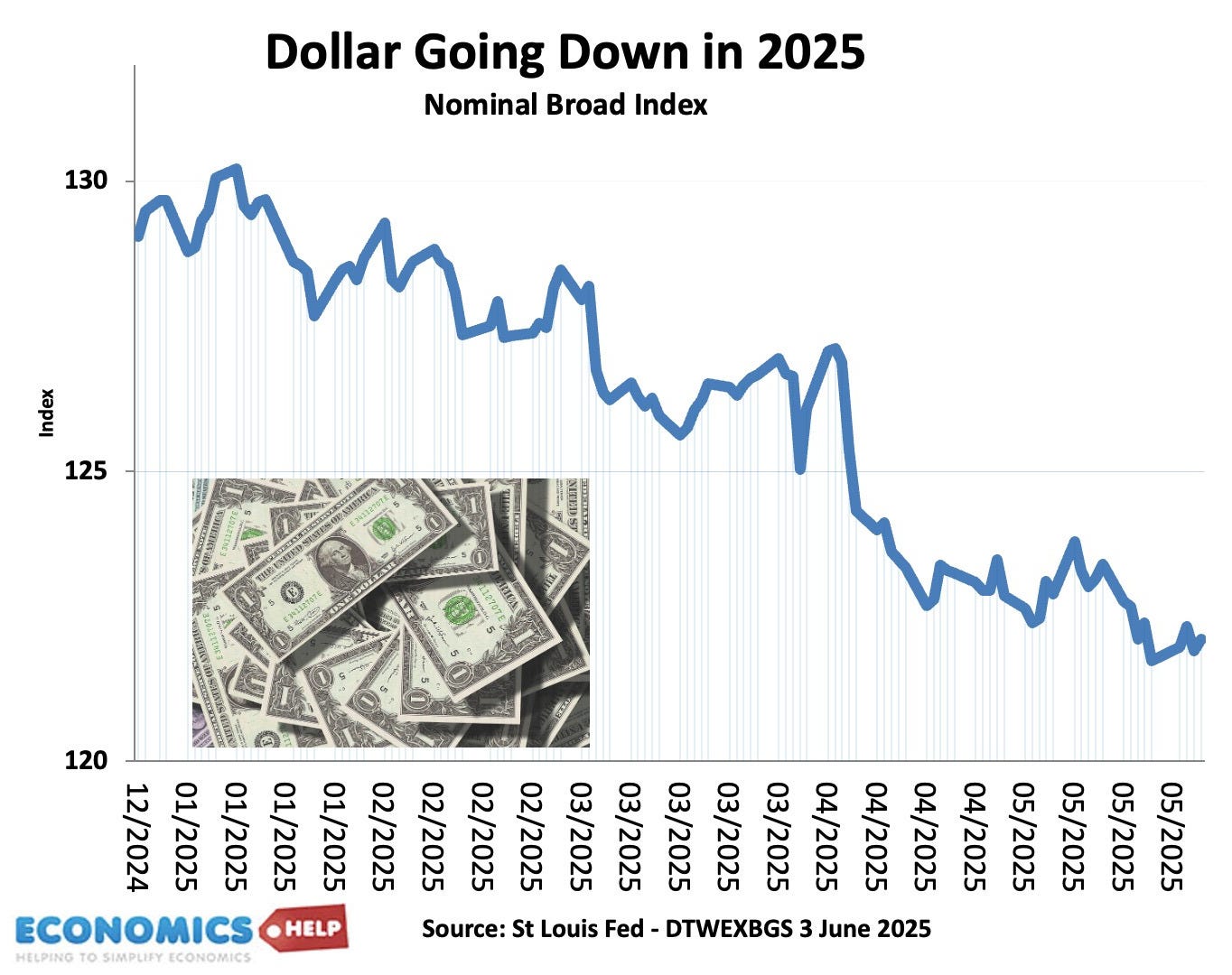

Since the start of the year the dollar has fallen 9%. The global reserve currency is under pressure.

