Main types of tax in the UK

- Income tax – This a tax on people’s income. The basic rate of income tax is 20%, paid on income over the income tax threshold of £10,400.

- National insurance contributions. Another type of income tax is national insurance contributions, which are based on a similar principle of taking a certain percentage of income.

- Consumption tax – VAT – 17.5%

- Excise duties on alcohol, tobacco

- Corporation tax – tax on company profit

- Stamp duty – tax on buying houses/shares

Income tax rates in the UK

| Threshold | £11,500 The first £11,500 is tax free |

| Basic rate 20% | £11,501 – £45,000 Most people start paying basic rate tax on income over £10,000 |

| Higher rate 40% | £45,001 – £150,000 Most people start paying higher rate tax on income over £41,865 |

| Additional rate 45% | Over £150,000 |

Main types of tax

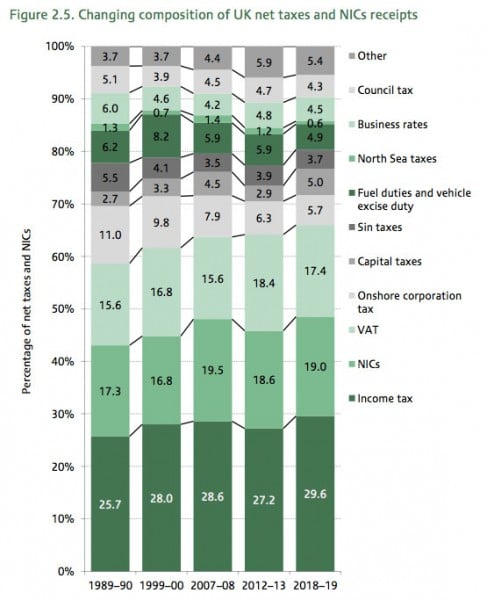

This shows the biggest source of tax revenue is income tax and NIC (a form of income tax) – these raise 46% of total tax revenue.

VAT accounts for 18%

Changes in tax composition

Source: IFS Green Budget 2014

This shows that income tax is rising as a share of tax revenue. Fuel duty is falling from 2000 to 2018.

Why is it getting more difficult to collect tax? – Reasons for falling tax revenue.

How much is income tax?

Example, if your income is £50,000 of taxable income

- You pay 0% on your Personal Allowance of £11,000.

- You pay 20% on the income from £11,000 to £45,000 (21,866) = £6,800

- You pay 40% on income between £45,000 to £50,000 – £8,134 = £2,000

- Total tax – £8,800

- average tax rate 17%

Progressive tax

This is a tax that when income rises people pay a higher % of their income in tax. For example, the top rate of income tax is 40%. This is paid on earnings over £40,000 a year. (See: progressive tax)

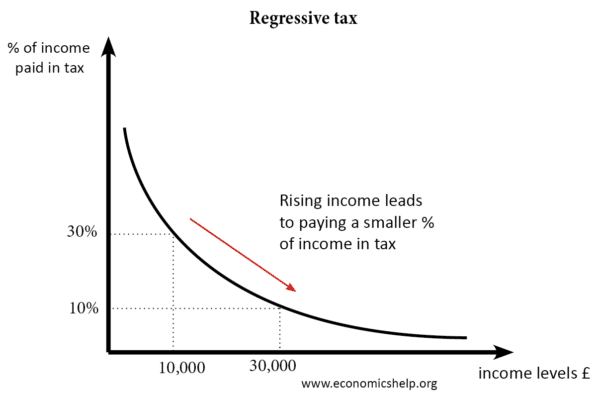

Regressive tax

This occurs when an increase in income leads to a smaller % of their income going on the tax. E.G excise duties, tobacco duty. A regressive tax means those on low incomes pay a higher percentage of their income in tax. (See: regressive tax)

Proportional tax

This occurs when an increase in income leads to the same % increase in tax.

Types of equity

- Horizontal equity: The equal treatment of people in the same situation

- Vertical equity: The redistribution from the better off to the worse off in the case of taxes this means the rich paying proportionately more taxes than the poor

Direct vs Indirect taxes?

Direct taxes are collected at source. For example, under PAYE when an employer pays you income tax and NI’s are automatically taken off. When we buy a good, we pay the VAT indirectly. It is the responsibility of the firm selling the good, to give 20% of selling price to government.

The requirements of a good tax system

- Horizontal equity. People in the same circumstances should pay the same taxes, e.g. you shouldn’t be able to avoid paying income tax because of a particular situation.

- Vertical equity. A degree of proportionality is important, e.g. progressive taxes.

- Cheap to collect

- Difficult to evade

- Efficient, non-distortion e.g. if taxes are too high people may be put off working

- Easy to understand

Reasons for tax

- Raise revenue for government spending.

- To promote redistribution of income and wealth.

- Discourage consumption/production of goods with negative externalities or demerit goods

Negative income tax

This is a progressive system of tax and benefits designed to reduce relative poverty. Those on low incomes are a given benefits, as income increases, the benefit decreases. After a certain level of income, people will start paying tax.

Examples of tax

- Carbon tax – environment tax on CO2 pollution

- Sugar tax – is it a good idea?

- Petrol tax