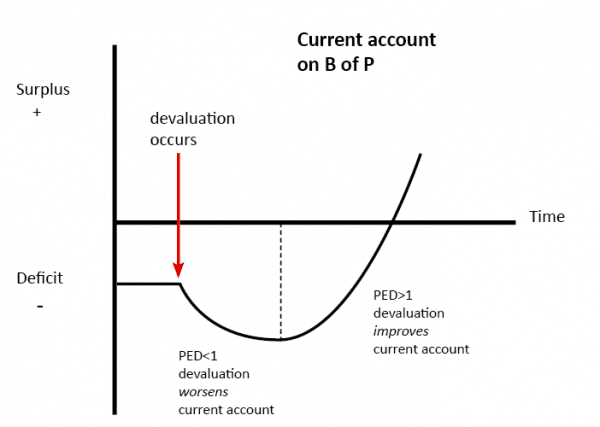

The J Curve effect a depreciation in the exchange rate can cause a deterioration of the current account in the short-term (because demand is inelastic). However, in the long-term, demand becomes more price elastic and therefore, the current account begins to improve.

The J-Curve is related to the Marshall-Lerner condition, which states:

- If (PED x + PED m > 1) then a devaluation will improve the current account.

The J-Curve is an example of how time lags can affect economic policy. It also shows the link between microeconomic principles (elasticity) and macroeconomic outcomes (current account)

The current account on the balance of payments measures the net value (X-M) of exports and imports of goods, services and investment incomes.

Short-term effect of depreciation

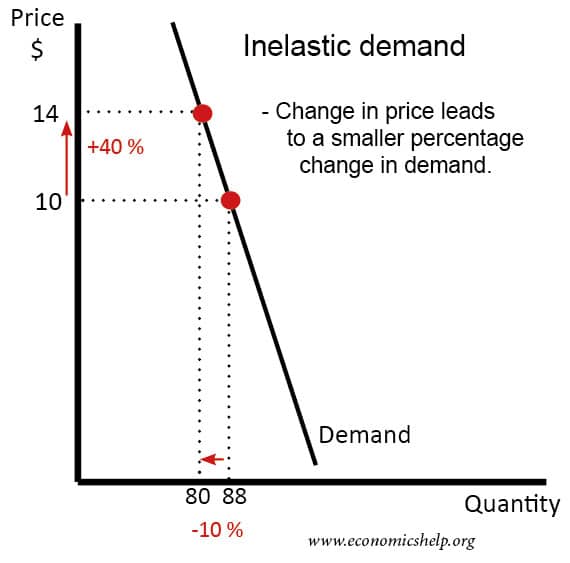

- In the short-term, a fall in the price of exports will only cause a smaller percentage rise in quantity demanded.

- A rise in the price imports will cause a smaller percentage fall in demand for imports. Therefore, the value of imports actually rises (we spend more on imports)

- Therefore, if demand is inelastic, following a depreciation, we actually get a worsening of the current account account

Long-term effects

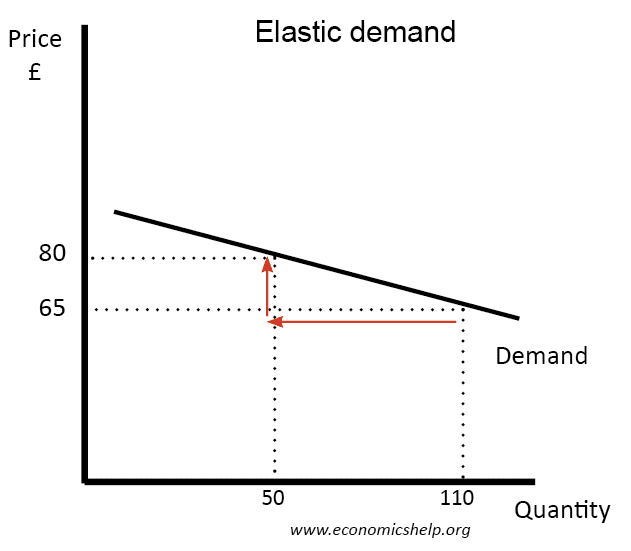

In the long-term, demand for exports and imports will tend to become more price elastic. (more sensitive to price)

- Therefore, a fall in the price of exports will cause a bigger percentage rise in quantity demand. (And therefore we get a bigger rise in the value of exports) When demand is elastic, the value of exports rises – and we get an improvement in the current account position.

