In times of uncertainty, people seek to find a safe investment. But, what are safe investments?

Gold is currently over $1,500 May 2011

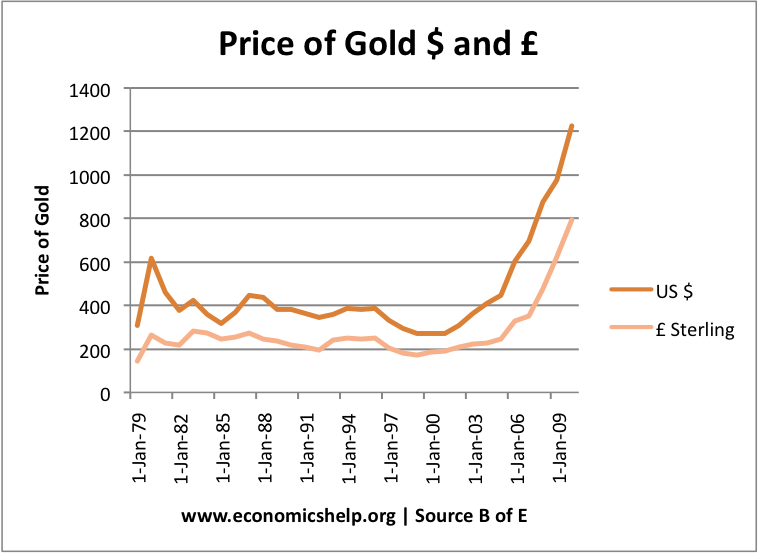

Gold / Silver. These are typically seen as a good investment and safeguard against inflation. Inflation decreases the value of money, but gold retains its value. With experiments in quantitative easing, there is a fear of inflation and this has helped increase demand for gold. The price of gold has risen sharply.

However, fears of inflation look mistaken; apart from some temporary commodity inflation, there is little prospect of runaway inflation. When interest rates rise gold may start to look over-priced.

Government Securities

The performance of the bond market suggests that market investors still see the UK, US and Japanese debt as a relatively safe investment. This may sound curious since debt levels have increased sharply. However, even a credit warning in the US did little to increase yields. Government securities are seen as a safe investment. Especially when governments retain an independent monetary policy and have a good track record.

However, the safety of government securities can be misplaced, especially when they are in a monetary union. Fringe European countries like Spain, Portugal and Ireland have seen an unexpected rise in bond yields due to credit crisis. In 2007, Ireland had one of the lowest debt to GDP ratios and a budget surplus. Three years later and there is a fear of debt default. The Irish experience is a result of the government bailing out the private sector bank debt and also their lack of room for manoeuvre in monetary and fiscal policy.

See: Why UK rates stayed low when others increased

- Another fear of government securities is that their continued demand and low-interest rate is a result of better alternatives – rather than an underlying strength in the quality of the investment.

- For example, markets were burnt by mortgage-backed securities. There is still a fear of emerging economies and so there is a willingness to buy US bonds despite concerns over ability to tackle long term deficit. Therefore, by default government securities have become perceived as a ‘safe’ investment.

Bank Deposits Probably one of the safest investments if the bank savings are guaranteed by the government. However, at the moment ultra low interest rates mean that saving in a bank is not too attractive.

Housing In the long term, housing was often seen as a safe bet. However, some countries like US and Japan have seen a prolonged slump in property prices.

Cash under the bed. In a period of deflation or zero inflation, holding on to cash will retain its value. In some developing economies, people actually pay people to look after their cash. But, any inflation, will start to reduce the value of holding money in cash form.

Related

1 thought on “Safe Investments in Times of Uncertainty”

Comments are closed.