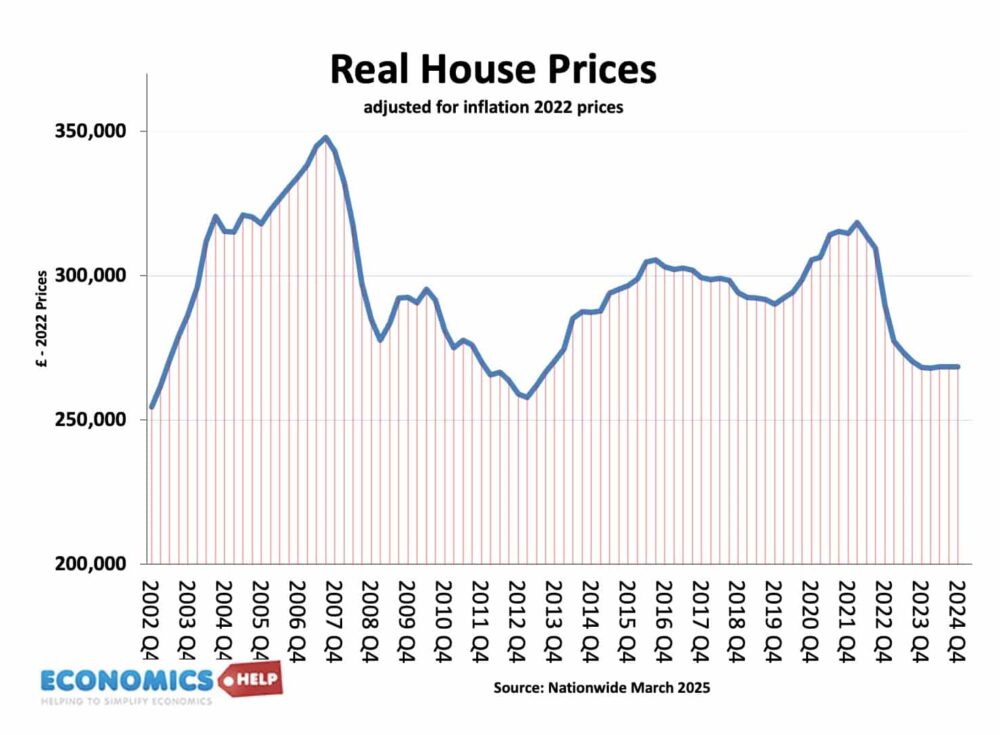

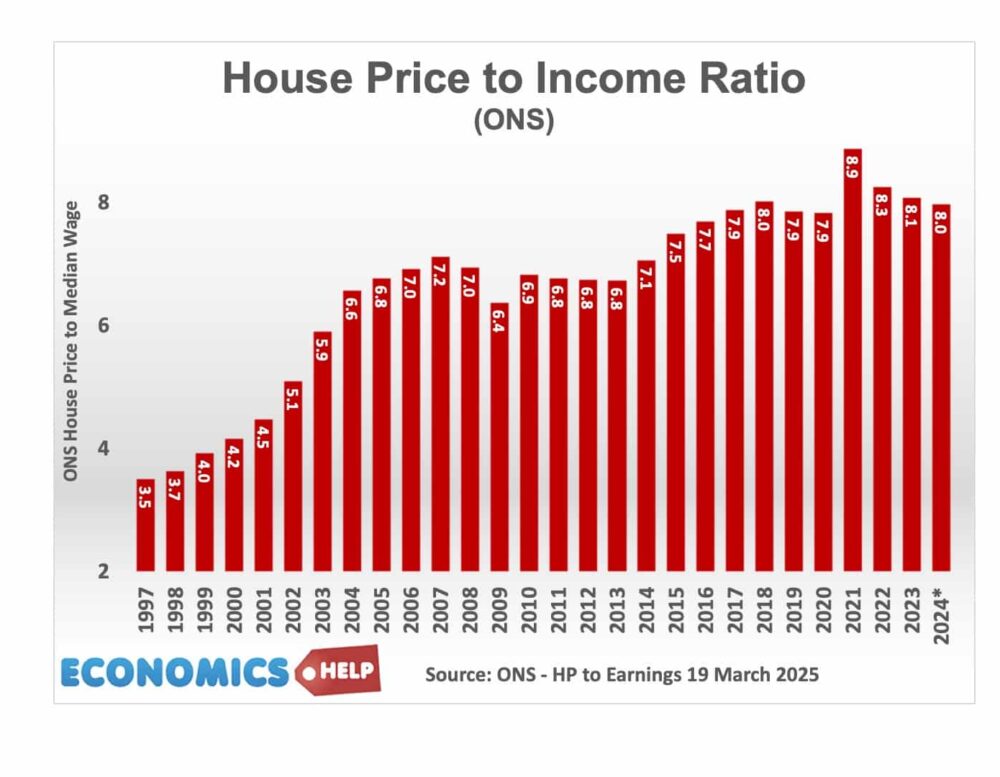

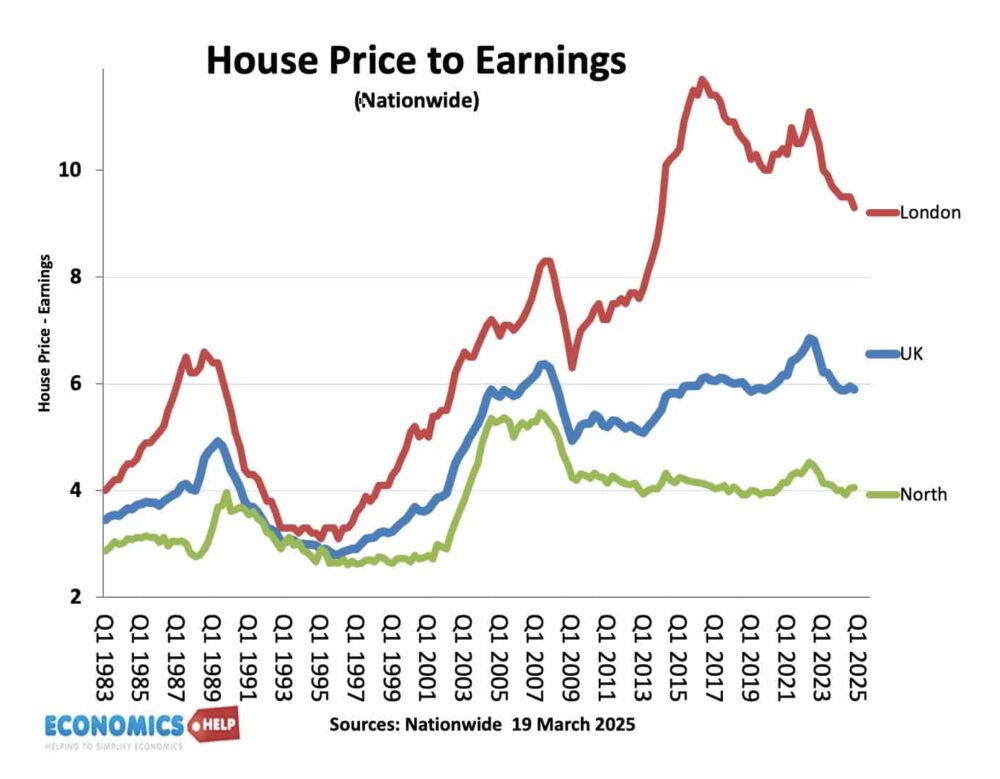

Here is a graph that often surprises me. If we adjust UK house prices for inflation, they are the same level as 2003. In other words, if you bought a house in 2003, ignore the effects of inflation, then the average house hasn’t increased in value at all. In fact, house prices are 15% lower than the start of 2022 and 23% lower than the 2007 peak. Why does this surprise us? Well it doesn’t feel like house prices have fallen and become cheaper. And compared to income, house prices, are in fact very expensive. Despite some modest declines since 2022, the ratio of house price to incomes is close to record levels. Yet, according to Zoopla research, UK house prices are now only overvalued by 8%.

