Readers Question: Where does the UK government get its money from?

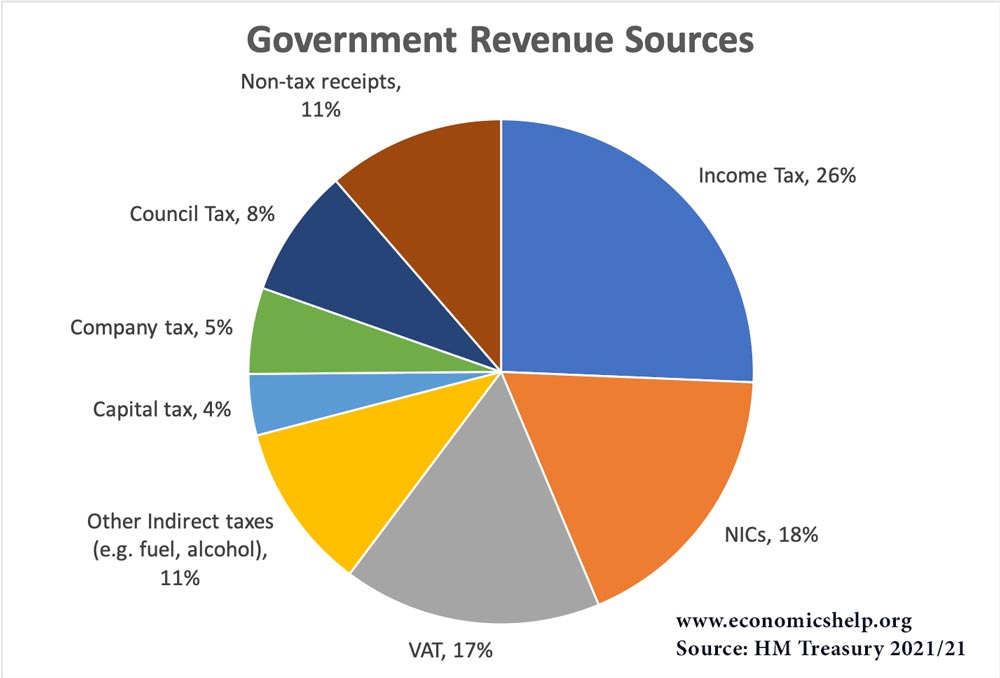

UK tax revenues come from a variety of sources. The main sources of tax revenue include:

- Income tax (main tax rate is 20%)

- National Insurance (NI) – a form of income tax

- VAT (20% on most goods and services)

- Corporation tax

- Council Tax (local government)

- Business rates

- Excise duties (alcohol, cigarettes)

- Other taxes include (stamp duty, carbon tax, airport tax, inheritance tax, capital gains)

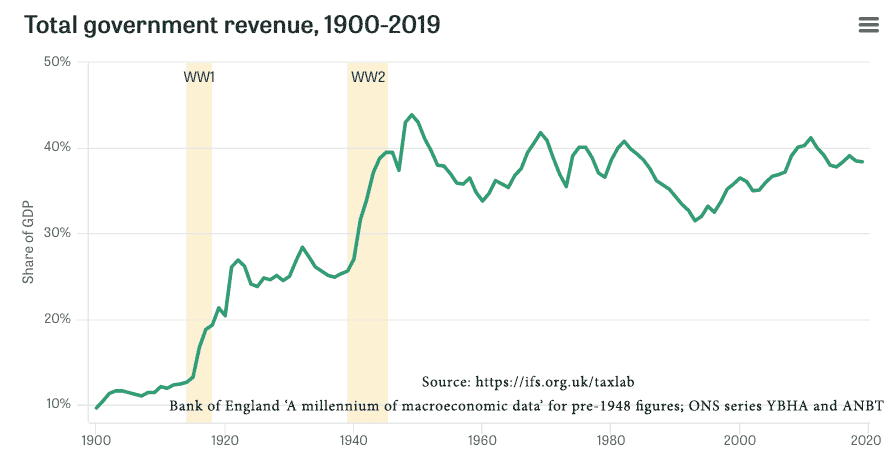

Tax revenue as a share of GDP

UK Tax revenue share 1900-2019. IFS

Most tax is collected by HM Revenue and Custom.

