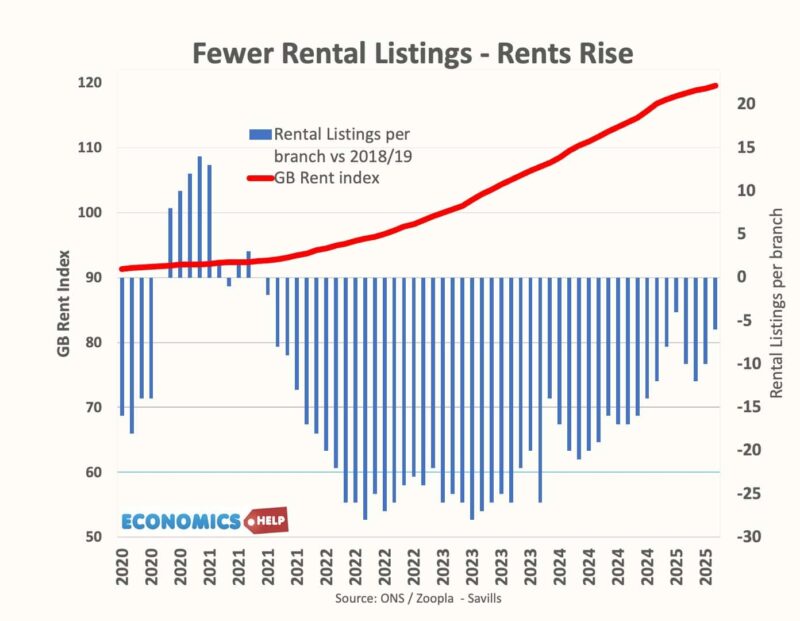

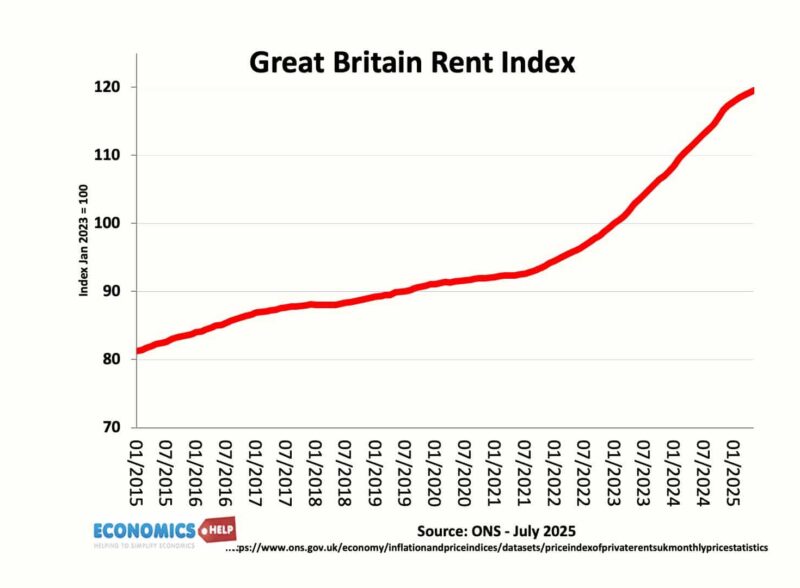

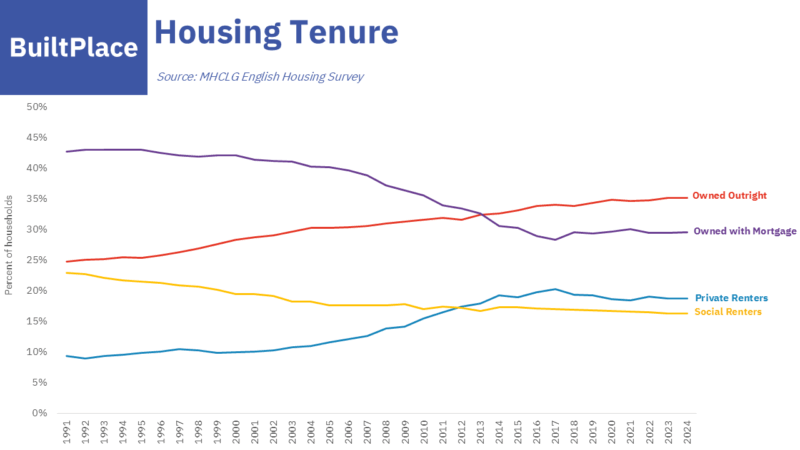

Since the early 2000s, the number of households in the private rented sector has roughly doubled to 5 million in Great Britain. However, in recent years, the number of rental properties listed has been falling. This mismatch of rising demand and shortage of supply is a key factor behind rents becoming more expensive.

