Readers Question: What is the economic impact of proposed welfare benefit freezes proposed by Chancellor, Mr Osborne?

Mr Osborne has proposed a welfare freeze, worth £3 billion of savings over two years. This benefit freeze includes Jobseeker’s Allowance, Income Support, Child Tax Credit and Working Tax Credit, Child Benefit and Employment Support Allowance (paid to those judged capable of work). It does not include pensions, disability benefits and maternity pay.

The Treasury said that about 10 million households would be affected, roughly half of which are working.

The freeze will raise around £1.6bn in 2016/17, rising to around £3.2bn a year in 2017/18.

An argument for freezing welfare benefits is that it will help reduce the budget deficit and also – since 2007, average earnings (+17%) have been rising at a slower rate than working-age benefits (+22%.)

Economic effects

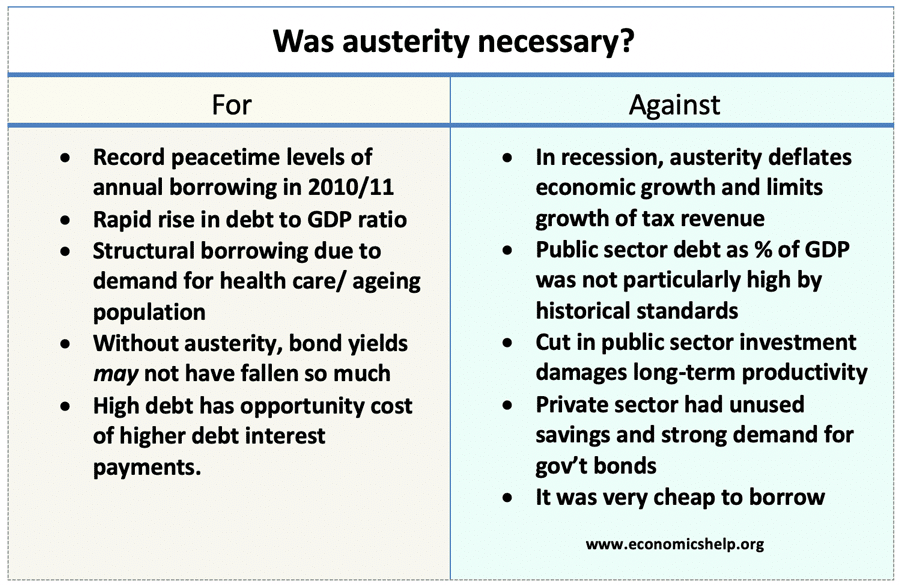

Aggregate Demand (AD) / economic growth. Welfare freezes will (ceteris paribus) reduce consumer spending, and lead to lower aggregate demand. It is an example of deflationary fiscal policy. It will be quite significant because people receiving welfare benefits have a high marginal propensity to consume because, on low incomes, they don’t have the luxury of saving – therefore, lower welfare benefits will directly lead to less spending in the economy. Welfare freezes will also contribute to a decline in consumer confidence because it will be a visible reminder of economic hardship. Combined with other spending cuts of up to £24bn, there is still scope for these planned spending cuts to derail the economic recovery and cause lower growth or even a future recession.

However, the strength of the recent recovery suggests the UK may be in a better position to absorb austerity than a few years ago. Also, the chancellor can rely on the Bank of England to maintain a very loose monetary policy, which will help to offset the impact of this deflationary fiscal policy.

However, we still don’t know the position of the economy in a couple of years. there is evidence that the recovery still is unbalanced with low productivity growth and low real wage growth making the economy still vulnerable. Continued recession in Europe could also act as a drag on the UK economy; it is possible that these commitments to spending cuts could hold back economic growth, that even monetary policy can’t overcome.