HM Revenue and Customs are responsible for income tax, excise duties, VAT and NI. Tax revenue at HM Treasury

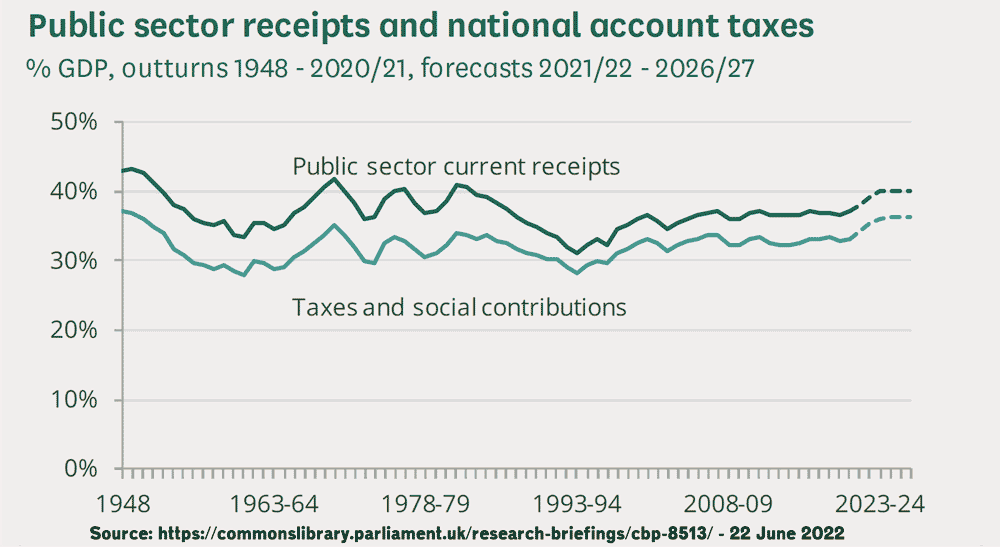

However, the central government also get revenue from other sources. Public sector finances at ONS (less detailed)

Tax revenue sources 2016/17

| Value added tax VAT | 135.4 | |

| Fuel duties | 27.9 | |

| Business rates | 26.8 | |

| Stamp duty land tax | 12.4 | |

| Stamp taxes on shares | 3.7 | |

| Tobacco duties | 8.7 | |

| Alcohol duties | 11.1 | |

| Vehicle excise duties paid by businesses | 2.2 | |

| Other taxes on production | 24.6 | |

| Income tax (gross of tax credits) | 185.6 | |

| Corporation tax | 55.9 | |

| Vehicle excise duties paid by households | 3.7 | |

| Bank levy | 3.0 | |

| Television Licence fee receipts | 3.2 | |

| Misc tax inc. inheritance | 7.5 | |

| Other central government taxes | 17.4 | |

| National insurance contributions | 125.9 | |

| Council Tax | 30.4 | |

| Public Sector Interest and Dividends | 6.3 | |

| Public Sector Gross Operating Surplus | 47.2 | |

| Other Public Sector Receipts | 5.2 | |

| Public Sector Current Receipts | 726.5 | |

Source: Public sector current receipts ONS

[abridged version, I left out some obscure taxes, which raise very little.

Pie chart of tax revenue

Sources:

- Tax revenue at HM Treasury

- Public sector finances at ONS (less detailed) Dataset of tax revenue

List of Tax Receipts by Type of Tax

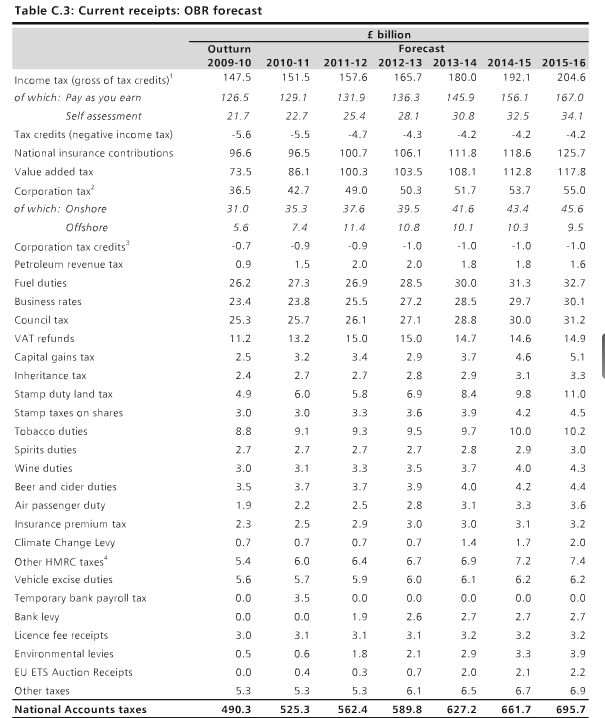

OBR forecast. OBR

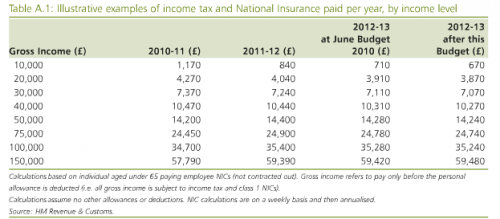

How Much Income Tax do People Pay?

