US Treasury Secretary Scott Bessent recently criticised China for having the most unbalanced economy in the history of the world. Omniously, he said, “China cannot be allowed to export their way back to prosperity.”

The US is doing their best to upend the global trading system and make it difficult for China. In 2025 US tarrifs on China in 2025 have gone from 0 to 30 to 145 and back down to 30 – and that’s called a tariff holiday.

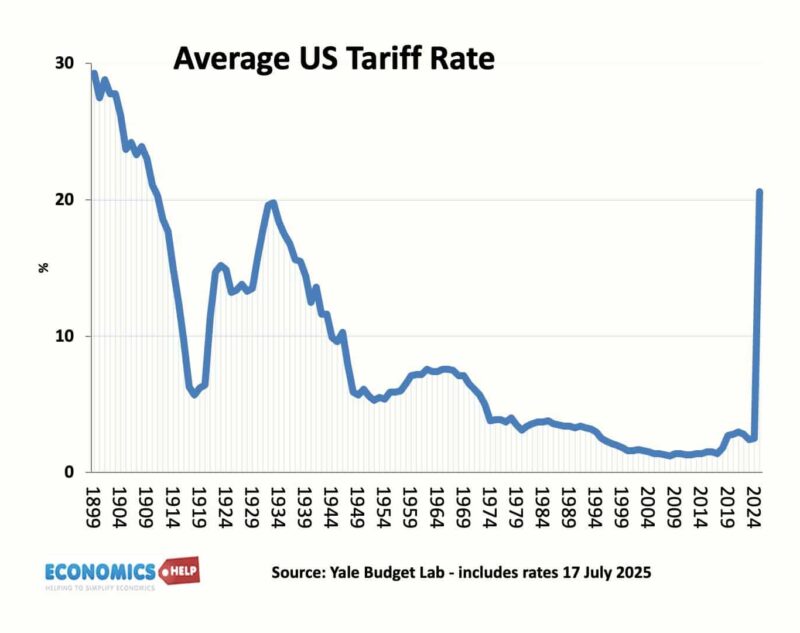

There is an idea that Trump changes in mind and never really implements tariffs, but that is not true; the average tariff rate is going up. As of July 14, 2025, Yale budget lab estimates the average US tariff rate is 20.6%. That is the highest level since the 1930s. Even one of the very few trading agreements with Britain, involved tariffs of 10%. The age of free trade is over; it’s a seismic shift in the global economy. In the past 50 years global poverty rates plummeted, but in a recent report, the World Bank warn the conditions which led to prosperity have now swung into reverse and it will be the poorest countries who suffer the most. Global growth rates have been falling for decades. What does the future hold now?

2025 will be one of those seismic changes in the global economy – comparable to the tariff shock of 1932, oil price shock of 1973 or end of post-war consensus in the early 1980s.

But, whilst America is looking back in time to the 1950s, when the US had 17 million manufacturing jobs, China is looking forward, with the next generation of industrial production. In the 80s and 90s, China dominated through cheap, abundant labour. But, in the coming decade, China is looking to dominate through a revolutionary Artificial Intelligence automised production. Chinese tech giant Xiaomi has recently launched a fully autonomous smart factory, capable of manufacturing 10 million handsets annually. The factor operates 24 hours a day, without the need for even human operatives to oversee problems. Not only that there is a continuous search to improve and automate production methods further. And China is bringing unprecedented economies of scale, government support and a culture of firms who are motivated not so much by profit margins, but the goal of neijuan – the never-ending race to outcompete and gain market share, with a relentless focus on lower prices. China is slipping into deflation and are exporting electric cars which obliterate European and American rivals in terms of price. BYD’s lowest-cost car sells in China for under $8,000. The cheapest electric car in the UK is more than double. In the new tariff regime, US firms may eventually reshore some production back to the US, but don’t expect a new surge of manufacturing jobs. This new automated production style will eventually come everywhere. The strength of the US economy will not be manufacturing but its own high tech AI industries.