(BTW: real problem in Japan was 30 and 40 year bonds)

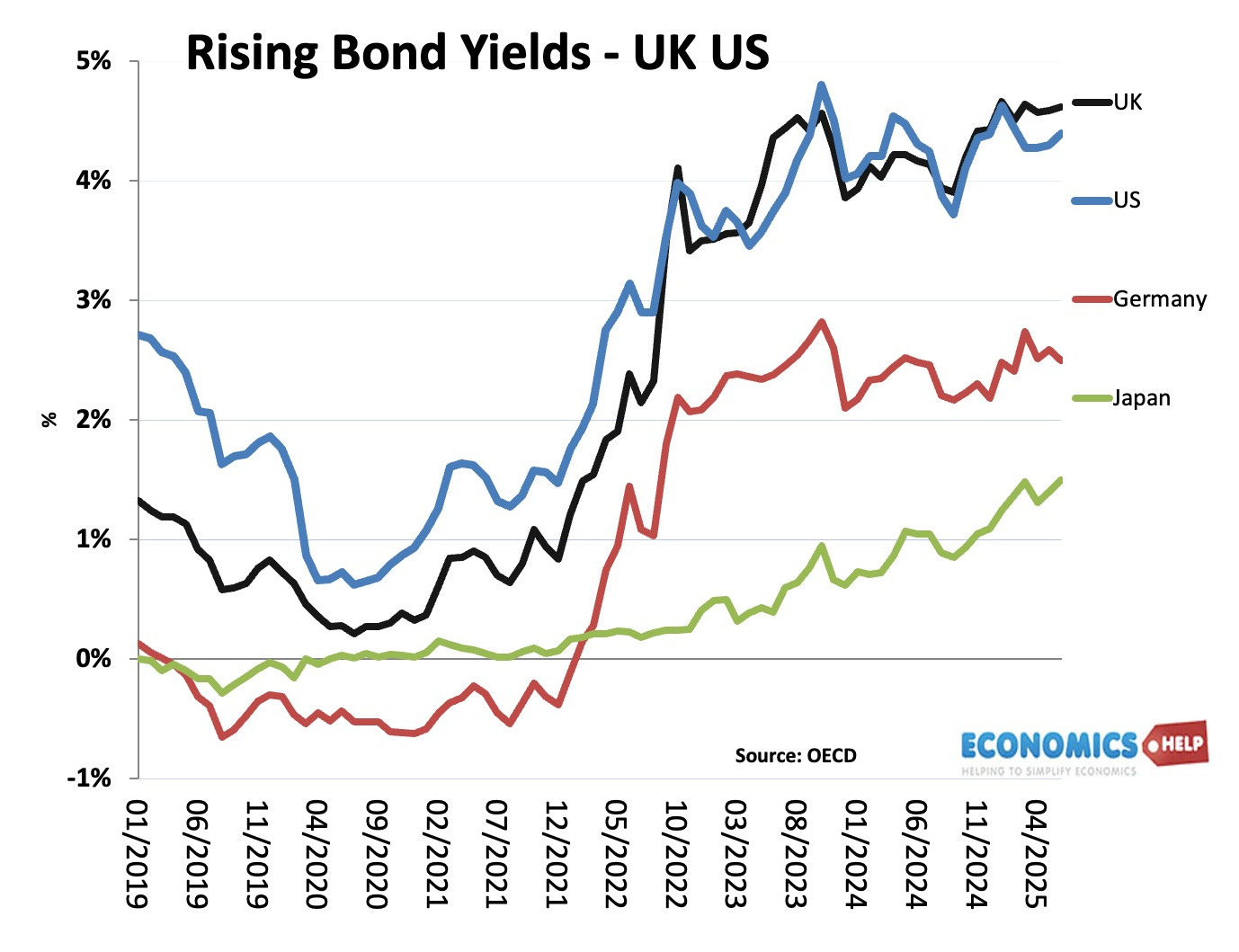

Yet at the same time, bond yields are rising creating a headache for the government and financial system. In Japan, the recent surge in bond yields and fall in bond prices has caused the Bank of Japan to report unrealised losses of 28 trillion yen or about $200bn. A sudden rise in bond yields can cause even bigger problems for highly leveraged banks and hedge funds. The UK pension fund meltdown in September 2022 was a warning of how markets carry more risk than is first visible. In 2008, the financial system collapsed unexpectedly because bad debts had been repacked and hidden from view. No one knew they were there, or perhaps they just didn’t want to look under the mattress. But, after massive government bailouts, new regulations were brought to supposedly prevent this kind of future collapse. But, regulating financial markets is a bit like playing whack-a-mole. You regulate bank lending, so markets shift to new types of non-bank lending, which are less regulated. In 2023, the non-bank lending sector grew to $250 trillion or 50% of the market. Venture capitalists, hedge funds and private credit, companies like Blackrock, Appollo and KKR have taken on the roles of traditional banks. But a recent report by Moody’s suggests this growth of private credit could amplify the next financial crisis because banks are opening themselves to new channels of risk by lending to private credit while shifting assets off the balance sheet. Two lessons of the last financial crisis of 2008 showed that regulators are often fighting the last battle and the banks always get bailed out. Has anything changed?

Biggest Risk

But, what is the biggest risk to the financial system? is it overvalued shares, stagflation, a weakening dollar, rising global debt, or the growth of risky assets? The uncertainty has certainly made gold an attractive investment in the past 12 months do gold investors know something we don’t?

