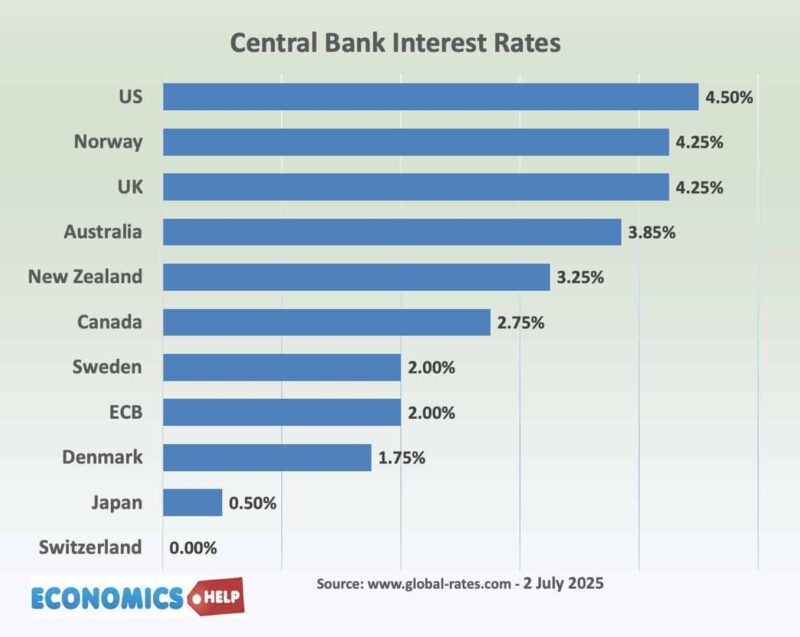

Recently, Donald Trump told the chair of the Federal Reserve that the US should be cutting interest rates like other countries. And it is true the UK and US have been slow to cut interest rates. They are now double the level in Europe and Canada. Although Rachel Reeves is unlikely to be sending notes to the Bank of England, she is probably hoping for interest rate cuts too. There are high stakes – lower interest rates will make households feel better off, encourage spending, reduce the cost of mortgages, which in America, especially, is strangling the housing market.

Lower interest rates also reduce the cost of living, a recent report suggested that if the US had included borrowing costs in the inflation index. The inflation rate people felt in 2023 would have been 14% rather than 4%. Conversely, a cut in interest rates with lower mortgages and lower borrowing costs would make households feel much better off.

But, it’s not just the cost of living, there is also the increasingly big matter of rising debt. Both countries, the UK and US have similar long-term debt trajectories. When you are borrowing $1 trillion a year to fund tax cuts, a small cut in interest rates, if it feeds through into lower bond yields, saves the government a lot of interest payment costs. In the UK, lower interest rates and lower bond yields would give a small lifeline to the beleaguered government finances.

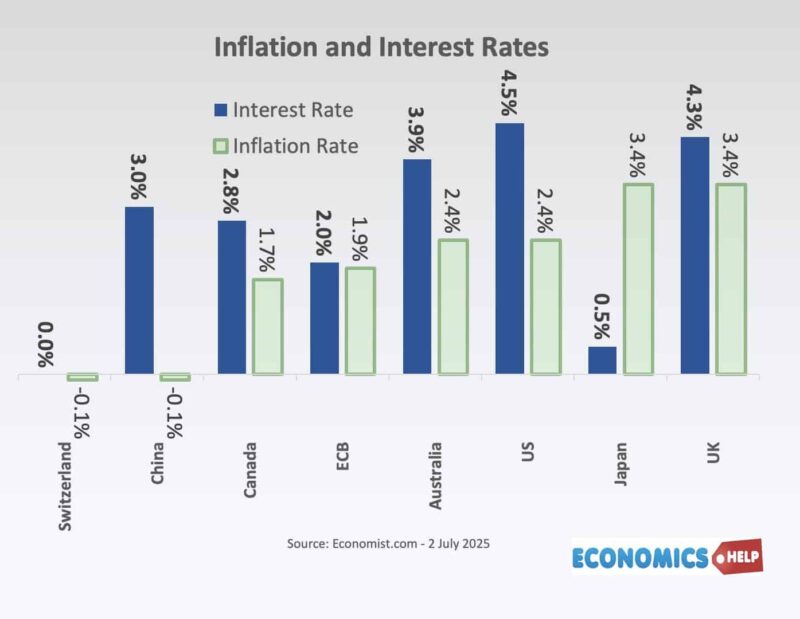

So, what is holding back the Federal Reserve and Bank of England? The UK is an outlier with the highest inflation rate. US inflation is relatively low compared to interest rates, though underlying core inflation is actually a bit higher at 3.1% Jerome Powell blames his reluctance to cut rates on the inflationary impact of the president’s trade policies. Tariffs raise the price of imported consumer goods, and the cost of imported raw materials. Although tariffs have come down from the high rate of mid-April, they are still unusually high by historical standards. According to Yale’s Budget Lab, the average effective import tariff in June is 15.8%. They suggest as a result of tariffs, prices will rise by 1.5% in the short run. If this were to happen, it would increase inflation towards 4%. Given that inflation expectations have also risen in the US, this is another factor that would push up inflation.

