Definition of tax tolerance – The amount of tax that a population is willing to tolerate and put up with.

In the western world, there are strong political movements to resist higher tax and commit to lower tax rates. The amount of tax a nation is willing to accept depends on many factors.

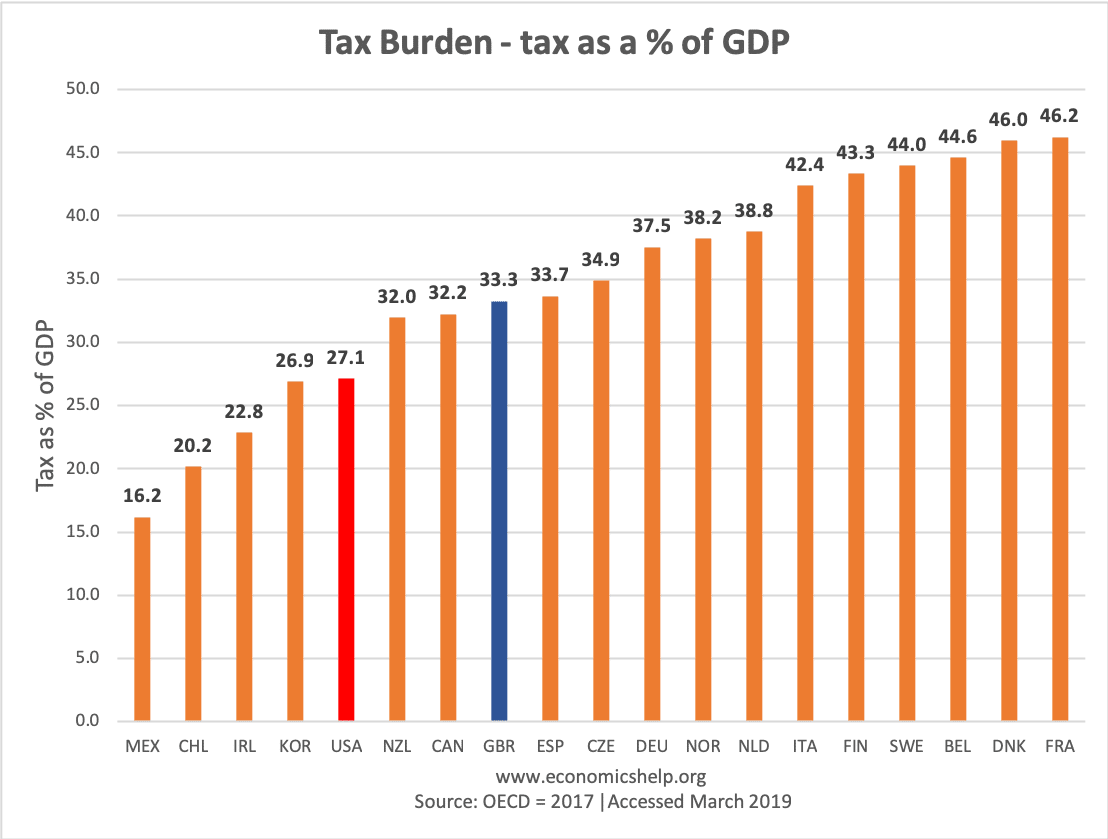

For example, the strongest tax resistance movement is probably in the US, despite its tax levels being lower than in Europe. This perhaps reflects the US (28% of GDP) preference for individualism vs collectivism.

In Europe, there is broader support for a government-funded welfare state / Health care. Some of the highest tax rates are found in Nordic countries such as Denmark (48% of GDP) Sweden and Norway. However, these countries also display some of the highest standards of living, with comprehensive public health care and welfare services.

Resistance to tax isn’t just based on tax levels but the type of tax. Broadly speaking there is greater tolerance of tax if it is:

- Considered to be fair – e.g. there was widespread resistance to the poll tax in the UK

- Considered to influence economic behaviour in a beneficial way e.g. higher taxes on cigarettes and alcohol.

Although nations generally welcome more progressive (i.e. fairer) taxes, it is also the case that often the most vociferous opponents of higher taxes are business and high-income earners. You could argue that those who control the media have a vested interest in promoting tax breaks for business and high-income earners. For example, the recent Bush tax cut benefited the top 2% of earners the most. (Bush tax cuts for high earners at FT)

Tax Tolerance and Government Spending

The tolerance to tax may also be determined by what the government is perceived to be spending money on.

For example, during wars, tax rates usually rise to finance the cost of war. An ageing population and increasing number of adults on welfare benefit may reduce tolerance of higher tax rates, as generally there is less enthusiasm for paying taxes to pay pensions and welfare benefits.

Alternatives to Tax

Western Europe has a greater tolerance to higher taxes because health care systems are largely publically funded and free at the point of use. If we adopted a US-style private health care insurance scheme, it would mean having to take out private health insurance which would be expensive and inconvenient. This helps support taxes for the purpose of public health care.

Related Concepts

Blog Posts