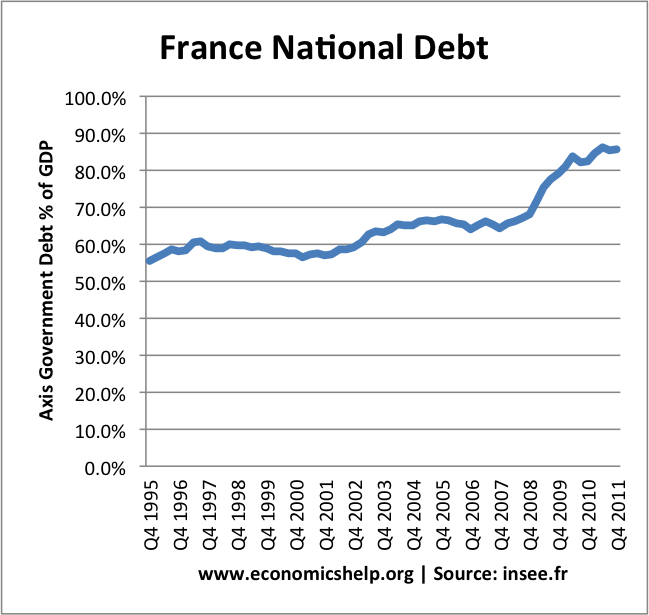

France national debt has increased significantly over the past two decades. In 1985, government debt was 37.9% of their GDP. French national debt is now 85% of GDP. In Q4 2011, French debt is currently 1717 bn Euro

Source: INSEE – general government debt according to Maastricht criteria. Up to Q4 2011

Public sector debt is 85% of GDP in 2011

Forecast for 2012 is public sector debt of 90% of GDP.

Composition of Debt

- short term securities 258.9

- Long term securities 1042.4

- short term loans 39.2

- long term loans 175.7

France still has a AAA credit rating (list of countries with highest rating) Despite a relatively high public sector debt, it is financed by long term securities giving France more leeway. Also, its annual budget deficit is not too high. The President has sought to cut the annual budget deficit from 7.1% of GDP (2010) to 3% of GDP by 2013. Forecast deficit of 2011 of 5.7% (reuters)

However, markets are concerned over France’s exposure to other Euro members debt. Under its current guarantee to the bail-out fund, France has a contingent liability of 8% of GDP. If Italy was part of the contingent fund, France’s contingent liability would increase to almost 13% of GDP. [1. economist]

In the long term, there are also concerns over the vibrancy of the French economy, economic growth has been relatively low since 1998. (France stats at OECD) Furthermore France has one of the most generous welfare states. A low retirement age and powerful unions to resist any increase in retirement age, means the government could increasingly face a rise in the dependency ratio and higher entitlement spending.

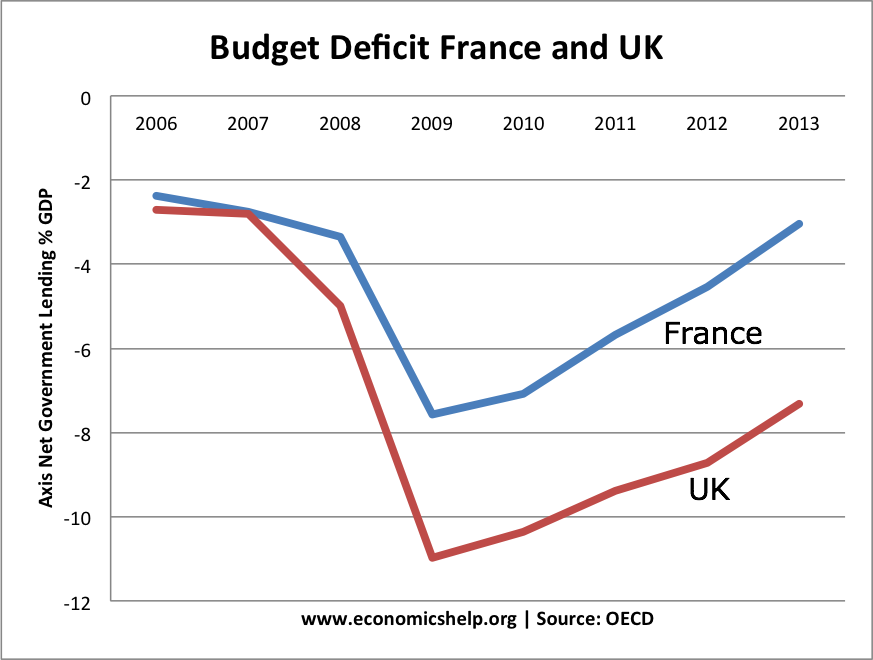

France Government Borrowing

This shows the annual borrowing requirement. I have compared it to the level of borrowing in the UK, which is higher.

Source: OECD (2013 forecast)

Notes:

The public net debt is defined as the difference between the public debt according to the Maastricht definition and the deposits, loans and securities other than shares held by the general government over the other sectors. Those assets are accounted in their nominal value.

France Credit Rating

Until 2011, France had the highest credit rating AAA. This was downgraded to AA+ by Standard & Poor’s (S&P). In May 2012, S&P warned there was a one in three chance that France will lose its AA+ credit rating over the next year and a half. Moody have kept France’s AAA but have put it on a negative watch. (Moody at Bloomberg, April 2012)

Related

French debt at Spiegel

Paul Krugman did his PhD thesis on the post World War 1 French national debt. He had an article in the New York Times recently on this. See:

http://krugman.blogs.nytimes.com/2011/08/11/franc-thoughts-on-long-run-fiscal-issues/