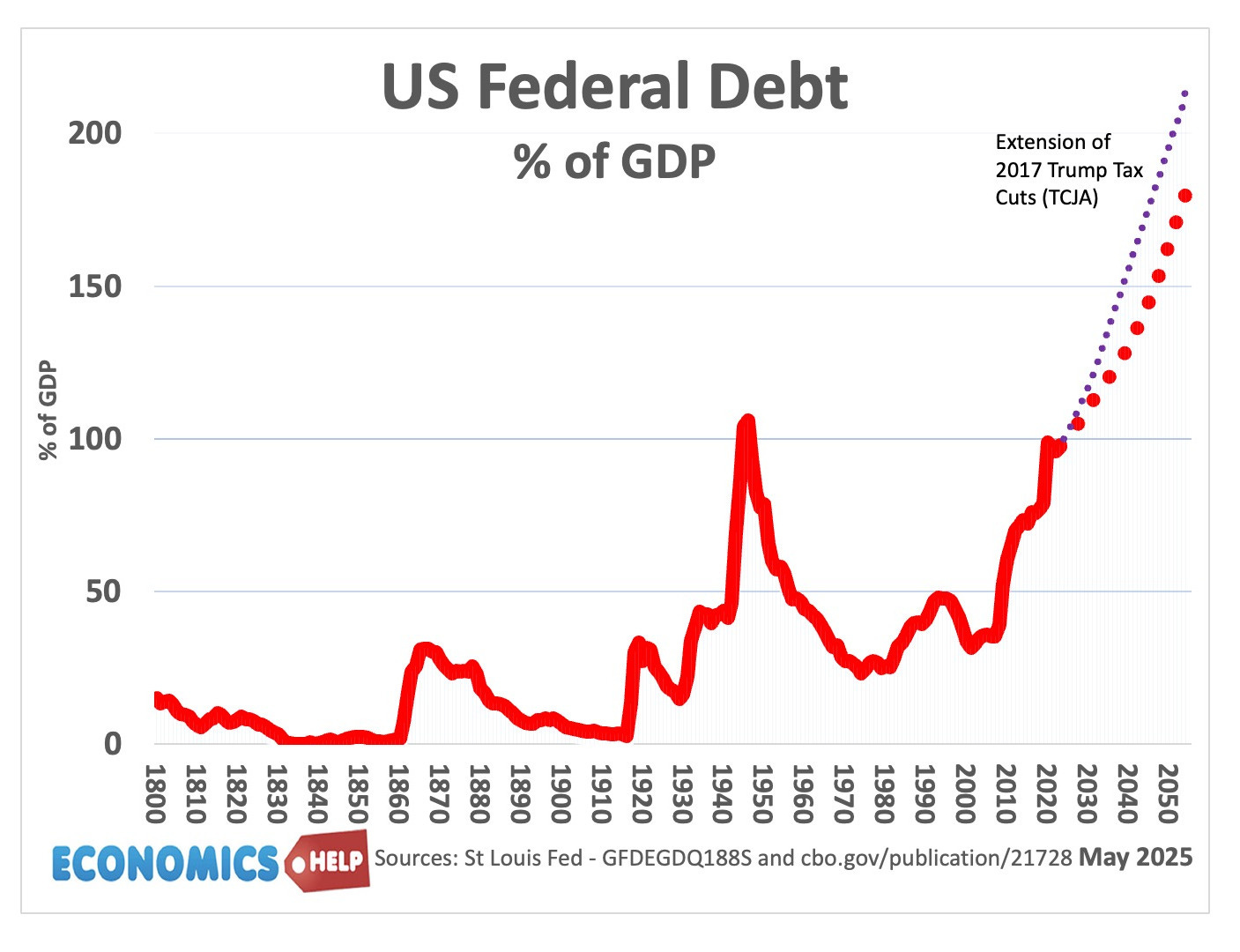

The world’s biggest economy is certainly going through interesting times. For years, the US has seen debt steadily rise, but this hasn’t really mattered, due to huge foreign demand for US bonds, a strong growing economy and the Fed buying bonds. However, the Fed is now offloading these bonds, but it comes at a time when tax cuts will cause the budget deficit will rise to 9% of GDP. It means in 2025 the US will spend an estimated 4.5% of GDP on debt interest payments alone, higher than other countries according to the OECD forecast. But, some black swan event could easily cause this to be higher, and in the past decade unexpected crises have become more common.

Concerns over the budget has led to a rise in demand for credit default swaps which is insurance against US debt default. A further complication is that the tariff turmoil and a sharp drop in confidence has caused US GDP to fall 0.2% in the first quarter, raising the prospect of stagflation – higher prices and lower output. It is easy to dismiss this negative growth as a one-off statistical glitch, but more forward-looking manufacturing surveys signal a third monthly decline in output in a row. The changes in tariff rates have been dizzying and unprecedented, and many firms are struggling to keep up with the changes. Consumers are also unnerved about the prospect of higher prices. Confidence has fallen and expectations of inflation have risen, making it harder for the Fed to cut rates and risk inflation.

Shares overvalued

It is not just tariffs, there are also other warning signs. US shares are the most overvalued in the world, demand for housing is falling as high interest rates make a home unaffordable for most Americans. As well as households there is decline in demand from institutional investors – a reflection perhaps that US house prices are at record valuations and with high interest rates making it less attractive as an investment opportunity.