- Also, if demand for imports is price elastic, then there will be a bigger percentage fall in demand for imports. In this case, the total spending on imports starts to fall.

In the future, the trade deficit may continue to improve if global demand picks up.

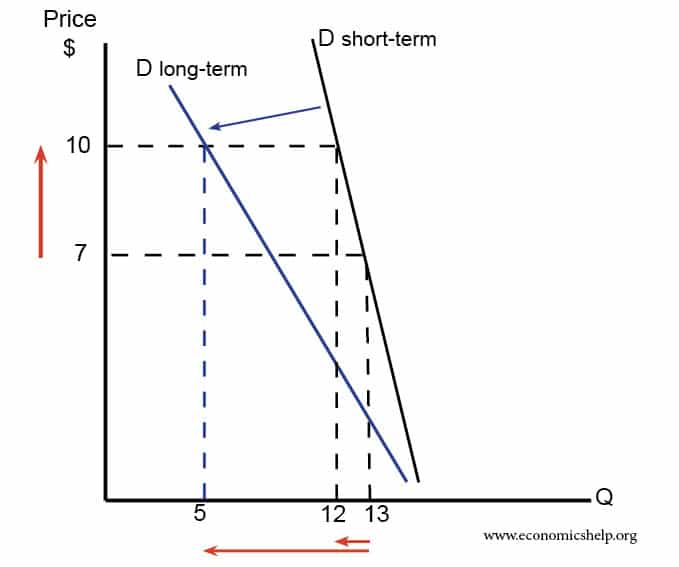

Why is demand more price elastic in the long-term?

- In the short-term, firms and consumers may have contracts to keep buying the good.

- It takes time to find alternatives.

- The higher price of imports will be an incentive for domestic firms to increase production, but this takes time

- Elasticity and time

Evaluation of the J-Curve effect

Many factors affect the current account apart from the exchange rate

- The current account will depend on consumer spending and the rate of economic growth.

- It also depends on consumer spending in foreign countries (hence demand for exports)

- It depends on Inflation (e.g. depreciation can cause imported inflation which reduces the competitiveness of exports)

- Firms may engage in insurance policies to hedge against exchange rate movements.

The Marshall Lerner condition

This states that, for a currency devaluation to lead to an improvement (e.g. reduction in deficit) in the current account, the sum of price elasticity of exports and imports (in absolute value) must be greater than 1.

- If (PED x + PED m > 1) then a devaluation will improve the current account.

- If (PED x + PED m > 1) then an appreciation will worsen the current account.

This is because the effect on the current account depends on the total value and not just the quantity of exports.

