Readers Question: Assess the effectiveness of the UK’s taxation structure in terms of reducing inequalities, negative externalities and unemployment.

Some of the UK’s tax system is progressive. A progressive tax takes a bigger % of income from higher earners. The UK’s income tax system is progressive. In 2012-13, the tax threshold will be over £8,100 This means people on low income, pay zero income tax. For people earning over £34,000, they will pay a marginal tax rate of 40%. For earners over £150,000 there is a marginal tax rate of 45%

The system of marginal tax rates means that the average tax rate increases the more you earn. You only pay 45% tax on income over £100,000.

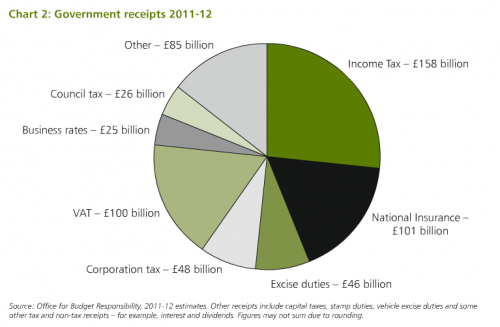

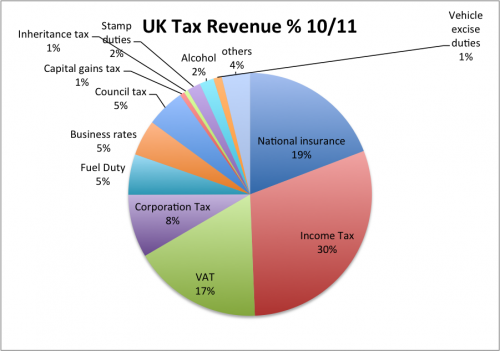

National insurance is also quite progressive as it takes a % of your income. However, with national insurance there are upper limits so you don’t have to pay tax on income above that. Income and NI taxes account for 50% of total tax revenue. The government have admitted that the combination of income tax and NI makes it unnecessarily complicated. A commission will be looking at merging the two.

However, although the income tax system is progressive, other taxes are more regressive.

At 20% VAT tends to be more regressive. People on low income have a higher marginal propensity to consume. Therefore, the VAT they pay is a higher % of their total income. People on high income will spend more and will pay more VAT, but they will have a lower marginal propensity to consume (People on high incomes can afford to save a higher % of income). Therefore, VAT will be a smaller % of income spent. The regressive nature of VAT is slightly compensated by the fact that in theory, necessities like food (e.g. cold pastries, cabbages) don’t have VAT. VAT is supposed to be targeted at luxury goods.

Other taxes like excise duties on cigarettes are much more regressive. Smoking rates tend to be higher amongst people with lower incomes. Also, it will be a much bigger % of income than for rich smokers.

Council Tax can also be quite regressive and arguably unfair. People living in expensive areas end up having high housing costs, but also a higher council tax band. Arguably a fairer method of collecting local tax would be a local income tax.

Another problem with the UK tax system is the scope for having offshore accounts and avoiding paying tax through tax avoidance schemes. Tax avoidance is often easier by people with high incomes. Offshore tax avoidance

The Mirrless report by Institute of Fiscal Studies argued that the UK tax system was costly, ineffective and complicated. Guardian link

Although, the Tax Justice movement were critical of this Mirrless report.

What is the effect of the UK tax system on Unemployment?

The tax system has only has a minor impact on UK unemployment.

You could argue that since the UK’s corporation tax is higher than many European competitors we lose out on inward investment (e.g. Ireland has benefited from inward investment due to low corporation tax). The current government have promised to cut corporation tax to encourage investment, and hopefully job creation. But, the experience of Ireland shows that a low corporation tax is no guarantee of low unemployment. Corporation tax is only one fact that determines inward investment. Firms will also look at factors such as infrastructure, labour markets flexibility and labour productivity.

Taxes on income could contribute to frictional and structural unemployment. If income tax was very high, this may contribute to the poverty trap, where there is no incentive to move from benefits to paid work, because the after tax income is no better than what you get from benefits.

In this regard, the UK tax system might help avoid this. The increase in the income tax threshold to around £7,000 means those moving into a low paid job will lose only a small amount in income tax.

Another factor is the tax rate paid by employers (e.g. employers NI contributions). High tax rates on employers may discourage job creation because of the additional costs.

Very high tax rates could cause some frictional and structural unemployment. But, it is important to keep it in perspective, there is no direct correlation between tax rates and unemployment. Unemployment is more influenced by factors such as rate of economic growth, flexibility of labour markets, and mismatch of skills.

What is Impact of Tax on Negative Externalities?

Several taxes are targeted at negative externalities. The UK has high tax rates on several goods which create negative externalities.

- Cigarette tax

- petrol tax

- alcohol tax

- Airport tax

- congestion charge in London.

In these cases, the tax helps increase the price of the good closer to the social cost, making people pay the external cost involved in the consumption of the good.

It is harder to tax other goods. For example, a tax on landfill waste was scrapped because it led to an increase in illegal fly-tipping. Apart from London, we don’t have a congestion charge because of difficulties in implementing it. This means we don’t tax the external cost of driving when and where congestion is at its worse.

Also, the tax levels are not directly targeted to level of external costs. There has been no attempt to actually work out external costs of goods involved and place tax correspondingly. The government use these excise duties as primarily a way to raise revenue. A cynic may argue, tax is so high on cigarettes because it is politically easy to increase tax on tobacco and it’s a good source of revenue. But, a by product is that the tax does get close to the external cost.

Related

The UK tax system is relatively fair. The problem we hear in the media and in general is peoples misunderstanding of the bigger picture and in general, they only care about themselves and how they are affected. This may be a reasonable stance for them however, if everyone’s outlook is this narrow in general progress for everyone suffers and the correct path is harder to find.

The council tax system is grossly unfair for single occupancies.

If you were to table a typical council tax charge for a band D property based on the number of adults per property, this would be to the result

£1542.08 Council tax charge

£1157.31 Single occupancies (including 25% discount)

£771.54 2 adults sharing

£514.36 3 adults sharing

£385.77 4 adults sharing

£308.62 5 adults sharing

As you can see the more adults who share a property the less council tax each will pay. Yet In reality the more people who draw on the services provided by the council (i.e. refuse collection/disposal, education, leisure facilities etc) the more it will cost. In effect single occupancy subsidize the council tax for households with more than one adult when the vast majority of these households have two or more earners and/or state pensions, and are in a position to share the cost of mortgage/household bill/improvements/car expenses including the Council Tax.

Second, singletons have one income per houseold and represent the lowest income households, as such they are unable to share the cost of household bills/mortage/car expenses inclucing council tax with other members of the household.