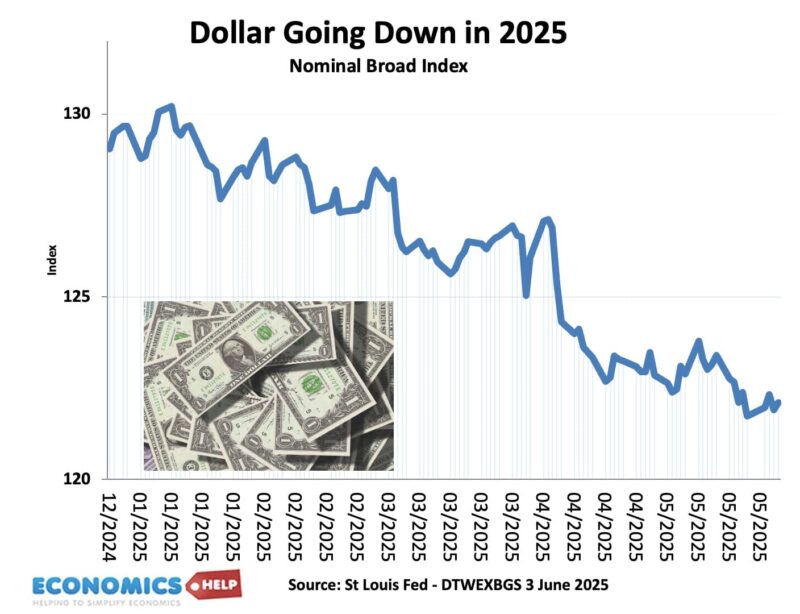

Dollar Down

Another complication for cutting US rates is the decline in the dollar. Usually, tariffs, and economic shocks cause a strengthening dollar, which helps to reduce imported inflation. But, the dollars fall has the effect of rising import prices and increasing the uncertainty in foreign investors buying US debt. However, the fall in the dollar may well be reflecting the market’s assessment that Jerome Powell doesn’t have too long in the job, and that President Trump will soon get his wish to see lower US interest rates.

Also, there are other factors which may make lower interest rates desirable. The US economy has slowed down. Tariffs don’t just raise prices; they also contribute to lower economic growth. Budget Lab at Yale predict 0.6 percentage points lower from the 2025 tariffs. Add greater uncertainty, and the delayed impact of high interest rates and the economy is slowing down. However, on the flip side, the recent bill of tax cuts passed by the Senate will have a moderate effect of increasing economic growth, though with most of the tax cuts benefiting the richest 20% of households, the impact on increasing consumption will be limited because the wealthy have a lower propensity to spend. The lost income from the lowest deciles will cause them to cut back their spending.

For the past five years, US growth has been exceptional, faster than the UK and Europe, and this justifies relatively higher interest rates – the economy is stronger, and by historical standards, 4.5% interest rates are not particularly high. But, if we get a real economic slowdown, rising unemployment and falling wage growth, then there becomes a strong case for reducing interest rates. Markets predict two or three interest rate cuts this year, but this could be just the start if the economy really does stagnate.

What would be very interesting if the US cut interest rates and also restarted quantitative easing to buy bonds and fund the deficit. The M2 money supply has increased since 2023 and it was the big expansion of M2 between 2020 and 22 which contributed to later inflation of 2022.

Oil Prices

Another complication for interest rates is movements in the oil price. Last week, oil prices soared on fears over Middle East instability. But, oil prices fell even more quickly than they went up. With oil currently trading at $65, this is a disinflationary pressure which supports lower interest rates.

What about the UK, which unfortunately has one of the highest rates of inflation in the G10, 3.4% and even higher service sector inflation. The UK is more vulnerable to rising gas and electricity prices. Expectations are still for inflation to fall, and given GDP growth is struggling to meet 1% a year, the economy would benefit from lower rates.

