Printing money creates a sense of nervousness amongst both economists and the general public. It immediately conjures up memories of hyperinflation in Weimar Germany in 1923 and Zimbabwe in more recent times.

If a government prints money faster than the growth of real output it reduces the value of money and this invariably causes inflation. Governments often resort to printing money when they cannot finance their borrowing by selling bonds. This hyperinflation can be extremely damaging to an economy.

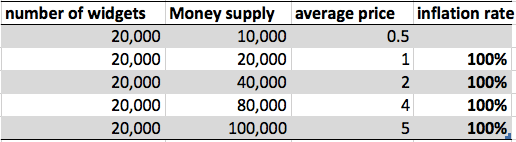

Example of printing money

Suppose we have a fixed number of goods (widgets) in the economy.

Initially, there are 20,000 and a money supply of £10,000. In this situation, you would expect the average price to be £0.50 (10,000/20,000)

Suppose the money supply doubles. This means that the average person has twice as much money as before. Therefore, the nominal demand for the 20,000 will increase. Consumers are willing to pay twice as much – because they have twice as much money. Firms respond to this higher demand by putting up the prices.

The number of widgets stays the same. But nominal prices and incomes have gone up. With doubling the money supply we get an inflation rate of 100%.

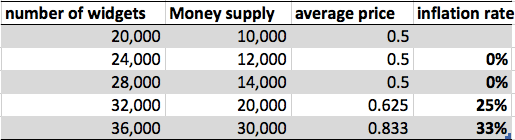

Money supply growth with growth in output.

In this case, the number of widgets increases by 20%. The money supply also increases by 20%. In this case, there is 20% more money, but 20% more goods. Therefore, the prices stay the same, and the inflation rate is 0%.

However, when money supply increases from 14,000 to 20,000. This is a bigger increase in the money supply than an increase in output. In this case, prices will start to rise and we get inflation.

This explains the basic premise that if the money supply increases faster than nominal output, it will lead to inflation.

However, this is a simplistic model which assumes factors such as the velocity of circulation are fixed.

Printing Money and Quantitative Easing

Despite the possible threat of inflation, governments in Japan, US and now the UK have resorted to using quantitative easing (a form of printing money) to deal with deep recessions and the prospect of deflation.

In a very serious recession, demand falls so much that it is possible to increase the money supply without creating inflationary pressure. (If we consider quantity theory of money MV=PT. V, the Velocity of circulation falls in recession, so we may need to increase money supply just to avoid deflation) So usually printing money causes inflation. But, in periods of falling velocity of circulation (the number of times money changes hands), printing money doesn’t necessarily cause inflation. The credit crunch has caused a fall in the velocity of circulation.

How Does Quantitative Easing Work?

There are different forms of quantitative easing. This is one form:

- The Central Bank creates reserves. This is creating money electronically. Basically, the Bank just decides to inflate its cash reserves by say £50bn.

- With this extra cash, the Central Bank will buy a range of government gilts and private sector assets such as corporate bonds.

- Private banks sell their assets to the Central Bank and see an increase in their cash reserves. With these cash reserves, they should be more willing to lend money.

- By buying government bonds, the Central Bank increases the value of bonds pushing long-term interest rates down. This fall in long-term interest rates also has a reflationary effect.

Does Quantitative Easing Work?

Some say Japan’s period of stagflation would have been worse without quantitative easing. But, it is early to say for US and UK.

Quantitative easing is risky. One issue is whether the Central Bank can remove the excess liquidity when the economy recovers.

Why Risk Printing Money when it could cause inflation?

The prospect of deflation is much worse than inflation. Deflation could make a minor recession into a prolonged depression. Deflation is very damaging to the economy because it discourages spending and increases the burden of debt.

Printing Money and effect on Exchange Rate.

Printing money reduces the value of your currency. Inflation reduces the value of domestic securities making international investors leave the economy. (printing money and effect on exchange rate)

Further Reading

The above is a good summary of quantitative easing. But I disagree on the following points.

It is claimed above that “If a government prints money faster than the growth of real output it reduces the value of money and this invariably causes inflation.” The word “invariably” is too strong. Printing money does not necessarily cause inflation: the initial effect is to boost demand. If demand is boosted by just enough to escape the recession, but not by so much as to cause excessive demand, then with a bit of luck, no inflation would ensue. The US monetary base has DOUBLED in the last quarter. This is unprecedented, but no one is expecting rampant inflation in the US any time soon.

The third para above refers to “ quantitative easing (a form of printing money)”. Q.E. does not necessarily involve printing money. The Bank of England a month or so ago announced that it intended starting on Q.E. quite soon, but that it would initially sterilise any money supply increase by selling gilts. They said that a month or two down the road they would think above ceasing to sterilise if it looked as though the economy needed a stronger boost.

“In a very serious recession, demand falls so much that it is possible to increase money supply without creating deflationary pressure.” The word “deflationary” should be “inflationary” should it not?

How can you measure QE?