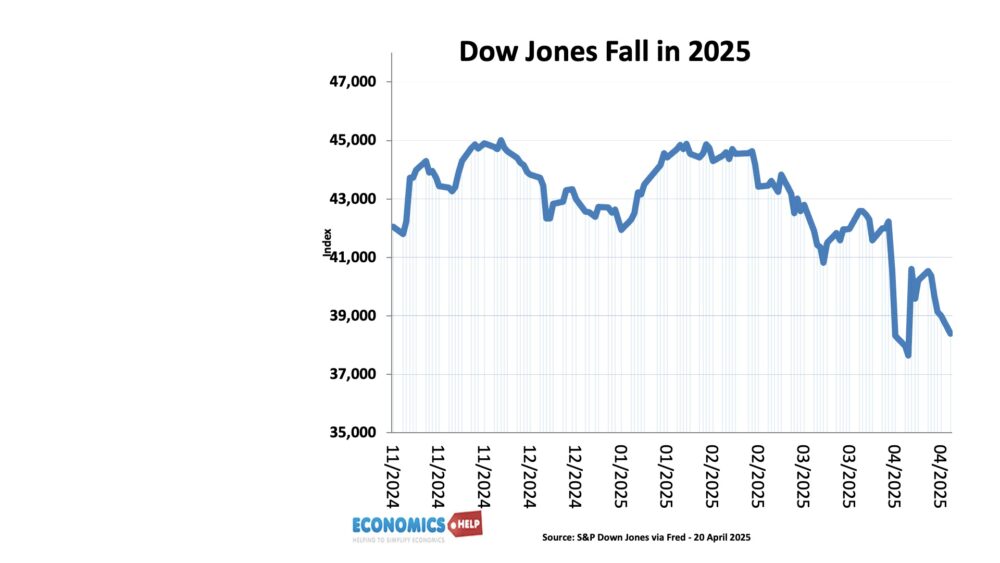

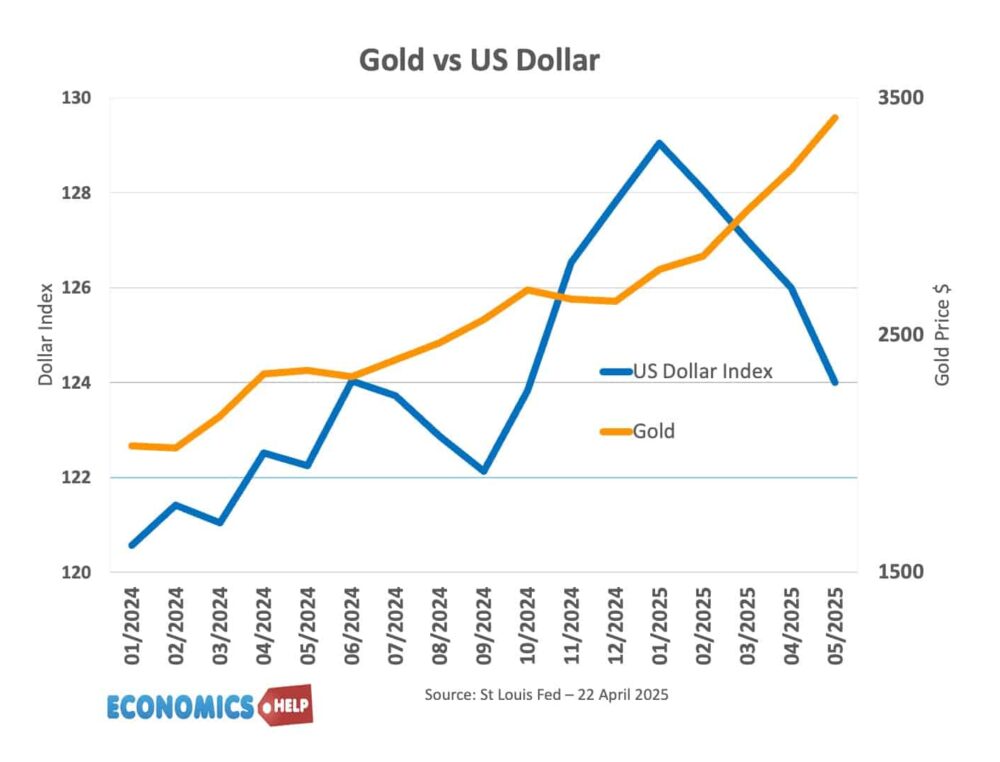

Since the start of the year, the Dow Jones has fallen 10%, but this is more than a stock market correction. Bond yields are rising, the dollar is falling and price of gold is soaring.

