Arguments for a sugar tax

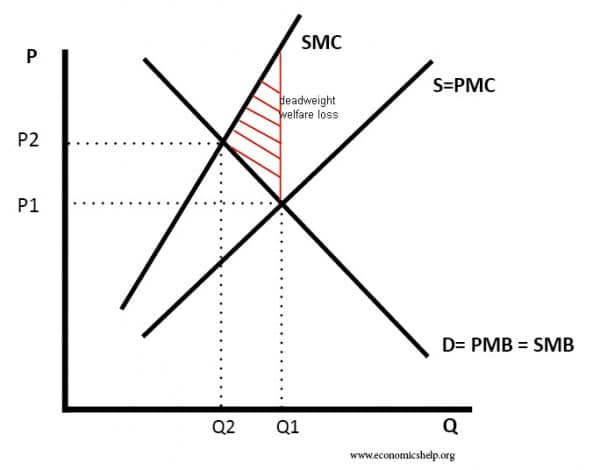

1. External costs. Sugary drinks impose high external costs on society. The overconsumption of sugar is a major cause of health problems such as

- Diabetes (in particular, type 2 diabetes)

- Obesity and obesity-related illnesses, such as back pain, heart disease,

- Tooth decay (especially amongst young people

These external costs are reflected in higher costs imposed on the national health service. Poor health also adversely affects work and productivity. Therefore, the social cost of sugar consumption is greater than the private cost of sugar.

This diagram shows the impact of a good with external costs. The free market price is Q1, Price P1. But, the socially efficient level is at Q2 (where SMB social marginal benefit = SMC social marginal cost)

The solution is to impose a tax which raises the price and reduce the quantity to Q2. (See more detail at: tax on negative externality)

2. Demerit good

In addition to the external costs, we can class sugary drinks as a demerit good. This is because people may be unaware of the personal costs involved in sugar consumption. Alternatively, people may be aware sugar is bad for you, but struggle to reduce consumption because of its addictive qualities.

Furthermore, these sugar hits can lead to mood swings. A ‘hit’ of sugar gives a high, but then as the sugar wears off and the body releases insulin to cope with the surge in sugar, it leads to a decline in energy and endurance – which can only be solved by taking more sugar.

The average UK resident consumes 238 teaspoons of sugar per week – but often without realising, because so much sugar is ‘hidden’ in soft drinks, and processed food. This lack of awareness about sugar is an example of information failure – consumers not having full information to make informed choices.

- The amount of sugar in certain foods/drinks

- The harmful effects of sugar

3. Raises revenue

It is estimated a 20% sugar tax could raise approx. £1billion (BBC) This could be used to

- Reduce over taxes (£1 billion is worth about 0.5p on basic rate of income tax) or VAT

- Fund spending on growing health problems of sugar consumption (e.g. diabetes clinics)

From a political perspective, having a tax earmarked to fund spending in a particular area, makes it more palatable for consumers. If they feel tax raised is being used to fund health care or education about healthy eating, then it feels like a good use of tax raised.

4. Shifting supply and consumption

A sugar tax creates an incentive for firms to supply alternatives which are healthier. If you go into certain fast food restaurants, sugary drinks have often been heavily promoted – e.g. free refills in McDonald’s. Here you could argue that supply creates its own demand. But, if firms have incentives to promote healthier drinks with substantially lower sugar content, then consumers will to an extent follow the supply. If you are offered a free coke with a Big Mac, you take it. But, if you are offered free water, you may take that too.

