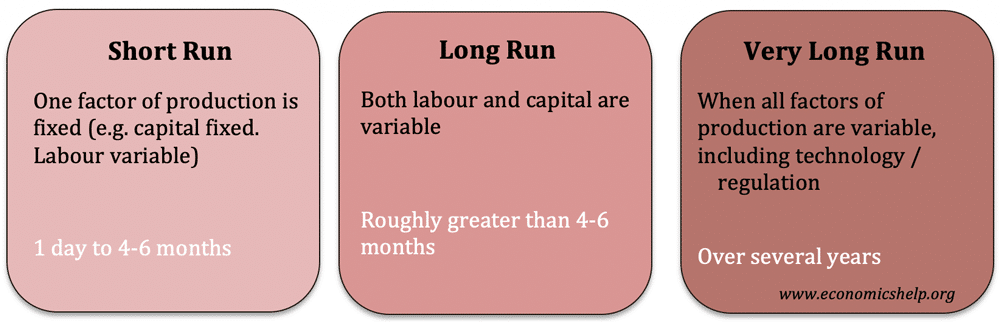

The short run, long run and very long run are different time periods in economics.

Quick definition

- Very short run – where all factors of production are fixed. (e.g on one particular day, a firm cannot employ more workers or buy more products to sell)

- Short run – where one factor of production (e.g. capital) is fixed. This is a time period of fewer than four-six months.

- Long run – where all factors of production of a firm are variable (e.g. a firm can build a bigger factory) A time period of greater than four-six months/one year

- Very long run – Where all factors of production are variable, and additional factors outside the control of the firm can change, e.g. technology, government policy. A period of several years.

More detailed explanation

Very short run (immediate run)

- At a particular point in time a business may not be able to ask employers to work at short notice or they may not be able to order more stock.

- In the very short run, the firm can only do things like perhaps changing price, giving special offers or trying to manage exceptional demand by queing system.

Short run

- In the short run one factor of production is fixed, e.g. capital. This means that if a firm wants to increase output, it could employ more workers, but not increase capital in the short run (it takes time to expand.)

- Therefore in the short run, we can get diminishing marginal returns, and marginal costs may start to increase quickly.

- Also, in the short run, we can see prices and wages out of equilibrium, e.g. a sudden rise in demand, may lead to higher prices, but firms don’t have the capacity to respond and increase supply.

Long run

- The long run is a situation where all main factors of production are variable. The firm has time to build a bigger factory and respond to changes in demand. In the long run:

- We have time to build a bigger factory.

- Firms can enter or leave a market.

- Prices have time to adjust. For example, we may get a temporary surge in prices, but in the long-run, supply will increase to meet it.

- The long run may be a period greater than six months/year

- Price elasticity of demand can vary – e.g. over time, people may become more sensitive to price changes, in short run, people keep buying a good they are used to.

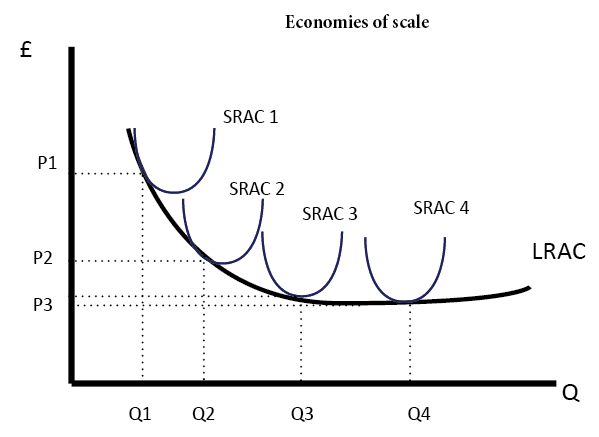

Relationship between short-run costs and long-run costs

- LRAC = long run average costs

This shows how a firm’s long-run average costs are influenced by different short-run average costs (SRAC) curves.

The SRAC is u-shaped because of diminishing returns in the short run.

See cost curves

The very long run

- The very long run is a situation where technology and factors beyond the control of a firm can change significantly, e.g. in the very long run:

- New technology may make current working processes outdated, e.g. rise of the internet and digital downloads have changed the face of the music industry, making it hard to make a profit from selling singles.

- Government policy may change, e.g. reducing the power of trades unions has reformed the UK labour market.

- Social change. For example, the First World War brought more women into the labour market and changed people’s expectations about the jobs women could do.

Short run long run in macroeconomics

We can also see the short run and long run in macroeconomics.

An increase in the money supply can lead to a short term increase in real output – as workers feel they have an increase in real income.

However, in the long-run, the increase in the money supply causes inflation and so workers realise real wages are the same and real output remains unchanged.

- For example, the difference between short-run aggregate supply and long-run aggregate supply.

Readers Question: what is the difference between short-run and short term?

Not much. If there is a difference, the distinction doesn’t matter at A level. When talking about production, we often refer to the short run and long run. For example:

- Diminishing returns occurs in the short run. In the short run, we assume capital is fixed. In the long run, the amount of capital is variable.

We may mention short term factors affecting exchange rates or short term factors affecting the economy.

- For example, an increase in the money supply may cause a short-term increase in real output. However, in the long-term, an increase in the money supply may cause inflation and therefore diminish the increase in real output.