Across the world, we have seen rising government debt, but this is more acute in the US where tax cuts could cause debt levels to rise to unprecedented levels for the US, it would be higher than civil war or second world war. Combined with higher interest rates this has caused a debt downgrade and convulsions in the bond market. The rise in bond yields to 4% on long-term bonds may not sound that much. But, with US debt interest payments set to rise to 22% of tax revenue, it is a big deal, especially when you factor in growing political uncertainty. Also, for decades, the US has benefited from foreign demand for US bonds. Despite China reducing exposure to treasuries, 30% of US debt is still foreign-owned. But, one of the few tax-raising measures in the recent budget is to tax foreign holders of US bonds. But, this will only make it less attractive. US debt has lost its shine as the gold standard for gold investment. The fall in dollar, erratic trade policy, rising domestic debt and now tax on foreign owners.

ETFs and Leverage

With any financial boom, we tend to see irrational exuberance, overconfidence and a willingness to take on more risk. The 1920s, boom in the stock market was driven by leveraged investment. 100 years later, and we see a new form of leveraged investment with a boom in the popularity of leveraged ETFs. Basically, it gives investors the opportunity to make much bigger gains and much bigger losses by betting on movements in the stock market. By the way, gambling has soared in popularity in the US, but that doesn’t include the unofficial gambling of memecoins and EFTs. We have seen 400 new ETFs launched in the US this year, but regulatory change means there could be a tsunami of ETFs being launched in markets. The number could rise to 7,000. You will be able to get leverage on pretty much everything. You probably know about Klarna a service that enables people to buy now pay later. In 2022, Deliveroo made a deal with Klarna to enable people to buy fast food, and pay later. The ultimate in instant gratification. Last October of last year, Klarna offloaded most of its UK ‘buy now, pay later’ debt to a hedge fund. Junk food, is now the new junk bond. Now junk food debt is not going to cause a financial crash like the mortgage debt of 2008, but, at least with a house, you have collateral; when you’ve eaten a pizza, that’s it. But, it is the addiction to debt which is worrying, especially with interest rates significantly higher than five years ago.