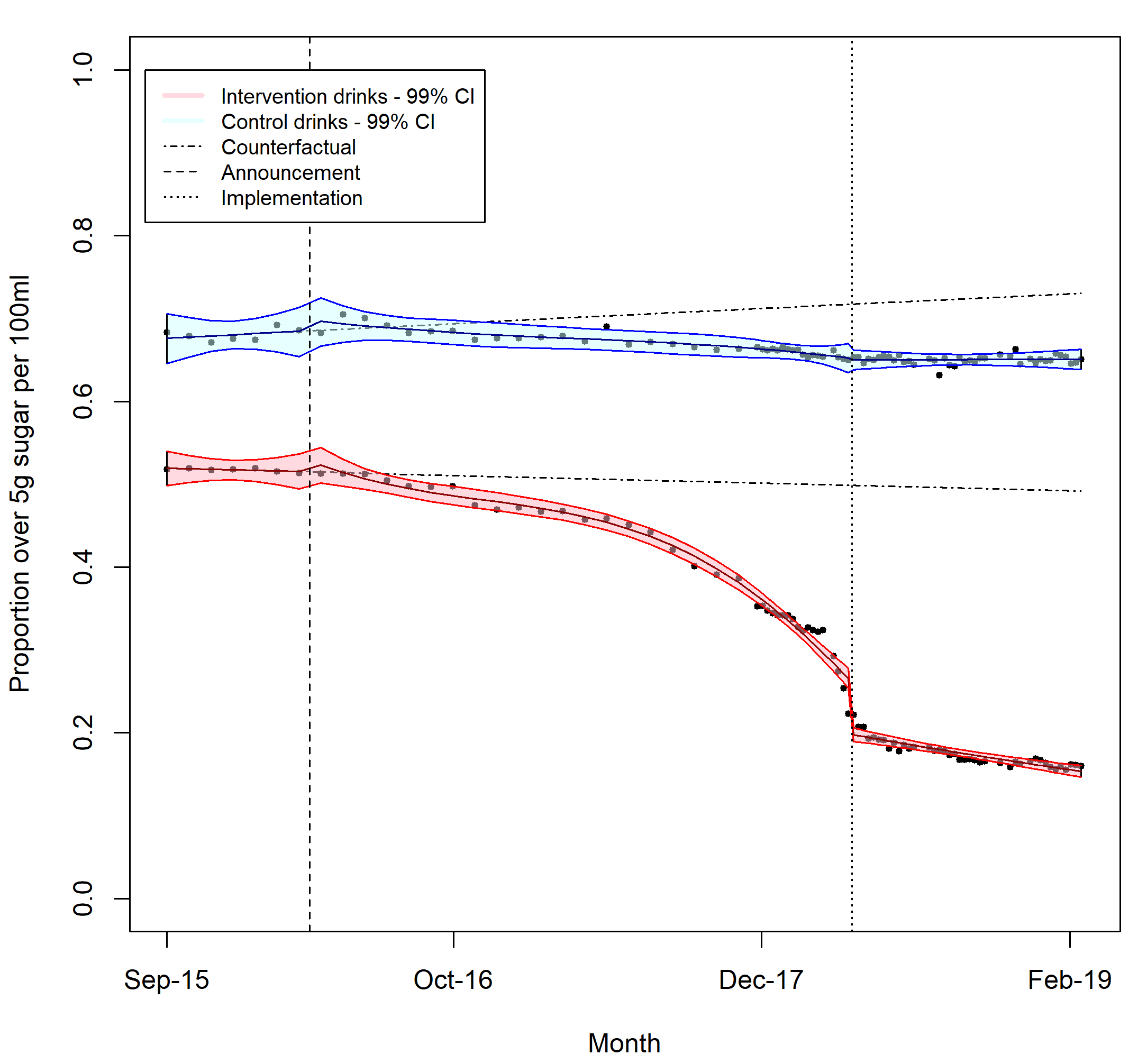

Evidence from the UK sugar tax suggests this is true. In the two years after the UK introduced a tax on sugary drinks, manufacturers responded by reducing the sugar content in their drinks to avoid the tax.

Drinks with more than 5g of sugar per 100ml fell from an expected level of 49% to just 15%.

5. Sugar tax in the UK

- £0.24 per litre for drinks with over 8 g sugar per 100 mL (high levy category),

- £0.18 per litre for drinks with 5 to 8 g sugar per 100 mL (low levy category)

- no charge for drinks with less than 5 g sugar per 100 mL (no levy category)

A study on the effect of the UK sugar tax, found prices only rose by 31% of the tax levy, suggesting manufacturers absorbed 2/3 of the tax increase themselves, suggesting demand is price sensitive for sugary drinks – with many alternatives.

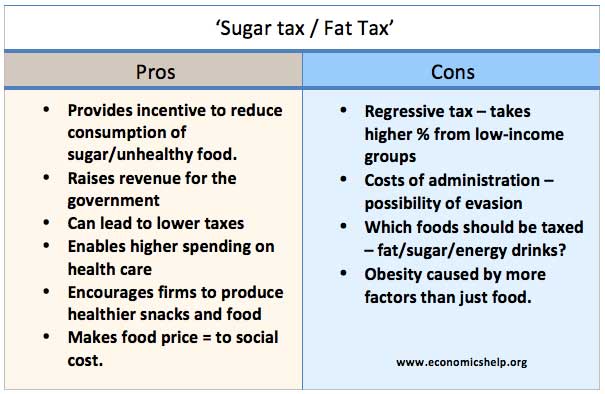

Arguments against sugar tax

1. It leads to job losses. Recently the head of Weatherspoons claimed ‘Jamie Oliver’s plans for a sugar tax would costs pubs millions of pounds and lead to job losses

“Showboating of this kind by Jamie Oliver will close pubs.” (Independent)

From an economic perspective, it is hard to give too much weighting to the idea that a sugar tax will lead to job losses.

