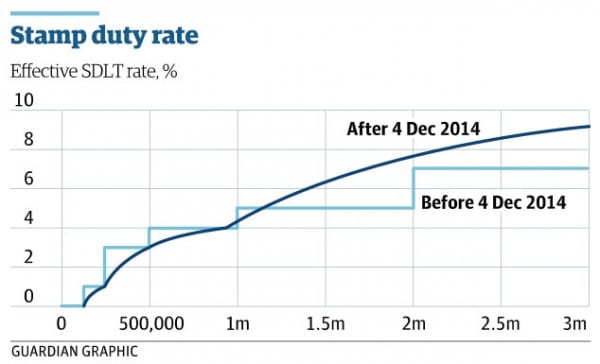

The government have announced a change in stamp duty. The chancellor George Osborne claims the change to stamp duty will cut the rate of tax for 98% of house purchases.

New marginal tax rates are:

- 0% tax on house purchases up to the value of £125,000

- 2% tax on purchases between £125,000 and £250,000

- 5% tax on purchases from £250,000 up to £925,000

- 10% tax on purchases from £925,000 to £1.5m

- 12% tax on purchases over £1.5m

The tax change will cost the public purse £800m and represent a £4,500 cut in tax on average home of £275,000.

For an average priced home of £275,000, there will be £4,500 cut in stamp duty.

Commentary

Firstly, it makes sense to get rid of the old system, where a £1 increase in house price could cause £3,000 extra tax. Marginal tax rates avoid this tax-cliff, which distorted house sales around the stamp duty rates.

It is also very progressive, with a steep increase in tax rates for more expensive houses. In some ways the new stamp duty is a weak substitute for the proposed mansion tax.

However, there are two main problems.

1. This is not a good time for tax cuts. Given the need to improve public finances, it seems strange to offer a big tax cut on stamp duty. Revenues from stamp duty have already fallen significantly since 2008 because of lower house sale volumes. This tax cut will worsen public finances. It would be better to avoid a tax cut for stamp duty and have an extra £800m to spend on infrastructure (like for example, building affordable social housing).

Some might say, ‘But, you often argue for expansionary fiscal policy, so why not support a tax cut to boost spending and support economic growth?” – Well firstly, the aim of this tax cut is not to boost economic growth. If you did want to pursue expansionary fiscal policy, you would cut VAT or income tax. Increasing income tax threshold would increase consumer spending, but I’m not convinced a cut in stamp duty would have much impact. A cut in stamp duty is not really going to encourage people to go out and spend supporting a sustained economic recovery.

With stamp duty cut we get the worst of both worlds – we get a deterioration in public finances, but it doesn’t even offer much help to the economic recovery.

2. Overheated housing market. The UK housing market is already over-heated. House price to earnings ratios are near record levels, why fuel an already over-heated housing market? The last thing the UK housing market is an artificial boost to demand.

Although the tax is progressive, it is only progressive for home-owners, and the number of homeowners is declining as many are priced out of the market. The biggest inequality in the UK is often coming from home-owners vs renters. To improve equality in the housing market, it would be better to use the £800m to offer more affordable social housing – rather than the home-owner who has done well from rising house prices and ultra-low interest rates.

Unfortunately, it seems that prospective house buyers are a more important political target than renters.

Related