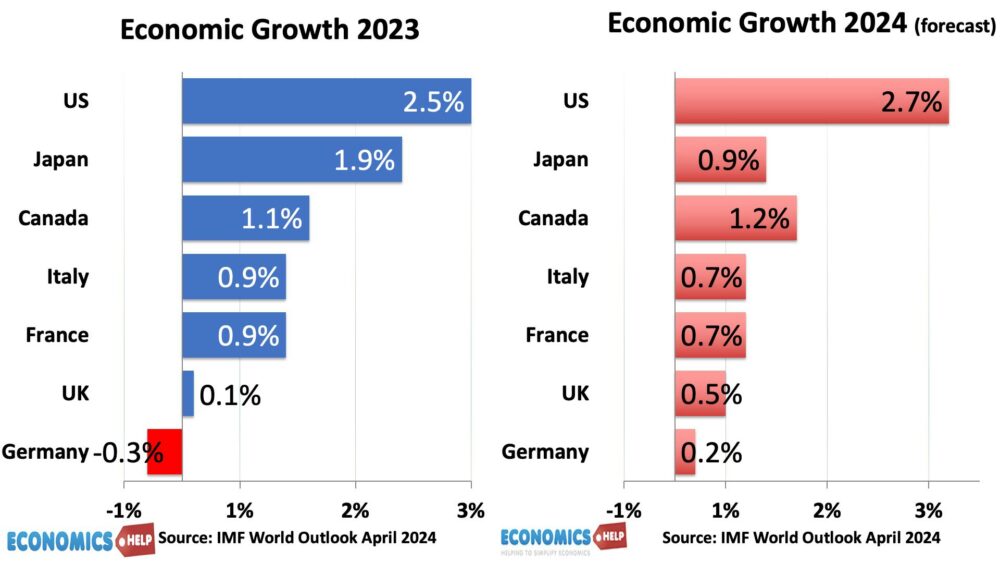

The US economy is booming. It was the fastest-growing economy in 2023 and will be the fastest in 2024.

The World Bank claims the US is the world economic dynamo and the contrast between the UK and US is stark. Whilst the UK is stuck in economic stagnation, the US shows a different outcome is possible. Yet, with debt rising and savings falling is the US economy really as marvellous as it appears on the surface? But, first what can the UK learn from Bidenomics?

Is US Economy Really doing better than the UK?

A major reason for strong growth in the US is the most ambitious government intervention since the 1930s New Deal. There have been three major policies, the infrastructure bill, domestic chip manufacturing and the Inflation Reduction Act. The bills offers the potential for $1.1 trillion (4% of GDP) in direct federal spending through grants, loans and subsidies. (In real terms that is larger than FDR’s New Deal.) Not all has been taken up, but at least $400bn has been spent. It is has led to a boom in private sector investment, jobs and construction. The investment is across the country from solar and wind power in Utah to new battery factories and flying electric planes in Georgia. The growth in solar energy in the US is startling. 2024 is set to be a record year with 80% of new power capacity to be solar and batteries. The US is proving that environmental goals are compatible with strong economic growth. But what about the UK? Offshore wind has been one of the successes of the past 14 years, with a significant growth in capacity. But the current government have a budget of only £1bn (0.05%) for encouraging renewable investment. Initially, the Labour party had a more ambitious plan for £28bn of green investment, but this has been reduced to £15bn (0.75% of GDP). Very modest compared to the US. But will a fiscally conservative Labour government be able to make the kind of difference Bidenomics has?