Firstly, it will shift demand away from sugary drinks to non-sugary drinks so it will shift demand within the non-alcoholic market. Ironically, Weatherspoons also said “Sales of non-sugar drinks in the non-alcoholic category are increasing at a rapid rate and are in the great majority when you take into account coffee and tea.”

The tax will just accelerate that shift to non-sugary drinks. It’s hard to imagine people not going to a pub because full-sugar coca-cola is now 20% more expensive.

It is possible that the tax will lead to a small decline in the soft-drink market – people may drink tap water and not the non-sugary alternative. It is possible that lower spending on soft-drinks will lead to some decline in market share and job losses. But, at the same time, the sugar tax will be spending £500-£1bn on health care / education initiatives. Jobs will be created in the treatment of diabetes and education of young people about healthy diets. The tax should be employment neutral. It is simply shifting resources from sugary drinks to health care market. (Related article on Luddites and unemployment)

2. It is unfair on low-income groups

It is argued that the sugar tax is regressive because it will take a higher percentage of income from those on low-incomes. However:

- If people are price sensitive then they can switch to non-sugary drinks and avoid tax.

- Everyone will benefit from the increased health care spending and improved quality of life.

- If there were concerns about income distribution as a result of the tax, the tax revenues could be used to reduce other regressive taxes such as VAT, but spending on health care will probably be a better way to improve quality of life for those on low-incomes as they are unable to afford private health care treatment.

3. We shouldn’t make judgements about people’s lifestyle

The other argument about sugar tax is that it is wrong for the government to make judgements about people’s lifestyle and influence consumer patterns.

This is a weak argument.

- Firstly, you don’t have to pay the sugar tax, because there are many alternatives to sugary drinks.

- Secondly, if a government has a commitment to provide universal health care free at the point of use, it has also has a right to encourage healthy lifestyles which avoid placing undue strains on health care services. Good health care is not just about treating ill health; much better to prevent ill health in the first place.

4. Tax is not the best policy to reduce sugar consumption

Campaigners suggest that other policies, such as banning advertising at children, education initiatives – could be more effective in reducing excess sugar consumption.

However, this is not an argument against a sugar tax. It is merely an observation that we shouldn’t rely on tax alone. The most effective strategy is a combination of policies – education, tax and ban on advertising. The past few decades have shown that demand for cigarettes can be reduced significantly through advertising, regulation and tax. All can play a role.

Conclusion

There is a very strong economic, social and personal benefit from a sugar tax. It will play a role in encouraging a healthier diet and at the same time raise money to deal with the rapidly rising health costs associated with obesity and excess sugar consumption.

The only potential losers are the soft drink industry who will see some fall in demand. But, at the same time, there are opportunities for the soft-drink market to produce healthier options which avoid the sugar tax. It will also be good for the national health service.

Overall, there will be a net welfare gain from a sugar tax, with minimal economic disruption.

Related

I think the arguments against a sugar tax are getting weaker and weaker. In Jamie’s program, he mentioned that a sugar tax had already been introduced in Mexico and has had positive benefits. The major blocker at the moment seems to be the government’s reluctance to introduce a new tax. I think people are generally happy paying extra if they support the reasons behind the tax or what tax money is sent on; we only complain when our hard-earned money is spent inappropriately.

Tejvan studied PPE at LMH, Oxford University and works as an economics teacher and writer.

Comparisons between cocaine and sugar are highly misleading and not based in science. Saying that the molecular structure of sugar is similar to cocaine, implying its addictive qualities, makes a mockery of chemistry. Referring to it as being ‘purer’ than cocaine is false and has little relevance. You could say that table salt is purer than cocaine, for example.

The assumption made in this article that sugar is addictive is very fashionable, but is lacking in empirical evidence and is still much debated in the scientific community.

The reference included to justify these claims is dubious.

I suggest removing these pseudo-scientific points from an otherwise good argument.

Doesn’t matter if there is a lack of ‘Emperical evidence’ it’s common knowledge that sugar has addictive qualities

I know sugar is addictive because everyday I ate 3 kitkats. Don’t know if this counts as scientific studies though 🙂

This should count as this would be counted as a research or poll.

aids

Fair enough. I should stick to economics rather than dabbling in Chemistry.

Brilliant article, thank you.

My question is, what happens long term if such a tax is introduced and is successful? If people would actually consume significantly less sugar as a consequence, would that not reduce the tax income generated and offset some of the suggested benefits?

