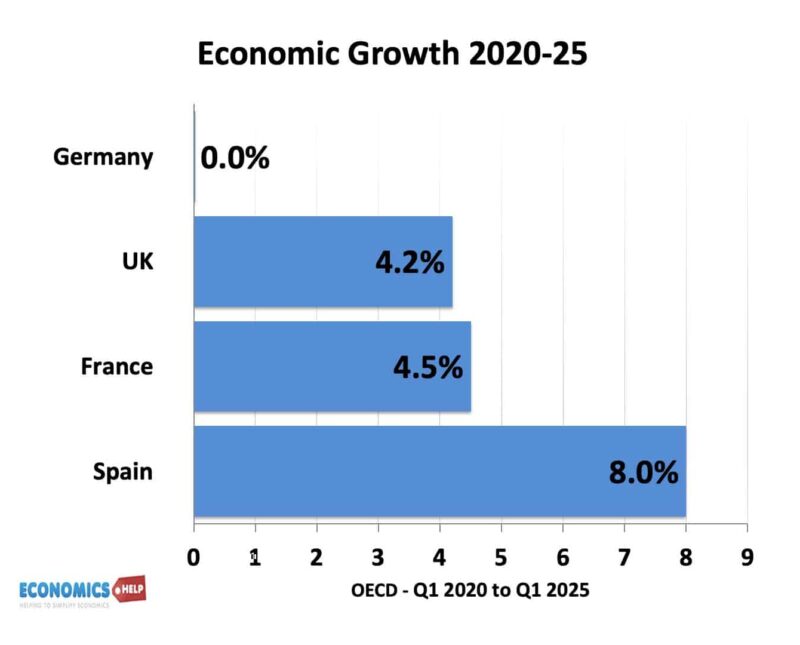

Since 2020, Spain has been one of Europe’s best-performing economies. Despite Covid, it has grown by 8%, outperforming the likes of the UK, Germany and France. In 2024, Spanish growth was an impressive 3.1%, (and according to the boast of a Spanish minister), accounting for 50% of all the EU’s economic growth.

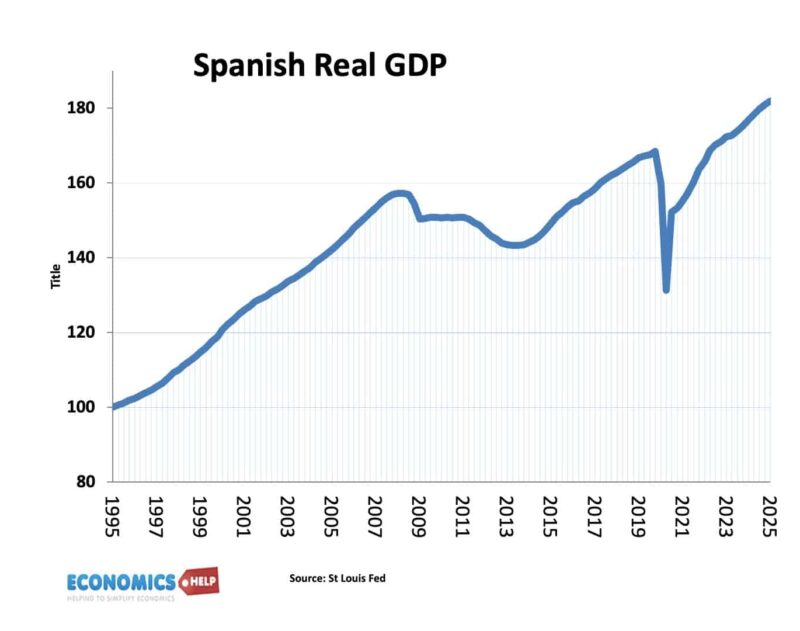

Euro Debt Crisis and Spain

It wasn’t always like this. The Euro Debt Crisis hit the Spanish economy hard. House prices crashed, bond yields soared, and Spain was forced into punishing austerity. It led to a decade of negative growth and an unemployment rate of over 25%. Combined with one of the lowest birth rates in Europe, just 1.16, the future looked bleak. In the post-crash era, Spain was left with unsold houses, roads to nowhere and derelict white elephant airports like Castellon and Ciudad.

In the boom years, local politicians had boasted about the latest vanity project, but a derelict airport with a half-finished statue to a disgraced local politician was more than symbolic.

With youth unemployment of over 50%, and an economy in special measures, there was a mood of despondency and net emigration as people left Spain. Yet, in recent years it’s economy has been revitalised, helped in large part by a huge movement of people. Tourism, long a staple for the Spanish economy, has received more than just a post-covid bounce, with one study suggesting it will become Europe’s most popular destination by 2040.

Housing Costs

However, whilst tourism has boosted revenues, economic growth and the balance of payments, it has also come with a darker side. High migration and exploding tourist numbers, especially through AirBnb rentals have meant many locals have become priced out of housing in tourist hotspots. Protests have rocked major tourist cities like Barcelona with angry demonstrations. Like other parts of the world, it seems growth has come at a big cost.

