The nominal value is the actual value stated on note, coin or government bond.

- Nominal value can also be referred to as the face value.

- Nominal values imply there has been no correction for the effect of inflation or market prices.

Nominal value vs market value

A government sells bonds with a nominal value of say $100. At the end of the period, the government will pay back the bondholder this nominal value. However, in the meantime, the bond can be traded on the bond market. The market value can differ significantly to the original nominal value. For example, if the initial interest rate is 2%, but then market interest rates rise, the bond at 2% will be less attractive, the market value will fall below the nominal value.

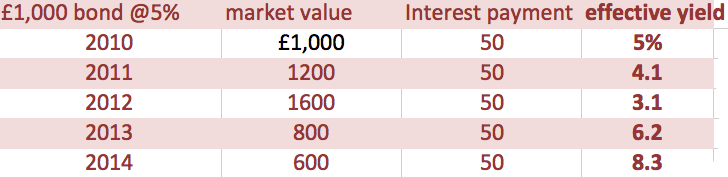

The nominal value of the bond is always £1,000. But, the market value can change.

Nominal house prices

![]()

Between 1987 and 2007, nominal house prices rose from £40,000 to £180,000 = 350%

However, adjusted for inflation, real house prices rose from £95,00 to £180,000 = 100% (approx)

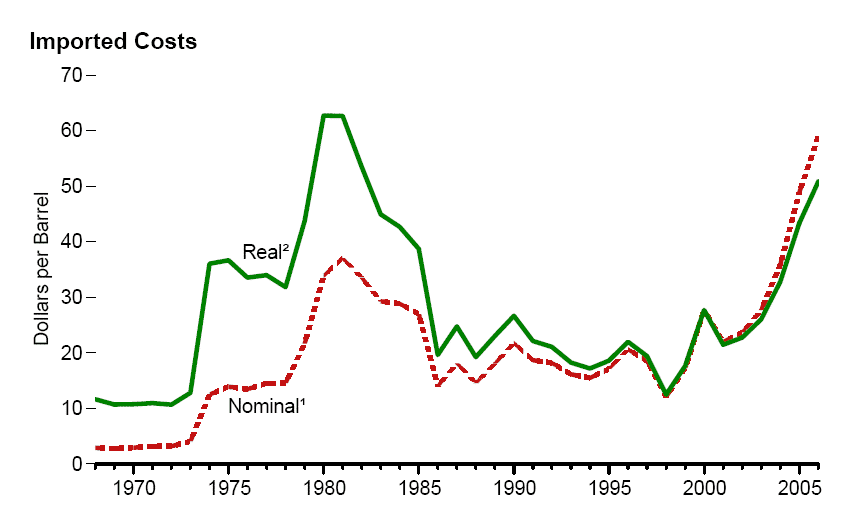

Nominal and real oil prices

Nominal value and interest payments

If you buy a bond with a market value of £600, interest payments will be determined not by market value, but by nominal value and nominal interest rates.

Related

- Nominal statistics – explaining the difference between nominal and real values.

- Nominal GDP and the effects of inflation