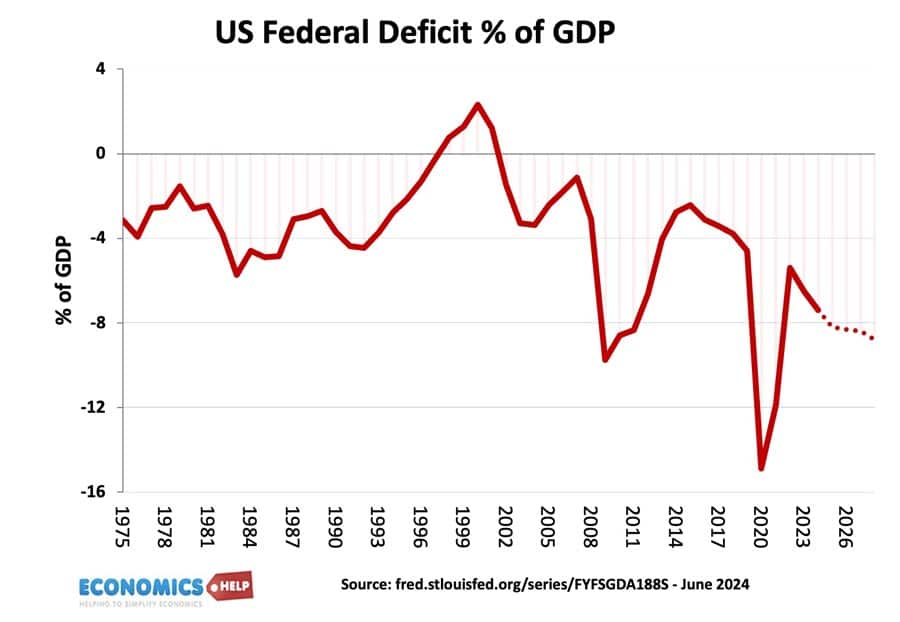

Borrowing

The reason for Labour’s caution is the different approaches to borrowing. The ambitious Bidenomics has come at a cost – a record budget deficit of 7.4% of GDP. This is unusually high for this stage in the economic cycle. According to classic Keynesian economics, booms are periods to reduce borrowing, not increase it. The UK by contrast has much more modest debt targets. US debt is forecast to grow towards 150% of GDP in the coming years. In theory, UK debt will peak at 100% and then start falling, though no one really believes that. As current spending cuts are seen as fiction and almost impossible to implement with. An interesting question to ask, is it true that the US finds it easier to borrow than other countries like the UK? Well, there is certainly high demand for US treasuries across the world. The massive rise in US debt has not spooked markets. In fact bond yields have been fairly stable, helped by strong growth. This is the paradox, high growth can improve long-term tax revenues. Stagnation is the worst long-term outcome, and why UK taxes have been rising as a share of GDP, despite spending cuts. However, the problem is the Truss budget of 2022– which was a massive fiscal expansion that spooked markets and caused interest rates to soar. Now this was partly about the timing of inflation being 10%, but it helped to cement fiscal conservatism in the UK. However, there is a danger firms will give up on the UK and move elsewhere. The US has unfortunately started a subsidy arms race, which could easily damage the UK economy.

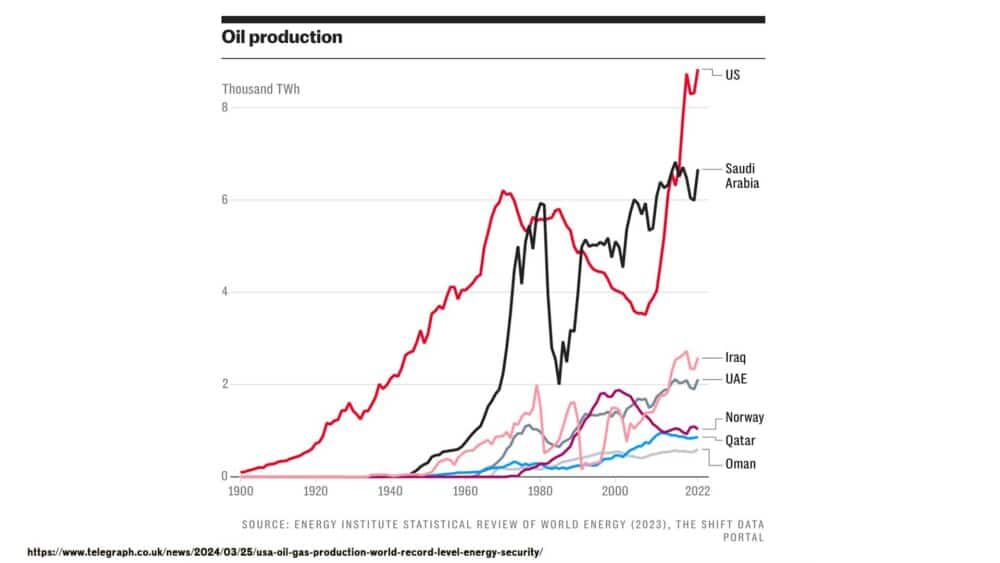

Fossil Fuels

Now, whilst green subsidies have led to impressive growth in renewables, there is another source of US economic growth, and that is the traditional fossil fuel industry. The US has become the leading exporter of natural gas and the world’s leading producer of oil. President Biden whether through good luck or good management proved an adept trader. Selling oil from strategic reserves when the price was $95, it helped the US avoid the same kind of energy crunch as Europe. Since prices have fallen, the government is now buying at $67 making the government a tidy profit. By offering to buy at a fixed price, the government is encouraging further shale oil exploration. However, the main reasons for the surge in US oil is not anything to do with government policy, most of the shale oil lies off Federal land in places like Texas so there is little the government can do to stop production, even if it wanted to promote climate goals. But, it is leading to a bonanza for the US economy and complete energy independence. The US is now a net exporter of oil, a far cry from the 1970s when an oil embargo crippled the US economy.