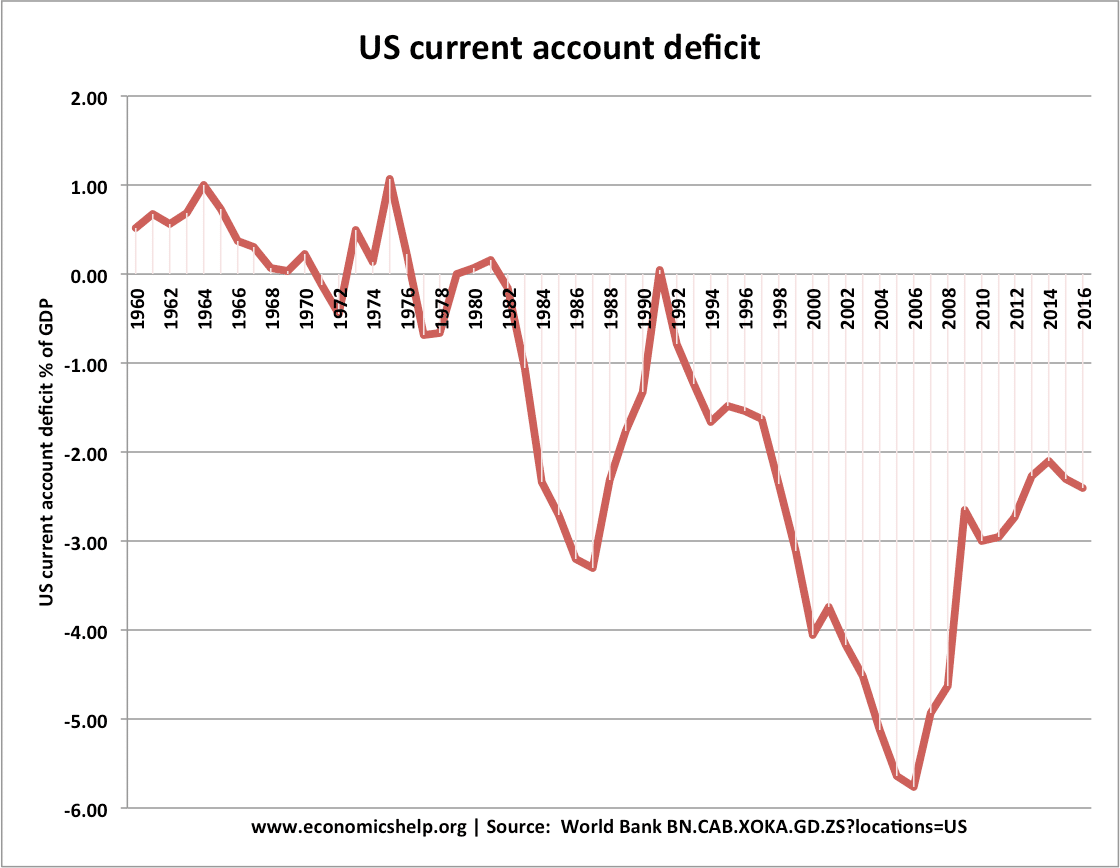

Example US depreciation and current account

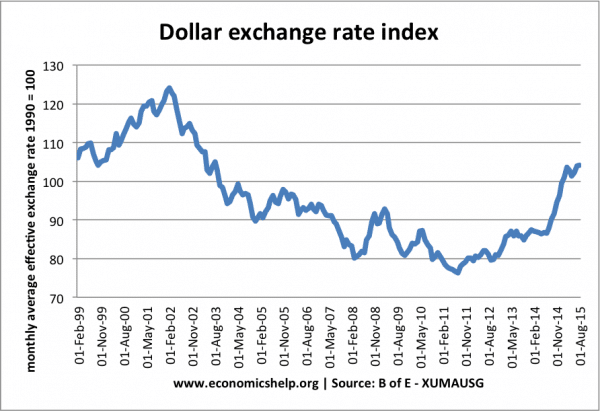

From early 2002 to 2008, there is a steady depreciation in the US dollar.

- From 2002 to 2006, there is a deterioration in the current account (also caused by strong domestic consumption)

- After 2006, there is a sharp improvement in the current account. Suggesting that the J-Curve may be coming into play – the current account is finally responding to the depreciation in the dollar.

- However, the sharp improvement in the current account from 2006 was also due to the slowdown in the US economy and a decline in consumer spending on imports.