It is an unusual combination to have falling stocks and rising long-term bond yields, markets are asking themselves whether the era of US exceptionalism is over. And whilst the dollar dives, gold is one of main beneficiaries, reflecting the new era of instability.

At the start of the year, I made a video about a potential stock market crash, noting in particular they were overvalued, near record price to earnings levels and with tariffs on the way, a stock market fall looked likely. Since then US tariffs have exceed market expectations and there is still an a fear that markets are failing to price in the record levels of uncertainty and disruption to international trade from the new trade wars.

Past Crashes

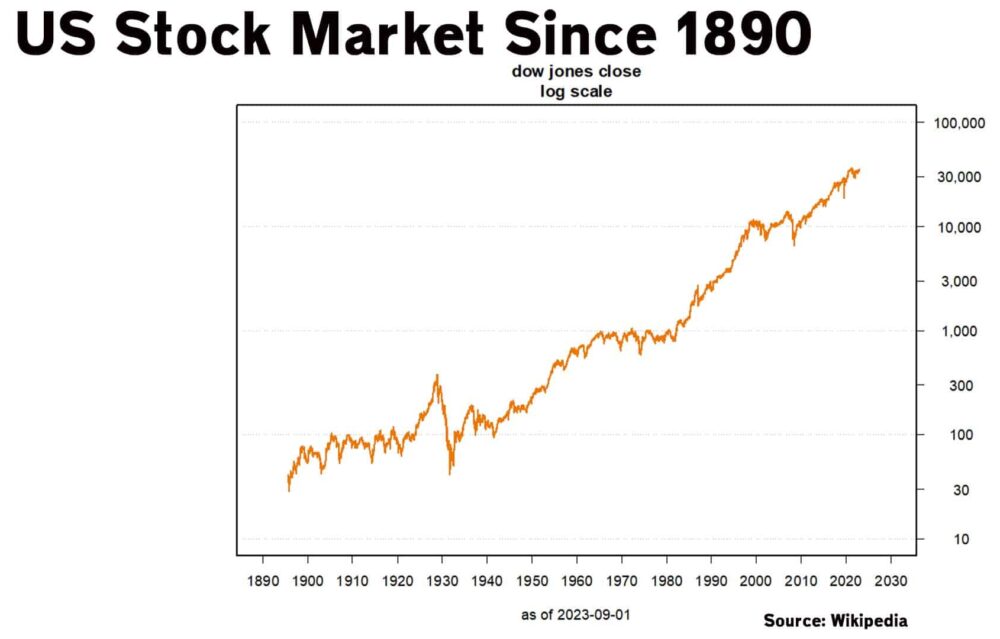

If we look at past stock market crashes, it is usually some major external shock which is the trigger for a major correction. Historically, these major stock market falls have averaged a decline of around 30%. Despite a pause in some tariffs announced on 9 April, even higher tariffs on China mean that the US still faces the highest average tariff level since the 1930s Great Depression. Already, trade with China is beginning to plummet with trade down. The US imports $500bn of goods from China, meaning that with tariffs jumping from 10% to 145%, there is going to be a major increase in price for consumers. (Since starting to write this article, this tariff rate looks to be cut to just 50%!) Over time, demand may shift away from China, but the era of super-cheap Chinese imports are over, and household disposable income will be affected. Also Tariffs are not one-way, although the US runs a trade deficit with China – $150bn of exports to China will now be hit by China’s very high retaliatory tariffs. US firms in China are also feeling the heat from China’s new restrictions on US companies. China is a key market for Tesla, receiving 37% of Tesla exports. No wonder Tesla stock has fallen in past year.

Inflation Expectations Rise

Worryingly, consumer expectations for inflation are starting to jump to the highest level since the Covid inflation shock. Similarly consumer sentiment has fallen to the lowest level for many years. Although the US economy has grown strongly in recent years, there were some warning signs even at the end of last year that under the surface things were rough, especially for median workers. Mortgage delinquency has been rising with long-term mortgage rates elevated. Credit card defaults have also increased. And these trends are before the additional impact of tariffs. The non-partisan tax foundation suggest the current tariffs will reduce average tax income of households by 1.2% or $1,243. Torsten Slok of Apollo Asset Management argues there is now a 90% chance of a recession, which would have a big impact on the prospects for stock market. The US stock market’s past stellar value was largely based on the assumption of US exceptionalism, the fact that US productivity, profit and growth was much better than Europe and Asia. A US recession is still not priced in to US stocks. Although the price to earnings ratio has fallen since the start of the year, it is still relatively high by historical trends and international comparisons.