Despite a gloomy economic outlook, there are signs that the UK housing market is picking up – with strong growth in demand, and greater supply of houses coming onto the market. According to the Land registry data, house prices in the UK rose around 4.6% last year and this is supported by mortgage approvals have returned to their long-term average. Part of the recent activity is people trying to avoid stamp duty hike, but looking away from current situation – is there hope for UK house prices to become more affordable in the coming years, or with interest rates set to fall, could we see yet another boom in prices like the late 1990s or early 2020s?

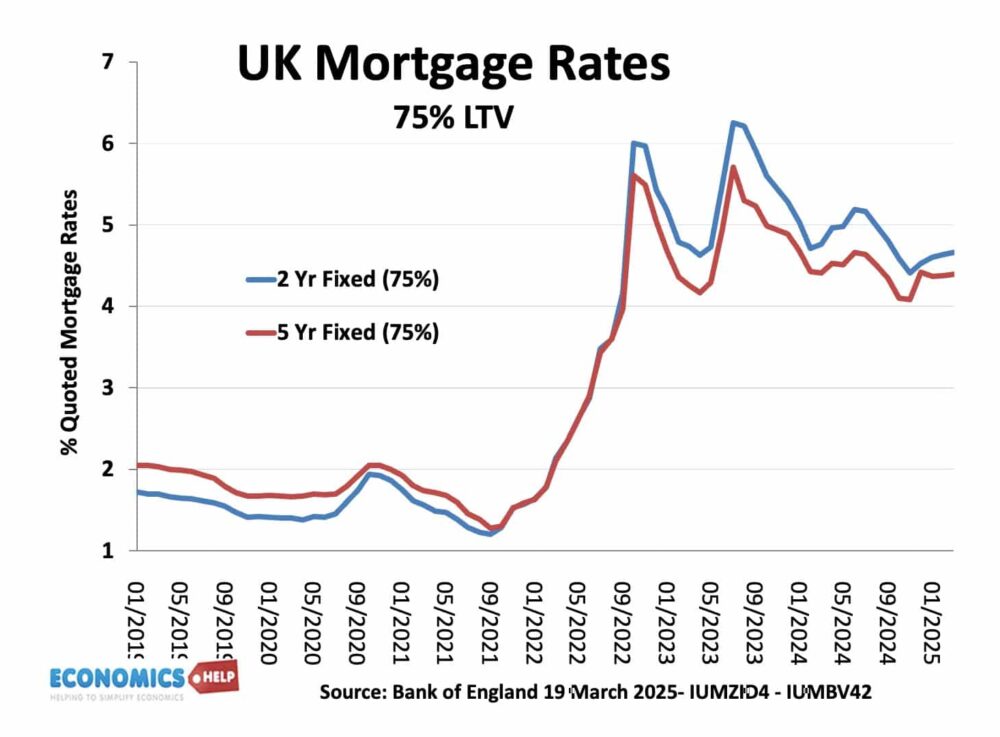

There are three reasons to worry about another period of house price rising rapidly. Firstly, interest rates are set to be cut this year. At the start of the year, the consensus was for interest rates to fall to 3.5%. By 2026, Goldman Sachs predicts it could be as low as 3.25%. This may not sound a lot, but a 1% reduction will considerably reduce the cost of mortgage payment and extend the range of people able to buy. Already mortgage rates have been coming down, a further cut of 1% would see the average mortgage payment fall £150 a month. What about the fact that inflation is proving a bit more sticky and is still above the target, doesn’t this mean the Bank will keep interest rates high? It is possible, interest rate forecasts are a little higher than last October. But a few things. Firstly, UK interest rates are really quite high compared to other countries. The US is very likely to cut interest rates as the economy slows, and this will make it easier for the UK to cut. Also, the Bank won’t just look at inflation. The UK economy is barely growing, and onthe metric of GDP, there is a strong case for rate cuts, even if core inflation is still a headache.