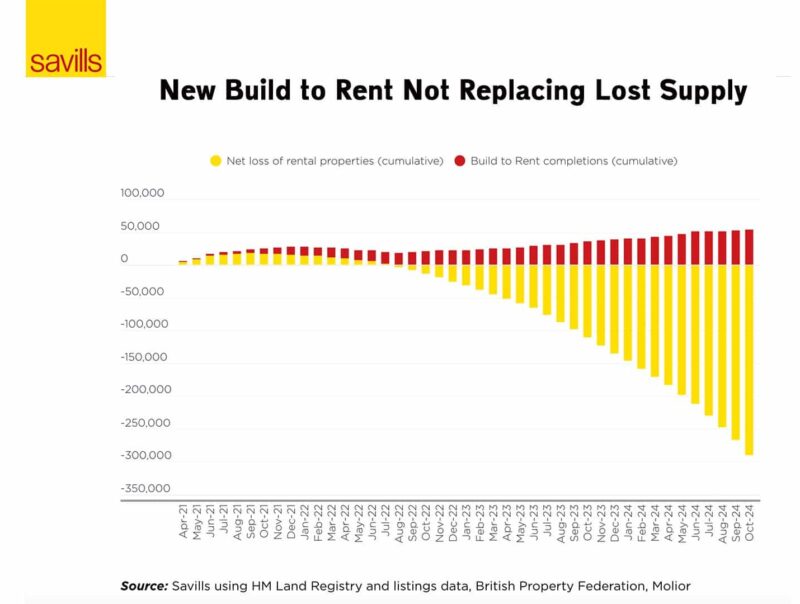

Since 2021, listings have declined, and rents have risen 30%. Yet, whilst domestic amateur landlords leave the market, they are being replaced at least partly by big foreign private equity and corporations. There has been a rise in build-to-rent, which tends to be properties owned by large corporations, over half of the capital comes from abroad, such as US private equity.

However, whilst new build to rent is welcome, it is not replacing the net loss of properties, which, according to Savills, is much greater. This all leaves an uncertain future for private renters, who can be paying 32% of their income on housing costs, a sharp contrast to homeowners who typically spend a much smaller share of income. And, with house prices on average eight times income, an increasing cohort of young people is facing renting for life.

Why Landlords Leaving?

