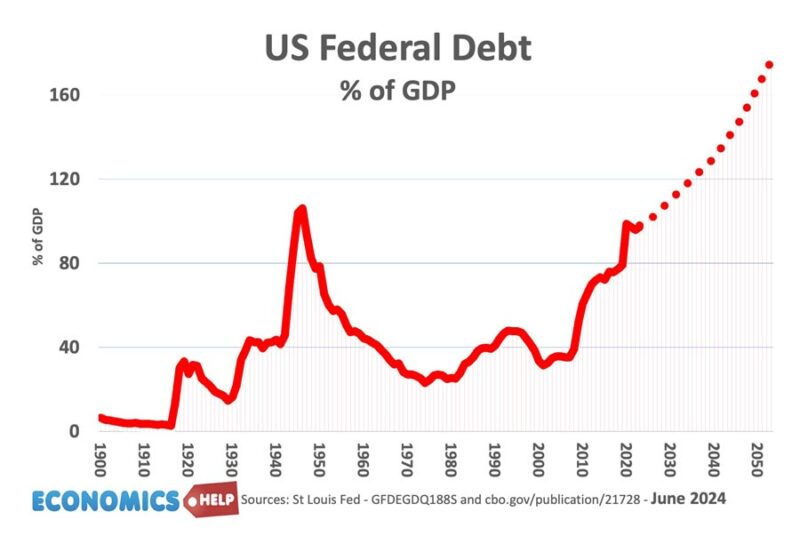

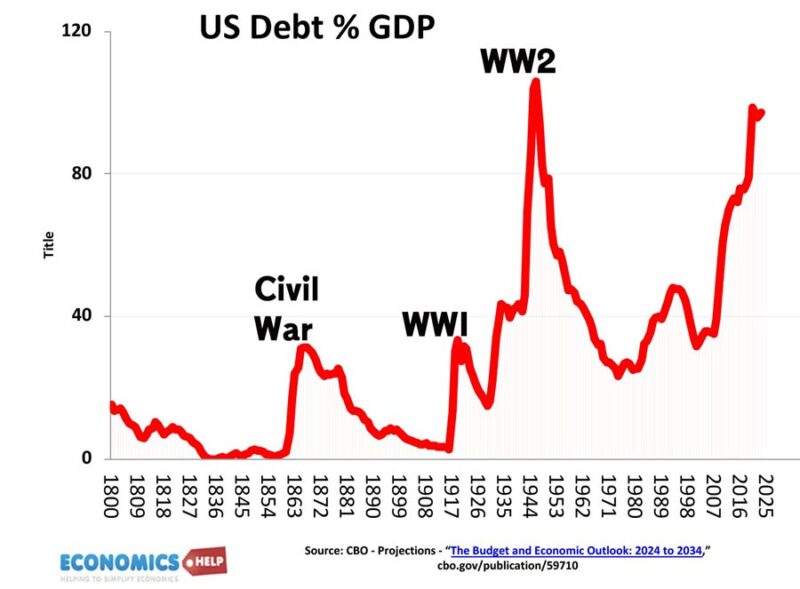

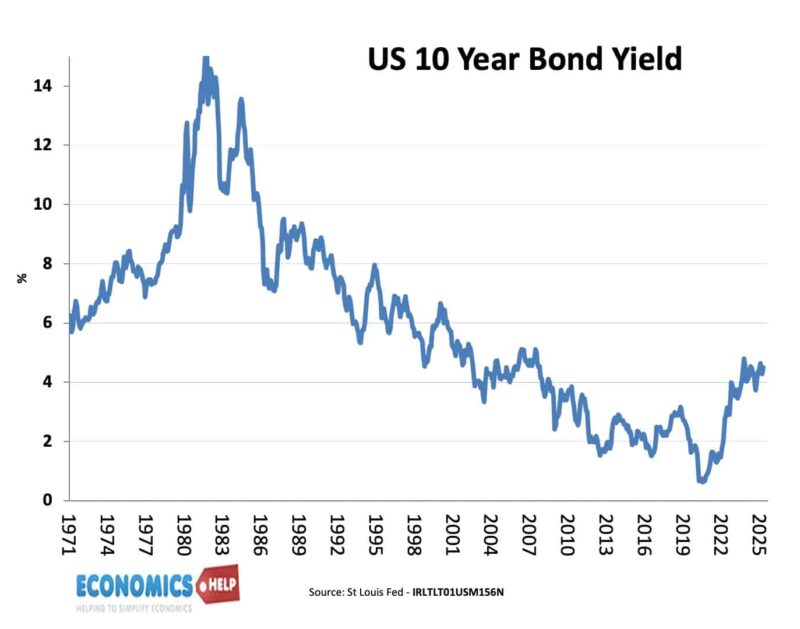

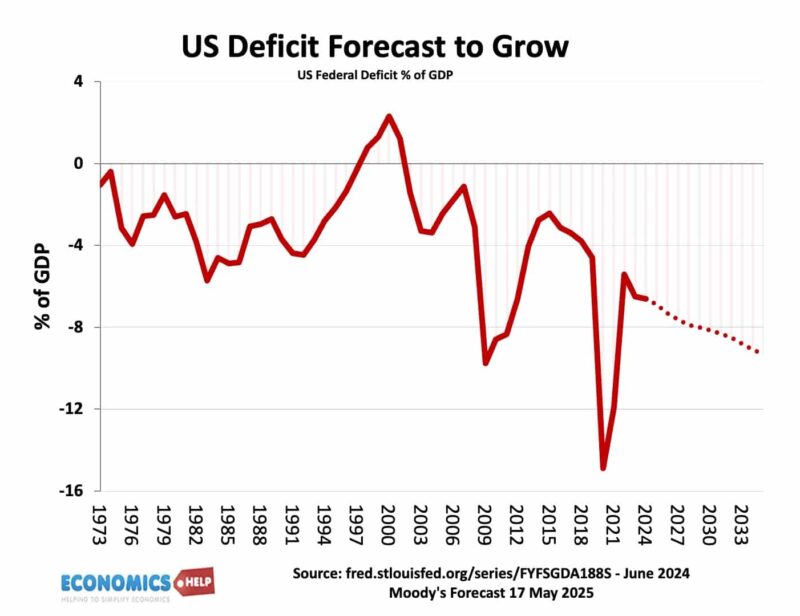

Last week, for the first time in history, Moody downgraded the credit rating of US debt, it has sparked long-term bond yields to rise to levels last seen in 2008. Moody’s predicts that the US deficit will rise to 9% of GDP by 2035. This is really unprecedented for peace time. The forecast assumes no major crisis like Covid, extreme weather events or a financial crisis. Last year the Congressional Budget Office forecast that on current trends and policies US debt would rise to 180% of GDP by 2050.

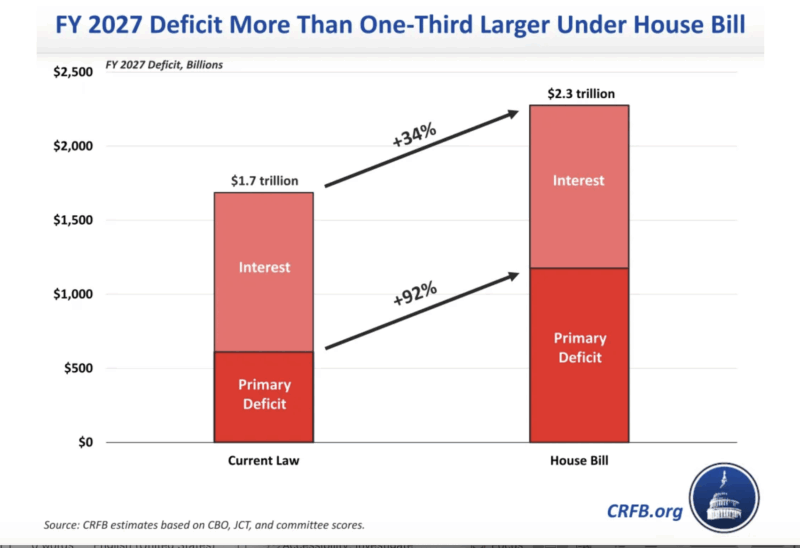

