Suppose, the Eurozone stumbles through this crisis. Suppose countries avoid leaving the Euro and endure several years of low growth and internal devaluation?

What is to stop another Eurozone crisis occurring in 5 – 10 years time?

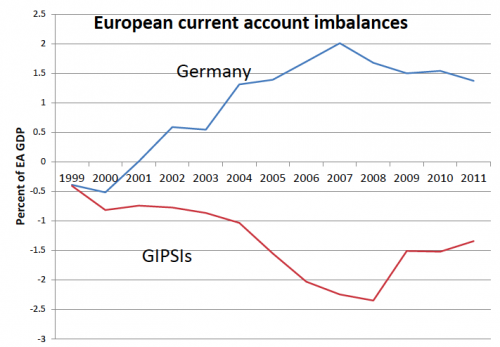

I can’t see how Greece, Spain and Portugal will ever be able to thrive in the Eurozone. Unless there is dramatic structural and cultural change, there will be continued threat of divergence in inflation and labour costs. There will be a continued threat of current account imbalances. (Deficit targets will not solve these Euro imbalances)

source: Brussels pdf, Krugman

Note GIPSI

- Greece

- Ireland

- Portugal

- Spain

- Italy

This article in the Guardian article outlines some of the worst case scenarios for leaving the Euro. (though if you read close, you might read the line:

The examples of Iceland and Argentina, where recovery has been impressive, offer some hope, though – although Argentina’s default took place at a time when the global economy was on the up.

Default and devaluation have happened before.

Leaving the Euro could cause terrible immediate costs. But, it would leave a country responsible for its own fate. It wouldn’t feel like a European power was dictating spending cuts and job losses. At least, they would avoid getting into this situation of an overvalued exchange rate again.

Given how spectacularly the Euro has failed southern European countries, how desirable is to stay in a monetary system which fundamentally doesn’t work for you?

Related