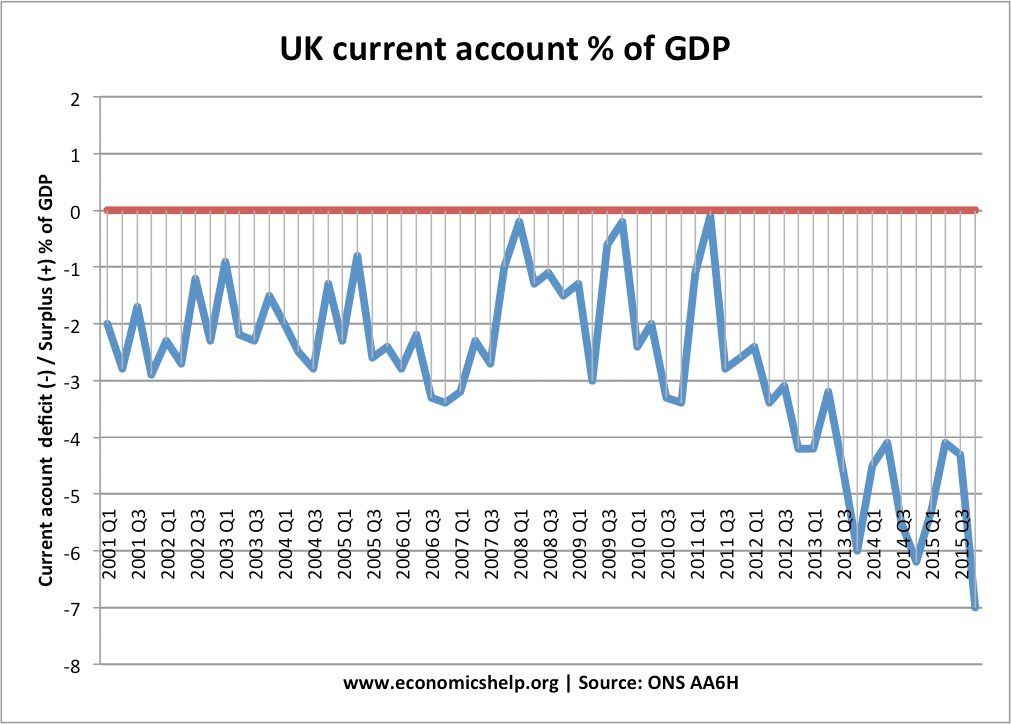

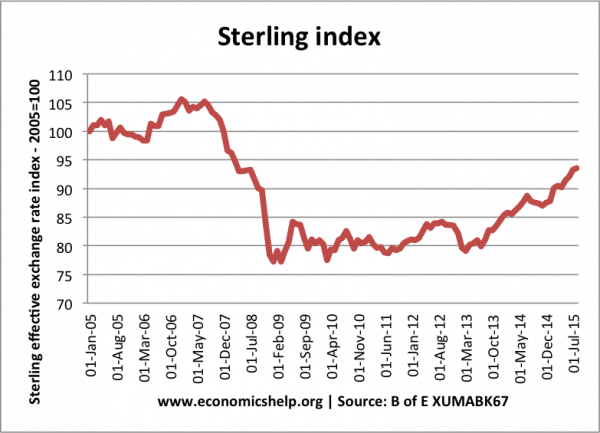

Example UK devaluation 2008-09

Sharp devaluation in the value of the pound from 2007 to 2009.

UK Current account 2001-2015

During the depreciation of 2007-09, there is no discernable improvement in the UK current account – it is volatile, but remains in deficit.

In the longer-term, after the depreciation, we might expect an improvement in the current account, but actually, it worsens.

This is not helpful for trying to prove the J-Curve effect. But, it shows many factors can influence the current account balance of payments other than the exchange rate. This includes

- State of the economy (in a recession demand for import spending falls)

- Consumer demand in other countries (e.g. Eurozone recession hit demand for UK exports)

- Productivity and competitiveness of manufacturing industries – relative to main competitors.

Related

Helpful

Great

what are 4 limitations of the j curve

Many factors affect the current account apart from the exchange rate

The current account will depend on consumer spending and the rate of economic growth.

It also depends on consumer spending in foreign countries (hence demand for exports)

It depends on Inflation (e.g. depreciation can cause imported inflation which reduces the competitiveness of exports)

Firms may engage in insurance policies to hedge against exchange rate movements.

ok