According to the National Institute for Economic and Social Research (Niesr), fiscal consolidation in the UK is likely to increase the UK’s debt burden. Or to put it in layman’s terms there will be ‘pain, but no gain’

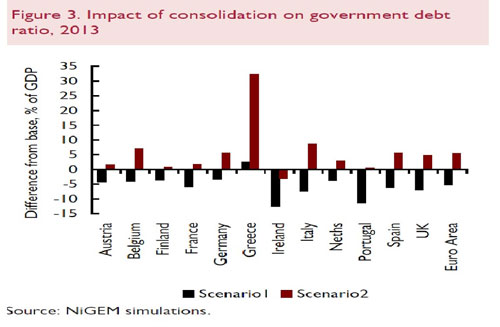

They model the impact of fiscal consolidation in both ‘normal’ times (scenario 1) and in the current economic climate (scenario 2). This second scenario models the impact of fiscal cuts during the economic situation we currently have. (liquidity trap, debt burden, low confidence, low bank lending, Europe wide recession

Fiscal consolidation means government spending cuts and or tax increases. It is the attempt to reduce a budget deficit. It could also be termed deflationary fiscal policy.

Impact of Fiscal Consolidation on Debt Levels

The think tank, NIESR, states that Britain’s debt to (GDP) ratio will be 4.85 percentage points higher by 2013 because of the spending cuts and tax rises introduced by the Coalition government.

They have also modelled the impact of European wide austerity measures, and come to the similar conclusion.

Why Is Austerity Raising the Debt Burden Under Current Economic Situations?

- In the current climate, there is no effective loosening of monetary policy to help boost aggregate demand (AD). In normal circumstances, fiscal consolidation could be accompanied by lower interest rates which boost private sector demand.

- Private sector is not being crowded in. In normal circumstances (when the economy is close to full employment) a cut in government spending and or taxes, usually leads to a rise in private sector investment and spending. However, because the private sector have low confidence and are still concentrating on reducing their debt overhang, the private sectors hasn’t taken up the slack from the government.

- Large negative multiplier effect of spending cuts.

- European wide austerity. The fact most European economies are pursuing austerity and experiencing lower economic growth means that it is hard to increase exports. In normal circumstances, fiscal consolidation has often been offset by increasing external demand. But, the European wide recession is also hitting export demand.

The most tragic case is Greece. Despite repeated attempts to reduce government spending, and fiscal consolidation of 10pc of GDP, the country’s debt burden will still increase by 32.4 percentage points, to almost 190pc of GDP next year, from 165.3pc in 2011.

The author’s conclusion makes stark reading.

The direct implication is that the policies pursued by EU countries over the recent past have had perverse and damaging effects. Our simulations suggest that coordinated fiscal consolidation has not only had substantially larger negative impacts on growth than expected, but has actually had the effect of raising rather than lowering debt-GDP ratios, precisely as some critics have argued. Not only would growth have been higher if such policies had not been pursued, but debt-GDP ratios would have been lower.

1. The paper “Self Defeating Austerity” by Jonathan Portes and Dawn Holland is published in the National Institute Economic Review, no. 221, October 2012. full pdf at NIESR

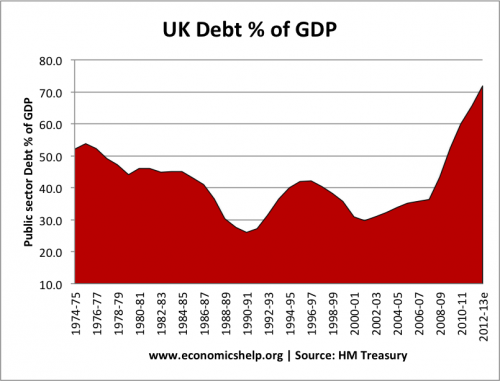

UK National Debt

more on UK Debt

Related

- Is Austerity Self Defeating?

- Self defeating austerity – the Treasury view

Great analysis.

You do a great job in explaining complex economic issues in relatively simple language. Something that I also strive to achieve on my blog.

All the best

Tom (Another Angry Voice)

Thanks Tom. Good luck with blog, looks good

It would be interesting to show private debt alongside public to get a sense of the scale. The last figure I can find put it at 450% of GDP, or £7 trillion in 2011. If we could see the real scale of private sector debt we’d see just how underplayed it is by govt and economists.

The other thing I’d like to know is what the average rate of interest on that £7 trillion is. Whatever it is, it amounts to a significant fraction of our GDP each year!

At the end of the day, decisions will be prioritised by political motivation. There will be spectacular graphics on both conclusions which u polar opposite. If pain is to people who will not support the Government- they will not care as long as their supporters gain. Romney blurted out the truth about 47% ! As a medical leader( in my microcosm of austerity), I believe the solution has to be a range of options, innovation being the top priority. Plus, strengthening the process of Democratic election whereby independant research will have more persuation than campaign strategy + “lay” people being mature enough not to cast vote based just on emotion. Democracy presupposes responsibility; for the population as well as the leaders. Educating / empowering people is the job of the researchers. I hope this article will reach people.

Many commentators suggest that the government is increasing its borrowing and that this borrowing is funded by some outside source and will need to be repaid at some point. Who is lending to the UK government? Little from private investors, little from other sovereign states so to who is this supposed increase in debt payable to?

Thank you

you put a lot of effort into gathering all this information