However, Washington is in no mood to reduce the debt. The current Trump administration are looking to extend tax cuts which will cause the deficit and debt to rise even further. There are some proposed spending cuts to food stamps and medicaid, but overall, the budget deficit will rise because of the scope of tax cuts, an ageing population, higher debt interest payments and increased spending on social security.

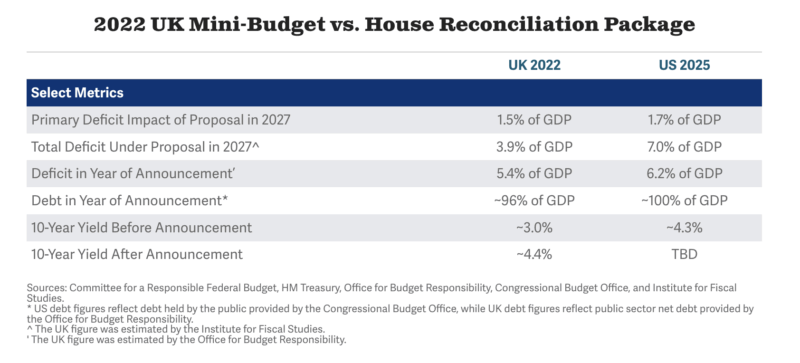

The planned budget suggests a 33% rise in the deficit. The Committee for a Responsible Federal Budget suggest there are interesting parallels with the Truss budget of 2022, which caused a meltdown in Sterling, and rise in UK bond yields.

