Why didn’t the UK Join the Euro?

Joining the Euro would give the UK various advantages:

- predictability of exchange rates with Europe

- Easier for consumers to compare prices (price transparency)

- Lower transaction costs

- Encourages investment because of greater stability in trade.

However, despite these potential benefits the UK decided not to join and shows no indication of joining in the future.

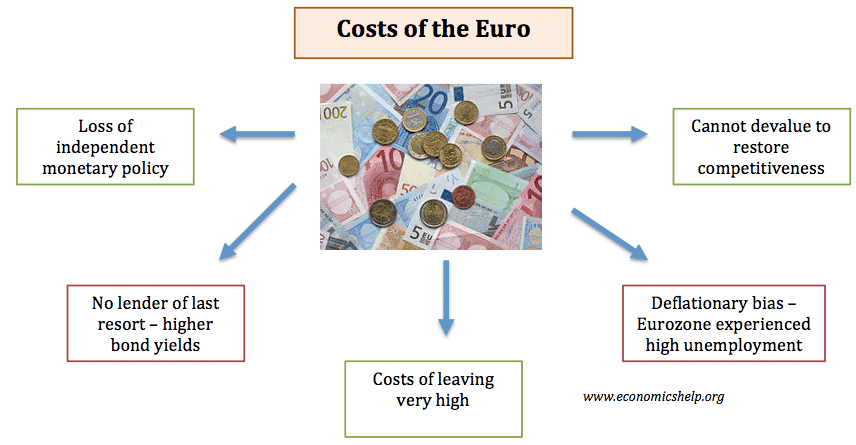

Main reasons for not Joining the Euro

1. Loss of Independent Monetary Policy

Joining Euro also causes a loss of an independent monetary policy. Interest rates are set by ECB and may not be suitable for the UK.

2. Different Stage of the Trade Cycle.

The UK’s economy has been growing faster than the Eurozone. If the UK was in the Euro, interest rates might be too low causing an inflationary boom in the UK. This would be a return to the stop-go cycle of the 80s. The MPC has been able to keep interest rates sufficiently high to prevent inflation going above inflation target.

3. Unique characteristics of UK Housing Market.

UK Housing market has a high ratio of house prices to income. It means that many homeowners face mortgage payments which are a high % of income. Therefore, UK homeowners are more sensitive to interest rate changes. More homeowners have a variable mortgage as opposed to a fixed rate. The effect is that a 25 basis point rise in interest rates has a more significant impact on the UK housing market and economy.

