Definition: The fiscal stance of a government refers to how its level of spending and taxation impact on aggregate demand and economic growth. Higher taxes and a budget surplus is seen as fiscal consolidation or deflationary stance. A budget deficit has an expansionary impact.

A fiscal stance can be expansionary, neutral or deflationary.

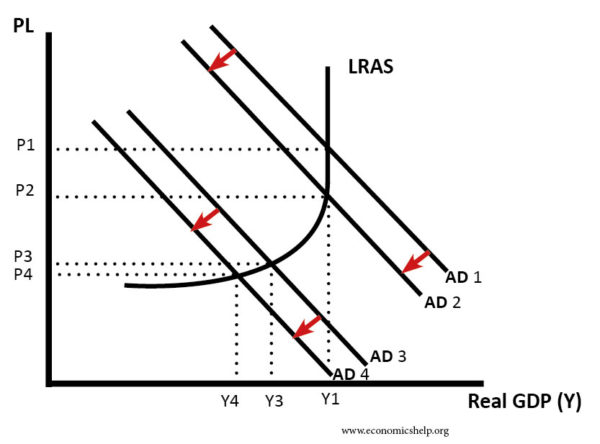

- Expansionary stance: If the government has higher government spending than tax revenues, we say the fiscal stance is ‘expansionary’ as this tends to increase aggregate demand. For example, if the government cut income tax, households will increase spending.

- Deflationary stance or ‘Fiscal consolidation’. If government spending is less than taxation revenue, then the fiscal stance is deflationary. The government is reducing domestic demand by increasing tax (reducing consumer spending) and/or cutting government spending.

Example of US fiscal stance

The federal surplus or deficit reflects government spending – government tax revenue.

From 2007-2009, the US saw a rise in government spending and fall in tax revenue. Part of this was due to recession (automatic stabilisers), but partly it was due to discretionary fiscal stimulus. During this period, the government were pursuing a looser or expansionary fiscal policy – such as tax cuts and higher spending..

After 2010, the government pursued a tighter fiscal policy, with a rise in government tax compared to government spending leading to a marked reduction in the budget deficit.

How to measure fiscal stance?

The actual Deficit/surplus. A simple measure is to consider the actual budget position. A deficit implies spending greater than tax (expansionary). A surplus implies tax greater than spending (deflationary). However, whilst this can be used as a starting point more detail may be needed.

Cyclically adjusted deficit. During a recession, tax revenues fall and spending on unemployment benefits rise (known as automatic stabilisers). Taking out this cyclical component leaves what the government is actually doing in terms of discretionary fiscal policy. For example, at the start of the Great Depression, the UK government increased taxes and cut spending (deflationary fiscal policy). Government borrowing still rose because of the recession. But, the fiscal stance was deflationary.