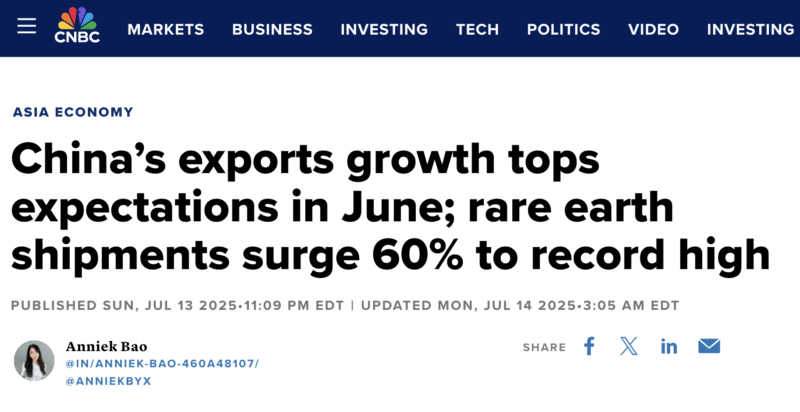

Will Tariffs Derail Chinese Exports?

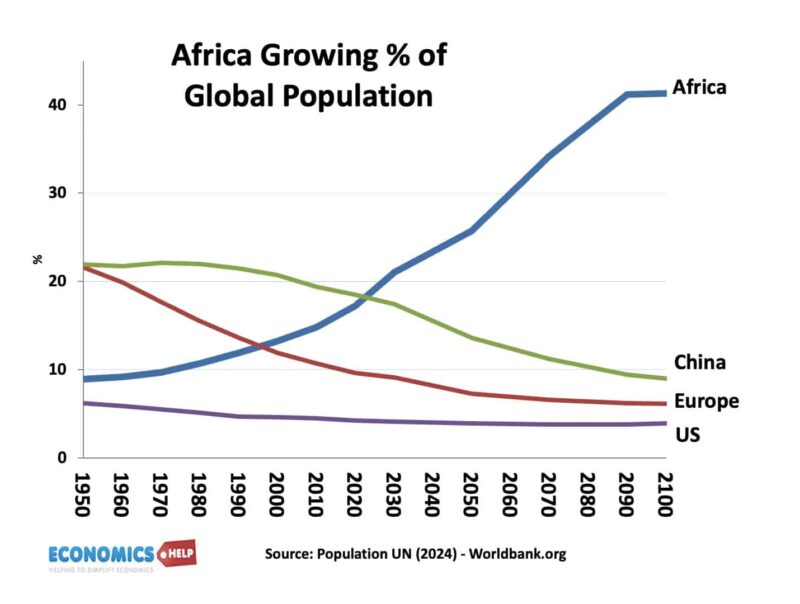

But, the big question is – will tariffs derail Chinese exports and the Chinese economy? The US is China’s biggest export market. $525bn of exports in 2024, but still only 14% of Chinese exports, down from 20% share in 2017. US tariffs will not end the Chinese economic model. The US is declining as a share of global GDP, and the emerging economies are ready to take China’s cheap exports.

The next 50 years will also see the emergence of Africa as it will be one of the few places with an expanding working age population. The rest of the world is in decline.

So far, despite a 16% fall in exports to the US, China’s economy has been resilient and overall exports are reaching record levels. China certainly has its own economic problems. Scott Besant may exaggerate but the Chinese economy is unbalanced, with domestic consumption too low, housing debt a real problem and an ageing population. But, after the last round of tariffs, Chinese firms just shifted final production to other countries. Never underestimate the capacity to get around tariffs. The big story is that in the 90s, China exported low inflation, with falling industrial prices, they may be doing the same in the next decade. If Europe really wants to transition to a green economy, for minimal cost, the price will have to import from China.