A cynic might say that such a tax would have to be not too high so that enough people don’t actually change their lifestyle and reduce their sugar consumption (or stop smoking)?!?!

What are the findings from tobacco or alcohol? Does a tax still generate income to the state as well as convince people to live healthier lives, or does the change in consumption actually cost the taxpayer money in the long run?

Tax generated from tobacco sales is pretty high (£10bn a year – https://www.economicshelp.org/blog/4001/economics/tax-revenue-sources-in-uk/) This is despite falling tobacco consumption in past years. But, that is partly because rate of tobacco tax has also been increased making cigarettes expensive.

But, the aim of a sugar tax is to 1) Raise revenue and 2) Reduce consumption.

Isnt the idea, that the health benefits outweigh the costs, and in the case of better health, does that not impact and lower the overall cost of managing said health?

Personally, I have given up sugar for several years. I am fit and healthy, after 44 years of smoking and consuming sugar of all sorts. I lost 60 pounds, exercise regularly, and feel great. This can be anyone. Sugar is a criminal enterprise, when it is put into foods for no apparent reason than to get people to purchase it because it does have indications that it stimulates the sensory part of the brain that produces pleasure. If people got sick, every time they ate sugar, they would absolutely quit it. The truth is, they are getting sick every time they eat it and just dont really know it until it is too late.

The smoking is very dangerous for our health and environment. Wherever tobacco is grown, this puts a serious hit on the environment. There are various types of the product available in the market.

But one thing they don’t tell you is that instead of sugar they will start pushing through things like sucolose aspartame and Sacrane things that are far worse for your body than sugar. Sugar is only bad for you if you eat far to much and don’t excercise, so because of the obese people we must suffer. Simples if your over weight 20 star jumps and 20 press ups in the shop for your mars bar.

What are the long term effects of this?

Hmmm, as a 21 year old who drank tonnes of cola throughout life and has never managed to reach 8 stone in weight… I think it’s a rubbish idea. Has everyone forgotten about the other end of the spectrum?

what can i say apart from the human body needs sugar to survive, i for one if the government has its way will never be able to buy a cold drink as i cannot have anything that has any kind of sweetner and there will be many 1000’s of others the same

hi

My 95 year old Mum needs every calorie she can get and doesn’t like the taste of reduced sugar juice but gov has put 98 pence on a bottle of her diluting juice .

I feel this whole debate on sugar is binary, if sugar on its own was addictive and bad for health then the tax must have been on Sugar and not Sugary drinks.

Average Briton have more than 1kg of Sugar in their kitchen at point of time. How many people have reported to be addicted to pure sugar on its own.

The best way to test if sugar is addictive is to eat 2-3 table spoons of sugar morning afternoon and night for a week.

The fact is you can’t have even eat a table spoon of sugar and enjoy it.

Addiction happens when sugar is combined with fats and other carbs.

Venu Menon

We are doing a debate on this topic. This webbsite is really good. Does anyone have strong argument for Sugar Tax!!!!

When the sugar tax was introduced, I understood that an extra charge would be levied on manufacturers making drinks with a high sugar content more expensive than those with lower sugar content. Indeed, our local KFC even warns that non-diet/zero sugar drinks will be more expensive. However, when ordering a takeaway from another outlet for delivery, I noticed that the price of sugary and non-sugary drinks is the same. Does anyone know whether this is allowed or not?

Late to this conversation but you should indeed stick to economics and stay away from chemistry, (if you must dabble in dietetics and nutrition perhaps read first, post later?)

Alternatively, people may be aware sugar is bad for you, but struggle to reduce consumption because of its addictive qualities.

ADDICTIVE :

: causing a strong and harmful need to regularly have or do something

: very enjoyable in a way that makes you want to do or have something again

Go eat a bowl of sugar – you won’t enjoy it nor will you likely do it again.

The rubbish on sugar ‘hits’ is inexcusable there is no such thing – multiple studies and meta-analyses published which all reach the same conclusion – latest was last year ‘Sugar rush or sugar crash? A meta-analysis of carbohydrate effects on mood,’

The econmist says…

Furthermore, these sugar hits can lead to mood swings. A ‘hit’ of sugar gives a high, but then as the sugar wears off and the body releases insulin to cope with the surge in sugar, it leads to a decline in energy and endurance – which can only be solved by taking more sugar..

The science says….

CONCLUSION These findings challenge the idea that CHOs can improve mood, and might be used to increase the public’s awareness that the ‘sugar rush’ is a myth,….

You are probably a bloody good economist so stick to that _ i couldnt do your job just as you can’t do mine.

Cheers