Firstly, I thought it might be helpful to talk about the different types of spending cuts that people refer to.

- An actual cut in government spending. e.g. one year we spend £39bn on defence, the next year that is cut to £38 bn. This is a nominal cut of £1bn. The real cut will be even bigger.

- A cut in real government spending. If inflation is 3% and government spending on education rises by 1%, that is a real cut of 2%. Departments will still have to cut back on wages and spending because with inflation higher than spending rises, they can afford less spending. It is fair to call this a spending cut

- A cut in % of real GDP

Suppose, real GDP rises by 3%, but one department sees a rise in real spending of 1%. In this case, the department has a smaller share of national income, but at the same time has a real increase in the amount of money. This isn’t a cut in government spending, but it is cutting the share of GDP spent on that department.

- A cut in quality of services. This is even more subjective. Suppose economic growth is 3% a year, but we increase the NHS budget by 4%. This is a real increase, and we are spending a higher % of national income on health. However, some may argue the demand for health care is rising by 8% a year due to rise in number of old people, rise in obesity e.t.c. Therefore, unless we match the demand for rising health care, it will lead to a cut in the quality of service and a rise in waiting lists. It is disingenuous to call a 4% real rise in spending a cut, but people’s experience of the NHS may feel like they are experiencing a cut.

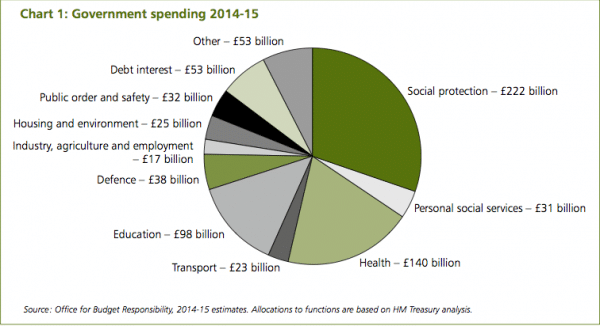

Government spending as a pie chart

Which piece of pie should be cut?

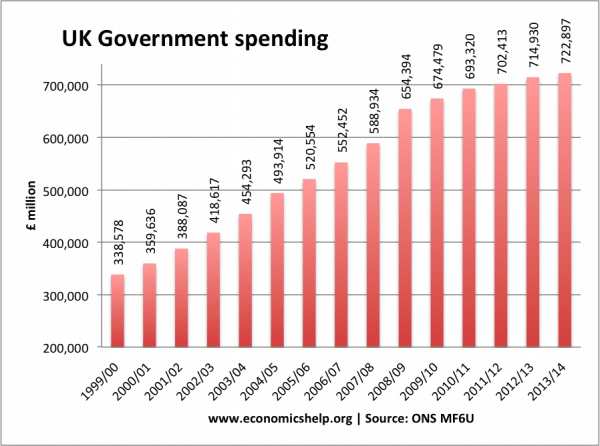

UK government spending, nominal (not inflation adjusted)

Firstly, government spending has risen since 2010/11. There has been no overall nominal cut.

One feature of the coalition government is that in practise they have been less radical than they promised. The promised austerity, but fortunately they didn’t quite follow through with their own promises, with many proposed cuts delayed.

However, within this overall rise in government spending, some departments have seen cuts; some departments have seen big rises.

Autumn statement

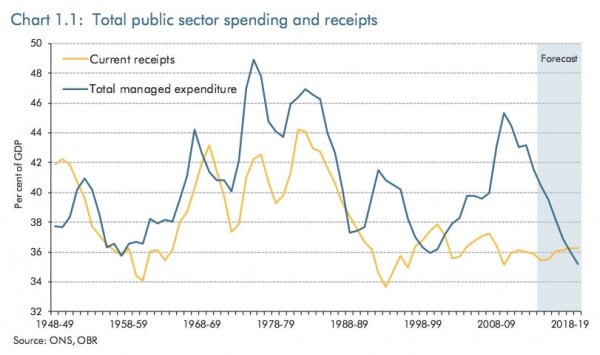

The autumn statement is really radically in promising a lot more spending cuts. If the chancellor gets his way, government spending as a % of GDP will fall to the lowest level since the late 1940s (or if you prefer since the great depression of the 1930s). See chart top.

Firstly, I am suspicious any government will be able to do this. Thatcher and Reagan always talked about rolling back the frontiers of the state, but the reality often failed to match the rhetoric. It is easy to slip in unspecified spending cuts of £30bn or so in your autumn statement, it is much harder to implement it in practise.

The other issue is that government spending as a % of GDP, relies on optimistic growth forecasts

Fundamental re-imagining of the state

But, let us assume the government has the willingness to actually implement this level of cuts, where will they come from?

We are told the NHS and education are ring fenced. State pensions have risen £18bn in the past four years. We have an ageing population increasing the pressure on the NHS and pension spending.Pensioners have received many promises that pensions will be linked to a triple lock (rising with wages, prices or 2.5%, whichever is the highest) – a very generous promise in the circumstances

The most popular target for spending cuts is the welfare budget, but if you look at the detail of the Social protection budget of £250bn, there is much less ‘welfare’ spending than you might first imagine. Unemployment benefits amounts to less than £5bn, there really isn’t much room for more cuts there. The government may be able to squeeze income support, tax credits and housing benefits. But, there is no sign of a end to the housing crisis or number of people in low income jobs.

The IFS have stated that £35bn of cuts had happened (from departments like defence, policing, local government, but with £55bn more of cuts to come. (IFS)

That is a lot of cuts. The first round of cuts is always the easiest; you can get rid of less essential services, but after that cuts really will mean a big change in operations. With the main departments facing cuts of 40% – it is not hyperbole to say this essential means re-imagining the role of the state. It is a clear ideological attempt to reduce the influence of the government.

It will mean vastly different roles for transport, defence, policing and local government. The question we need to ask is –

- Do we really need to cut government spending as a % of GDP?

- Why are tax revenues as a % of GDP so low?

- Can the free market really provide better infrastructure spending, social housing, policing, local council services?

- What will be the impact on equality and quality of life from reducing government spending as a % of GDP?

The great ideological debate

The Conservatives have opened up a big ideological debate about the role and size of the state. If I was an opposition party to the Conservatives, it would be easy to open up a difference of policy opinion – why do we have to reduce government spending as % of GDP to 35%?

Related