If you read any number of self-improvement books, you will come across ideas such as ‘what you think, you will become’. Over, 2,500 years ago, the Buddha said: “All that we are is the result of what we have thought. The mind is everything. What we think we become.”

When overused these positive thinking mantras can become a bit tiresome. But, maybe there is still some relevance to modern macroeconomics. Not least, we have the phrase of ‘talking ourselves into a recession’. The idea that if key people in the economy keep talking about a recession, this can become a self-fulfilling prophecy. With a threat of recession, people spend less, firms invest less and this creates falling aggregate demand. Cynics may say, people wouldn’t talk about a recession unless there was some economic justification so it will be hard to attribute it all to merely negative talk. Nevertheless, it does show the potential of strong opinions having a significant bearing on the outcome.

If you wish for Austerity, you tend to Get it

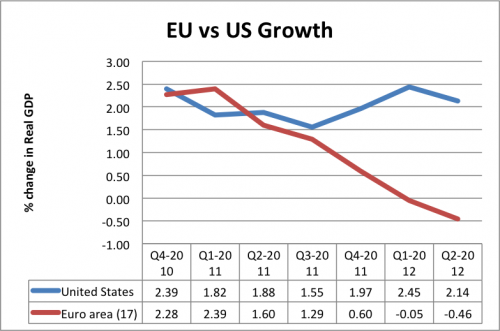

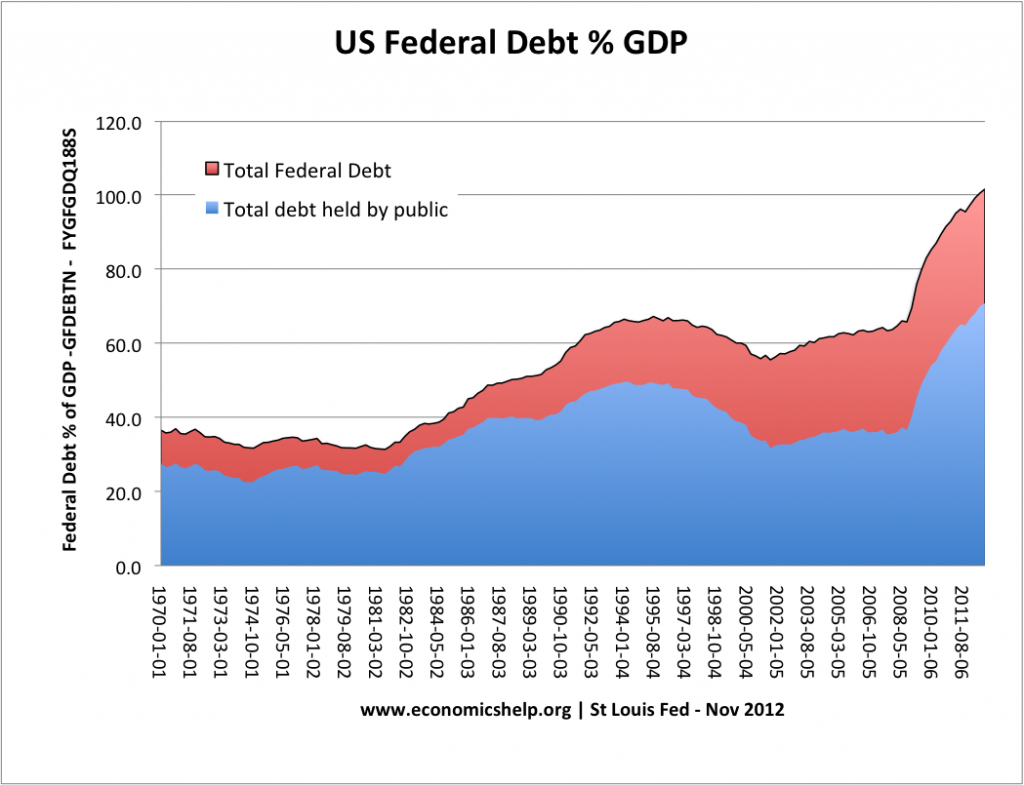

The next thing that springs to mind is the recent attitude to the economy and debt. We could characterise the EU and UK’s attitude as ‘austerian’. Generally austerians take a very pessimistic view towards the economy. They are deeply worried about levels of debt and government borrowing. They fear bond markets will very soon penalise these high levels of debt. Austerians spend a lot of time telling the electorate how the economy is in a bad shape and we need to respond with strict spending cuts and tax increases. There is also a sense of morality attached to this austerity approach. ‘Debt got us into this mess, we can’t use debt to get out of it.’

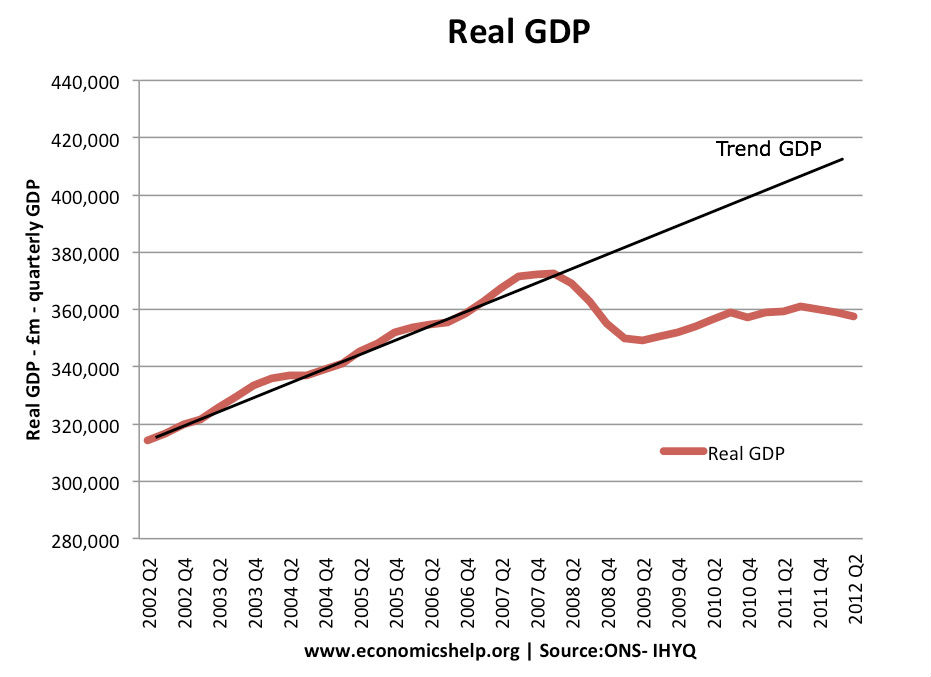

The consequence of austerity measures has generally been higher unemployment and lower economic growth. In the Eurozone, austerity policies have generally failed to reduce debt to GDP ratios because of the recession. Therefore, with budget deficits failing to fall, austerians take this as evidence to cut spending more deeply. Again it is accompanied by a sense of morality. “We almost deserve a period of austerity in response to the previous lending boom of the mid 2000s.” ‘We can’t spend money, we don’t have’. Those of an Austerian nature have an instinctive dislike to the idea of printing money – even though all evidence of the past five years is that increasing the monetary base has not caused any significant inflation. Perhaps it’s related to the idea ‘we don’t deserve to create money from nothing, but we do deserve a recession.’