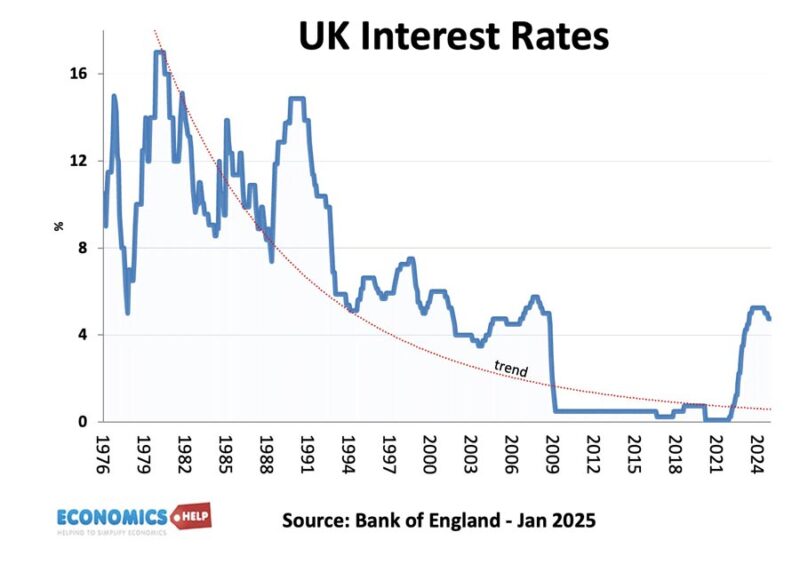

Long-Term Pressures

What about long-term pressures on interest rates? Global real interest rates have generally been falling for centuries. In the post-war economic boom period, interest rates were significantly higher. What happened after the financial crash is that we entered a liquidity trap, a long period of ultra-low interest rates. 13 years of near-zero interest rates lasted longer than anyone expected. What happened is that growth was unexpectedly weak in the aftermath of the financial crisis and even low interest rates did little to boost growth. The interesting question is – was that an unusual decade, or is it a sign of things to come? There is the argument that we are entering secular stagnation with an ageing population and a falling working age population, and growth rates are going to fall. savings glut due to an ageing population – old more likely to save, growth in corporate savings, and a greater risk-averse nature since the financial crisis. For example, the UK has seen an unexpected rise in the savings ratio. Countries like China and Germany running large current account surpluses also create excess savings. Japan in a way is the canary in the coal mine, since its property bubble popped in the late 1980s, growth has slowed down, and interest rates hovered around 0% for so long.

Japan

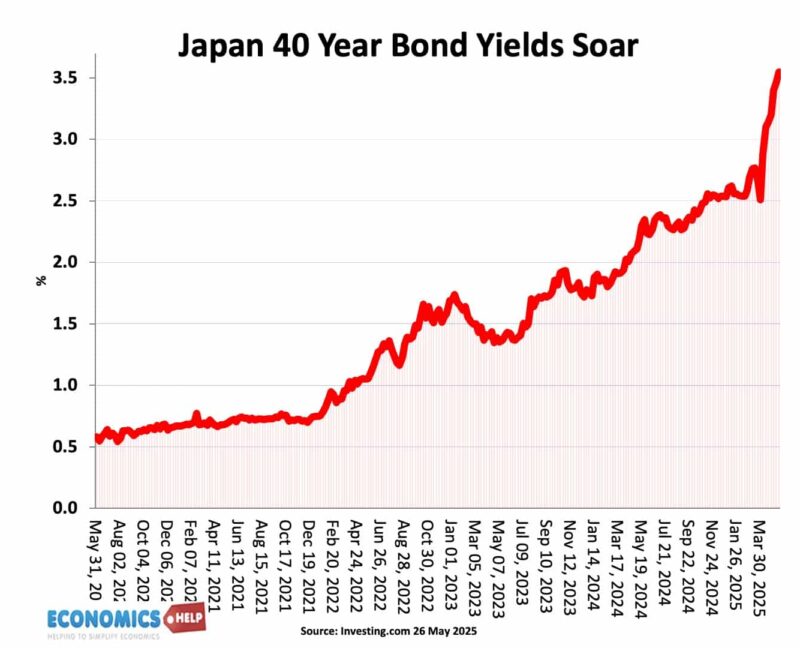

However, talking of Japan one of the interesting features is that Japan is seeing its first major inflation for decades, prices are rising, and Japan are seeing rising interest rates for the first time in decades. So if you rely on Japan to predict permanently low interest rates, that model may be changing in real time.

Higher Long-Term Rates

The other way to look at the economic situation is that actually there are several factors, which could lead to higher long-term interest rates and the global savings glut is a bit of a myth. The cost of government debt is rising, and with all major economies are seeing a rise in borrowing. The US deficit is set to soar to 9% of GDP and this may push up bond yields and create pressure for higher interest rates. Secondly, the economy is undergoing transition to renewable energy, updating networks and investing in new technology, this will require more investment and push up interest rates. Thirdly, China long a source of excess savings, is slowing down with its property crisis and ageing population.

So what is going to happen to interest rates, the biggest effect of trade war will probably to reduce growth rather than cause inflation. The tax cut bill will contribute to growth a little. But, overall rates are likely to come down. Goldman Sachs predict three rate cuts in 2025. Other forecasters like Morning Star predict by 2027 interest rates could be as low as 2.75%

In the UK, the forward market interest rate suggests interest rates of 3.6% by end of 2026. It’s hard to see a surge in economic growth which would cause renewed inflationary pressures. The real threat to higher interest rates could be cost-push inflation shock, like a rise in oil prices.

Sources:

https://budgetlab.yale.edu/research/state-us-tariffs-june-17-2025

https://www.cbo.gov/publication/61387

https://www.morningstar.com/markets/when-will-fed-start-cutting-interest-rates

https://www.fidelity.co.uk/markets-insights/markets/uk/when-will-interest-rates-fall/