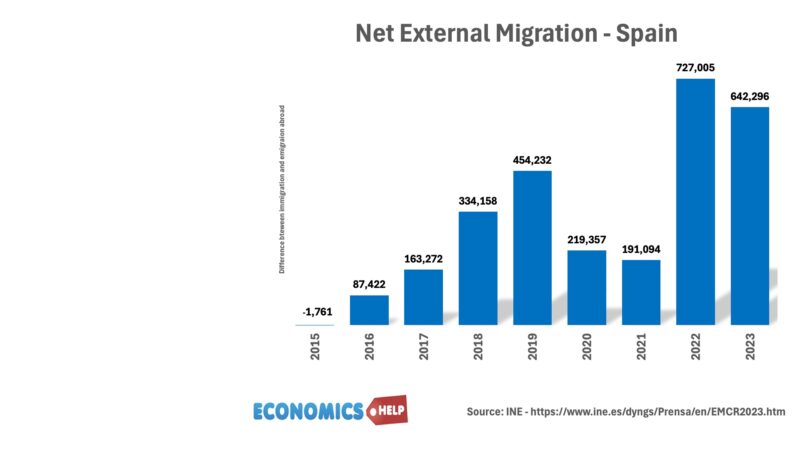

Net Migration

Also, this growth in tourism and the economy couldn’t have been achieved without a boom in net migration. In 2 years, there was net migration of 1.38 million people entering Spain 3% of the total population. Since 2021, over one million migrant workers, often from Latin America have gained jobs, reflecting 75% of the growth in the Spanish labour market. But, unlike say the UK where high levels of migration have corresponded to stagnant real wages, Spain has managed to combine high migration with rising real wages. The rise in real wages has been helped by a boost in the minimum wage, meaning the lowest paid workers have seen the biggest rise in wages. It means that when adjusted for purchasing power, Spanish wages are now only slightly lower than the European average.

EU Membership

When Spain joined the EU in 1987, living standards were around 72% of the European average. But, after four decades in the EU, this has increased to 92% of the EU average. Despite the very painful years of the Euro debt crisis, most Spanish can see the benefits of EU membership with above average support.

Even today, Spain continues to benefit from EU funds. It was the second largest recipient of the EU’s post-covid Infrastructure and recovery fund, gaining €150bn of investment in housing, energy and infrastructure. Like Italy, this has definitely helped Spain’s recovery. As well as EU funds it has successfully attracted foreign investment, especially in renewable energy, AI data centres and electric car manufacturing. Although Spain has not particularly prioritised manufacturing, its huge boom in solar power and access to natural gas from north Africa has given Spain one of the lowest electric costs in Europe. The industrial cost of electricity in Spain is half the cost of the UK and this has helped Spain remain competitive. Spain gains 58% of its energy from renewable and capacity is set to continue rising. However, the recent blackout in April 2025 was a major setback to this goal, with the power failure blamed on the low inertia of solar power, a lack of suitable backup and insufficient energy grid systems. Reaching 80% renewables may be more challenging than expected.

High Speed Rail

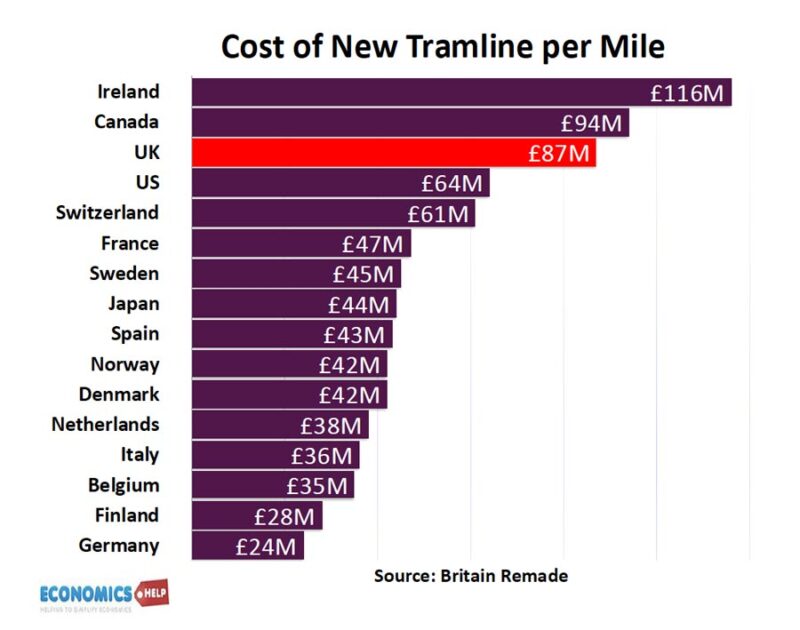

Another aspect of Spain’s strong economic growth has been successful investment in high speed rail, and new metro lines. Spain has 4,000km of high speed rail, built at relatively low cost, and is very important for a country with a large geographic distance. The UK has only 113km and will spend the best part of two decades to tortuously try and build the next 200km from London to Birmingham. A key factor is Spain’s ability to build at relatively low cost. It’s average building cost is just €17.7 million per km, compared to a European average of €45 million, and a UK average of €232. Partly, this reflects lower population density and easier terrain, but it is much more than; it is a relentless focus on simple, repetitive design to minimise costs, learning from experience and a relatively simple planning system.