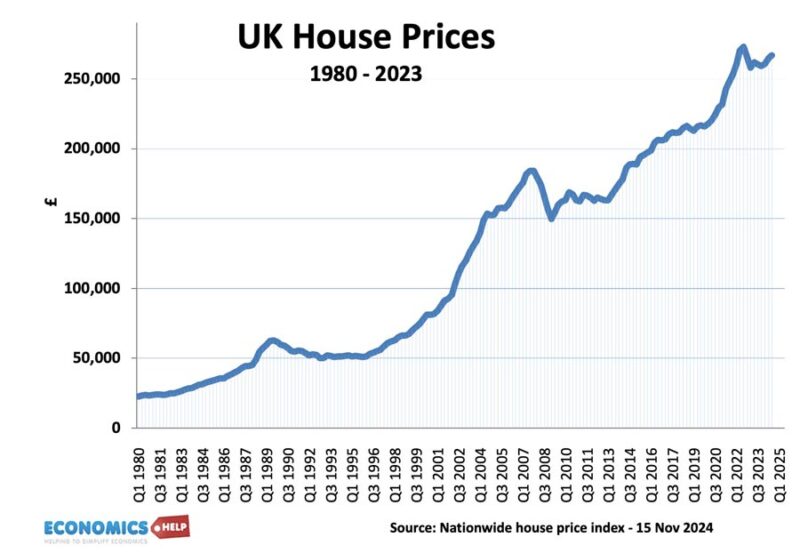

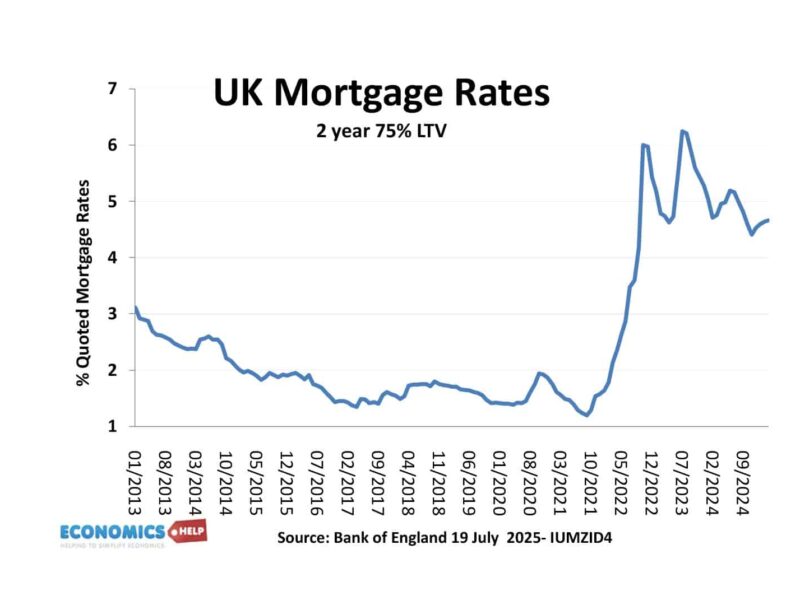

But if rents have risen 30% in a few years, why are private landlords pulling back from the market? Well, there was a time when buy to let was seen as a license to print money. Those who bought houses in the mid 1990s or even mid 2000s, will have seen rapid capital gains which far exceeded any inflationary impact. Not only that but there was relatively favourable tax treatment, and landlords could even claim mortgage interest relief. But that is all going into reverse, the share of buy to let mortgages is unmistakably falling. Successive government legislation has removed tax advantages, increased the rate of stamp duty for landlords and also introduced new regulations which are swinging the balance more in favour of renters.

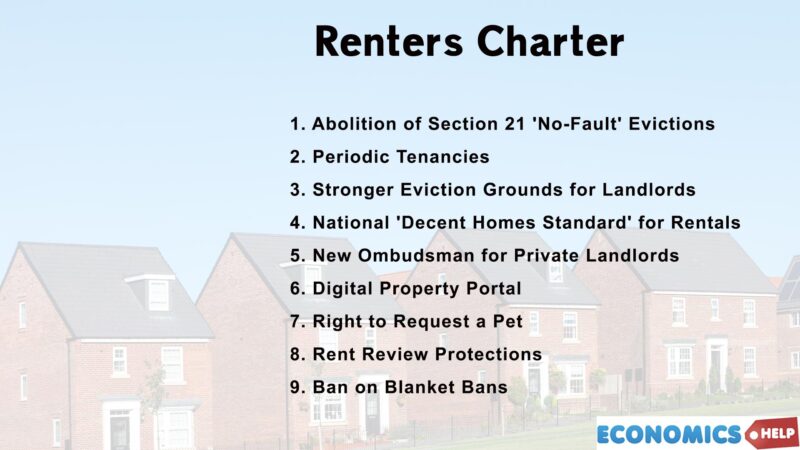

Renters Charter

The new renters’ charter will also strengthen the position of those renting, but increase costs for landlords and possibly reduce supply further. According to a survey by buy to let lender Lindsay 16% of landlords say they will sell all their rental properties if the bill goes through. In theory, 750,000 properties will drop out of the market. I would be sceptical of that figure, we have been talking about landlords exiting the market for years.

However, the statistics do show a steady decline already. The age profile of landlords is also quite high, many who bought over 10 years ago, are sitting on capital gains and with more hassle to let, selling up to finance their retirement will make sense. The impact is more houses coming onto the market for sale, which will keep a lid on house price inflation, good news for first time buyers, but not good news for renters.

It is worth bearing in mind generation rent is an increasingly influential political force, with around 11 million people living in the private rented sector. Generation Rent have increased the pressure to loosen planning regulations, the YIMBY voting block, but also have been key in strengthening renter rights and rent controls.