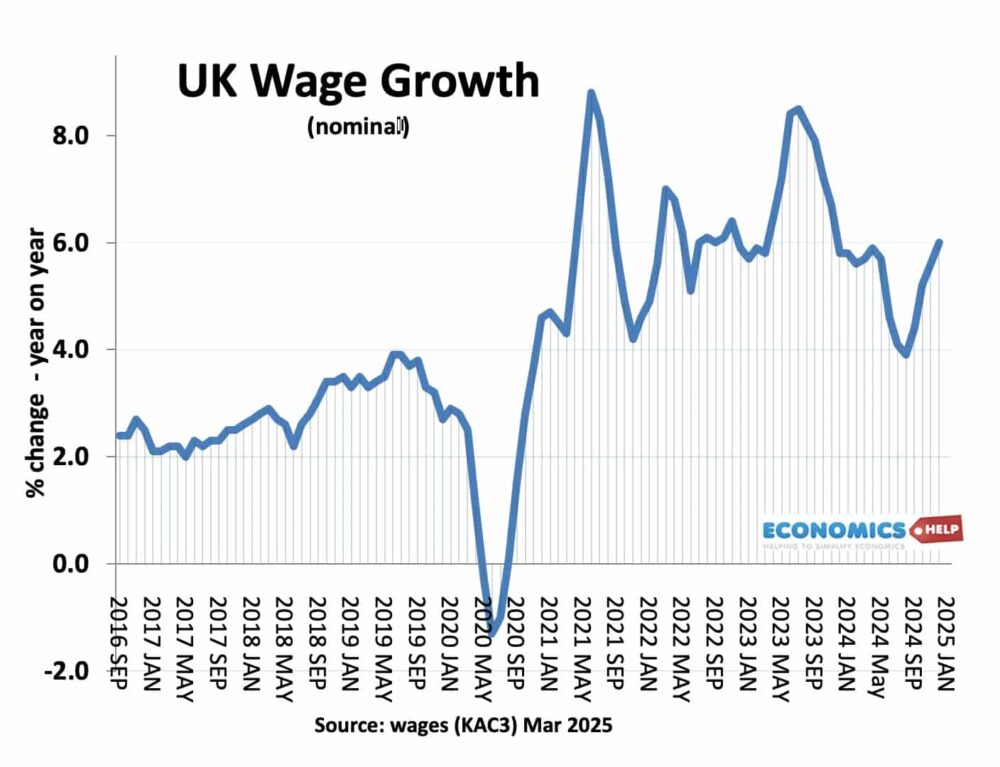

Despite a stagnant economy and GDP per capita still being lower than 2019, another stat that may be a little surprising is that nominal wage growth was running at 6% by the end of 2024. Even adjusted for inflation, that is a 3% rise in real incomes. Now, this rate of growth is likely to moderate in the coming year, but there is an element of wages catching up with the 2022 inflation. Wages are important because income is the largest factor in determining house prices. Continued wage growth will increase the buying power of first-time buyers, creating more demand. The big question is with a weak economy, how long this wage growth will last.