Spain has been successful in building and extending metro systems in major cities such as Madrid, Barcelona, Sevilla and Malaga, again, it has achieved this at much lower cost than other countries. And these improved train links have been vital for commuters who work in major cities, but feel increasingly priced out by high housing costs.

And this is the darker side of Spain’s recent economic boom, the Bank of Spain suggests that since 2020 there has been an increase in national rents of 30%, even more in tourist hotspots and major cities. And this increased housing costs are more than enough to wipe out gains in real wages. Damaging housing costs is a familiar refrain from many countries, and it seems Spain is no exception, taking the gloss out of the apparently good economic growth. It means for all the impressive GDP statistics a large majority of the population don’t feel the benefit. Analysis suggests that in major cities, many tenants are paying over 50% of their earnings on rent. In Madrid to rent an average flat costs around €1,650 a month, which on an average salary of €2,340 is an eye-watering 71% of income.

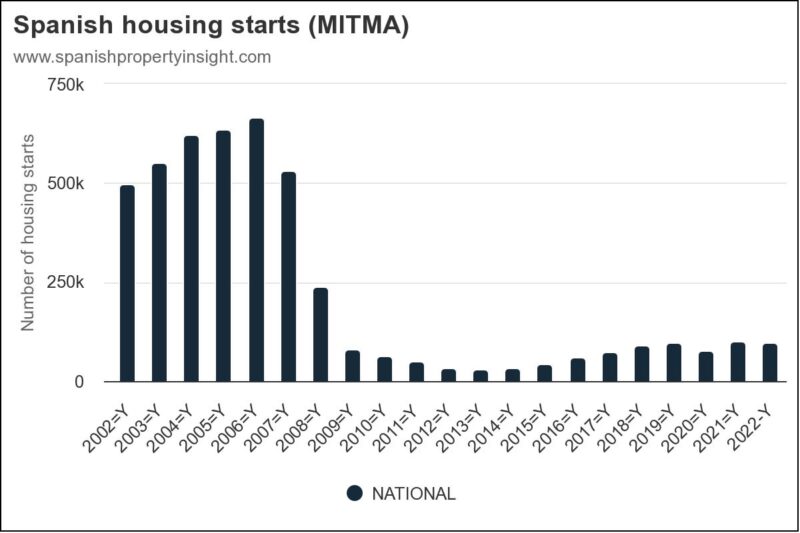

One reason for the low supply of housing is that in the financial boom years of the 2000s, Spain had a bubble in house building. It meant that when markets crashed, Spain was left with unsold housing and prices collapsed, many construction firms went under and so the construction sector is smaller than pre-crisis. Given a large rise in population from high migration levels, the supply of housing has failed to keep up with demand. The government has tried to impose price caps on renting, but this has the effect only to reduce the attractiveness of renting and tends to create a two-tier rented sector with market prices far exceeding official rent caps.

Good news

It’s not all doom and gloom; it is worth bearing in mind that Spain’s economic growth has been more broad-based than tourism. It has excelled in the service sector exports, with a growth in banking and financial services. In 2024, non-tourism service exports reached €100 billion, more than even tourism. And many of the former ghost towns and abandoned airports have found themselves actually proving more useful than expected. Castellón airport, once a disused white elephant is now accepting 300,000 passengers a year, with 14 regular European roots. Even towns almost abandoned in the crisis years on the outskirts of Madrid have been revitalised by super-fast rail connections and a growth of workers trying to find affordable housing.

Living standards stagnated

Yet, for all the good news, average households are not convinced, with housing costs eating into real wages. Also, despite years of austerity, government debt is still over 100% of GDP and the coalition government struggles to pass through even minor tax rises or spending cuts. Another problem looming on the horizon is Spain’s small share of spending on defence. With Trump pushing Nato countries to spend 5% of GDP, Spain is nowhere close, with just 1.28% of GDP on defence spending in 2024. To get anywhere close would require huge opportunity cost, which will not be easy with an ageing population.

So far, mass migration has not proved as politically toxic as other countries, helped by boost to economic growth. But, if housing costs continue to soar, it is only a matter of time before attitudes could change very quickly.

Spain has done many things well, but like many countries around the world, it hasn’t managed to keep a lid on housing costs. Also, with one of lowest birth rates in the world, how long can Spain rely on mass immigration to deal with the looming demographic crisis.

Sources

https://www.bbc.co.uk/news/articles/cp8d87l6lp1o

https://www.ineco.com/ineco/en/communication/news/spain-produces-most-efficient-high-speed-world

https://www.the-cword.com/post/c-for-challenging-the-costs-analysing-uk-s-high-speed-rail-network

https://www.economist.com/europe/2024/12/12/spain-shows-europe-how-to-keep-up-with-americas-economy

https://euroweeklynews.com/2025/06/04/madrids-ghost-towns-are-being-revived-to-curb-spains-housing-crisis/