Definition of disinflation

Disinflation is a fall in the inflation rate. It means that the general price level is increasing at a slower rate.

When people talk of disinflation, they often mean a period of low inflation. For example, inflation falling below the inflation target of 2%.

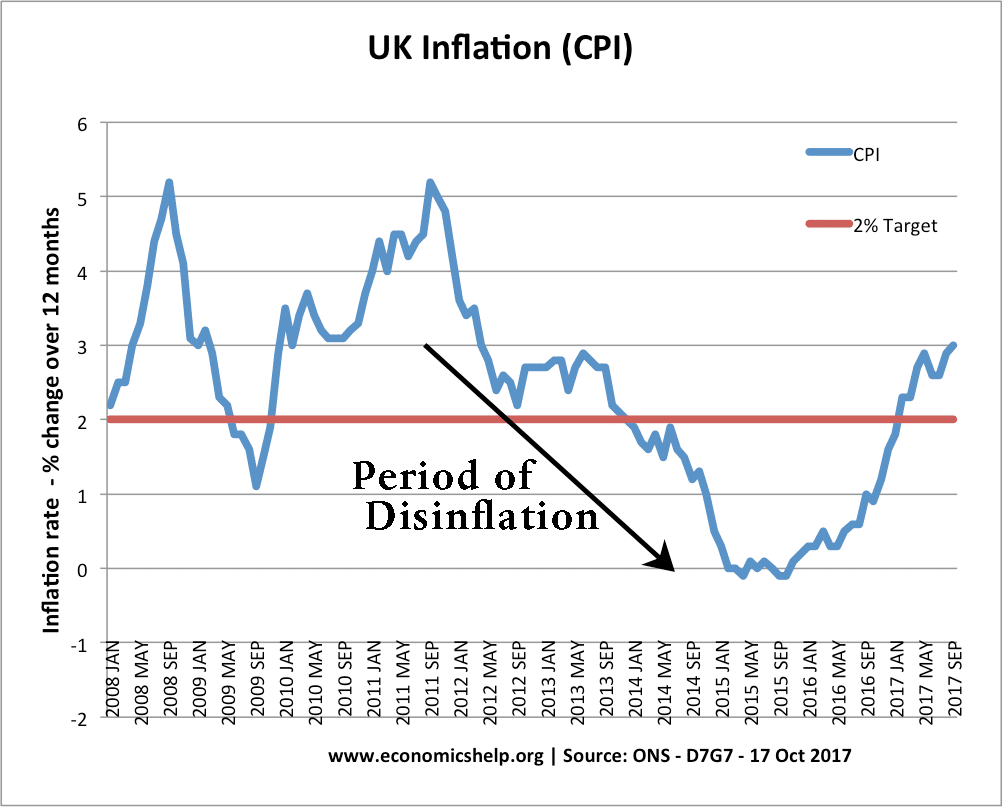

Between 2011 and 2015, there is a fall in the UK inflation rate from 5% to 0%. This is a period of disinflation. It was caused by

- A fall in the costs of production – falling commodity prices

- A slight appreciation in exchange rate making imports cheaper (compared to past depreciation)

- Weak economic growth – stagnant real wages.

Disinflation and deflation

If the inflation rate is already very low, then disinflation could lead to deflation. Deflation is where there is actually a fall in the price level.

In Sept 2015, the UK had a minor period of deflation – the inflation rate was -0.1%.

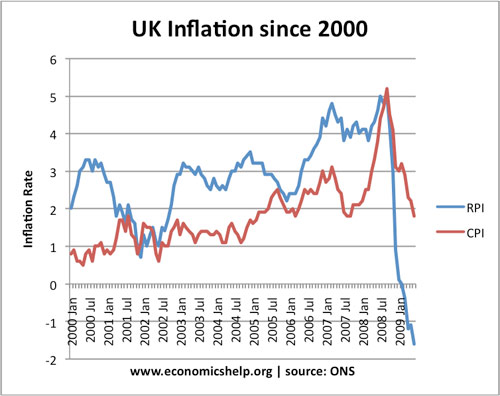

From 2008 to 2009, the UK inflation rate (RPI) fell from 5% to -1%. This is a period of disinflation was caused by

- A fall in oil prices

- The recession which led to a fall in aggregate demand and lower wages.

- Fall in interest rates which lowered mortgage repayments.

Deflation can cause lower economic growth through discouraging consumer spending and increasing the real value of debt.

Disinflation in the Eurozone

In the period 2012-2014, the Euro has experienced disinflation with the inflation rate falling to 0.5% – well below the inflation target of 2%.

Is disinflation a problem?

The government generally targets a low inflation rate of less than 2%. If inflation falls from 5% to 2%, this is considered a benefit for the economy

- It improves international competitiveness

- It reduces uncertainty

- It protects the value of saving.

However, disinflation could be a problem.

- If disinflation is caused by a fall in demand and negative economic growth.

- If disinflation leads to deflation and the problems associated with rising real debt and falling spending as consumers wait to see if goods become cheaper.

Related

- Stagflation – inflation and negative growth

- Would it help to have a higher inflation rate?

- Different types of inflation

How does the government deal with disinflation ?

https://www.economicshelp.org/blog/12840/inflation/policies-solve-deflation-low-inflation/

The invisible hand of Adam Smith would do far better than all the central bankers of the world. One only needs to look critically at history to appreciate how central bankers have created massive booms and busts which would have been far better moderated had they been well enough alone and let a free market work.