Meme Coins

It’s not just ETFs; there has been an explosion in new types of financial speculation. In 2024, meme coins, a digital currency that has no intrinsic value, surged in value from $20bn to $120 bn. A 500% rise, which is expected to continue. Dogecoin was started as a joke in 2014, but people took the joke seriously. Its value looks like a rollercoaster. The Trump coin was released in January 2025 with a value of $1, it’s value soared to $70 before plummeting. The thing with memecoins is that they have no value are not backed by assets, they can’t be used to buy things in shops and their value depends largely on social media presence. Some will lose money by buying at the wrong time. Now on it’s own, this is not going to cause any kind of crash, but it is indicative of the wild west of Crypto, new forms of investing and the risk of investors over-extending.

In the US, Households owe a record $18.2 trillion in various forms of debt. Many are trying to cut back while leaning on instalment loans for basics. There is a particular rise

In student loans, credit cards and auto loans. Though it is very significant how little delinquencies there are in mortgages, a stark contrast to 2008. Basically, one change from 2008, homeowners are on 30 year mortgages, insulated from interest rate rises.

The thing is with finance, everything is interlinked. A slowdown in the economy will put upward pressure on deficits and loan defaults. Rising debt, rising interest rates and slowing growth is the kind of fundamental change in the economy, which can start lead to debt losses. Like 2008, the financial sector is increasingly interlinked with banks more exposed to private credit and leveraged bonds. This web of linking can throw up unexpected systemic risk.

But, at the same time, there are a few points to bear in mind.

Firstly. Mortgage repossessions are much lower than 2008. The US economy still has some momentum from several years of fairly strong investment and productivity growth.