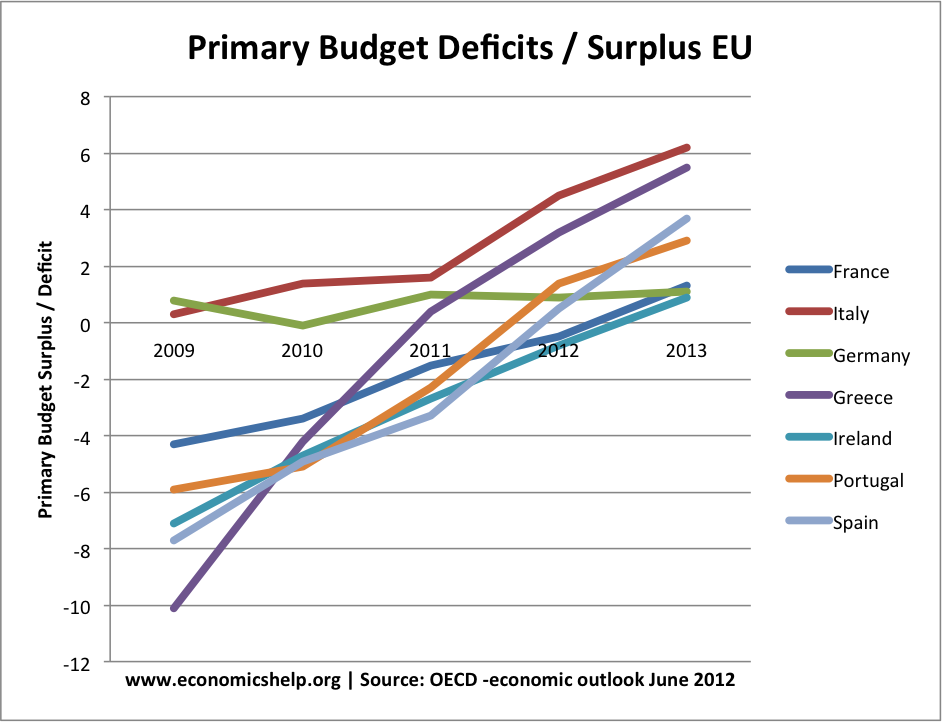

Primary budget deficit. The primary budget deficit ignores interest payments on previous debt. If a government has a primary surplus, then this may be deflationary. For example, in the aftermath of the Greek crisis 2012-14, the EU stated Greece needed to pursue a primary budget surplus. The actual budget deficit was still high because of the substantial interest repayments but to achieve even this primary budget surplus required harsh spending cuts.

Primary Budget Deficits in the EU

Domestic fiscal balance. This looks at domestic government spending and tax revenues. This may be relevant for countries who earn substantial tax revenue on exports – Tax revenue from exports will not affect domestic demand.

The operational balance. During high inflation, governments need to offer high-interest payments to compensate bond owners for the decline in the real value of bonds (and fall in the real value of debt). The high-interest payments increase government spending and the actual deficit – however, this cost is offset by the decline in the real value of debt due to inflation. Therefore, the interest cost due to inflation can be discarded in determining long-term debt burden. This was an issue in the 1970s

Other factors that determine the fiscal stance

It depends on how the deficit is financed. If the deficit is financed by the government selling bonds to the private sector then selling bonds may lead to a fall in private sector investment. In other words, government borrowing crowds out private sector investment. Therefore, there will be limited impact on domestic demand.

If the deficit is financed by the Central Bank printing money and purchasing bonds from the government, then this new money in the economy will have a more expansionary effect (and may cause inflation.

What fiscal stance should a government take?

The classic Keynesian view is that in a recession – with low demand, high unemployment and high private sector saving, the government should pursue fiscal expansion – run a budget deficit to provide demand stimulus.

The need for expansionary fiscal policy is greater if the economy is in a liquidity trap (low inflation, low interest rates and low growth) because with interest rates close to zero, monetary policy is limited in boosting demand.

In a period of high inflation and high borrowing, the government should shift its fiscal stance to reduce government spending and turn the deficit into surplus.

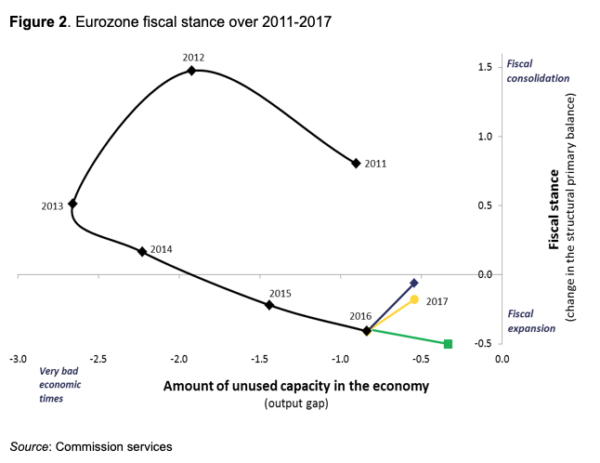

EU Fiscal stance 2011-18

Source: Voxeu.org – why the EU needs a positive fiscal stance.

Source: Voxeu.org – why the EU needs a positive fiscal stance.

Many economists criticise the EU’s fiscal consolidation in 2012 and 2013 during a period of large output gap.

Related