A significant issue in the US political economy is the perceived transgressions of Chinese economic policy. These tend to revolve around:

- Undervalued Yuan – making Chinese imports cheaper

- Current account (trade) deficit. China exports more goods and services than imports – switching demand from US firms to Chinese firms.

- Copyright infringements and lack of intellectual property rights.

Main US criticisms of China

1. Undervalued yuan. The undervalued yuan has long been a source of grievance amongst US manufacturing concerns. It is argued that the Chinese intervention in the foreign exchange markets (selling Yuan and buying dollars) helps to keep the Yuan undervalued.

An undervalued Yuan means Chinese exports are relatively more competitive, and US imports more expensive. This provides a boost to Chinese exports at the expense of US exports, and this explains the record levels of trade deficit between the US and China.

However, it should be noted that the US has benefited from this Chinese intervention in the foreign exchange markets. The Chinese have been keeping the Yuan low by buying US government debt. The demand for US government debt has kept US debt interest rates low, reducing the cost of servicing US public sector debt.

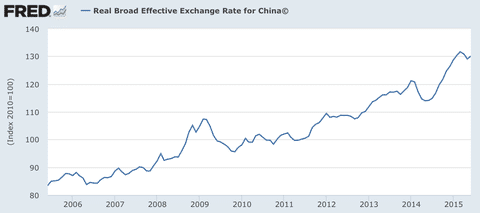

Also, it is debatable whether the Yuan is undervalued. Certainly, in 2011, the Yuan was undervalued but between 2011 and 2016, there has been a steady appreciation in the Yuan

It is true that in the recession, China has become a relatively less important buyer of US debt. But, given the predicted levels of debt over the next few years, the US will still be hoping China continues to buy.

2. US Trade deficit

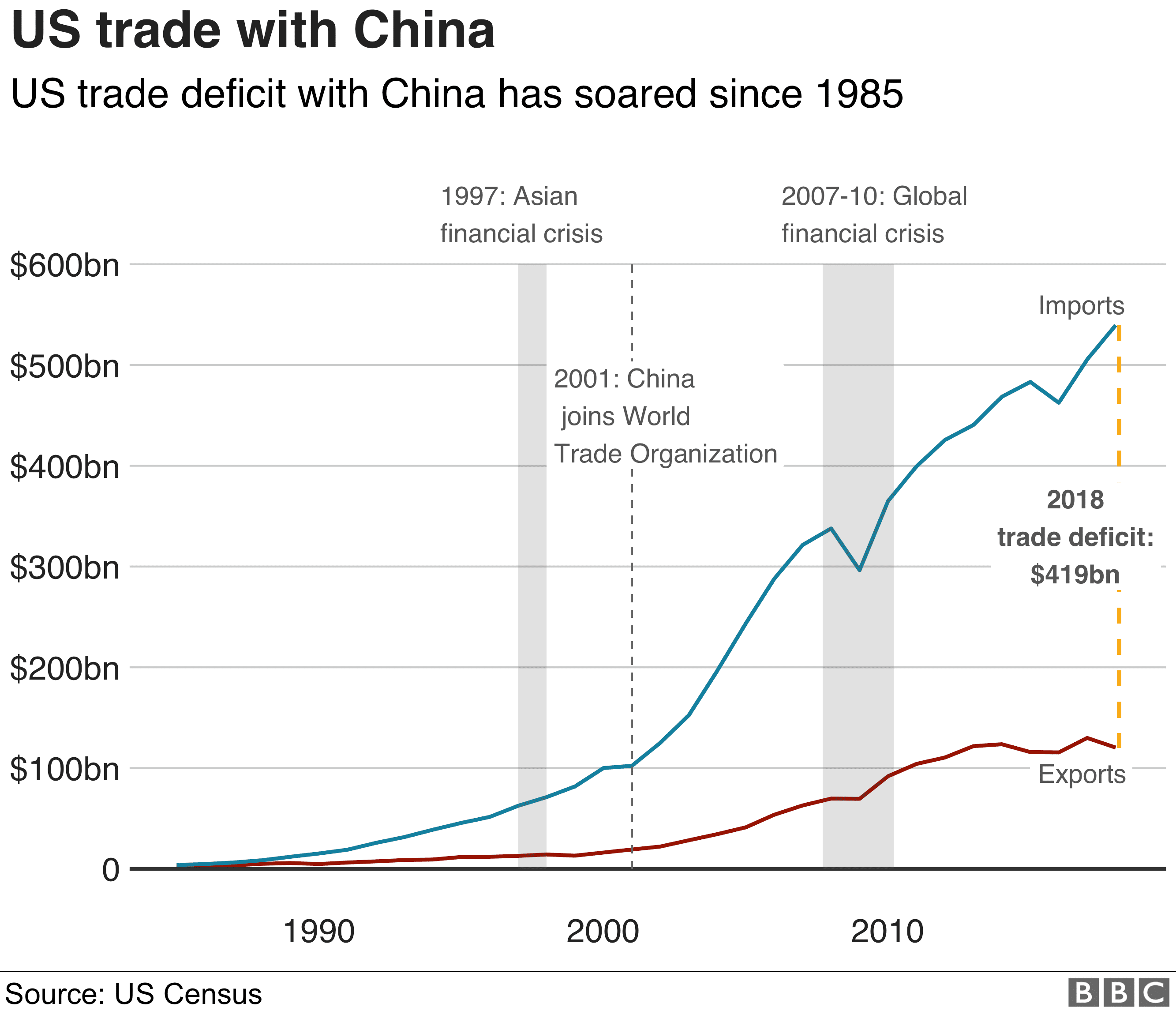

US trade deficit with China BBC

Since 2000, there has been a growing trade deficit between the US and China – showing the US imports more goods and services than exports. The deficit with China accounts for up to 40-50% of the total US trade deficit. President Trump argued this trade deficit proved that the US is on an ‘unfair footing’ and proof China is undervaluing its currency. A trade deficit means that demand is shifting from US production to Chinese imports. However, other economists argue it is a mistake to see a trade deficit as evidence of ‘foul play.’

The US has long run a current account deficit, but this is easily financed by capital flows to the US. The mirror of a US trade deficit is a surplus on the capital account. For example, Chinese banks buying US bonds, securities and shares. Money flows out to buy goods, but it flows back in to buy capital.

A trade deficit enables US consumers to have better living standard. US consumers have benefitted from cheap Chinese imports (e.g. mobile phones, computers, clothes and footwear), this increases their effective spending power and can lead to increased demand for other US goods.

3. Copyright infringements

A bigger criticism of China’s economic policy is the limitations of enforcing copyright. In theory, China has signed up to the Berne Convention in 1992, but in practise, many US companies are unhappy that it is easy for Chinese companies and consumers to get hold of bootleg material and not respect copyright in the field of arts, entertainment and technology.

China’s Criticism of US

1. China has been criticising the Federal Reserves decision to increase the money supply. Increasing the money supply is likely to cause future inflation, reducing the value of the dollar. In turn, this reduces the substantial value of US dollar assets.

This explains why China has been increasingly buying gold, rather than US bonds. However, it is worth bearing in mind; gold deposits only account for a small percentage of China’s foreign currency reserves.

In response, the US will say that the policy of quantitative easing is necessary given the scale of the recession and the deflation endemic in the US economy.

Also, the recession has seen a rise in private sector saving and China is now buying a smaller % of US debt than before. But, still, China holds over $2 trillion of US securities – no small matter.