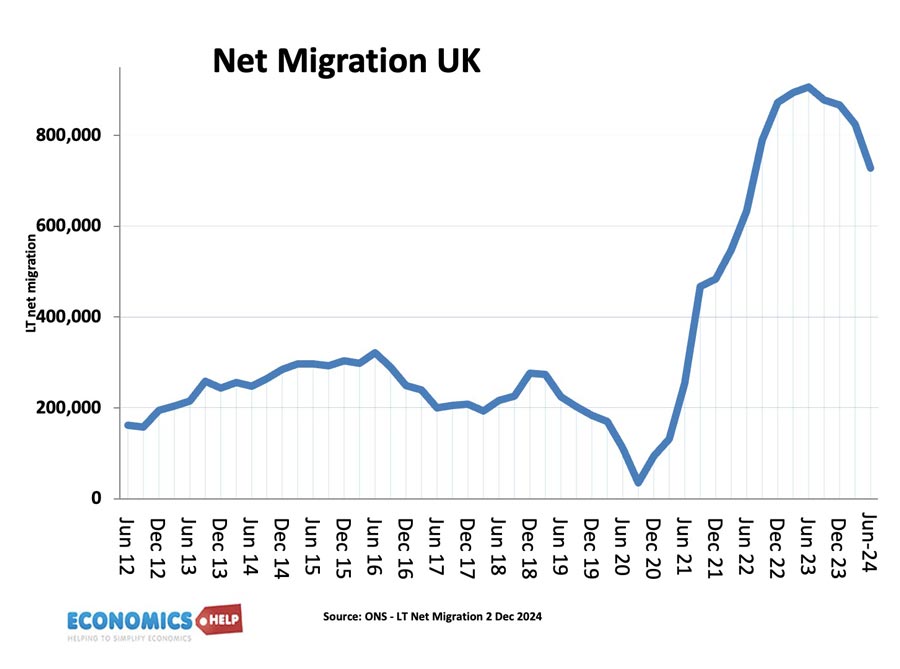

Population

In the long-term, another factor that will cause upward pressure on the housing market is the continued growth in the population and the number of households. The number of households would be even higher if it wasn’t for many households being suppressed by high housing costs. High levels of net migration may be set to fall compared to the recent boom, but it will still be a net upward pressure on housing demand. Most newly arrived migrants don’t buy, but end up in the private rented sectors. But, that is another factor affecting house prices. Rents in Great Britain have been rising faster than inflation in recent years, meaning many are facing very high housing costs. Despite high house prices, the cost of renting creates a very strong incentive to try and buy if it all possible. Zoopla report more renters are looking to buy compared to last year

One reason for the growth in house price to income ratios in recent years is that it is not just income being used to buy housing, it is also wealth. In particular,r help from parents and inheritances are a key factor in inflating house prices. In 2023, 47% of house purchases had some help from family members £8.1 billion of additional spending power. But, as the baby boomer generation ages, this great wealth transfer will only continue to increase in the coming years. This flow of wealth will rise to £150 billion a year by 2035 and of course a lot of this will end up in the housing market. If you’re paying £2,000 a month in rent and you inherit £500,000 – what would you do? I know what I would do – buy a house.

Housing Market still in a tight spot

That is the bullish case for the housing market. At the very least, you can a expect rise in nominal house prices. But, before we get carried away with the idea of a big rise in prices, it is worth bearing in mind, this is definitely not the mid 1990s. Firstly, affordability is stretched; this is the ratio of mortgage payments as a share of income. Nationwide data is not perfect, but it gives a rough guide. It’s not as bad as those pre-crash peaks in 1989 and 2007, but it is still elevated compared to the periods of booming house prices. Lower interest rates will bring it down a little further. But, despite relatively low rates, house prices are just expensive. According to ONS data 8 times income.

So even with combined mortages, many couples struggle to buy. Don’t forget that potential buyers are facing many more constraints than in previous boom periods. The mortgage market is more regulated. In particular, mortgage stress tests are more stringent than 1990s and 2000s. This means you have to prove you can afford to pay even if interest rates jump. The benefit of this is that when rates increased in 2022, arrears remained relatively low, the downside is that many can’t get a mortgage, even if they would prefer to be paying a mortgage than renting. Secondly, there has been the removal of help to buy, which did much to support new mortgages in the 2010s, between 2013 and 2018, 38% of all new build properties were supported with help to buy and encouraged an estimated 14% increase in new build housing.