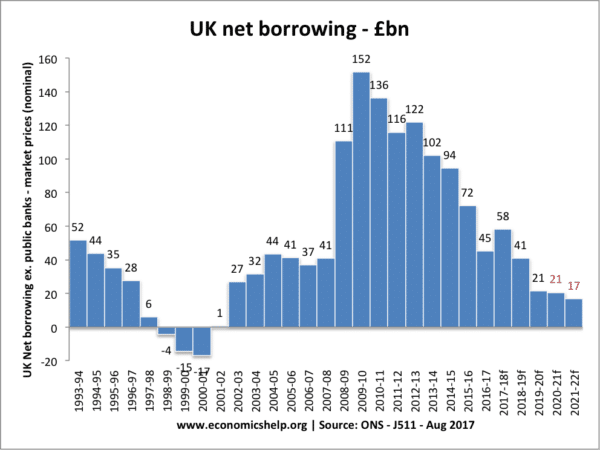

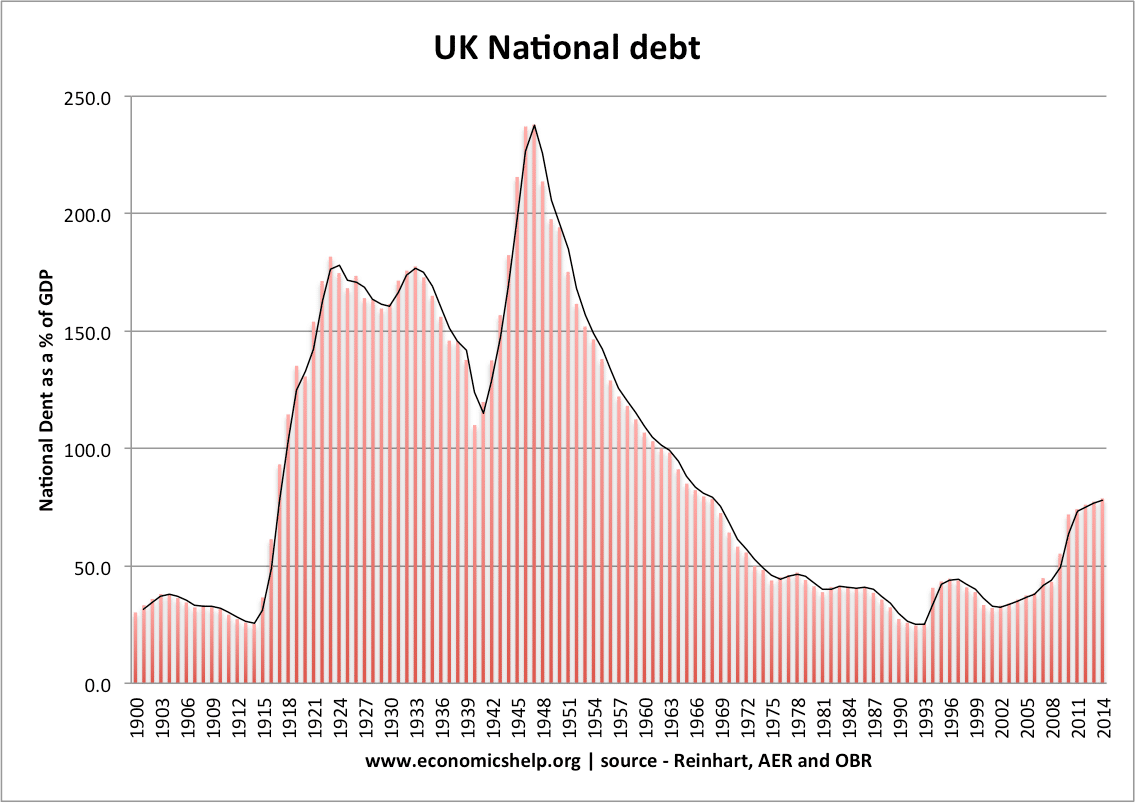

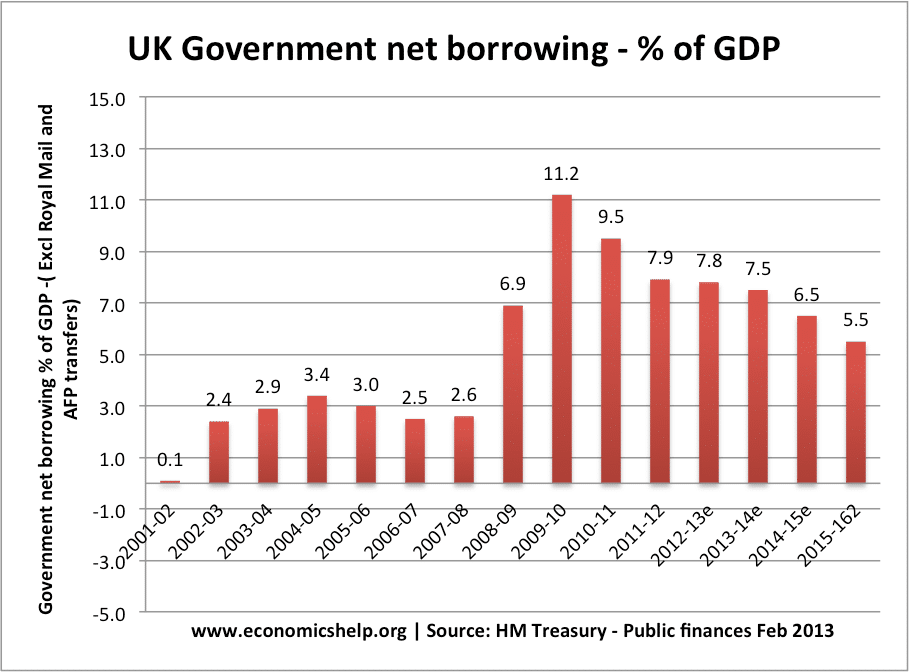

Deficit reduction. The spending cuts will contribute £3bn to saved spending, helping to reduce the budget deficit. However, it is still a small % of the current budget deficit (£93bn). Also, the reduction in deficit may be less than planned because it will cause a fall in tax revenues (e.g. less VAT receipts from lower spending) and also lower economic growth from the austerity measures.

Some economists argue that deficit reduction is essential and there is no alternative but to cut spending. They hope that cutting the deficit will reassure markets and business about the long-term strength of the economy. Other economists argue that recent evidence suggests people don’t gain confidence from austerity – but actually the opposite. (see: Confidence fairy)

Read more