In fact the total US deficit would be 7% of GDP higher than the then UK deficit of 3.9%. However, there are some important differences. UK inflation was 10%, and interest rates rising, US inflation is closer to 3%, and interest rates are still likely to come down a little this year. We won’t see a Truss-style meltdown, but the long-term trajectory is very interesting to say the least.

This year has been a bad year for US bonds, the long-term bond yield has risen, even as the stock market has fallen too.

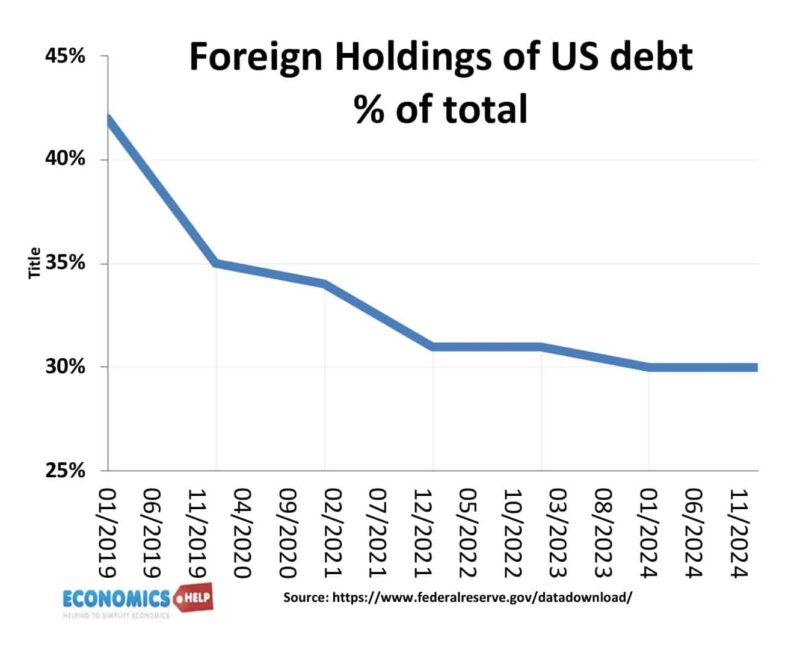

Many foreign holders of US debt are slowly and steadily reducing their exposure to US securities. China, Japan, Taiwan all are selling off US bonds, pushing up bond yields. China and other Central Banks has been buying large quantities of gold, which has seen gold prices soar, hardly surprising given the level of uncertainty in global economy.

As bond yields rise, it becomes more expensive for the US government to borrow. The CBO forecast that by the 2030s, the US will be spending 22% of total tax revenue on servicing debt. It will become one of the biggest areas of government spending. And as debt rises, it will put even more upward pressure on bond yields to keep investors buying. You might think a country as wealthy as the US should have no problem selling Treasury bonds, there is a lot of surplus wealth amongst the rich. But, the US political system could easily lead to wranglings over the debt ceiling which could force a government shutdown – the kind of event that could cause panic in the bond market.

