Q. Evaluate the economic case for and against the UK government further increasing the tax on tobacco in order to reduce smoking.

Increasing tax will lead to a fall in demand, although this may only be a small effect because demand is price inelastic. People are addicted and there are no close substitutes.

Cigarettes are a demerit good, therefore, consumers may underestimate the costs of smoking – e.g. they ignore the damage to their own health; this is a reason to try and stop people smoking.

Also, smoking has many negative externalities (passive smoking, the cost to the NHS is estimated to be £1.5 billion) therefore, the social cost is greater than the private cost; if the social cost is greater than the present price, social efficiency can be increased by making smokers pay the true social cost.

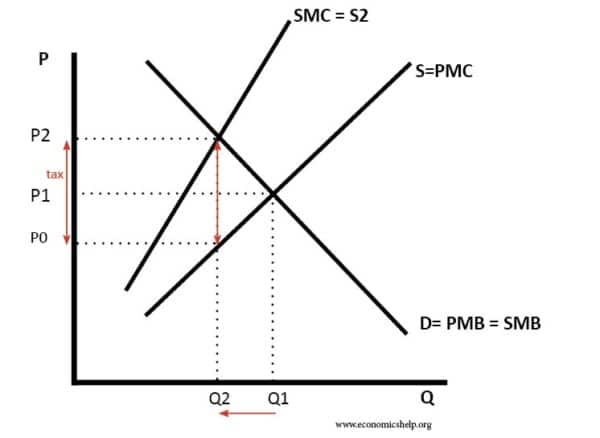

Diagram showing the effect of Tax on Cigarettes

A tax shifts the supply curve to the left causing a fall in demand this is more socially efficient because at Q2, SMC=SMB.

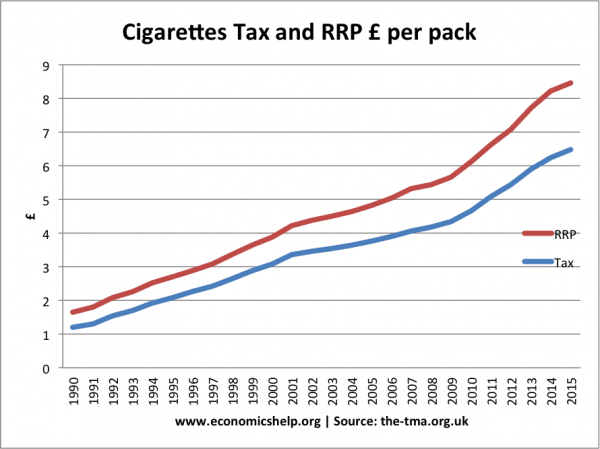

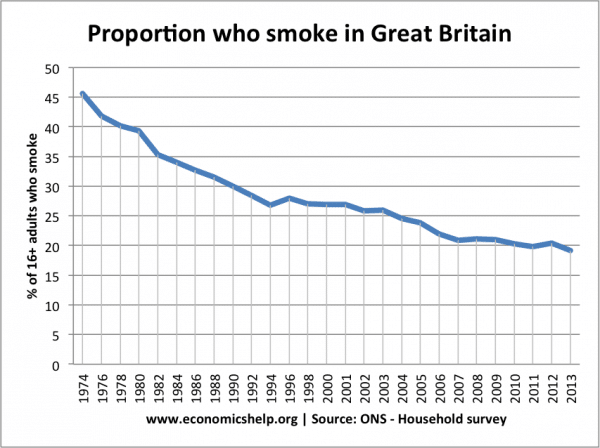

Evidence suggests a higher tax on tobacco have played a role in reducing demand.

Showing rise in tax rates on cigarettes.

Fall in the proportion of people who smoke in Great Britain.

Another advantage of increasing tax on cigarettes is that it will lead to increased tax revenue. This will enable the government to spend money on health care or on campaigns to encourage people to stop smoking. Alternatively, they could lead to lower tax rates, e.g. VAT.

Arguments against increasing tax on cigarettes

- Smokers already pay a lot of tax £7 billion. Also, they do not cost the government much because they die early and save pension and health care spending

- Demand is very inelastic and therefore increasing price will only cause a small fall in demand

- Higher taxes will increase inequality because the poor will pay a higher % of tax than the rich who are more likely to have given up (However the government can use other taxes to reduce inequality if it is concerned about this)

- Higher taxes will encourage people to smuggle illegal cigarettes and avoid paying the tax.

You could argue that smokers already pay the social cost of smoking given the high level of current tax. Therefore the best argument for increasing taxes is the normative judgement that smoking is bad for people and the government should intervene to reduce demand.

Related