A credit rating is a judgement made on the security of government bonds. They are made by credit rating agencies who evaluate several factors and decide on their likelihood of default. A triple-A credit rating implies the bond is secure. A junk bond status implies the government is likely to default.

Readers Question: Hello, I was wondering if you could help clear up for me how France has not balanced it’s budget in 30 years as many websites are reporting. And yet it only recently lost its triple-A credit rating. Am I missing something here?

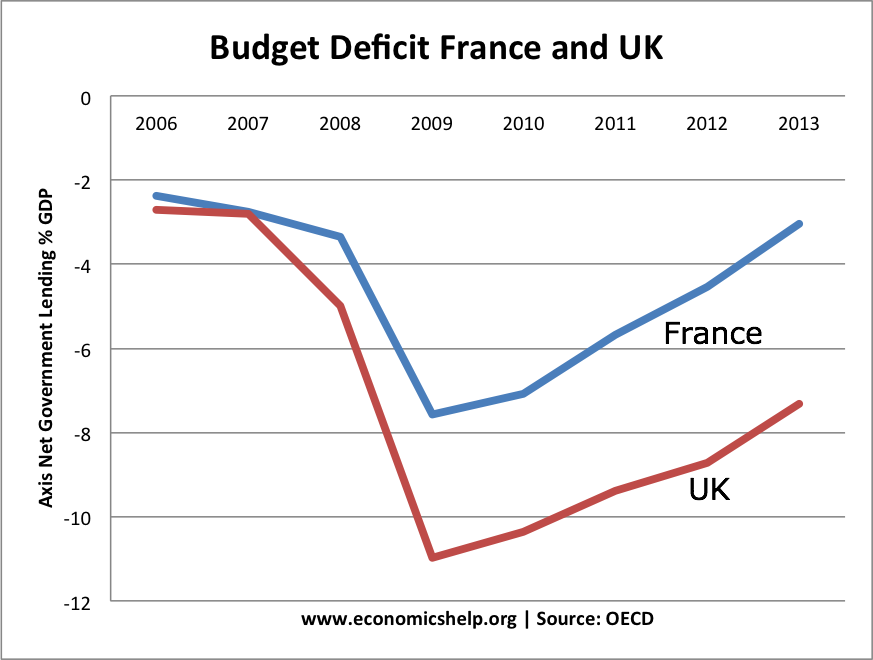

Source: OECD (2013 forecast)

- The graph above shows the annual level of government borrowing as a % of GDP for both France and the UK since 2006.

- France has had only a small downgrade in credit rating S&P rank it AA+, which is second highest credit rating. Moody has kept France at AAA although have put it on negative watch.

- It caused some consternation in France that the UK kept the highest AAA credit rating – despite having a much higher level of government borrowing.

- It is also worth pointing out that Japan has a net public sector debt of over 220% and yet has a credit rating of AA- (S&P Bloomberg)

- A large government deficit doesn’t mean that the government is going to default. The UK has had much higher levels of national debt in the past (see: historical national debt) – and it never defaulted. This is one factor in helping UK keep its AAA credit rating.

What Factors Determine Credit Rating?

Credit ratings are determined by whether there is a realistic chance that the country will default on interest payments and repaying its debt.

- Level of government borrowing. If government borrowing is relatively low e.g. 3-5% of GDP then this is likely to be sustainable. However, if government borrowing is over 10% of GDP, then the risk of unsustainable growth in government borrowing is much higher. But, what constitutes sustainable levels of borrowing depends, e.g. the UK borrowed over 10% of GDP without losing AAA rating.

