Readers Question: What influences consumer spending

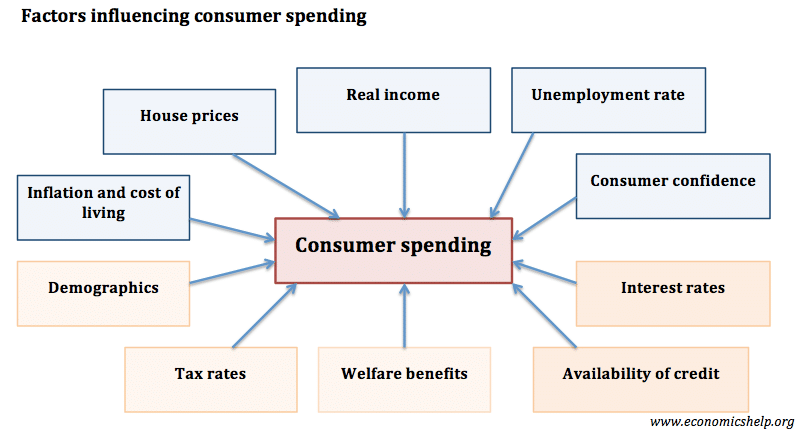

Consumption is financed primarily out of our income. Therefore real wages will be an important determinant, but consumer spending is also influenced by other factors, such as interest rates, inflation, confidence, saving rates and availability of finance.

- Interest Rates – Interest Rates influence the cost of borrowing and mortgage interest payments. – Higher interest rates increase the cost of mortgage payments. Therefore higher rates will lead to lower spending as consumers have lower disposable income. It is also important to note real interest rates – interest rates – inflation.

- However, higher interest rates will also increase the income from savings, so some groups of people may feel they have more income.

- Wage growth. Higher wages are the most significant factor in encouraging consumer spending.

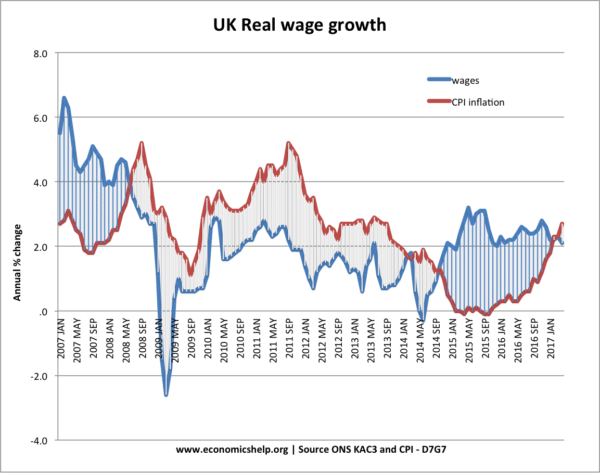

- Inflation. Inflation can be influential in determining spending. If inflation is greater than nominal wage growth, then consumers will see a fall in disposable income.

This graph shows nominal wages and inflation. Between 2008 and 2014, inflation was higher than nominal wages – causing weak consumer spending.

- Deflation – periods of deflation (falling prices) can also have a negative impact on consumer spending. If prices are falling, consumers may feel that prices will be cheaper in the future and therefore, they delay purchasing goods – hoping they will be cheaper. Deflation can also cause a rise in the real value of debt, squeezing incomes.

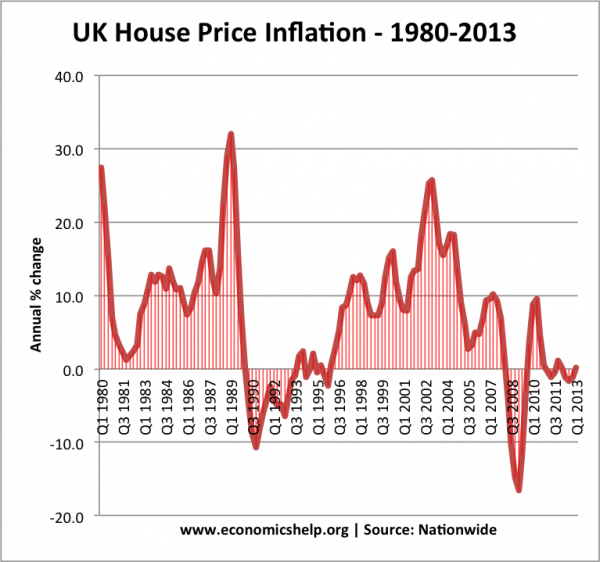

- House prices – Housing is the biggest form of wealth. When house prices are rising people are more confident to spend and they can also remortgage their houses. Rising house prices cause a wealth effect – with higher prices encouraging spending.

- In the late 1980s, the UK experienced rapid house price inflation, this was a factor in causing the “Lawson Boom’ – a period of rising consumer spending.

- However, very expensive house prices and rent can reduce consumer spending amongst the younger population who spend a high percentage of income on rent and try to save for a deposit.

- Consumer confidence. Higher confidence will encourage people to spend more. With higher confidence about future incomes, consumers will be more willing to borrow and spend.

- Difficulty/ease of borrowing money. If finance is easily available, it will encourage people to take out personal loans and credit on credit cards. e.g. after the credit crunch, it was more difficult to borrow from banks leading to lower consumer spending.

- Tax rates – A cut in income tax would give consumers more disposable income

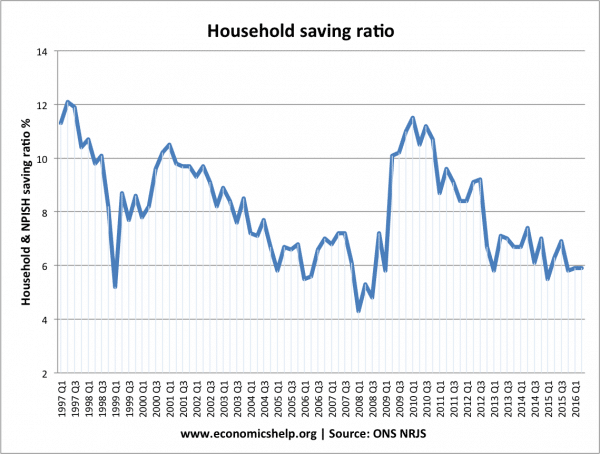

- Propensity to save. The opposite of consumption is saving. If consumers become more pessimistic and increase savings, then consumption will tend to fall.

The sharp rise in saving ratio in 2008/09 – corresponded with the recession of 2008/09 and sharp fall in consumer spending.

- Demographic factors. Another factor that influences consumer spending is demographic factors. If a population has an ageing population, the ratio of saving may rise and consumer spending may fall.

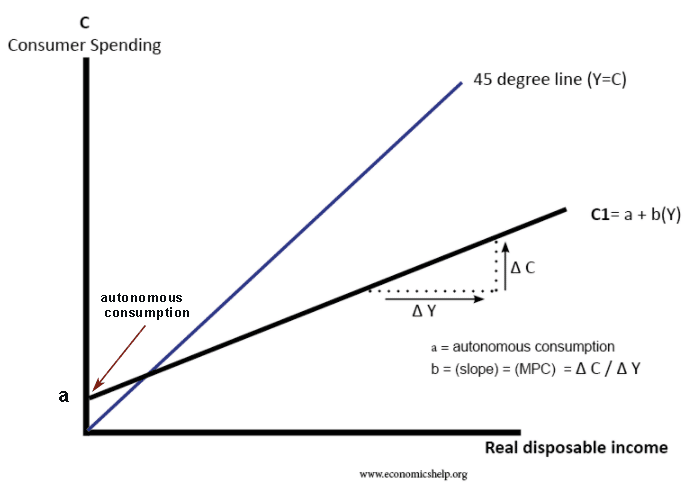

Autonomous and Induced Consumption

In Keynesian models of consumption, it is argued that even with zero income, people will still consume a certain amount (to buy food to live). This consumption may be financed by borrowing or running down savings. This consumption is known as autonomous consumption

See: Keynesian Consumption Function

see also: Causes of economic growth

Related

1 thought on “Causes of Consumer Spending”

Comments are closed.