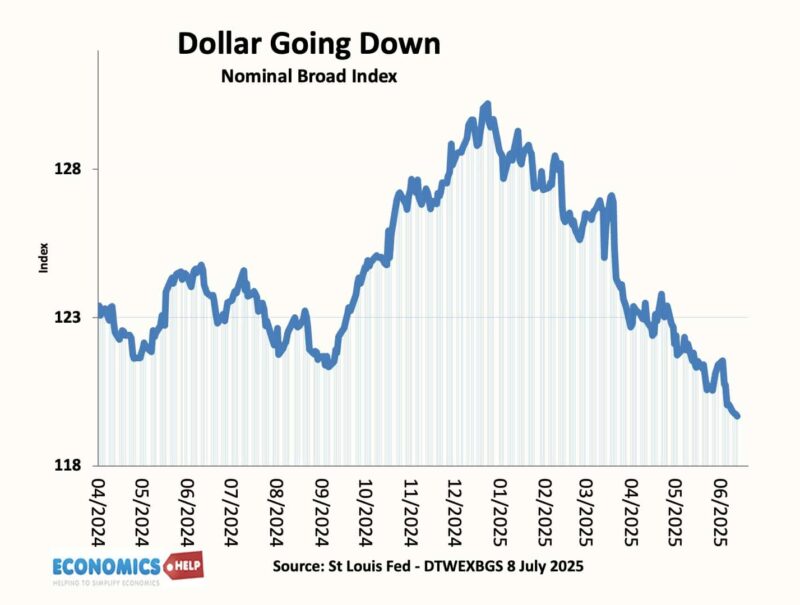

Dollar Decline

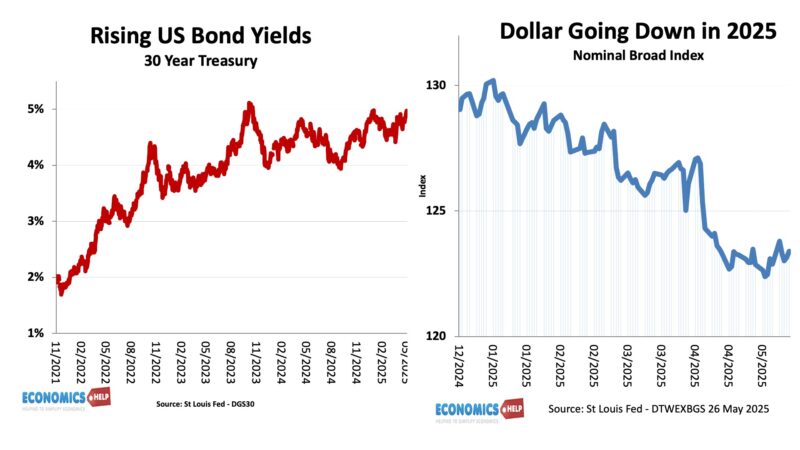

But the change in the global economy is more than just tariffs. 2025 marks the beginning of the decline of the dollar’s dominance. The dollar is falling for many reasons, less confidence in the US, concerns over debt and attitude to bond holders.