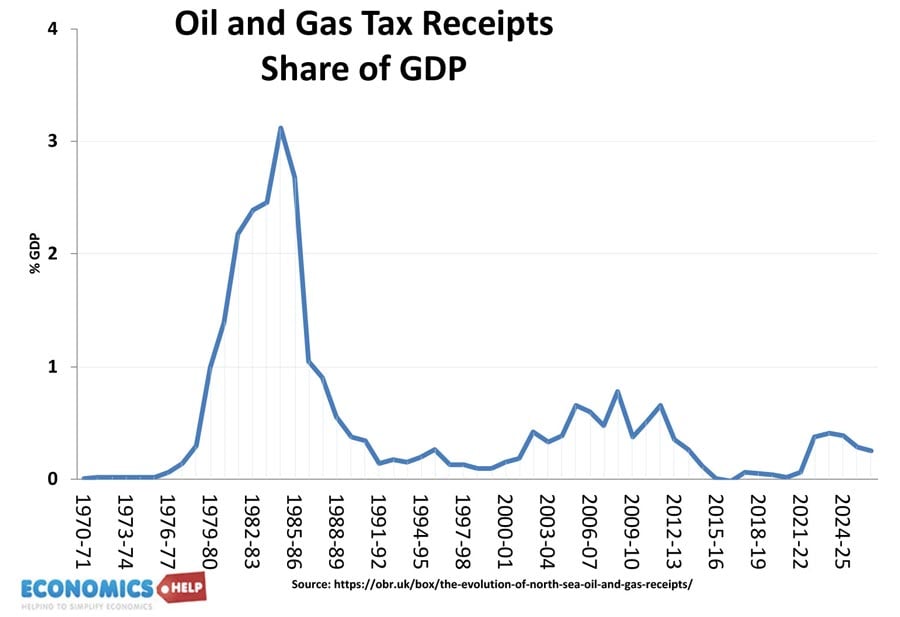

UK Oil

The UK by contrast is a very different picture. The golden days for the UK were the 1980s when oil revenues soared and helped fund Thatcher’s tax cuts. Both the Conservative and Reform manifesto proudly proclaim that they would ignore green objectives and encourage more oil exploration in the North Sea. But, the truth is the North Sea is a busted flush. The reserves are just not there. The recent announcement to allow more production is more symbolic than anything. The extra output is shaded in red, but the big picture is long-term decline, there is no economic boom from oil. There is shale oil and gas in parts of Britain, but there is no logic in drilling for gas in densely populated regions like Lancashire. US has a population density of 37 per km2. The UK is nearly 10 times that level at 279 per KM.

Spending and Saving

A third reason for the booming US economy is the willingness of consumers to spend. In the UK, we have been battered by stagnant real wages. But, all the uncertainty and cost of living pressures have caused consumers to be more pessimistic, and this has led to a rise in the savings ratio. Traditionally, the service sector is a strong source of UK growth, but consumers are holding back in the face of higher prices. The UK has also been more affected by higher interest rates. In the US, the most common mortgage is now a 30 year fixed, in the UK it is closer to 2 year fixed. This year more UK homeowners are facing higher rates. One thing that would help the UK’s economic growth is a drop in interest rates.

Net Migration

An interesting parallel between the US and UK economies is that both are experiencing rapid rates of net migration. In the US, high levels of migration may be unpopular, but they it is credited with making a more flexible labour market, eagerly used by firms who have been hiring more workers. Some claim it has played a role in reducing wage inflation. In the UK, net migration reached a peak in 2023, yet, these high levels of net migration seem to correspond to a period of stagnating real GDP per capita. In fact, in the UK net migration is responsible for 75% of the growth in real GDP. This contrast suggests net migration is neither a guarantee of strong growth, nor is it a simplistic reason for stagnation.

Yet, despite all the good news from the US is it actually worse than it looks? Real wages have barely grown in the past few years, and the growth has been maintained by a sharp fall in savings. This video looks at whether the US growth is too good to be true.

Related