A specific tax is a fixed amount of tax placed on a particular good. It is also referred to as a per-unit tax, and the tax will depend on the quantity sold (not price).

Examples of specific taxes

- A tax of £0.40 on 500 ml sugary drinks.

- A tax of £3.92 per 20 pack of cigarettes.

- A tax of £0.75 per litre of petrol.

A specific tax does not vary with the cost of the good – like for example an ad valorem tax – which is a percentage of the price.

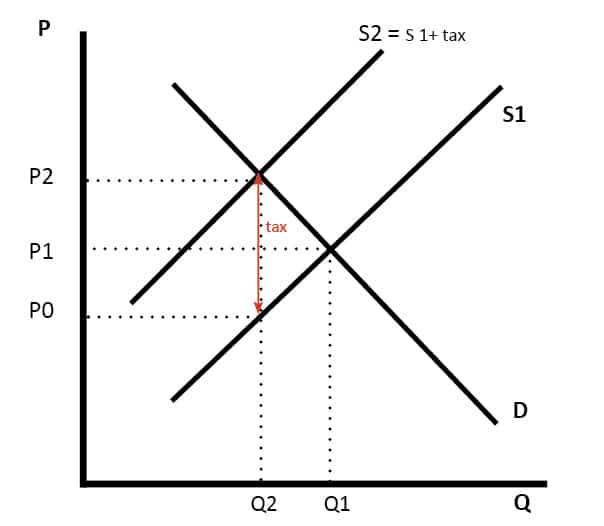

Diagram of specific tax

Placing a specific tax on a good shifts the supply curve to the left.

The specific tax is P2-P0

- A specific tax is borne by both producers and consumers.

- Consumers see the price rise from P1 to P2.

- Producers receive P0 rather than P1.

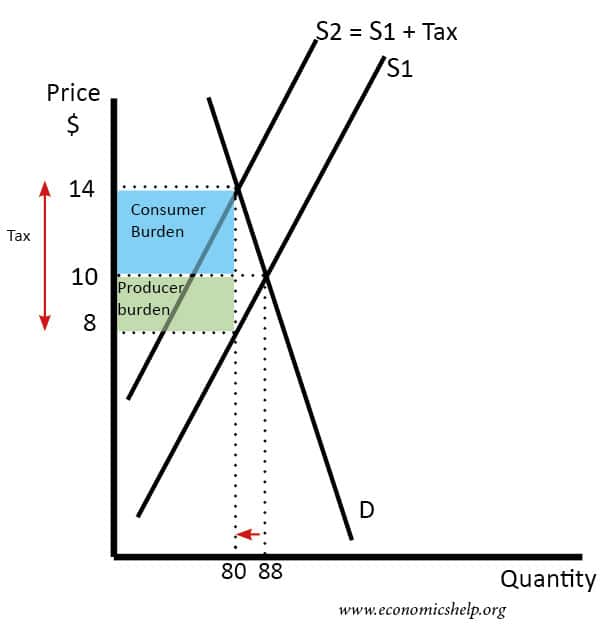

Burden of specific tax

In this case, the specific tax is $6. The consumers see a rise in the price of $4, and producers see a fall in the price they receive from $10 to $8.

Advantages of specific taxes

- Easy to understand

- A specific tax is effective at reducing demand. For example, cigarette tax has steadily contributed to reducing cigarette consumption in past few decades.

- An ad Valorem tax places a proportionately higher tax on expensive goods. This can encourage consumers to switch from expensive alcohol and expensive cigarettes – to cheaper varieties. A specific tax increases the price of all equally and has a bigger effect on reducing overall demand.

Disadvantages of specific taxes

- More likely to be regressive. The tax paid will be the same for different income groups. So those on low-income will pay a higher percentage of income in tax. An ad Valorem tax collects more tax from those consumers willing to purchase more expensive varieties.

Related