Antitrust policy refers to government intervention in markets dominated by monopolies and abuse of monopoly power. In the UK, antitrust policy is better known as simply competition policy, with the OFT and Competition and Markets authority investigating mergers and abuse of monopoly power.

In the US, antitrust become important in the late nineteenth century, when American industry and become dominated by a few very powerful firms – in particular, Rockefeller and J.P. Morgan trusts. In 1890, the US antitrust board successfully broke up some of the big railroad firms, Du Point chemicals and Rockefeller corp. This became known as the Sherman Antitrust act of 1890 and dominated American antitrust policy in the twentieth centuries.

Reasons for antitrust policy

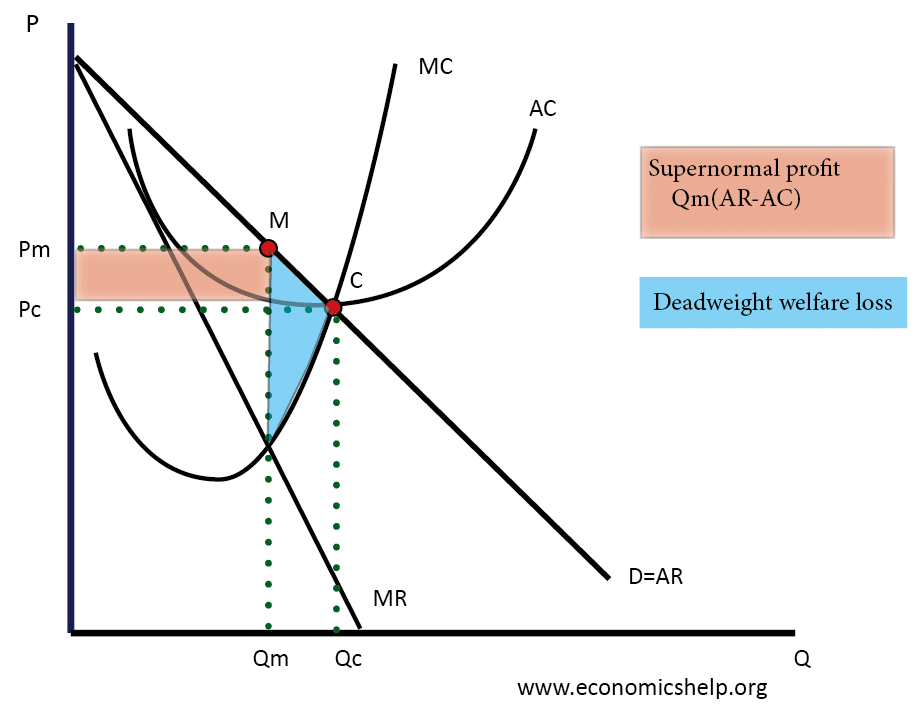

When firms have monopoly power, they are able to exploit their market power it will lead to results such as

- Set higher prices than a competitive equilibrium. This leads to a decline in consumer surplus and rise in allocative efficiency.

- Make ‘excess’ profits at the expense of consumers. Powerful monopolies are able to gain profit at the expense of workers and consumers. This represents a shift in wealth throughout the economy.

- Stifles innovation and investment. Powerful monopolies like Rockefeller were using their market power to try and block new entrants to the industry. This leads to less choice for consumers and a decline in new ideas. Preventing one firm dominating the industry leads to greater innovation.

- Powerful trusts often have monopsony power. This is market power in employing workers or buying supplies. It can be another way to increase profits at the expense of stakeholders in society.

Types of antitrust policy

Government policy can involve

- Breaking up a large monopoly with very high market share. For example, the government could break up Google into different companies in order to create competition between different branches

- Preventing mergers which would increase the power of an existing monopoly. All mergers which lead to a firm with more than 25% market share are referred to Competition and Markets Authority.

- Legislation against unfair pricing strategies. For example, if a monopoly uses vertical price restraints to discourage new firms entering the market, the government could impose fines.

- Legislation against collusion.

- Preventing barriers to entry. Opening up markets to competition. For example, electricity and gas markets have been deregulated, allowing new firms to use existing infrastructure.

Anti Trust and Microsoft

Under the Clinton administration, the monopoly power of Microsoft was targetted and the company was recommended to be broken up. However, on appeal, Microsoft were able to overturn the judgement. This shows the debate about how aggressive antitrust policy should be. For example, some economists (such as the Austrian school) argue big firms are not necessarily bad but maybe a reflection of a successful company.

Anti Trust and Contestability

Often antitrust policy was based on the market share of the leading firms. E.g. if a firm had more than 25% it was assumed to have market power. However, recently greater importance has been given to contestability. This looks at the ease of entry and exit into the market. If there is the ease of entry then the threat of competition may be sufficient to keep prices competitive, no matter what the market share.

Related