- Inflation means a sustained increase in the cost of living. It means the value of money will decrease.

- If you owe someone £1,000, inflation will make this relatively easier to pay off.

- Assume that if prices go up by 10% a year wages also increase by 10% a year. This means each year you have an extra 10% income but the actual amount you owe stays the same. Therefore to pay back the loan requires a smaller % of your income.

- If prices and wages rise, then a lender who receives £1,000 in five years time will be worse off – because getting the same amount of money, with a higher cost of living means you can buy fewer goods.

- If savers keep £1,000 in cash, then inflation will reduce its value and in the future, it will buy fewer goods.

When I first took out a mortgage for £140,000 the mortgage payments were a big % of my disposable income, however, rising nominal wages mean that it is now a slightly smaller share of income.

Note: if prices went up but wages didn’t, borrowers wouldn’t be better off. But, usually wages increase in line with inflation.

Inflation and Savings

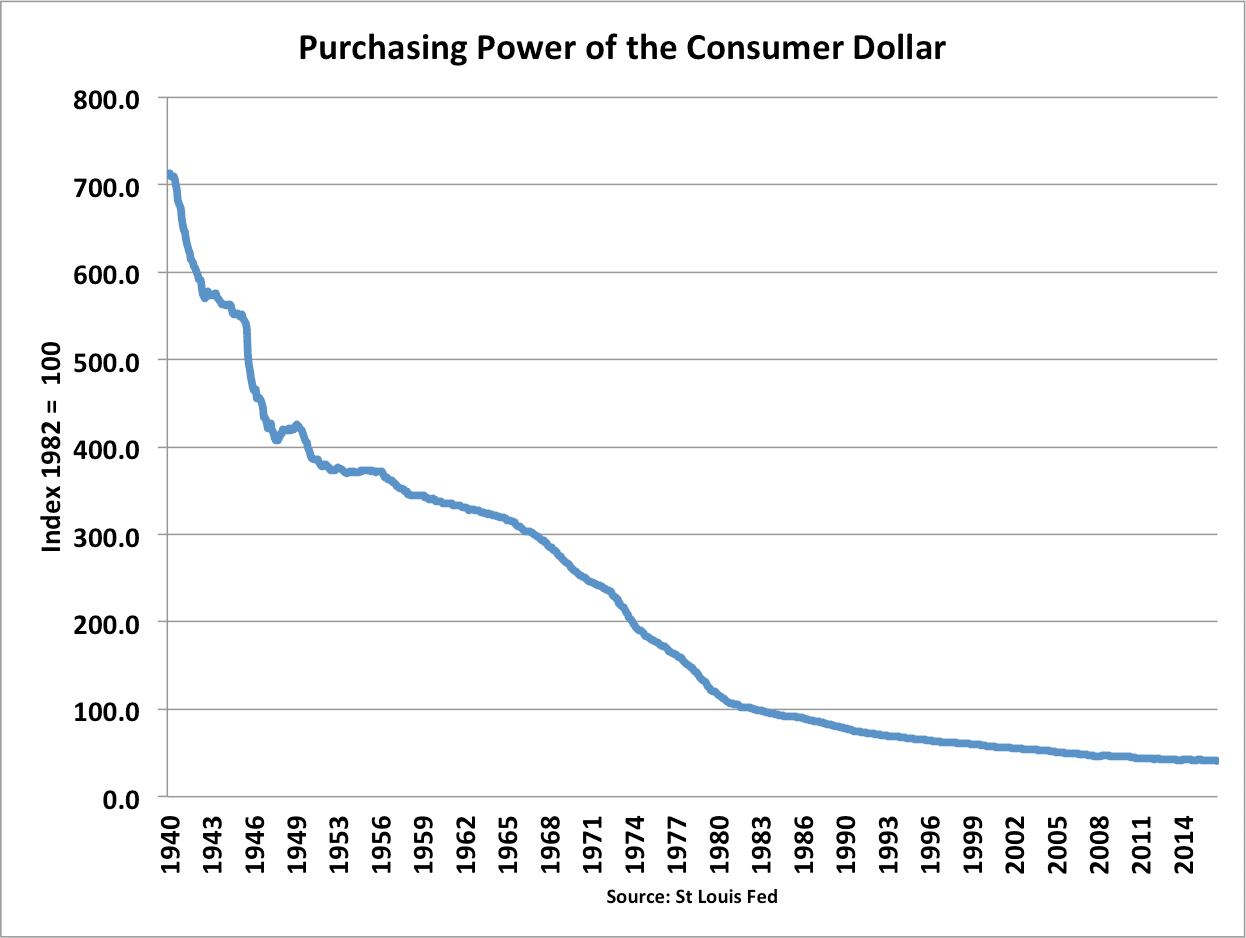

This shows the purchasing power of a US dollar since 1940. Inflation has meant that the amount of goods you can buy with a fixed amount of dollars falls.

If you save money in cash, then inflation reduces the effective value of your savings because, over time, your savings will buy a lower quantity of goods. This is because you have the same amount of money but goods will be more expensive.

Real Interest Rates

The impact of inflation on savers and borrowers also depends on the real rate of interest.

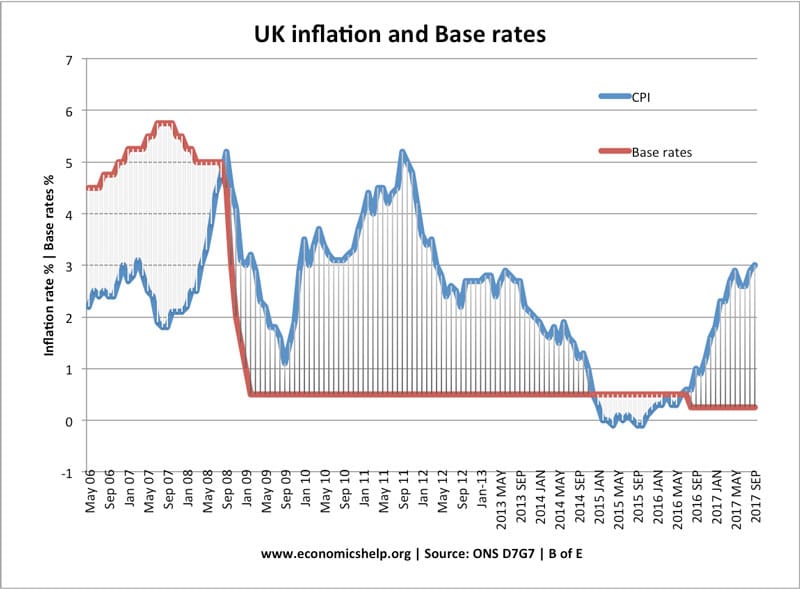

Between 2009 and 2015, inflation is higher than the base rates.

This means we have negative real interest rates. This means if you are saving money in a bank, the rate of interest you get will be lower than the rate of inflation meaning you are becoming worse off.

If you could get a rate of interest of 6% when inflation is 4%, savers would still become relatively better off, because in this case, the rate of interest is greater than the inflation rate.

Therefore inflation doesn’t always make savers worse off. You can insulate your savings against inflation as long as they are in an account which pays a positive real interest rate. However, if you keep your money under your bed, then inflation will definitely reduce the value of savings.

At the present time, savers have to look hard to find saving accounts which pay an interest rate greater than inflation.

Related