Readers Question I would like to know the full explanation of Expansionary Discretionary fiscal policy and its effects on the economy.

Fiscal Policy is changing the governments budget to influence aggregate demand. i.e. changing taxes and spending.

Discretionary fiscal policy means the government make changes to tax rates and or levels of government spending. For example, cutting VAT in 2009 to provide boost to spending.

Expansionary fiscal policy is cutting taxes and/or increasing government spending. Lower taxes (e.g. lower VAT in the case of the UK) increases disposable income and in theory, should encourage people to spend.

Discretionary fiscal policy are different to automatic fiscal stabilisers. Automatic stabilisers occur where in a recession a government automatically spends more because there are more claiming unemployment benefits. However, the government may feel these automatic stabilisers are insufficient and so they decide to increase public work spending schemes too.

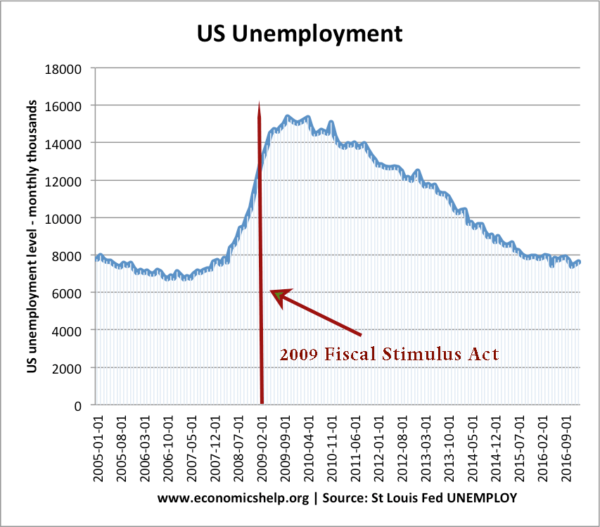

Discretionary fiscal policy in the US

In the US case, the loosening of fiscal policy did play a role in reducing the rate of unemployment from 2009 onwards.

After fiscal stimulus act of 2009, unemployment started to fall. This was partly due to fiscal expansion, but also the natural economic cycle.

In theory, expansionary fiscal policy should increase AD and economic growth. But, in practice, this can take a long time to affect the economy. It will also lead to higher borrowing.

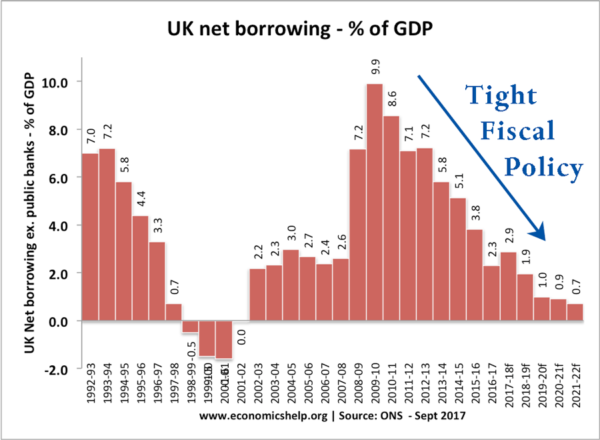

Impact of tight fiscal policy in UK

The UK had a similar experience, in 2008/09, the economy went into recession, and this led to an expansionary fiscal policy in 2009 – which helped the economic recovery.

However, after 2010 election, the government pursued tight fiscal policy trying to reduce the budget deficit. This led to a double-dip recession.

Related concepts

Automatic fiscal stabilisers – in a boom, tax receipts automatically rise, spending on benefits automatically falls – this helps to limit the rate of economic growth. In a recession, tax receipts fall, but spending on benefits rises – causing a rise in government borrowing and helping to provide some stimulus to the economy.

More on fiscal policy