4. UK economy has been doing well without being in Euro.

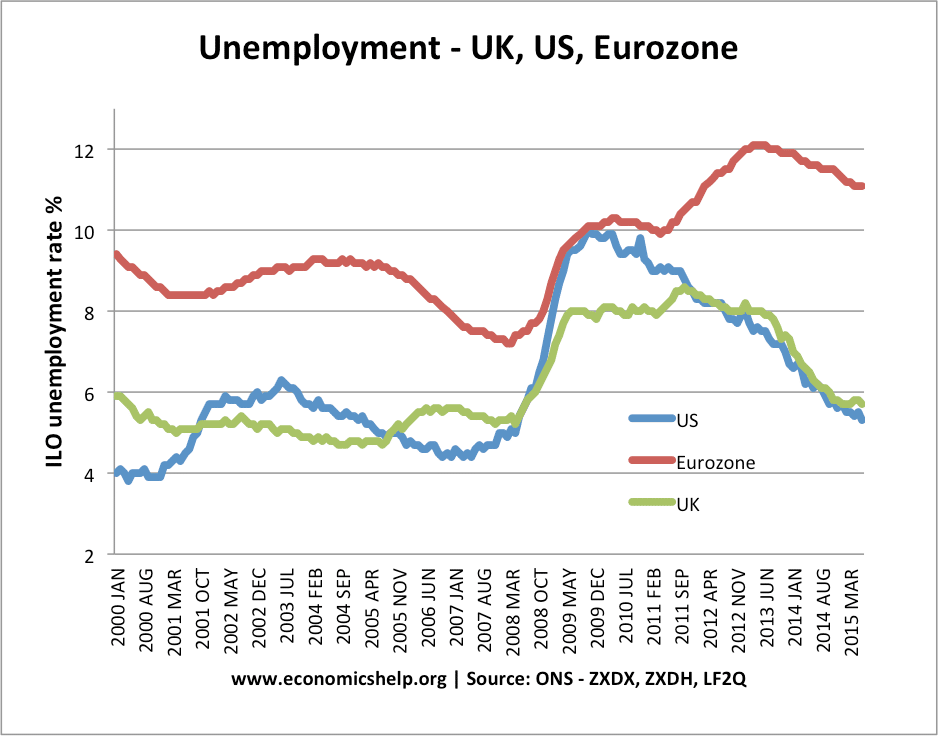

The benefits of the Euro are relatively small. But, the costs potentially very high. For example, the Euro debt crisis of 2011-12 saw Eurozone economies forced into austerity – leading to a prolonged period of economic stagnation. Outside the Euro, the UK had greater flexibility to depreciate the currency (making exports cheaper) and pursuing looser monetary policy.

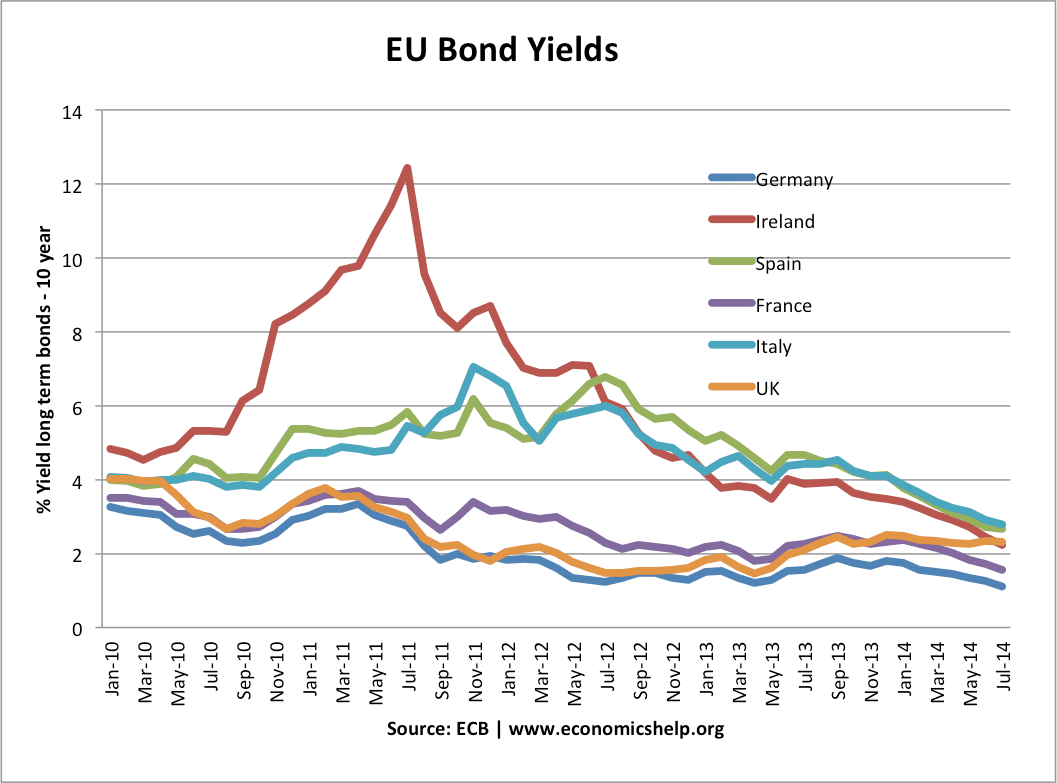

5. Bond yields. In the Euro, the Bank of England can no longer act as a lender of last resort – buying bonds if there is a temporary shortfall. Without a lender of last resort – bond markets can become uncertain and demand higher bond yields to compensate for the risk of liquidity shortages. Therefore, in 2011-12, many Eurozone economies faced rising bond yields – despite having lower debt levels than the UK.

See also: