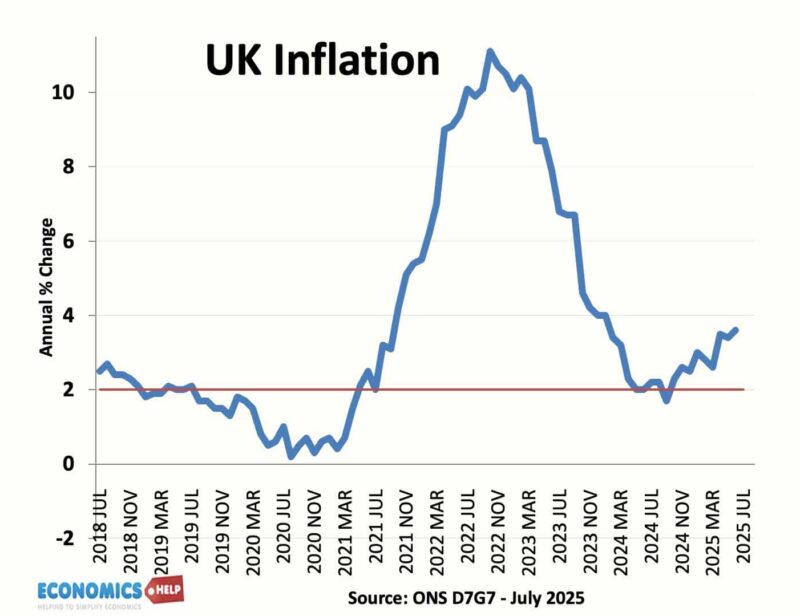

It’s been a week of unexpectedly bad news for the UK economy. Inflation was higher than expected 3.6% and core inflation 4.3%.

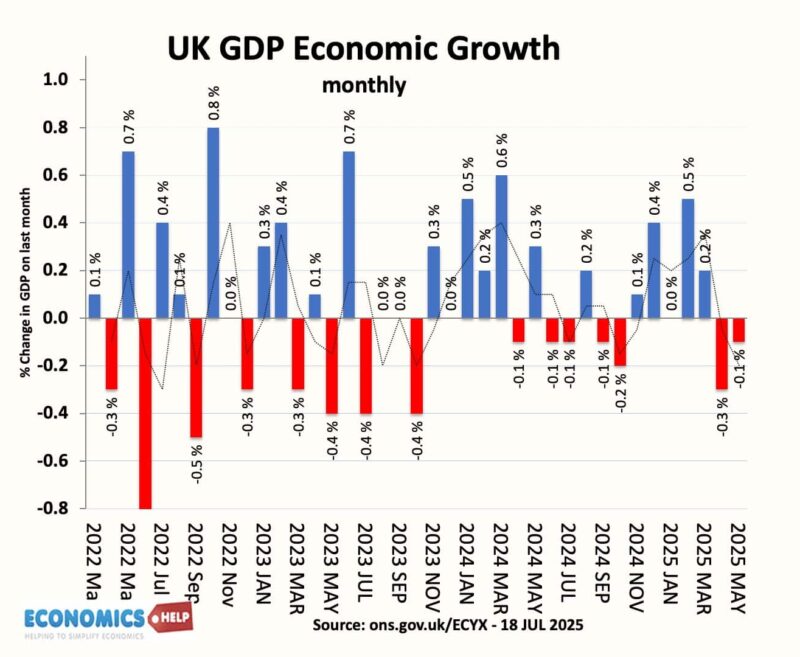

Unemployment was also higher than expected, and that is after last weeks economic growth was lower than predicted – a 2nd month of negative growth.

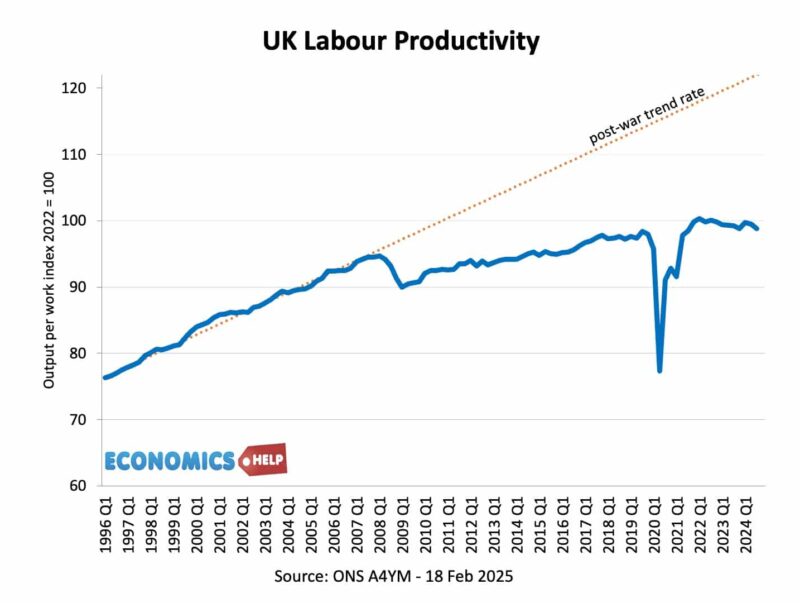

It is only a matter of time before government finances come in worse than forecast. In fact, you might ask – what is unexpected about the UK economy doing a bit worse than forecast, it’s been underperforming for many years, as this over-optimist forecast on productivity from the OBR shows. And talking about overly optimistic forecasts, this shows the OBR’s forecast for net debt and the actual debt profile. In other words, the OBR predict debt will rise and come back down, but the reality is it just rises 15% over five years.

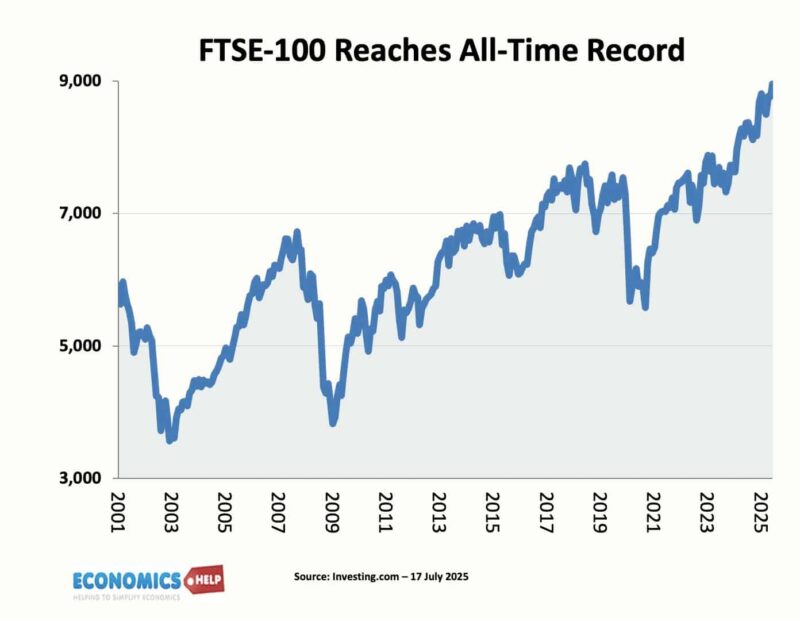

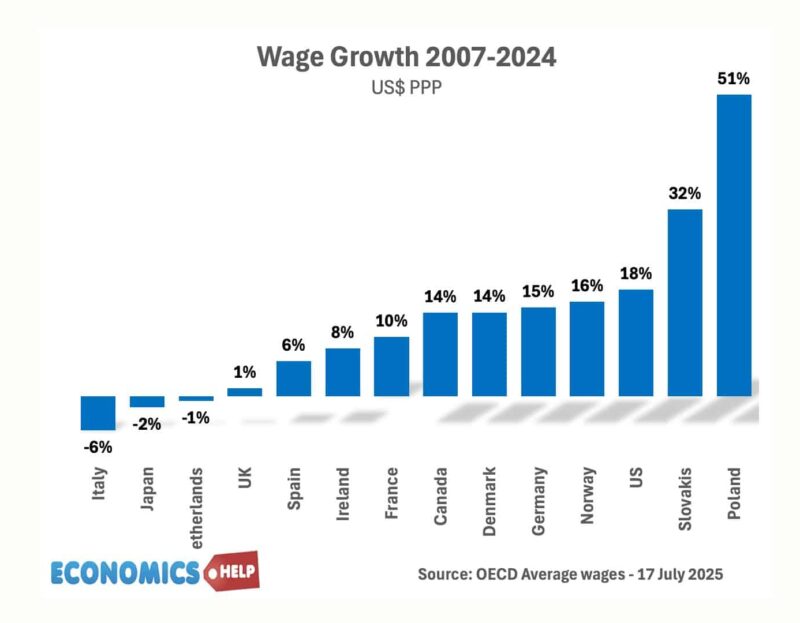

But, if the economy is doing so badly why is the FTSE-100 roaring past the 9,000 mark, hitting record levels? Well, I would always take stock market performance with a pinch of salt. It is not always a reflection of the real economy. Ironically, the UK stock market is benefitting from years of undervaluation, international investors are reducing exposure to the US and investors like BlackRock see the UK as a bargain basement. In fact, the economist recently ran a leader saying the great strength of the UK economy was that because wages were so low, it made the UK internationally competitive, with JP Morgan saying the UK was closer to India than the US for technical banking services.

Lower Pay

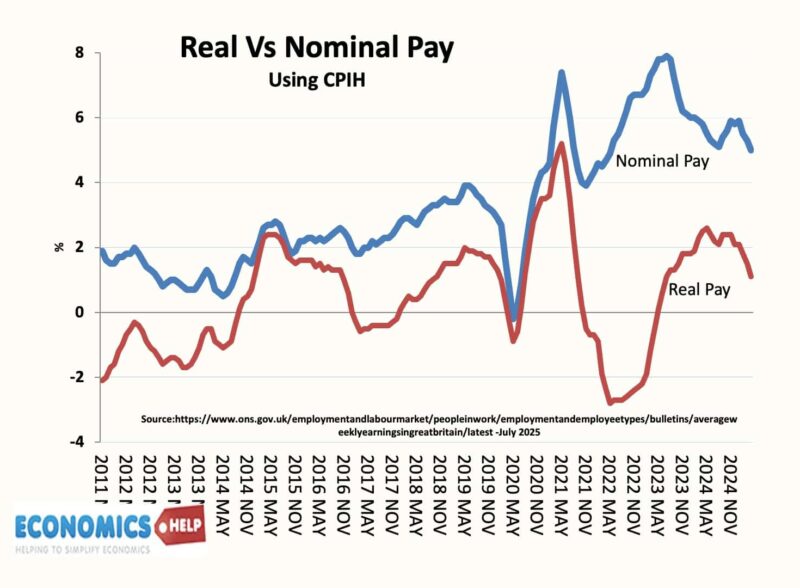

One of the few growth areas of the UK economy in recent years is financial and legal services, basically sending emails to confirm contracts. The UK is very good at this apparantely, although, the AI revolution may pick off many of these jobs in the coming years. As regular viewers know, I do try to make an effort to pick up on the relative brighter parts of the UK economy. And in recent months that has been relatively positive real wage growth. But, with inflation persistently high, real pay has been omniously droping back down.

It seems the previous spurt of real pay was more about catching up lost ground from the pandemic, than a fundamental shift. One reason for higher pay was driven by higher government pay settlements. For example, last year doctors received a 22% pay rise, but now they are on strike for another 29%. They argue that in the 2010s, real pay lagged behind, and working conditions are genuinely. But, given the fiscal backrop of the UK another 29% rise for doctors is optimistic to say the least.

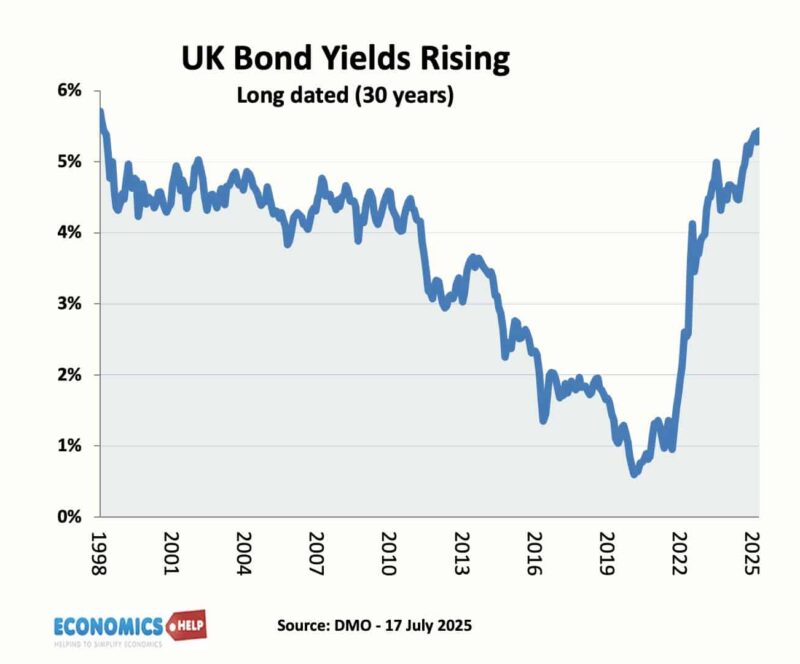

Because whilst the stock market may be booming the bond market isn’t. Bonds are falling, and long term yields continue to climb to the highest level since 1998 a reflection of higher debt, higher inflation and global instability. It has created a sense UK economy is walking a tightrope. The spectre of Liz Truss looms large over the current government. It was the state of government finances that led to a rise in NI tax on employers, a word salad of trying to avoid taxing working people. But, the rise in NI, combined with increased labour regulations and relatively weak demand, have seen a rise in unemployment and fall in vacanices, the biggest drop in employment are in hospitality, an area particularly affected by rising NI. The biggest growth in employment was in health care. It is symbolic of future employment patterns, government spending taking bigger share of economy, but with a shrinking tax base.

Higher Tax

The problem is that come October, unless a magic rabbit is pulled out of a hat, taxes will need to rise again. It will probably be a combination of a higher tax on banks, higher petrol tax plus freezing personal allowances. Some taxes are better than others. But, when growth is weak and taxes go up, it does have the impact of reducing consumption and investment.

Bank of England Dilemma

The tightrope equally applies to the Bank of England. On Wednesday after higher inflation, there were calls for higher interest rates. On Thursday after higher unemployment, there were calls for lower interest rates. The problem is interest rates are pretty ineffective in dealing with stagflation, when you get the worst of both worlds.

Inequality

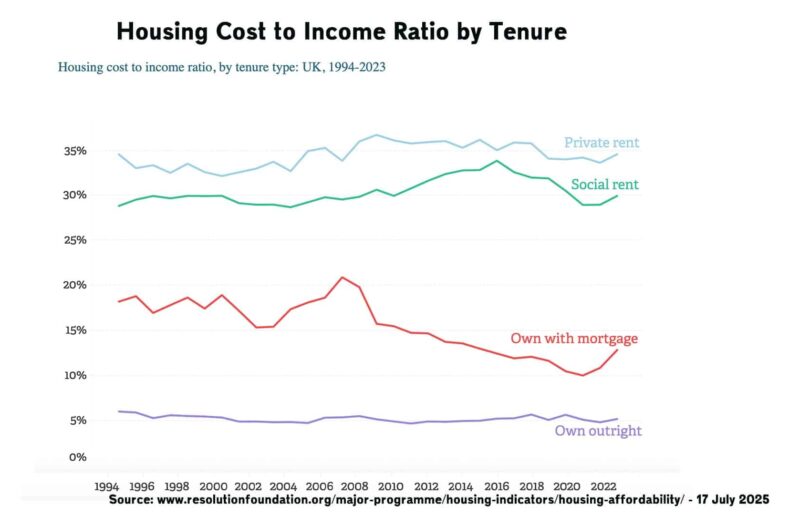

But, the problems facing the UK economy are more than just bad macroeconomic data. Different sections of the economy are experiencing the economy in different ways. To give one example, I was struck by this chart from the resolution foundation, showing how those renting are spending a significantly higher share of their income on housing than those who own a house outright and even those with a mortgage. Don’t forget these are averages; some private renters will be an even bigger share.