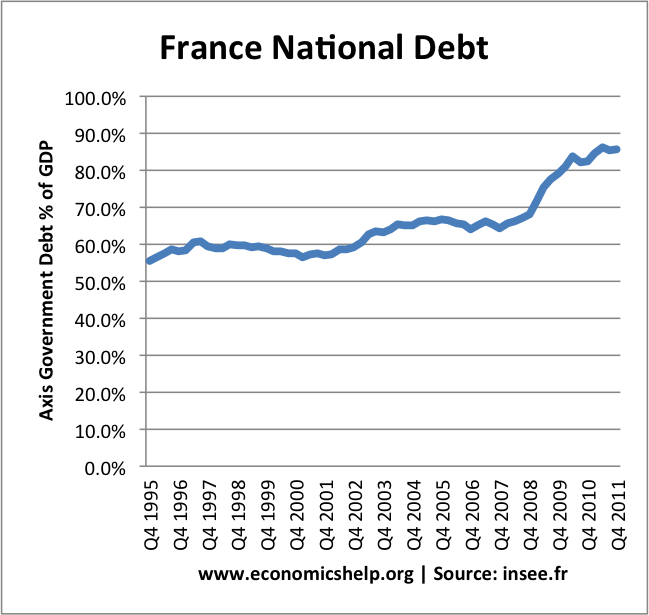

- Level of national debt. It isn’t just the annual level of debt which is important, but also the total outstanding debt. France has been reducing its budget deficit, but because of low growth, its total national debt has been increasing (see bottom graph). For example, when Greece passed 100% of debt to GDP, markets increasingly felt this was unsustainable. But, again, debt as a % of GDP is only one factor. Spain’s national debt is quite low (around 70% of GDP, but it has a worse credit rating than Japan which has debt of 230% of GDP.

- Prospects for economic growth. If an economy is forecast to grow, then this economic growth will lead to higher tax revenues and reduce unemployment making it easier to reduce levels of debt to GDP. A key factor in the credit rating downgrades of Eurozone economies like Greece, Portugal and Spain is because the economies are forecast to be in recession. Therefore, it will be hard to reduce debt to GDP ratios – despite their deep spending cuts.

- Debt interest payments as a % of GDP. In the UK, debt interest payments are over £40bn a year (around 3% of GDP). But, this is quite manageable. Even if the debt to GDP ratio continues to rise – if interest rates stay low, then the debt interest payments will be manageable. However, if a country experiences a rapid rise in debt levels, plus markets push up interest rates (see: Euro interest rates). Then countries face the unfortunate combination of rising debt interest payments. Even if countries cut spending, they need to spend the extra money on debt payments. It is a vicious circle.

- Confidence. Do investors have confidence in the country. Is there a history of default?

- Who Owns the Debt? If the debt is owned by domestic individuals and domestic pension funds, the debt is less risky to capital flight. For example, if a European country like Greece has debt held by people abroad, then if people fear Greece will end up leaving the Euro, then foreigners will sell their Greek bonds. Japan has been able to borrow so much because there is a large domestic demand for buying Japanese government bonds. Japan is not reliant on foreign investors.

- Debt Maturity. The UK has quite a high debt maturity. The average debt maturity in the UK is over 17 years. This long-term borrowing puts less pressure on the UK to refinance in the short term. If a country finances its debt by selling short-term gilts and bonds, it keeps having to resell bonds. Therefore, they are more at the mercy of investors confidence.

- The Eurozone has not been good for credit ratings. Many countries in the Eurozone have seen a deterioration in credit rating. This is because membership of the Euro has increased the chance of pushing economies into recession. Countries like Spain can’t devalue to restore competitiveness, they can’t pursue independent monetary policy. There is no lender of last resort (like the Bank of England). Therefore, their prospects for growth are worse. Problems of Euro

- Bond yields

- Bond yields are a guide to market perceptions of credibility. If markets feel governments may default, demand for bonds will fall – causing a rise in interest rates – markets need a higher interest rate to compensate for greater risk.

- If the UK was in the Eurozone, I am certain the UK wouldn’t have an AAA credit rating.

It is important to remember, Credit Rating Agencies are not infallible. It was credit rating agencies who give AAA to those US mortgage bonds which were useless. Credit rating agencies tend to reflect market sentiment – they don’t lead it. Who rates credit rating agencies?

France Credit Rating

Until 2011, France had the highest credit rating AAA. This was downgraded to AA+ by Standard & Poor’s (S&P). In May 2012, S&P warned there was a one in three chance that France will lose its AA+ credit rating over the next year and a half. Moody has kept France’s AAA but has put it on a negative watch. (Moody at Bloomberg, April 2012)

Source: INSEE – general government debt according to Maastricht criteria. Up to Q4 2011. France National debt

Related

Given that other counties have similar problems to Greece-does it make sense to organize Euro 2 ?

The PIGS(or Maybe PIIGS) very own coin.

Common central bank and harmonized fiscal policy .

At least this way no one need hate the Germans.

It would be better than Euro 1. But, the costs of monetary union (even for just southern countries) would be potentially much greater than small benefits. What’s wrong with having your own currency.