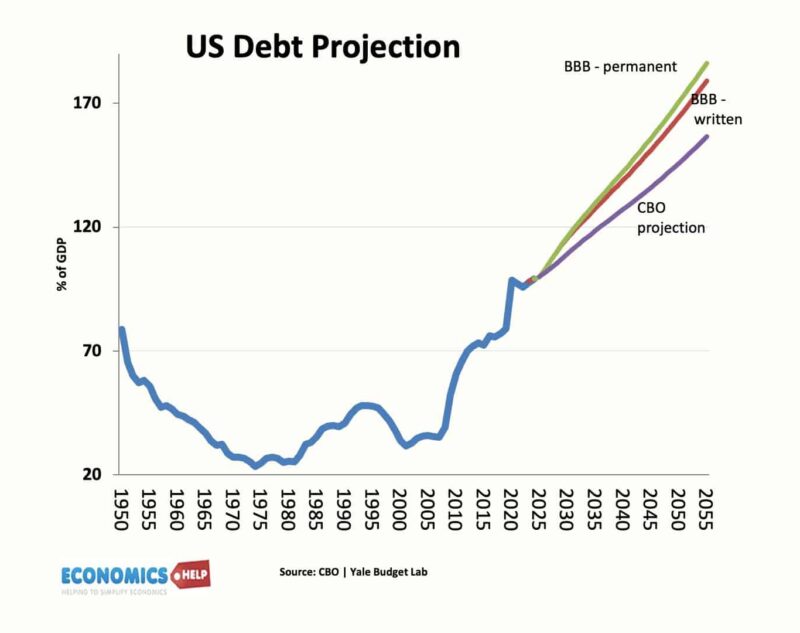

So even as US bond yields rise, investors are still selling dollar assets. It’s not just about a fall in the dollar; less trade will be conducted in the dollar, less foreign currency held in dollars, less invoicing in the dollar. And there will no be no clear alternative. What happens as the dollar loses its dominant position? Martin Sandbu in FT talks about the frightening world without the dollar as the dominant currency. Firstly, international trade will become more risky and expensive. But perhaps the biggest shock to the financial system is that the world could lose the US Treasury as a globally recognised safe asset. Currently, a US Treasury is seen as so safe and stable, it could be considered near money – it is highly liquid. But, investors look at projections for US debt and worry that given political dysfunction, this could easily end in a debt crisis, either increased money supply and inflation or financial controls. If this were to be even a risk, the global financial system would lose one of the factors that have underpinned financial stability, and it would have huge implications, notably higher interest rates, lower growth and less investment. Trade, credit and liquidity would all be more costly.

The huge shock of America’s unorthodox economic policies is pushing Europe out of its comfort zone. In the past decade, the US economy has significantly outperformed Europe, and Europe has become sclerotic with low growth, high regulation and low investment. But, with Trump cutting back defence commitments and threatening tariffs of 30%, Europe is being pushed to reinvent itself. The threat of the US’s global retreat could be the making of Europe. But, the fate of Europe remains a big unknown. can it reinvent itself as its population ages and gets weighed down with pensions?

The US is not alone in having a dramatic debt trajectory; the world is seeing a rise in debt because the world is rapidly ageing. Japan was the first country to see a peak in its population, one reason for its government debt 260% of GDP. But 2025 has been the year when Japan has seen sharp rises in the cost of borrowing. This raises the spectre of much higher debt interest payments. It will also encourage Japanese investors to sell their $1 trillion holdings of US debt and buy Japanese debt instead. The Japanese carry trade is over, and it means a sell off of global assets. And it won’t just be Japan, Europe is in a similar boat. The UK has experienced a decade of relative decline and has experienced deterioration in its financial prospects. But the UK also shows how difficult it is to deal with the dynamic of low growth and rising debt. Voters are fed up, and don’t want to see their pensions cut, even if they are not affordable in the long term.

And that is another shock facing the global economy. The advanced economies are slowing down. Rates of economic growth have been falling for decades. And generally, as a population ages, you can expect lower investment, lower growth, less dynamism, and that creates a negative feedback cycle for debt and growth. This will be greater than any tariff effect.