UK Income tax is based on marginal tax rates. See: marginal tax rates.

The table below is a useful guide to how much income tax you actually pay. It shows that income tax in the UK is progressive. (those on higher incomes pay bigger % of tax.

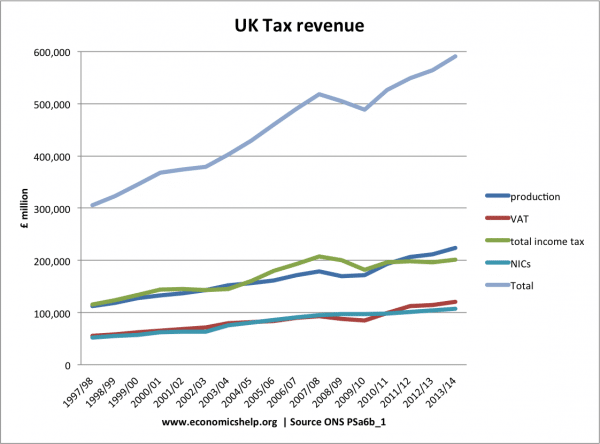

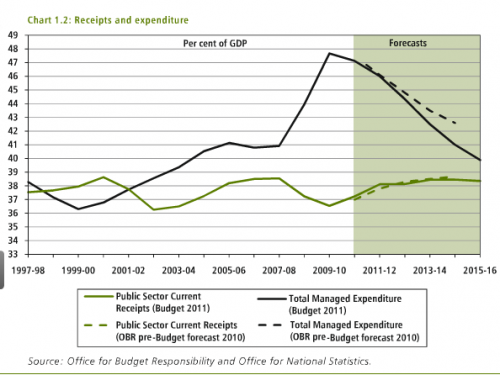

Changes in tax revenue 1997 – 2014

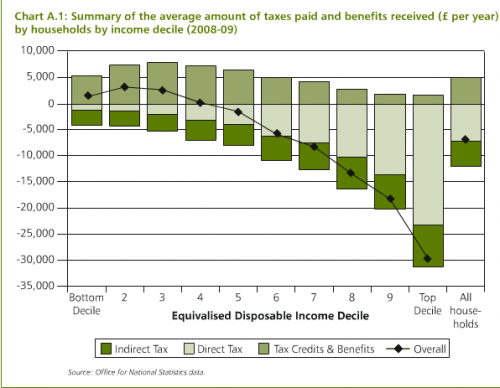

Tax and Inequality

The UK tax system plays a role in redistributing income.

- The poorest 10% pay £4,000 in tax (mostly indirect, VAT, excise duty). But, receive over £5,000 in tax credits and benefits.

- The richest 10% pay over £30,000 in tax (mostly direct, income tax). They receive around £2,000 in benefits.

- Overall, the average household pays £12,000 in tax and receives £5,000 in benefits.

- However, inequality in the UK has increased since 1980. See: Inequality in the UK

Tax receipts and government spending

In a recession, tax receipts tend to fall significantly as the government receive lower income tax and lower corporation tax.

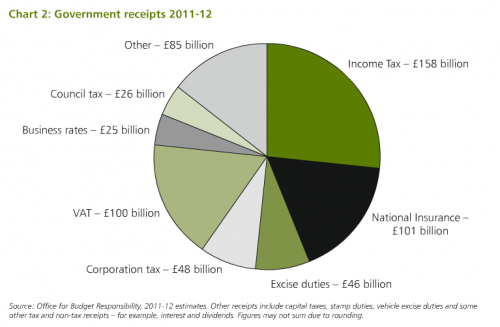

Source of Graphs: UK Budget 2011 HM Treasury

Related

Please could you tell me when the new ATAD European tax avoidance treaty comes into force,will the revenue collected still go to our treasury or will it go to the European central bank?