In recent years, major companies have seen a significant rise in cash reserves. These are profits which are not reinvested or distributed to shareholders but effectively saved.

The largest cash reserves are found amongst major US IT companies, such as Apple, Microsoft and Google.

These cash reserves have significant implications for economic welfare and income distribution in society.

Some economists see these cash reserves as effectively deadweight welfare loss. The $2 tn of reserves sitting in unproductive ‘offshore’ accounts, rather than being reinvested into the economy.

Net cash reserves

- Note net cash reserve = savings – debt levels.

Cash reserves of major US companies

According to Moody – a rating agency, US non-financial companies held a total of $1.7tn held on their balance sheets.

- Apple’s cash reserves are the largest with total cash reserves of $216bn, 93% of which is overseas.

- The top five companies Apple, Microsoft, Alphabet, Cisco and Oracle, had a total of $504bn of cash by the end of 2015.

- Microsoft has $90 billion of cash reserves – 91% overseas (Forbes)

- Google’s is $64.4 billion.

After the tech sector, the next biggest sector for cash reserves is the healthcare and pharmaceutical sector with 19% of the cash reserves equivalent to $136 billion.

Cash reserves of major UK companies

- According to FT, the net cash position of FTSE 100 companies has risen from £12.2bn in 2008 to £73.9bn this year in 2013. For all major companies, this cash reserve is £166bn. (cash reserves at FT)

- Since 2008, UK companies have taken the opportunity to reduce company debts, leading to this sharp rise in net cash reserves.

- Other estimates for the level of cash reserves by UK firms include a Bank of England figure at £284 billion (link). In addition to these cash reserves is a figure for £69 billion of investment in bonds, which are effectively a type of savings.

Reasons for the rise in cash reserves of firms

What are the reasons behind these rise in cash reserves?

- Increased profitability. Firms have been able to increase profitability, with rising demand for luxury goods, but limited growth in costs. In particular, real wages have been stagnant since 2008, which has helped increase profitability.

- Uncertainty, which discourages investment. Despite rising profitability, there are many factors which are increasing uncertainty and discouraging investment. These have included structural problems of Eurozone, the impact of Brexit on the world economy, and the sharp drop in commodity prices which are harming many producers of raw materials.

- Low-interest rates. The world has seen a fall in interest rates, with a remarkable rise in the number of negative bond yields. This means firms have less pressure to offer higher dividends to shareholders. Already there is a big gap between the yield on shares and the yield on bonds.

- Tax avoidance. One reason for the rise in US company cash reserves is the desire to avoid US corporation tax. 93% of Apple’s cash reserves are held overseas. Bringing this profit back to the US to invest or distribute to shareholders will attract relatively high rates of corporation tax.

Benefits of cash reserves

- Firms have an insurance against an economic downturn; this is important for firms in volatile sectors, such as commodities.

- With large cash reserves, there is potential for investment and acquisitions when the economic climate improves. Lack of financing should not be a reason to cut back on investment because firms have the capacity to dip into reserves.

- Some of the cash reserves are being invested in government bonds, which help to finance government deficits.

Problems of cash reserves

- In an age of austerity – with cuts to public spending and lack of infrastructure spending, these cash reserves could be more profitably used in the economy rather than being effectively idle.

- Reflects increasing inequality. Cash reserves are partly a result of widening the gap between profitability and wage growth. Firms have benefited from rising profitability, but this has not led to rising wages for workers.

- Firms can become reluctant to use them. The cash reserves have been rising for several years, and there seems to be a reluctance to use. It is uncertain how Apple would manage to spend $200bn of reserves in overseas accounts.

- It could lead to firms acquiring other unconnected businesses, but this could cause the firm to be over-stretched and lose focus on its core business. For example, Tesco expanded into many different companies at the expense of its core supermarket business.

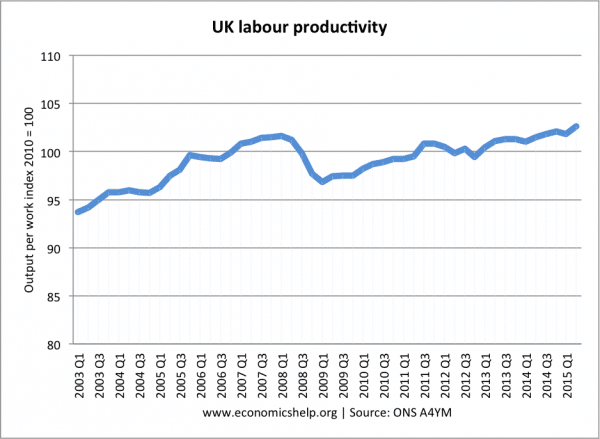

- Lack of investment could be a factor behind falling labour productivity.

UK labour productivity has fallen behind past trends, adversely affecting the UK’s long-run trend rate of economic growth.

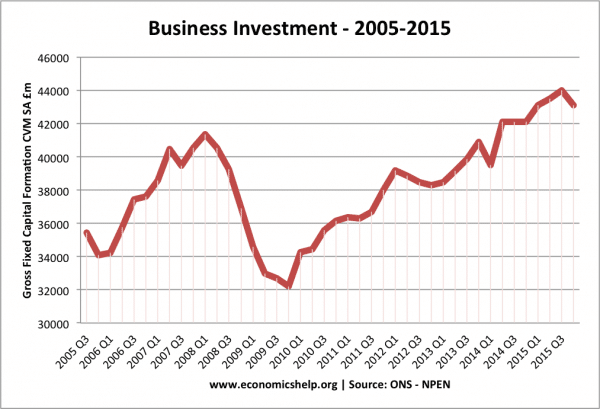

Business investment struggling to maintain former growth.

Tax on retained earnings?

One possibility is to have a tax on retained earnings to encourage investment. IT could even be made revenue neutral through an equivalent reduction in corporation tax.

Related