Foreign direct investment involves the transfer of funds to be involved in capital investment in a foreign company. For example, if a Japanese firm, like Toyota builds a factory in the UK, this counts as inward investment into the UK.

Foreign direct investment does not include portfolio investment, e.g. Chinese saving money in UK banks or buying bonds

FDI and balance of payments

- Inflows of inward investment count as a credit on the capital (financial) account of the balance of payments.

- However, if profit from the investment goes back to the country of origin, then this will be a debit item on the current account.

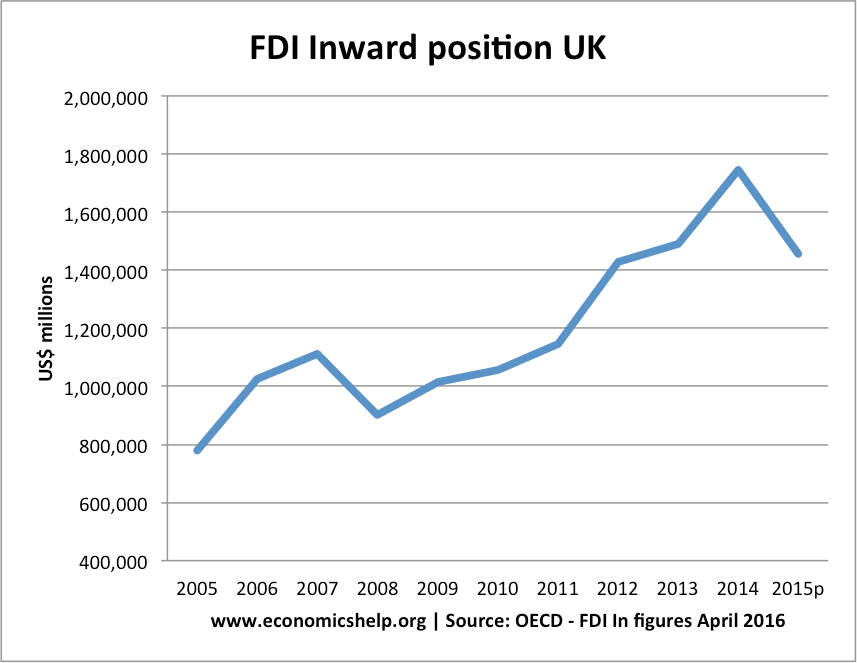

FDI Inward position

This is the total accumulated level of foreign direct investment. For example, in 2014, the value of accumulated FDI in the UK – exceeded £1 trillion. (Gov.uk)

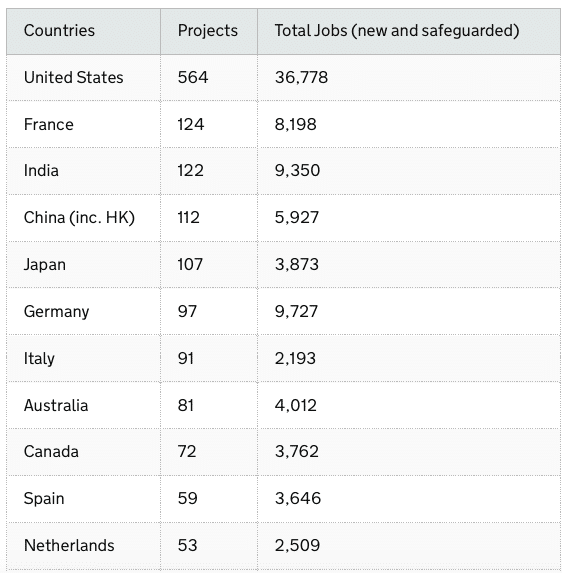

Top 10 countries for inward investment

In 2015, the UK ranked third for total levels of inward investment

Which countries invest in the UK?

Net direct foreign investment

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

| Total net FDI flows in the UK | 96,803 | 84,885 | 93,148 | 48,875 | 48,986 | 32,106 | 28,883 | 44,596 | 33,016 | 27,801 |

| Total net FDI flows abroad | 44,458 | 46,887 | 159,129 | 99,322 | 25,094 | 25,486 | 60,130 | 27,392 | 28,424 | -79,936 |

| (inflows – outflows) | 52,345 | 37,998 | -65,981 | -50,447 | 23,892 | 6,620 | -31,247 | 17,204 | 4,592 | 107,737 |

- Foreign Direct investment – inflows and outflows ONS

Related

- Foreign direct investment

- OECD notes on foreign direct investment