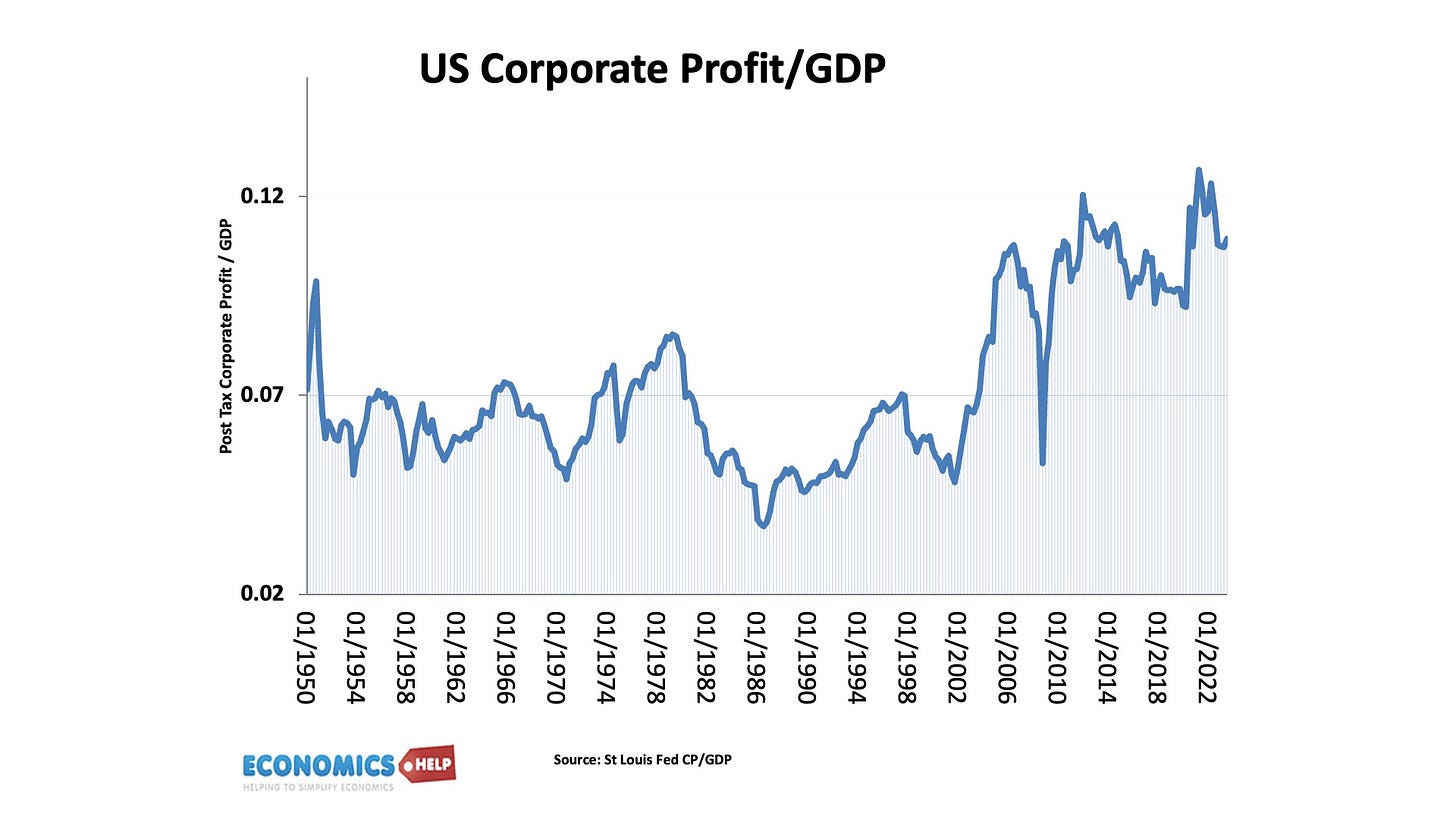

In fact US firms are still highly profitable. Profit margins are well above the long-term average and if profit levels do fall, it could make the highly valued US share prices look vulnerable. Also, in terms of US debt, although there has been a rise in credit default swaps, this reflects concern over breaching the US debt limit, rather than imminent default. The US could easily change its debt trajectory by increasing taxes. Tax rates in the US are really quite low by international standards. However, just because theoretically the US could reduce deficits might not matter, if there isn’t the political consensus to reduce the deficit and or raise the debt ceiling. Finally, although there is fear of inflation returning, a trade war is more likely to cause deflationary pressures and lower growth. I wouldn’t say it is 2008, it is very different, but at the same time there are new sources of risks and problems.

Sources:

- https://edition.cnn.com/2025/06/01/economy/consumer-student-loans-debt-squeeze-dg

- https://www.economist.com/leaders/2025/05/29/american-finance-always-unique-is-now-uniquely-dangerous

- https://www.reuters.com/business/finance/g20-watchdog-urges-governments-address-non-bank-financial-risks-2024-12-18/

- https://mondovisione.com/media-and-resources/news/fsb-reports-strong-growth-in-non-bank-financial-intermediation-in-2023-20241216/

- https://www.economist.com/special-report/2025/05/23/the-latest-investment-fad-is-made-for-gamblers

- https://www.economist.com/special-report/2025/05/23/what-it-means-to-be-illiquid

- https://www.newsweek.com/housing-market-expert-alarming-trend-investor-buying-2078698

- https://edition.cnn.com/2025/06/01/economy/consumer-student-loans-debt-squeeze-dg

- https://epbresearch.substack.com/p/the-us-housing-market-is-balanced

- https://www.bloomberg.com/opinion/articles/2025-04-16/financial-crisis-in-2025-regulators-must-ready-global-economies

- https://www.spiked-online.com/2025/05/28/could-burrito-loans-trigger-the-next-financial-crash/

- https://www.cnbc.com/2025/05/23/markets-investing-etfs-new-trading-strategies.html

- https://www.theguardian.com/us-news/2025/jun/02/us-firms-say-trump-trade-war-is-hitting-production-as-dollar-nears-three-year-low