Drop in Tourism

In addition to tariffs, Goldman Sachs believe the new approach to US border enforcement has led to a drop in tourism, with visitor numbers reduced compared to last year, this could lead to $90bn of less spending in the US economy. A bigger factor for the stock market is the rise in uncertainty. The uncertainty index has risen to the highest level since Covid. This is a reflection of not just high tariffs but uncertainty at which tariffs will increase. This uncertainty is a major factor in encouraging investors to seek a safe haven in gold. It has also caused European markets to do relatively better this year. But, the European economy and Germany in particular is still weak, and outside the US that is a broader concern that a trade war will slow down the global economy with growth forecasts downgraded. Although China recently posted impressive growth figures, the trade war will severely affect their economy which is heavily reliant on exports. In recent years, the global economy has relied to some extent on US demand and Chinese exports. This is why a US – China trade war will be a big shock to the global economy.

Is this end of Stock Market Falls?

That is the bear case for a further fall in share prices, but it is easy to get carried away with pessimistic scenarios. There are a few factors to bear in mind. Firstly, whilst consumer expectations of inflation rise, oil prices have fallen quite dramatically. This is an important counter-balance to the inflationary impact of tariffs. Lower oil prices will help reduce inflationary pressure. However, it is worth pointing out with oil prices at $63. It effectively means zero profits for US shale producers who have a production cost of around $60-$65. There is risk lower oil prices could lead to a big fall in oil profits.

Secondly, whilst Smoot Smoot-Hawley Tariffs did exacerbate the great depression, it would be a mistake to say we will see a rerun of the great depression. The 1930s, saw a massive contraction in the money supply and bank failures. There is, in theory at least, much greater knowledge about monetary policy. If the economy slows down as is likely we are probably going to see cuts in US interest rates to stimulate economic activity. This could boost prospects for economic growth and lower interest rates generally help the stock market. However, any cut in interest rates will lead to further downward pressure on the US dollar. Also, as tariffs push up prices it will be a difficult balancing act for the Treasury with the risk of stagflation a major problem for the economy. President Trumps criticisms of Jerome Powell chair of the Federal Reserve, for not cutting rates quicker have only made markets more nervous. The fear is that rising tariffs and aggressive cuts in rates could see inflation much more of a problem than investors are used to. Asset managers are worried that the US treasury is no longer the safe haven it used to be. This is a big concern for both stocks and bond markets, especially dollar assets.

Recession?

Not everyone is convinced of the inevitability of a US recession. A Reuters poll suggests the probability of recession has risen to 45%. Though it is worth pointing out that these surveys are notoriously unreliable. The recession risk in 2024 was well over 60%, but growth remained strong. Also, in terms of fiscal policy, it is likely that there will be another fiscal boost with an extension of tax cuts leading to more spending power with households, especially high income households. Though these tax cuts do raise another issue. The US budget deficit was 7% last year, very high for a fast growing economy. A slowdown, plus more tax cuts could add another $5.8 tn to deficits in the next decade. Even before 2025, US debt was set to soar, these fiscal cuts could double the pace at which debt to GDP rises. A combination of the falling dollar, rising inflation and a rapid rise in debt, is the kind of combination that could lead to very great financial instability.

Underlying Risk

In the aftermath of liberation day, US bonds wobbled in response, with sharp rise in yields, this was like a sneak preview in the underlying risk that is endemic in financial markets. US bond traders are using highly leveraged strategies to maximise profits. This is all very well when bond markets and stable. But, once you start to see uncertainty and unorthodox policies, the high levels of risk could raise prospect of a new credit crunch. Don’t forget in recent years there’s been a big growth in non-bank operators, new forms of money, lending, and crypto. There has been a surge in risk taking amongst investors, leveraged stocks, meme coins. US savings have been reduced and money put into stocks. It means the US economy is vulnerable to stock market falls

Another way of looking at the stock market is that in past century, stocks have averaged 10% growth a year, even accounting for crashes. So recent falls could just mean there is better value in the stock market when the trade uncertainty dies down. Certainly, YouTubers have probably been predicting stock market crashes every day for the past 20 years. But, this 10% average growth is not set in stone. The Japanese stock market has had pretty much zero growth over the past 30 years. Also, the global economy is slowing down. Western economies are ageing which leads to higher government debt and lower investment. Ironically, the US was once an exception to ageing population because of high levels of migration, and cutting migration may speed up the ageing process in the US.