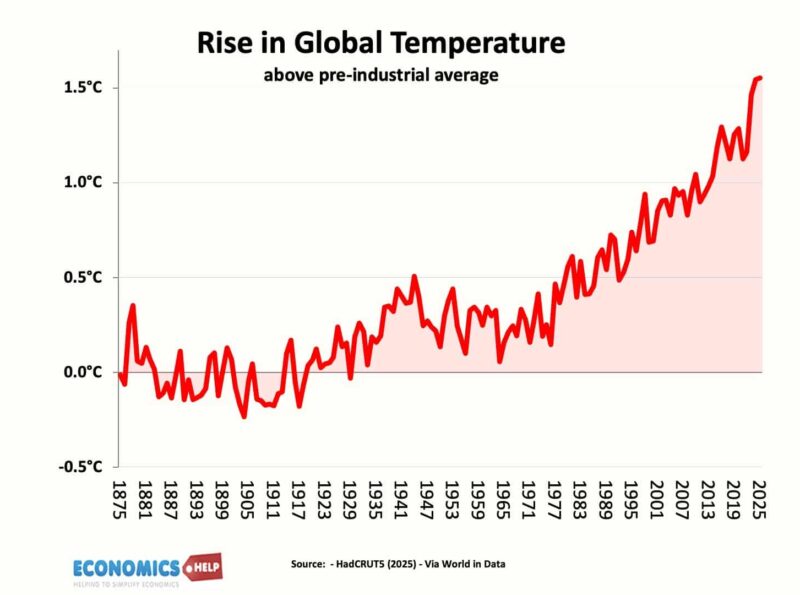

If that wasn’t enough, the world faces not just a new economic climate but literally a different weather climate too. The world is warming up, creating more extreme weather events. Insurers and actuaries are fully aware of the potential implications, even if politicians are not keen. This report suggests under current policies, the world could see a 33% loss of GDP from the impact of a volatile and unpredictable climate in the next few decades.

Positive Changes

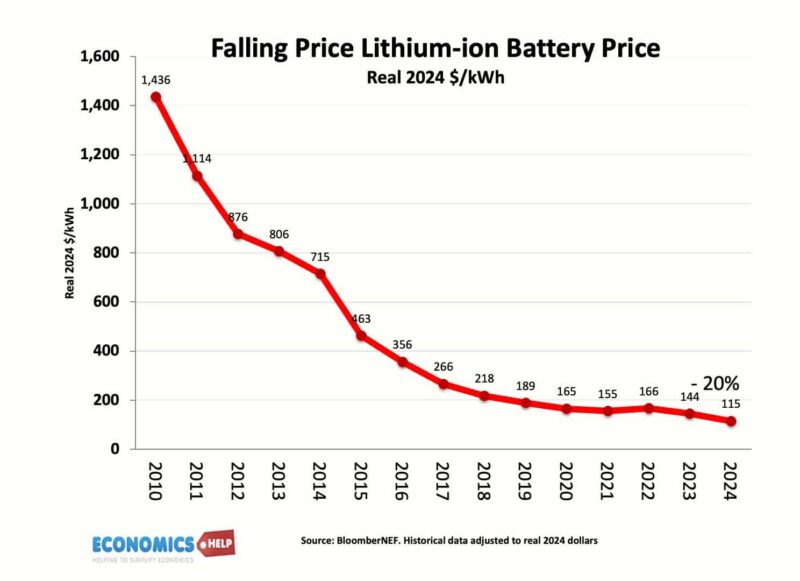

It would be a mistake to only focus on the pessimistic scenarios. Technological progress shows no sign of slowing. There has been a global surge in the installation of solar panels. The continuous progress in cutting costs is perfectly suited to renewable energy and battery technology.

We are seeing 20% improvements every year. We have also seen a huge range of innovations from farming to transport. And whilst we worry about a shrinking working population, we are developing increasingly humanoid robots which have capactity to move into areas like health care and care workers.

Even if we get a degree of de-globalisation, we won’t turn the clock back a century, industry is too global, what may happen is more regional blocks. Also, whilst everyone assumes America has permanently changed, it is quite possible, the tariff rollercoaster could be ended by the courts, congress, or future elections. And if the US is less dominant in the global economy, so be it. Economic empires always rise and fall. 100 years ago, the UK was the world’s largest economy in the world, who misses Britain’s dominance today? But, perhaps the biggest shock to the economy will come not from tariffs, technology or global warming, but the most important commodity of all – people. We just don’t want to have kids any more, and the population is set to fall. This video looks at why and what happens next.

Sources:

https://eu.usatoday.com/story/money/2025/07/12/economy-slow-second-half-2025/84544138007/

https://www.apolloacademy.com/us-makes-up-only-14-of-chinese-exports/

https://www.newsbytesapp.com/news/science/lights-out-factory-xiaomi-s-robots-take-over-24-7/story

https://www.cnbc.com/2025/07/14/china-exports-imports-trade-data-june.html