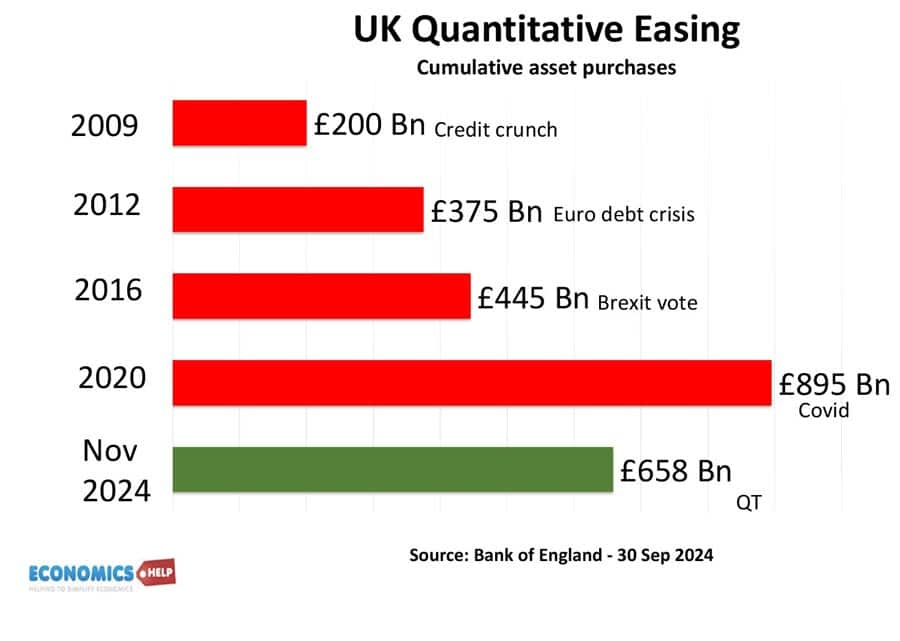

Another thing that supported house price growth in the 2010s was quantitative easing. The Bank of England’s policy to create money and buy bonds saw more liquidity in the banking sector, and this was a factor in pushing up asset prices. The Bank’s own analysis suggested there was a moderate effect on pushing up house prices. But, QE is now being reversed, already, the bank have sold £300bn of bonds and plan to do more in the coming 12 months. If QE inflated house prices, reversing QE will have in theory, have some negative effect on house prices.

Home Building

What about plans to build 1.5 million homes in the next parliament? Will this boom in house building finally deflate prices? Well, don’t hold your breath. Firstly, it will prove very unlikely the government will be able to meet its target of 370,000 homes a year. The housing market is currently nowhere near that level. Aside from shortage of workers, the biggest problem is that UK builders are sceptical there will be sufficient demand to buy that level of homes at current prices. Neil Hudson of BuiltPlace estimates a shortfall of £55bn. The total value of 370,000 homes a year on current prices would be £130bn, but the current market is only around £75bn. Help to buy at its peak offered £19bn a year, but that is no longer around. In other words, builders will not build expensive houses only to have to then discount them in order to sell. At this point, we might ask, why not just build more affordable homes? But, affordable homes are less profitable and only make builders less willing to build. Government provision of social homes is a nice idea, but not practical on a large scale given the woeful state of public finances. Another issue is why not build high-density flats and apartments, but interestingly, demand for flats continues to fall behind houses. In fact the gap between house prices and flat prices has reached a record level.

Certainly, if we look at house prices, apart from short periods, it seems to be a one way bet. Prices go up. Nominal prices at least will continue to rise. Savills, one of the few to make five year forecasts, predict house prices will rise 23.4% by 2029, but the highest price rises will occur in cheaper areas on the north and Scotland. London will see the lowest increases. Hamptons/ONS predict slower house price growth 12% by 2027. But, the days of getting rich by buy to let, is over.

Sources:

https://hoa.org.uk/advice/guides-for-homeowners/for-owners/mortgage-rate-forecast/

https://www.nao.org.uk/wp-content/uploads/2019/06/Help-to-Buy-Equity-Loan-scheme-progress-review.pdf

https://landregistry.data.gov.uk/app/ukhpi/

https://committees.parliament.uk/work/3987/help-to-buy-equity-loan-scheme-progress-review-inquiry/