The decision to extend the vote to 16 year olds and also automatic vote enrollment will only increase the political salience of renters even more.

In 1991, 40% of households were owned with a mortgage and just 10% private renters. Today, that gap has narrowed sharply.

Why Landlords Leaving?

Ever since 2021, there has been a strong net balance of landlords who say they are planning to leave the industry. A combination of factors make it less attractive. Firstly, buy to let properties now incur an additional 3% stamp duty surcharge. For houses over £250,000, investors will face a marginal stamp duty rate of 10%. That’s a big burden. In the past, a landlord could have relied on rising house prices to recoup this kind of cost. But, stretched by high income ratios, the likelihood of big price rises seems far distant. After the temporary Covid boom years, when interest rates were near zero, and the Bank introduced a new wave of quantitative easing, house prices soared, but since the,n rising mortgage rates and a reversal of QE have taken away that sugar rush of cheap mortgages. Adjusted for inflation, house prices are lower than 2022. In fact real house prices are still lower than 2007. If you are looking for capital gains, the housing market is not the one-way bet that it used to be.

One interesting observation is that as buy to let mortgages fall, there has been a rise in first time buyer mortgages. This is likely to be further helped by lower stamp duty rates for first-time buyers and a weakening of mortgage restrictions introduced after the financial crisis, which will once again enable higher income multiples. Also, because private renting is so expensive, it encourages people to try really hard and buy wherever possible.

Good Investment?

If a buy to let investor asks whether housing is a good capital investment, it would be hard to get enthused. Despite falling house price inflation, the ratio of house prices to incomes is not far off record levels. Affordability is weak, and with low income growth, it is hard to see prices rising. Savills offer a speculative five year forecast of 23% growth, the OBR just 13%, no one really knows that far in advance. But, once you account for inflation, even optimistic forecasts offere little real capital gains, certainly after costs and tax.

In addition to the prospect of stagnant house prices, many landlords will face higher costs. Firstly, just the usual wear and tear repairs have become more expensive since 2021 due to inflation. But the new rental legislation includes an end to section 21 no fault evictions, new licensing and safety checks schemes. The renters reform bill also gives tenants stronger rights to challenge rent increases and new rules around deposits. Also, for some landlords with older properties, the requirement to bring up houses to the environmental EPC grade C standard from 2028 will be very expensive. The UK has a high share of old draughty properties.

New Face of Renting

But, if the buy to let dream is over, who is going to be renting properties to the 5 million households in need of renting? Well, the big change is that private equity is getting involved in buying up properties for rent. According to Savills, private equity bought 5,000 homes in the year to September up 20% on the previous year. This sector is been driven by large private equity and large institutions such as Lloyds and Legal and General. In this regard, the UK is catching up with global trends. Currently, in the U,K just 3 per cent of rental homes are owned by institutional investors — compared with 37 per cent in Germany and 41 per cent in the US. But, this low rate is set to change. Blackstone, the world’s largest real estate investor, has bought about 4,500 rental homes from Vistry since late 2023, in two deals worth £1.4bn. Private equity sees the rental market as a strong, profitable business; they are less concerned about short-term capital growth, they are in it for the long-haul. They also have huge reserves of capital to invest. The impact of this change on the rental sector is uncertain. But, they are not in it out of charity.

Rental Yields

According to UK Finance, the average UK rental yield at the start of 2025 is 6.94% with an average buy to let mortgage interest rate 4.99%. This is higher than the rental yields of, say, 2017, when it was around 5%, but also mortgage rates are significantly higher. There is also regional variation with the best rental yields in areas of cheapest house prices like the north east, Scotland, and the lowest yields in London and the south east. So for a potential buy-to-let investor, it isn’t an attractive option unless you are skilled in doing up properties. But, this leaves the rental sector increasingly reliant on private equity and the new type of institutional investor.

Sources:

https://pe-insights.com/record-1-5bn-invested-in-uk-rental-market-by-private-equity-firms/

https://www.resolutionfoundation.org/publications/through-the-roof/

https://www.ft.com/content/0bcdcdd8-2e6a-4acd-bb70-5f003254842e

https://www.ft.com/content/5af7d6eb-1d2c-4298-81d0-b3a71bcfd953