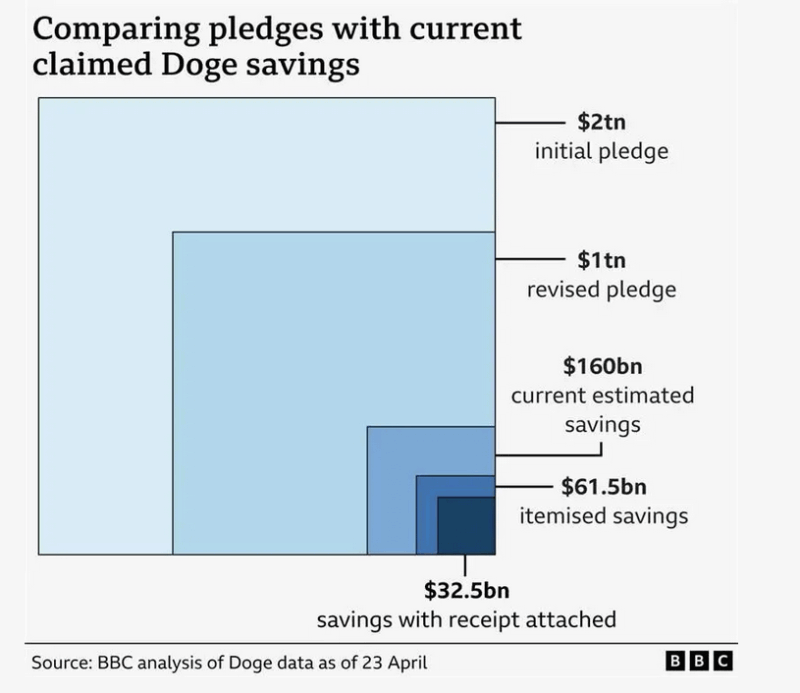

DOGE Savings

Elon Musk’s DOGE sought to cut away wasteful government spending. Initially claiming $2 trillion in saving cuts, that has now been reduced to $160bn, savings with receipts are even lower. The Partnership for Public Service (PSP) claims the cuts could cost the taxpayer $135bn in lawsuits from people losing their jobns, and lost tax revenue from layoffs at the Internal Revenue Service.

But, the bigger picture is that federal outlays in Feb and March grew £86bn or 7% growth compared to last year. That is annualised growth of $500bn mostly on social security, health care, defense and interest. The idea of cutting wasteful government spending is always popular, but the big drivers of US federal spending is social security and health, are all very popular with those who receive them.

So this is the bigger picture, like many other advanced economies, the US has an ageing population, in the past this has been muted by very high levels of migration. If this falls considerably, and fertility rates continue to fall, then the US may age faster than forecast. That means more spending on social security, but less income tax revenue.

US Growth

What has saved the US in the past, has been strong rates of economic growth, certainly faster than Europe and Japan. This US exceptionalism has been behind the US dollar’s strength in the past 20 years. But, since the start of the year, the dollar has been falling. Markets were a little cheered by the announcement of trade deals with UK and China. But, it is worth bearing in mind that although tariffs on China have fallen from 185% to 30%, they are still really elevated. After the announcement of cut in Chinese tariffs, the average tariff rate is 13%, less than 20% in April, but it still represents a big future shock to prices, consumers and businesses. Consumer expectations of inflation have shot up, and even with recent announcements, big firms have suggested prices will rise. The combination of higher tariffs, plus the uncertainty will adversely affect US growth in the coming months. Tariffs will raise a little revenue, but nothing like the sums needed to offset the income tax cuts.

Refinancing

However, the trade war is not the most pressing issue around debt. In the short term, the US needs to refinance $7 trillion of debt as debt matures. But, with bond yields edging towards 5%, it will be much more expensive than in the past decade. In the 2010s, US borrowing was made much easier by the process of quantitative easing with the Fed creating $6.8 billion of new money to buy bonds through process of QE.

Reversing QE

But, since 2022, the Fed has decided to reverse QE and is selling these bonds back onto the market. This means not only are bonds being sold to finance budget deficit. But, more bonds are coming from QE being reversed.

If US debt does increase out of control, then there is always the option for the Fed to go back to QE, creating money and buying bonds directly. In the 2010s, the impact of QE was relatively limited because inflation was low as the economy recovered from financial crisis. There was a 600% increase in monetary base, but inflation was relatively muted. However, since the return of inflation in 2022, creating money could be more problematic if banks use it to lend more to households and firms. Inflation is still above the Fed’s target and more money creation at this stage would see a contribution to inflationary pressures.

Is US debt out of control? no not yet. Despite foreigners losing interest in holding US securities, the US is a rich country which could easily change the trajectory of its debt if it wanted to. The top 10% of the US own 67% of the nations wealth. This is a staggering $113.5 trillion in wealth amongst the top 10%. Even very modest increase in taxes on the wealthy could reduce the deficit and debt to manageable levels.

Another alternative would be to cut government spending, like raise retirement age, cut defense spending, reduce access to medicaid and reduce pensions.

However, although, in theory the US could easily change its debt trajectory, markets will be concerned about whether there is the political interest in doing so. Republicans are keen on tax cuts, Democrats have a long list of spending wish lists. Like many other countries, there is little appetite for a deficit reduction.

In the long-term, a key factor will also be the trajectory of US economic growth. Many advanced economies have seen slower growth rates in recent years, and it is quite feasible the US could follow course. But, on the other hand, the US economy has benefited from many strenghts, strong levels of innovation, reasonable levels of infrastructure, rule of law, high quality education, high number of patents, and strong international reputation. However, if these are diminished or fall, then over time, it will adversely affect US economic growth and give the budget an even bigger headache.

Sources

https://www.bbc.co.uk/news/articles/cn4j33klz33o

https://www.crfb.org/blogs/interest-debt-grow-past-1-trillion-next-year?utm_source=chatgpt.com