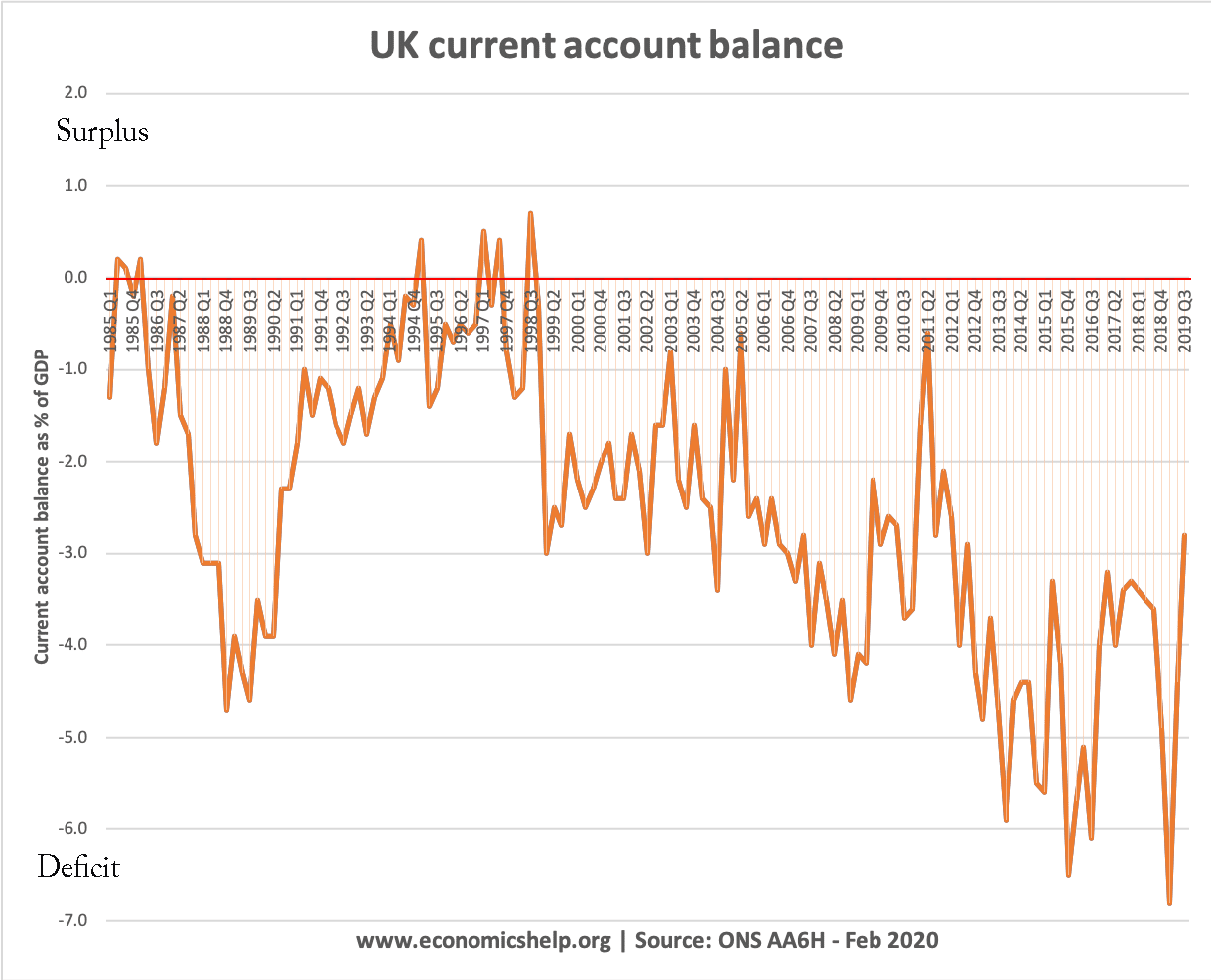

The UK current account as a % of GDP 2001-2015. This shows a deterioration in the current account since 2011. This was due to:

- UK economic recovery quicker than Eurozone, leading to higher import spending, but slow growth in UK exports

- Appreciation in the Pound Sterling, making exports less competitive and imports cheaper.

Related