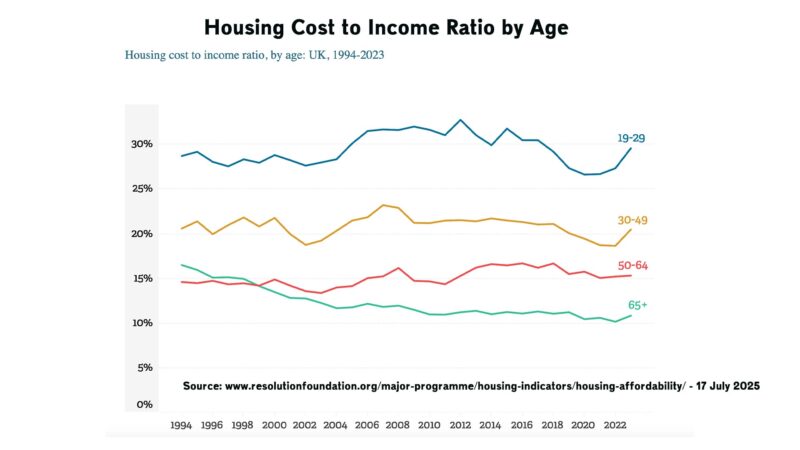

There is also a huge discrepancy over age. Those under 30 facing housing costs of 30%, but the over 65s just 10%. It is hardly surprising that the share of adults living with parents has risen from 40% to 51%

Housing costs are often ignored and we focus on actual income. But, it is worth mentioning that pension benefits have risen substantially more than say child benefit. The pension triple lock has proved more expensive than expected, and if the economy continues with volatility of inflation, the state pension will rise to 9% of GDP in the coming decades. I’m not against higher pensions per se, but there is an underclass of low income households, with growing poverty rates. The Joseph Rowntree Foundation predict that including housing costs will see living standards deteriorate, especially for low income groups. The economy may be struggling but some are much more badly affected than others.

Savings Ratio

Another kind of strength in recent years was the rise in the savings ratio. This was a strength in the sense it shows households have more latent spending power. But, it also reflects the weakness of consumer sentiment and pessimistic outlook that things will get worse in the future. However, even the saving rate declined in the first quarter of 2025.

It is tempting to blame everything on whoever is in government, but the economy didn’t start to perform badly in July 2024. It was a pretty terrible inheritance. The fundamental problem is that the whole performance of the economy has gone into reverse since the financial crisis of 2009. It is true that other countries have experienced a slowdown, but the UK is amongst the worst relative decline.

When productivity growth slows down to a trickle, then GDP per capita growth will be limited and it becomes very difficult to give any significant increase in real living standards and the government is left with a worse trade off, falling tax revenue, but greater strain on public services. The problem is after shock of financial crisis, Brexit was another negative shock, then the Ukraine War and a surge in gas prices affected the UK economy more than others. The problem is the UK has been more vulnerable to shocks, both self-inflicted and external.

Structural Problems

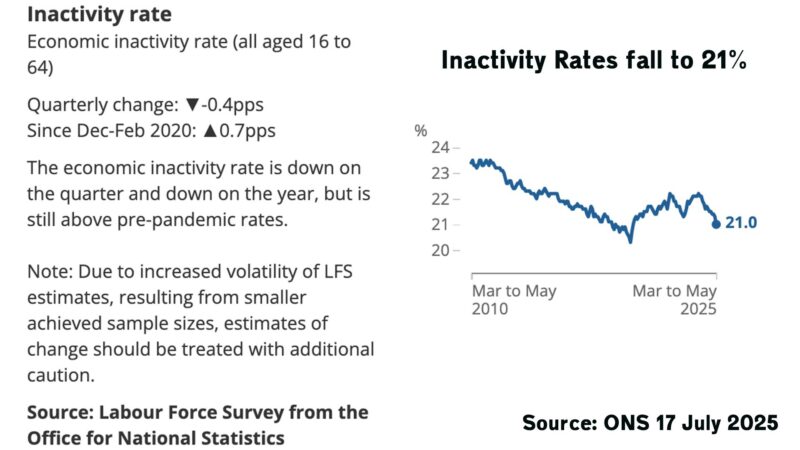

There are structural problems like low investment, which has been a growing problem since 2016. Also, there has been a a rise in the numbers of people not working. It is not just higher unemployment, but a rise in numbers of people on sickness benefits too. This both hits productivity, but also has led to a growth in in work benefit payments, which will be substantial over the coming years.

If you’re looking for some good news, the ONS do report a sharp fall in inactivity rates in the start of this year, this is welcome, but you will also notice the ONS state our stats may be too unreliable to use.

If that all sounds pretty grim, there are a few things worth mentioning. It is always best not to get carried away by monthly data being slightly worse than forecast. There is a good case for the ONS not publishing monthly growth figures, they are too noisy. The best is looking at growth over past 12 months. Although inflation continues to disappoint there are reasons to expect it to fall later in the year. When it does fall, the Bank will reduce interest rates.

https://www.economist.com/leaders/2025/07/10/britain-is-cheap-and-should-learn-to-love-it